Not So Deep Dive: Microsoft (Ticker: MSFT)

How much growth is left for the second largest company in the world?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Schedule for upcoming weeks:

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Charts and Graphics

Data and charts powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental investors.

Stratosphere.io has made it easy for us to get the financial data we need with beautiful out-of-the-box graphs that help us do research for Chit Chat Money.

🎉Stratosphere.io just launched their brand new platform and you can give it a try completely for free.

It gives us the ability to:

Quickly navigate through the company’s financials on their beautiful interface

Go back up to 35 years on 40,000 stocks globally

Compare and contrast different businesses and their KPIs

Easily track insider transactions and news updates for any stock we follow

Get started researching on the Stratosphere.io platform today, for free, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: They do a lot. Stealing a line from our friend Matt Cochrane here, “There might not be any company more engrained in enterprises and businesses worldwide than Microsoft.” I’ll try to break down each of their reporting segments, but it’s unlikely I’ll be able to touch on everything. They separate the business into 3 parts.

Productivity and Business Processes: (32% of revenue) This segment consists of 3 items: Microsoft 365, LinkedIn, and Dynamics 365.

Microsoft 365 is the one-stop shop for all productivity and security needs for both consumers and businesses. This encompasses Office 365 – Word, Excel, Powerpoint, Teams (Slack Competitor), Outlook, OneDrive, Sharepoint (website builder), and Skype – as well as advanced security for their larger business customers. For context on pricing, a personal plan costs $70/year and it’s delivered via the cloud now.

LinkedIn was acquired by Microsoft in 2016 and today it’s the world’s largest professional networking site with more than 875 million professionals on the platform. And they generate revenue in several ways. Talent solutions (businesses pay to find potential employees), marketing solutions (traditional ads + lots of B2B), premium subscriptions (extra platform perks for business leaders & job seekers), and sales solutions (paying for leads). Over the last 6 years, LinkedIn’s revenue has gone from $3 billion to ~$13 billion.

Dynamics 365 encompasses Microsoft’s business applications. So this is their enterprise resource planning solutions, their CRM solutions, their financial platform, and plenty more. Pricing varies depending on how many solutions a business actually subscribes to.

Intelligent Cloud: (38% of revenue) The way I understand it, this is primarily Azure and their other cloud and developer services.

Azure is so big that it’s hard to talk about in any sort of succinct manner. In fact, let me steal another quote this time from Microsoft’s Chief Marketing Officer, “You should just think of it as the oxygen that the company runs on. If you just look at infrastructure, you just look at lift and shift and the move to the cloud, you just look at Tier 1 workloads, then you add data on top, you add gaming on top, you add a business on top, it is the backbone of the entire Microsoft.” Companies use Azure for their compute and storage needs, and from what management says, it’s the most comprehensive and trusted cloud provider. They don’t break out Azure revenue specifically.

Other cloud services – To be frank, these are areas where I have no product experience whatsoever so any definition I give would be kind of useless. In the 10-K, here’s what they mention as the other services “SQL Server, Windows Server, Visual Studio, System Center, and related Client Access Licenses (“CALs”); and Nuance and GitHub.” Nadella has expressed a lot of optimism around GitHub, so I’ll explain that one. GitHub is one of the world’s most popular platforms for developers to share code and work on projects together. And it sells subscriptions to teams and organizations.

Consulting & Support for their cloud services for enterprise customers.

More Personal Computing: (30% of revenue) This one’s a little easier since most people are probably familiar with the products.

Windows: This is their operating system that comes pre-installed on a variety of devices. OEMs, or manufacturers, pay Microsoft in bulk to license this OS.

Devices: Microsoft makes and sells a number of physical devices themselves. They’re probably most well known for their surface tablet, but they also sell surface laptops, and I believe their Hololens is included here too.

Gaming: This is their Xbox ecosystem. Sales include hardware, game sales, Gamepass subscriptions, and app-store fees from 3rd parties. If interested, we covered Xbox specifically last year.

Search and news advertising: This is comprised of search ads for their own browsers, like Bing and Microsoft Edge, as well as 3rd party browsers, most notably Yahoo!. Xandr is also included here so I believe the CTV market they’re going after would be included in this segment.

(Ryan) History: Don’t need to go too long here, because it’s a pretty well-known story. Bill Gates and Paul Allen founded Microsoft in 1975. Allen had graduated from WSU and was working as a programmer in Boston, and Gates dropped out of Harvard. The genesis for the business was to build software for the Altair 8800, which was one of the earliest personal computers. And then in 1980, they struck a deal with IBM to build the operating system for IBM’s personal computer. This was really when the business started hitting its stride. By 1985, they introduced Windows OS, and a year later they joined the public markets. From that point on they were the largest software company in the PC space, and it really wasn’t until the late 90s/early 2000’s that they began to see some struggles. They were charged with violating antitrust laws and ended up reaching a settlement in 2001.

During that time Gates stepped down as CEO and was replaced by Steve Ballmer. Ballmer was there for 14 years and the stock was underwater that entire time (unfortunate timing). But in 2014 he was replaced by Satya Nadella.

(Brett) Industry/Landscape/Competition:

Industry and competition for big tech companies are difficult to parse out since someone like Microsoft basically competes with every software and internet service out there.

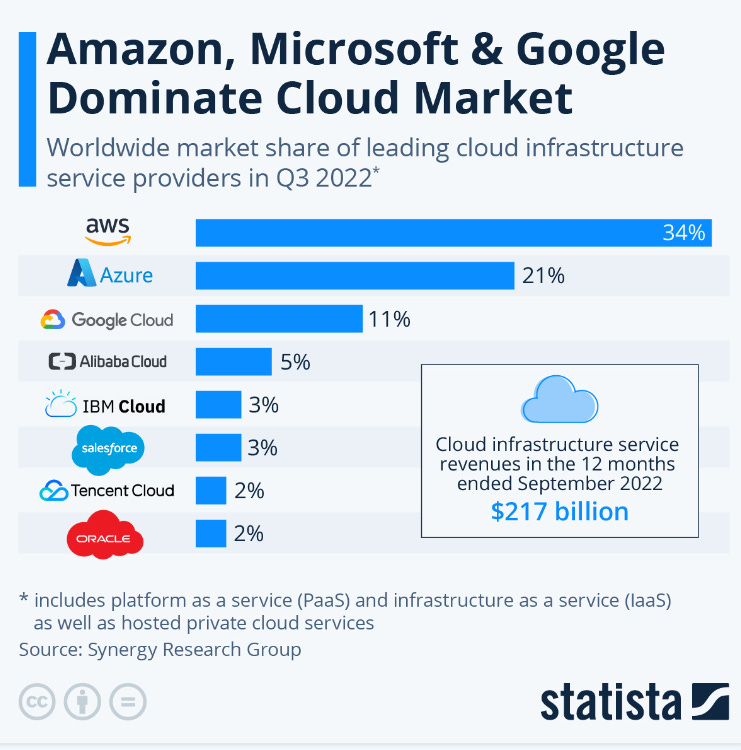

Looking at industry size, the cloud market is estimated to be around $500 billion today and is expected to hit $1.5 trillion by 2030. Those estimates may be overhyped and that is a long time from now but there is generally hundreds of billions of dollars in opportunity for a business like Microsoft Azure to go after this decade.

With competition, I am going to divide things up into separate sections:

Competitors to Microsoft Office: Apple, Google, Okta, Slack, Zoom

LinkedIn: Online recruiting networks (think ZipRecruiter), other social networks

Azure: Main competitors are Amazon Web Services (AWS) and Google Cloud. The market share of the cloud is ~30% for AWS, 20% for Azure, and 10% for Google Cloud.

Xbox Gaming Division: Nintendo and Sony

Windows: Apple and Google (operating systems)

Hardware devices ex-gaming: HP, Lenovo, other computer manufacturers

Search/advertising: Google and Meta Platforms are the big ones (don’t forget that Bing still exists!)

Notice a trend among the competitors?

(Brett) Management and Ownership:

The CEO is Satya Nadella

They have 12 members on the board, including Nadella. All look independent (Gates and Ballmer are not on the board anymore) and get paid around $350k each year. It is funny (or maybe disheartening) to see Microsoft board members get paid less than board members at a company 1% the size of it.

Moving towards executive compensation, Microsoft had to renew Nadella’s long-term equity plan this year:

During fiscal year 2022, we addressed the need to provide ongoing incentives to Mr. Nadella following the final vest in February 2021 of the long-term performance stock award granted at Mr. Nadella’s 2014 promotion to CEO. Shareholders expressed a desire to ensure the ongoing retention and motivation of Mr. Nadella and the independent members of the Board continue to have high confidence in Mr. Nadella’s exceptional leadership of Microsoft”“

After revising the equity compensation structure, 100% of Nadella’s stock awards now come from performance-based targets. I like to see that.

Executives get (shockingly) base pay, annual cash incentives, and performance stock awards

Annual cash incentives are based off of revenue and operating income + some ESG stuff

The LT incentive awards are based on some very interesting metrics:

$135.2 million in total executive compensation in FY 2022, or a negligible % of the 2022 gross profit the company generated.

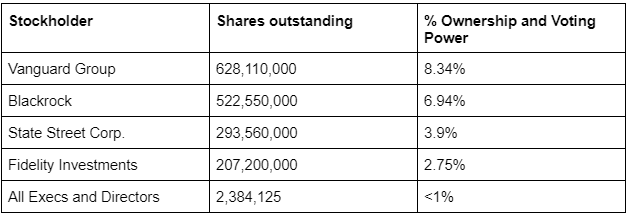

Even with large stock awards, executives and directors still own less than 1% of shares outstanding. The Gates family now owns an inconsequential stake in the business, shareholders are now just index funds, pensions, and large investment funds.

(Ryan) Earnings:

Last 12 months:

$203 billion in revenue, up 15%

$88 billion in operating cash flow (43% OCF margin)

$64 billion in free cash flow (32% FCF margin)

$31 billion spent on buybacks and $19 billion on dividends. So ~77% of free cash flow gets returned to shareholders.

Shares outstanding declined by about 0.7% over the last year and they pay just over a 1% dividend yield.

Most recent quarter:

$50 billion in revenue, up 11% (16% in constant currency)

Office revenue continues to grow steadily (+13% CC)

Linkedin still growing quickly (+20% CC)

Dynamics still seeing strength as well (+22% CC)

The intelligent cloud is the bright spot here (+26% CC)

All devices revenue are flat to down YOY

Returns to shareholders declined by 11%, due to significantly fewer buybacks.

$17 billion in free cash flow, which is down slightly YoY due to a couple of things

They had some tax benefit last year so basically didn’t pay any in Q1 of last year.

And CAPEX grew by 8%.

(Ryan) Balance sheet and liquidity:

Cash/Earnings:

$107 billion in cash and short-term investments

Like lots of other large companies, most of this is just held in US bonds.

And they generate $64 billion in FCF each year

Liabilities:

$49 billion in total debt, 94% of it is long-term and more than 60% of it is due after 2027.

This quarter they paid $500 million in interest expense and received $641 million in interest income.

The balance sheet is really a thing of beauty. They consistently issued new, low-cost debt up until 2021, to pay back more expensive old debt (see 2020 & 2021 issuance). Now they have $45 billion in long-term debt with a total cost of debt just north of 3%, and they’re earning interest on their cash at a higher rate.

(Brett) Valuation:

Market cap of $1.7 trillion

Enterprise value of $1.63 trillion

EV/OI of 19.3

EV/FCF of 25.8

Anecdotal Evidence:

(Ryan) For me, I actually have minimal exposure to Microsoft’s products in my daily life. I use G-Suite, not Office, I use Apple not Windows (although that might change), I don’t use Bing, and I pretty much use Twitter as a substitute for Linkedin. I wouldn’t read into this a whole lot though, because if I worked at a bigger business everything would probably be switched.

(Brett) Anecdotal evidence is going to be difficult for a tech giant, but I will try and give some on a segment that I think anyone older may not be aware of. Google Drive dominates usage on college campuses and for younger people in general. On the one hand, you would think it is a threat to Microsoft’s Office business (and it may be) but on the other hand, Google is basically giving all this software away for free and Microsoft is doing just fine. That is a testament to the switching costs.

Future growth opportunities:

(Ryan) Advertising. Not sure when it was first mentioned, but Microsoft has an advertising arm that generates more than $10 billion in annual revenue. Nadella broke this segment down into 3 elements: LinkedIn, Owned & Operated (Bing, Edge, Store, Etc), and 3rd-Party (Powers Yahoo’s ads, plus new Netflix deal). From what I can tell, up until 2022 this was sort of a hodgepodge of several independent advertising-based assets, but after acquiring Xandr for $1 billion in late 2021, they turned this into more of a single comprehensive advertising platform. Advertisers and ad inventory sellers can now come to one place in “Microsoft Advertising” to have their needs met.

(Brett) There are a lot of choices for this one, and if you are interested in gaming listen to our Xbox-dedicated episode from September. But my choice has to be the cloud/Azure. Microsoft’s total cloud revenue (not just Azure) is $96 billion compared to just $9.5 billion in 2016. This division has driven the majority of revenue and earnings growth over the past five years and will do so over the next five as well. If you are betting on the stock today you need to be betting on durable revenue growth at Azure.

Highlights and lowlights:

Ryan’s Highlights:

Scale & bundling. Thanks to its size and comprehensive product suite, Microsoft can offer competing products at a fraction of the cost of competitors. The growth of Teams is a perfect example.

Ridiculous switching costs. Both on the developer side as well as the business processes solutions they offer, once a company is integrated, they’re pretty much locked in for life.

They’ve turned the majority of their revenue streams into recurring cloud-based subscriptions. Office, Security, Dynamics, and even gaming to some extent. Kind of an obvious statement, but this makes raising prices and launching new features so much easier.

I really like Satya Nadella.

Ryan’s Lowlights:

I think Google has done a better job capturing younger audiences when it comes to productivity and creativity tools.

Just some of the difficulties that come with being a trillion-dollar business. The one that comes to mind for me is regulatory pressure. Any acquisition they make people could find a way to call it anti-competitive.

Brett Highlights:

The switching costs of Office software plus the ability to bundle things like Teams make the enterprise software division very competitively advantaged. As I mentioned above, they compete with companies who are giving away this software for free, and still, people won’t switch.

The growth potential of the cloud is staggering, and Azure has proven it can gain market share over the last five years (going from around 15% to 20% share of the infrastructure market). It would not be surprising if the Microsoft Cloud division is doing $200 billion in revenue five years from now with solid margins.

Management. Maybe I just like Satya Nadella because everyone tells me I should.

Brett Lowlights:

This may be the only lowlight for all of these big tech companies we are going to cover this week (they wouldn’t have become trillion-dollar businesses if they had many lowlights) but I do think there is “GE” risk of too much diversification that could hurt the business if given to the wrong executive team.

The employee growth over the last few years has been staggering and I worry that growing employees too quickly gets things all mucked up and bloated (although Microsoft might be lower on my list than a few other big tech companies).

Bull Case:

(Ryan) Brett lays it out well and frankly, I think it’s pretty simple. Office and Dynamics grow earnings at 10% and Azure grows at 15%+ over the next 5 years. Maybe you get some upside from the other businesses, but if the 3 things I mentioned occur, I think investors will get market performance or better from here.

(Brett) On the week we are recording this episode, Microsoft is trading at an enterprise value of approximately $1.6 trillion. If you are going to buy the stock today, I think you need to be asking yourself: when will the business hit $160 billion in annual earnings/cash flow? This is a 10% yield on current prices and around double where it trades at today. If the cloud division continues its impressive growth along with advertising + gaming and the legacy business stays stable I think that is doable within 5 - 7 years.

Bear Case:

(Ryan) I struggle to see any significant downside here other than a general economic slowdown causing top-line pressure and potentially compressing margins. But I don’t see what would really stop Azure.

(Brett) Here’s my realistic bear case: Slowing growth + competitive threats finally show up for Office + multiple compression. In this scenario, I don’t know if investors lose money over the next five years but they might not make any money. The growth from Ads/gaming is not going to be relevant to earnings growth anytime soon.

More or less interested?

(Ryan) More interested. After taking a deeper look at all the components of the company, it may deserve the title of #1 business in the world. However, I worry that because of that it gets too steep of a multiple.

(Brett) More interested. This is a great business and the only thing I would need to weigh is the valuation and opportunity cost vs. other stocks today.

Stock for next week? (Amazon)

Sources and Further Reading

Microsoft Advertising page: https://about.ads.microsoft.com/en-us

Fiscal Year 2022 Annual Report: https://www.microsoft.com/investor/reports/ar22/index.html

Microsoft page on Stratosphere.io: https://www.stratosphere.io/company/MSFT/