Not So Deep Dive: MGM Resorts Stock (Ticker: MGM)

Online gambling, international expansion, and the sportsification of Las Vegas

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Apple

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: MGM Resorts is one of the largest gaming and entertainment companies by market cap. They separate their business into 3 parts:

Las Vegas Strip Resorts: MGM operates 10 different casino resorts around the Las Vegas Strip. These include The Aria, Bellagio, Cosmopolitan, MGM Grand, Mandalay Bay, Luxor, New York New York, Excalibur, and ParkMGM.

Though these assets, in total, account for ~50% of Vegas’ entire gaming market, they actually earn most of their revenue through non-gaming segments. 75% of the revenue comes from hotel rooms, selling food & beverages, as well other entertainment and retail revenues (conferences, events, etc.).

So for this segment, the big drivers are dependent on traffic to Las Vegas overall.

Occupancy rates, ADRs, event revenues, these are all even more important than the actual gambling revenues.

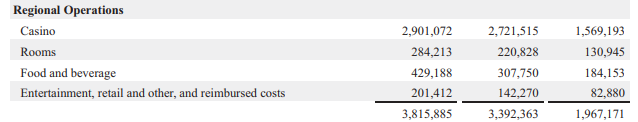

Regional Properties: This is the second biggest driver of revenue for MGM and consists of seven different casino resorts located in various different markets. These include the MGM Grand in Detroit, Beau Rivage in Mississippi, The Borgata in Atlantic City, and several more.

However, unlike Las Vegas, the regional properties generate the majority of their revenue from actual gambling. 76% of the regional properties revenue came from the casino itself. So these attract much more of your local gamblers instead of tourists.

MGM China: This is the 3rd reporting segment that they have. This is technically a majority-owned (56%) subsidiary that operates two casino resorts in Macau and Cotai. The numbers are a little distorted here since China’s lockdown really prohibited the kind of activities that MGM benefits from. It looks much smaller on 2022 numbers, but if you go back to 2019, it was actually close to the size of MGM’s regional properties in terms of revenue.

Unconsolidated subsidiaries: A couple of things to note here. So MGM used to own a stake in what was called MGM Growth Properties. This was apparently considered an umbrella partnership REIT that owned all the actual real estate for 7 of MGM’s Las Vegas properties. They sold that stake last year. So now MGM doesn’t actually own any of its domestic properties. They are all either owned by VICI or Blackstone. And they now lease those properties with built-in 2% rent escalators.

The other segment here that is perhaps most important is BetMGM. MGM technically has a 50% ownership of BetMGM with Entain (an online gaming operator from the UK) as the other partner. BetMGM is an app and platform that offers iGaming and sports betting. Today about 30 states allow sports betting, whereas iGaming is really only legal in 6 states right now. Last year, BetMGM delivered $1.3 billion in revenue and it’s growing like a weed. Management has said that they think the business could have potentially 30%-35% EBITDA margins at maturity. They are currently third behind DraftKings in sports betting market share and the leader in iGaming.

(Ryan) History: Not going to spend too much time here because it’s a pretty messy history of acquisitions and dispositions, but I’ll give them the genesis for the company for anyone interested. MGM Resorts’ roots date back to 1969. A fellow named Kirk Kerkorian, who was a casino and airline mogul at the time, bought a controlling stake in MGM Film Studios. However a couple years later he was struggling with some of the debt load, so he had to sell his casino company (called International Leisure at the time) to Hilton Hotels. Well, that integrated casino resort would go on to be the most successful hotel in Las Vegas.

After seeing that, Kerkorian decided to lead the film studio into the casino world. In 1973, they opened the original MGM Grand Hotel and Casino. They expanded these hotel/casino operations across different locations and in 1979, they decided to split the companies into two. Since then, it has been 40 years of acquiring and disposing of various casino properties. The most recent activity has been that MGM is raising capital through a number of different initiatives. They’ve sold The Mirage and their Gold Strike Mississippi casino, as well as sold the land of their Las Vegas properties.

(Brett) Industry/Landscape/Competition:

With all of its tentacles, MGM has exposure to the global gambling industry, both in-person and online

Globally, the entire “gambling and lottery” industry is expected to reach $1.4 trillion by 2030 (rough estimates, that’s for sure)

If you exclude lottery, that comes down to about $800 billion

If you exclude Asia, that comes down to around $300 billion for a global opportunity. How should we value MGM’s Asia opportunities? Including the Middle East

However, another way to look at it is – as one of the dominant players in Las Vegas gambling — they are riding the growth of the Las Vegas GDP.

One interesting note is the explosion of sports in Vegas over the past decade. You have hockey, F1, the NFL, and probably a baseball/basketball team also coming this decade. The Super Bowl will be hosted in Vegas for the first time ever this year, and will likely continue to come back. Thoughts on this tailwind?

The other important sector will be online sports gambling. Revenue is expected to be pretty explosive here (analysts expect about 20% CAGR), but market participants have been extremely aggressive.

(Brett) Management and Ownership:

MGM is run by a long-time employee of the company, William Hornbuckle. He has been president since 2012, COO in 2019, then CEO after that.

He has overseen the sports expansion, online betting, and new Asia bets for the company

The CFO Jonathan Halkyard has been in the job since January of 2021. He has been in charge of some of these leaseback deals and the share repurchase program. Check shares outstanding chart below

On an ownership note, IAC owns a roughly 19% stake in the company. However, they have been adding to the position and it increases as the company repurchases shares and they don’t sell. Do we like them as a big shareholder and board member?

The executive compensation stuff is rather disappointing. No talk of “per share” or “free cash flow” in the proxy (in a business with a lot of capex and a true ROIC company)

Executive compensation metrics have changed a lot in recent years. Generally, they are valued on adjusted EBITDAR targets and relative/absolute TSR

Would bad executive compensation keep you out of this stock?

(Ryan) Earnings: Saw some big disruptions due to the recent cybersecurity issue.

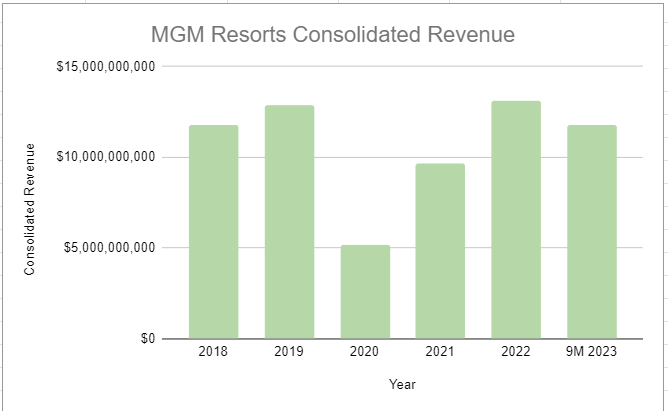

$15B in trailing 12-month revenue

$2.2B in TTM EBITDA

$1.5B in TTM free cash flow.

Most recent quarter:

China is booming again.

Cybersecurity issue hurt margins by about 200bps, but they are seeing really strong demand across their Vegas properties.

Regional properties are a bit lackluster.

I think the path to $2B in free cash flow is there, depending on how much capex is required for the Japan buildout.

(Ryan) Balance sheet and liquidity:

Assets/Cash Flow:

$3.3 billion in cash and cash equivalents

They generate just ~$5 billion in EBITDAR and just over $2.2B in EBITDA

Liabilities:

$6.5 billion in long-term debt (all due within the next 5 years)

Pretty much all fixed-rate senior notes. Weighted-average interest rate of 5.45%.

Only about $3.25 billion of it is domestic. So the notes due in MGM China are specific to that subsidiary

MGM has said they want to keep their leverage ratio below 4x EBITDAR and they’re at roughly 3.5x right now. They’ve explicitly said that they like taking on debt right now to repurchase shares. Here’s the quote from their CFO “We've been aggressive repurchases of shares. I will say that at these levels of trading in our shares and the value that we think is in there. We would certainly consider taking on some additional financial leverage in order to enable further share repurchases.”

(Brett) Valuation:

This one is going to be confusing

First, I am valuing the China business at zero. If you don’t do this, I don’t think you are being honest with the facts on the ground in the country (as well as your circle of competence, most likely)

Second, you can assign whatever value you want to BetMGM. It seems like it will be valuable but there is still a lot of uncertainty.

Third, I took the segment EBITDAR for regionals/Vegas and added them up over the last twelve months. Then, I subtracted SBC and corporate overhead costs

On that, you get an EV/earnings of 4.2

If you subtract TTM interest expense and the $600 million in guided maintenance capex, you get an EV/FCF of 5.7

MGM China is publicly traded in Hong Kong

Anecdotal Evidence:

(Ryan) I think if I were to start sports betting, BetMGM would be the most appealing to me thanks to all the rewards that you can get and redeem in person.

(Brett) Clearly a good collection of brands. Not much else to say.

Future growth opportunities:

(Ryan) Osaka resort. Just received approval to begin building one of Japan’s first integrated casino resorts with a partner. The project is expected to cost $10 billion in total, of which, MGM expects to pay around $2 billion worth. The remainder will be financed through ORIX, a third partner, and some debt. This will likely be the most expensive casino ever built. Per Scuttleblurb: “So maybe on a $10bn investment, the Osaka mega-resort delivers something like ~$6bn of revenue and ~$2bn of EBITDA. At 8x EBITDA, MGM’s 50% stake is worth $8bn, the equity portion ~$5bn, translating into ~$1.2bn of incremental equity value”.

(Brett) There is a lot we could include here. One that may be underfollowed is the potential of Dubai to legalize gambling in the region. There is a report that the UAE legalization is imminent. All the big players – including MGM – have hotels and basically a resort like the ones they have in Vegas except without casinos right now. If they get the green light here, there could be some major growth. Also, take this quote from the conference call in whatever manner you choose:

"Obviously, we've got boots on the ground. I think you all understand our former CEO is now Chair of the Gaming Commission there” [Dubai]

Highlights and lowlights:

Ryan’s Highlights:

I love that their rewards program can tie together all their physical and digital assets. Seems like a major advantage for competing in the iGaming and Sports Betting markets.

Over the last 40 years, visitor attendance has consistently trended up. And now it’s brought in an NFL team, a hockey team, it’ll be bringing in an MLB team, and there have been rumors about an MLS team. I think all of that serves well for visitor volumes at MGM.

Management seems very committed to the buyback. The fact that shares outstanding are down 35% in the last 5 years seems like a testament to this management team’s capital allocation skills.

Ryan’s Lowlights:

Cost inflation.

China + Vegas concentration risk

Brett Highlights:

The consistent buyback since things turned around in 2021. If you add in the leasebacks, I think MGM’s finance team has done a great job of optimizing the balance sheet

There is a lot to like with the growth opportunities. You have the continued growth of Vegas (sports/events being the key), Japan, Dubai, and online gaming. Maybe these don’t all work out wonderfully, but they should benefit from the global tailwind of gaming.

The operations have a good inflation hedge, which can counteract rising Capex needs.

Brett Lowlights:

Exposure to China. Look, I may be an extreme pessimist on China, but I think they are wasting time here. The government can just do whatever it wants, and I think the stake should be written down to zero. That’s what I am doing with my enterprise value calculation.

Maybe they are over-optimizing the balance sheet? The gambling industry is a bit cyclical, and there is a lot of operating leverage in the Vegas market. I might rather have them build up some cash in order to have a more conservative balance sheet and be more tepid on the repurchases. If/when the economy goes into a downturn, the company could have a lot of cash to repurchase shares at a cheap price.

They have union exposure. They just signed a contract before the workers went on strike. As a shareholder, this makes it difficult to forecast how big of a headwind labor costs will be. You have a lot tied to pricing power.

Bull Case:

(Ryan) Kind of hard to put it all together since there are so many moving parts.

(Brett) The stock looks cheap as long as the economy doesn’t go into a tailspin. The core operations will print cash and you have optionality in Japan, the Middle East, and igaming.

Bear Case:

(Ryan) Feels like there isn’t that much downside here. The big thing to me feels like a decrease in visitors to Vegas. Not sure why that might happen, but if it were to occur, it’s the biggest driver of their business so there’s probably a good chance the stock does poorly for a while.

(Brett) The economic cycle is the bear case. This may be annoying to try and factor in, but there is a lot of operating leverage with the Vegas operations. They mention specifically in the annual report that increased demand in Vegas leads to pricing power on the fixed amount of rooms they have. Reverse that and they could be in trouble. Just look at the stock price during the GFC.

More or less interested?

(Ryan) More interested.

(Brett) More interested. I would buy this during a recession if it is likely the balance sheet is fine. This is a great business in many ways, but a bit weaker in other ways.