Not So Deep Dive: Monster Beverage (Ticker: MNST)

The best performing stock since the year 2000...

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Stock for next week: Phillip Morris International

As always, listen to the episode on Spotify, YouTube, or wherever you are subscribed to the show. A Not So Deep Dive comes out every Tuesday morning!

Charts

Data powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: Monster creates and sells a variety of different energy drinks across 142 countries and through a mixed web of distributors including full-service bottlers/distributors as well as retail grocers, specialty chains, convenience stores, gyms, etc. Here’s the sales split:

Monster also breaks its brands into 3 (sort of 4) separate reporting segments:

Monster Energy Drinks - This includes all of Monster’s sales of ready-to-drink bottles. So their classic Monster cans and all its different variations, the Java Monster Coffee line, Monster Dragon Iced Tea, and its Reign brand (which they introduced in 2019). Accounts for 92% of revenue.

Strategic Brands - This segment refers to Monster’s sales of “concentrates” or “beverage bases” to their bottling partners. Some of the recognizable names from this category include Burn, Full Throttle, and NOS. Accounts for 6% of revenue.

Alcohol Brands - In 2022, Monster acquired CANarchy, which gave them an entrance into the alcoholic beverage category. This category includes all sales of either kegs or ready-to-drink alcoholic beverages. Some of the recognizable brands that they acquired include Jai Alai, Dale’s Pale Ale, and the line of Wild Basin hard seltzers. Accounted for 2% of revenue (but this was missing a month).

As for the manufacturing side of things, Monster still outsources that process to 3rd parties. This means that Monster is responsible for purchasing the ingredients, flavors, juices, cans, bottles, caps, etc., which are then delivered to their bottlers and co-packers. These are the largest contributors to the cost of revenue for Monster.

(Ryan) History: Fascinating history and some of it is actually hotly debated. The company was officially founded in the 1930s by Hubert Hansen and his sons with the focus of selling natural juices to film studios and retailers in southern California. That company (initially called Hansen’s) went through various corporate changes over the following 50 years including adding “natural sodas” to the mix in the ’70s. But in 1988, the business filed for bankruptcy and was acquired by the California CoPackers Corporation and renamed Hansen’s Natural Company.

Here’s where it becomes a somewhat interesting story. Hansen’s Natural introduced “Monster” in April 2002. The year prior to that launch, so 2001, the company did $92 million in sales and earned $3 million in net income. For context, this year (21 years later), Monster generated $6.3 billion in sales and $1.2 billion in net income. The controversy is really around the early branding and its ties to the War in Iraq. Rumors are that the company used military-like branding to appeal to the pro-war patriotism that was rampant at the time. Here’s a quote I found: “The camouflage pattern on the Monster “Assault” flavor’s can with its accompanying exhortation to “Declare war on the ordinary!” and the company‟s wide use of militaristic and violent rhetoric would seem to necessitate an acknowledgment of U.S. military action since 9/11 and since Monster started “cooking up” its “killer energy brew” the following year. However, even while employing militaristic imagery, the Assault 15 Can text includes a written disavowal of being “for the War,‟ or “against the War.” With this oblique reference to the ongoing conflict in Iraq (not to mention Afghanistan), Monster denies any political stand on this or any war.”

Now I don’t know if this was management’s direct intention, but there were clear appeals to the pro-military sentiment that was going on at the time (like their partnership with Call of Duty), that helped the company find remarkable product market fit. Monster Energy grew rapidly and by 2012 the company officially changed its name. Two years later (2014), Coca-Cola bought a major stake in the business for just over $2 billion in an attempt to make Monster its “exclusive energy play”. Coke transferred its energy brands to Monster and Monster handed over its non-energy business to Coke. The deal also included an agreement for Coke to distribute Monster globally. This has been a big driver of sales:

(Brett) Industry/Landscape/Competition:

The energy drink industry is estimated to be sized at $86 billion around the globe and is growing at just below 10% annually

However, Monster Beverage is actually competing in the entire packaged drinks market (mostly non-alcohol) as well as with coffee. This industry is estimated to do over $200 billion in annual revenue that analysts expect to double this decade.

The majority of industry growth is coming from non-alcoholic non-hot drinks. Monster Energy fits into this category, therefore giving it a nice long-term tailwind

Competition: Red Bull and Rockstar are the key competitors in energy drinks. However, they are really competing for the habitual drink people consume every day. Can they replace that soda? Can they replace the morning coffee? That’s how I view the long-term opportunity and competitive landscape

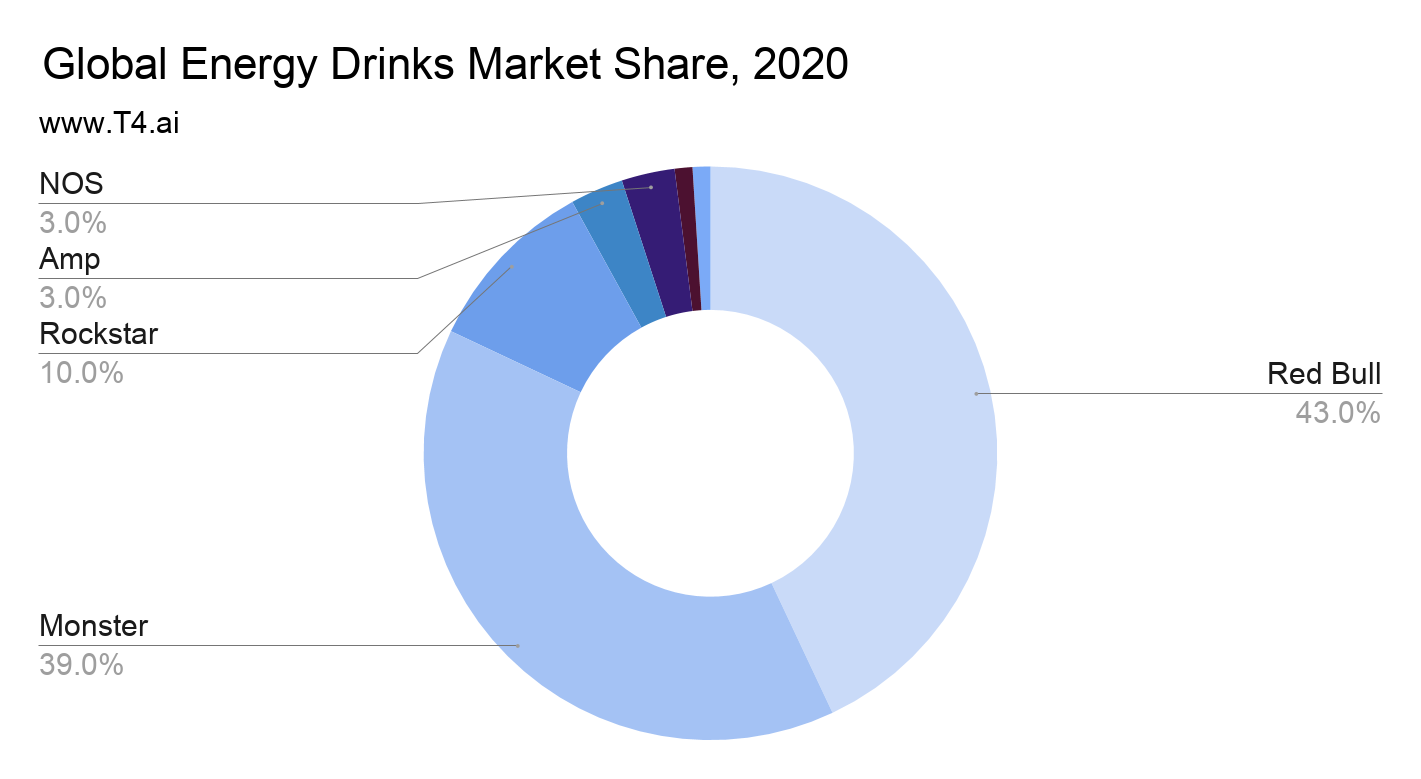

Nice graphic on energy drink brand market share:

(Brett) Management and Ownership:

These are going to feel a little outdated at the moment because we are at the time of year when 2022 annual reports are out but not the 2023 proxy filing (for most companies)

Monster Beverage is run by two men: Rodney Sacks and Hilton Schlosberg. They have been on the board of directors since taking over the company in 1990 and run the company as co-CEOs today

Looking at the executive team, all have had long tenures at the business

Coca-Cola has a big stake in the business and has a few members on the BOD

What do we think of the “frenemy” relationship between Coca-Cola and Monster?

Executives get a base salary, annual bonuses based on “adjusted operating income” targets, and long-term performance stock units based on adjusted EPS targets. Essentially, some boilerplate compensation consultant BS.

Exec compensation is just under $40 mil a year (cumulative) which is about 1% of annual gross profit

Red/yellow flags:

Compensation based on adjusted numbers

The two “founders” pay themselves a ton in salary/bonuses when they are already immensely rich from owning this business.

The founders get paid fees for two social clubs by the company

Related party transaction: Sacks charters his private jet to the company and forces them to pay him

There are multiple other related party transactions in what look like services with tons of different options the executive teams could choose

They make the ownership stakes of the two founders incredibly confusing to parse through

My read: lots of greed from these two. Doesn’t mean the business is going away but I believe it should rub shareholders the wrong way. Do they actually care about you?

(Ryan) Earnings: 2022 Full Year

$6.3 billion in net sales, +14%

50% gross margin vs. 56% in 2021

$1.6 billion in operating income or 25% operating margins, down from 32% last year.

Cases sold increased by 14% average revenue per case came in by 2%.

$888 million in operating cash flow, down 23% due to a $350 million increase in inventory.

Significant capex this year, but on average, purchases of property and equipment are a little under 10% of operating cash flow.

Long-term numbers:

Since 2012, Monster Energy case sales have grown at 12% a year.

Average net sales per case have actually decreased by ~1% a year.

Operating margin has been around 30% since 2005.

Since 2016, shares outstanding have come in by 14%.

(Ryan) Balance sheet and liquidity:

Really straight forward balance sheet.

$2.7 billion in cash and short-term investments

No debt

Will be receiving some additional cash this year from their settlement with Bang Energy. Historically, they’ve used their cash to buy other companies or buy back stock. That’s about it.

(Brett) Valuation:

Market Cap of $54.5 billion

EV/OI of 33.6

Anecdotal Evidence:

(Ryan) Lots of brand loyalty among the people I know that are customers. Feels similar to the nicotine market. The recent 6% price increase they had in the US saw little hiccups. Very addictive obviously.

(Brett) Brand is strong. They have great distribution, shelf space, mindshare among consumers, and a logo that gets more recognizable each year. Is the energy drink market going to end up like Coke/Pepsi with Monster/Red Bull? I think it is likely, but I’m not 100% convinced about the durability.

Future growth opportunities:

(Ryan) I think the obvious one here is an expansion of their alcoholic beverage category. They paid $330 million for CANArchy and I think that was really just a way for them to get an entry into the market. Here’s a quote from their presentation announcing the deal: “The company (CANarchy), and this is really important, already operates with the people, distribution network, licenses, alcohol beverage development expertise, manufacturing capability and infrastructure necessary to grow our alcohol business.” This quarter they launched The Beast Unleashed in 6 states and plan to have it national by the end of the year. Do you think the alcohol category can truly help drive sales growth for Monster?

(Brett) Can they become a good acquirer of brands and/or expand outside energy drinks and become one of the few lasting CPG drink conglomerates? They are making a decently sized push into alcohol with the craft brands acquisition and the launch of “Feed the Beast” 6% hard seltzer from the Monster Brand. If they can succeed this will not only diversify the business away from just the Monster Energy brand but also could provide another leg of growth for this decade and beyond. Would you try the “Beyond the Beast” hard seltzer? (caffeine and sugar-free).

Highlights and lowlights:

Ryan’s Highlights:

Strong brand loyalty, addictive products, and solid pricing power.

Global distribution network thanks to Coke. Although, not a massive advantage given that Red Bull already has that, and Celsius basically just got the same thing with their Pepsi deal.

Simple capital allocation strategy with the consistent buybacks.

Ryan’s Lowlights:

I think they could’ve been a little more aggressive with their balance sheet throughout 2020/2021. Certainly could’ve got close to free money given how predictable the business is. But I’m being nitpicky there.

I think it’s going to be harder to grow volumes over the next 10 years than the last 20. Unlikely to come from growth in distribution at least domestically since it’s already quite saturated. They’ll need to have success with other products or investors should expect lower growth in cases sold.

Brett Highlights:

The company has built up a brand recognition over the years that I believe has elevated them to the status of Coca-Cola, Pepsi, Gatorade, Red Bull, Tropicana, and other CPG drink name stays. This is extremely hard to do and makes it (from my seat) very difficult for someone to disrupt, at least quickly.

Consistent repurchaser of shares over the last five years.

Was the Coca-Cola partnership/investment a masterstroke in defending your position in the marketplace? I think so.

The leadership team generally has long tenures and speaks frankly, rationally, and conservatively to shareholders.

Brett Lowlights:

Management has gotten a bit greedy with corporate expenses and the self-dealing/milking of the balance sheet I outlined in detail above

The market share gainers within the energy drink category are important to watch. Celsius has grown quickly. Before that, it was Bang Energy. Before that it was Rockstar and 5 Hour Energy. None of them have shown the ability to meaningfully edge away Red Bull or Monster’s market share yet, but it doesn’t mean they won’t. I could also see a shift towards the “healthy” energy drinks becoming generally more popular, but Monster has some products in this space.

Bull Case:

(Ryan) Ok, let’s make some 5-year assumptions and see where we get: Let’s assume they grow total sales by 12% annually (the 10-year average has been 12.2%) and operating margins go back to their last 10-year average of 32% (instead of the 25% they had this year). In 2027, Monster would generate ~$11B in revenue and $3.6B in operating income. Their average EV/OI has been 25x over the last 10 years, so let’s say it’s the same, you’d have a $90B EV vs. $52B today. So 73% return over 5 years plus some buybacks.

(Brett) At 34x EV/OI, you need to believe margins expand higher into the 35%+ range and for revenue to grow at 10%+ for 5 - 7 years. How do they do that? I think they need to be successful in retaining market share with core Monster Energy, expanding into international markets with Monster/Other Brands, and have success in the alcohol category.

Bear Case:

(Ryan) Multiple compression is the big one or if operating margins are closer to 30% instead of the 35% they had from 2016 to 2022, I worry this would be closer to a low single-digit return.

(Brett) I think this is an extremely high-quality business, so the only bear case I have is multiple compression. If earnings grow at 10% a year for five years but we get a multiple of 15x - 20x in year 5, I don’t think investors will be happy with the returns.

More or less interested?

(Ryan) More interested. I think this is a truly wonderful business, but the market knows it. Hard to love the investment at this valuation.

(Brett) More interested. This is a fantastic business.

Sources and Further Reading

Coke acquires stake: https://www.marketingweek.com/coke-acquires-2bn-monster-stake-to-transform-brand-into-pure-play-global-energy-drink/

2023 Investor Update: https://investors.monsterbevcorp.com/static-files/b57f8e57-82b2-4bc5-b5d4-a9c0a5e754aa

Business Wars: Red Bull vs. Monster: