Not So Deep Dive: PayPal Stock (Ticker: PYPL)

It looks cheap, but does it have any competitive advantages?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: PayPal is a consortium of very different payments-related businesses. The best way I’ve seen someone segment the operations here is the way our friend Mostly Borrowed Ideas does it, Core Payments Processing (the PayPal button) and everything else:

The PayPal Button:

You’ll often see this referred to as “Branded Checkout”. This is currently the most important part of the PayPal business as it accounts for roughly one-third of all PayPal’s transaction volume and an estimated two-thirds of gross profit.

The reason it’s called the PayPal Button is because there are lots of different kinds of transactions that happen here. Example: Let’s say you’re going to buy cologne from Ulta Beauty’s website. When you get to the checkout you’ll see something like this:

This is the typical “PayPal Button” transaction. But it also includes cross-border transactions, BNPL transactions, and more. And the other difficulty is where does that payment come from? If it comes from money stored on PayPal, there’s a larger take rate than if it’s just an ACH transfer through PayPal. The most important thing to understand here is that checking out with the PayPal button is usually the highest margin type of transaction that PayPal gets. According to Morgan Stanley, “83% of the largest 475 digital merchants accept PayPal”.

Everything Else:

Braintree (aka unbranded checkout): This is the 2nd most important business under PayPal’s umbrella. Today, Braintree is a “full-stack” payments processor that competes with the likes of Stripe and Adyen, and importantly does not carry any sort of branding when the consumer checks out. So unlike PayPal, which is focused on both the consumer and merchant side of things, Braintree is focused solely on attracting merchants and typically large merchants.

Braintree processes ~$400 billion in annual payment volume (1/3rd of PYPL’s total TPV). For context, Stripe and Adyen are both at about $800 billion but Braintree is actually growing much faster.

Venmo: This segment of the business is pretty simple. This is their peer-to-peer payments app where PayPal collects a fee when consumers want to move money back to their bank accounts quickly. While they’ve rolled out some other initiatives over the years such as the Venmo credit card, it’s still predominantly driven by this core function of sending money to friends.

Xoom: PayPal bought Xoom for just under $1B in 2015 and it’s an international peer-to-peer money transfer service. Hard to say if they’ve really had a whole lot of success here.

HyperWallet: This is a pay-out solution for merchants. Let’s say AirBnB collects a payment via Braintree, the payout to the actual host can come via Hyperwallet. And while it typically takes 3 days or longer to pay these out, Hyperwallet (as its name suggests) speeds that up because PayPal fronts the cash.

I think I’m going to stop there. They have Zettle, Honey, Paidy, HappyReturns, Chargehound, Simility, and more, but those are all relatively small and the economics of each are unknown since they get lumped into either Peer-to-Peer (exc. Venmo) or other Merchant Services.

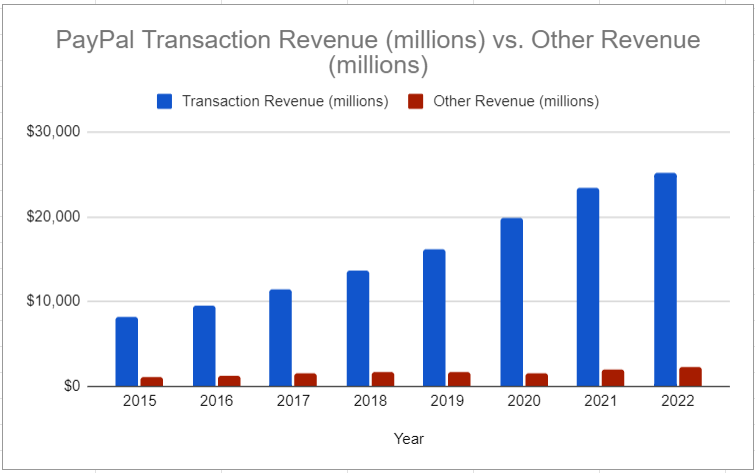

(Revenue breakdown, ignore the estimates)

(Ryan) History: The PayPal story is one that has been told many times and it is quite fascinating because the members of that original team have gone on to start the likes of YouTube, LinkedIn, Yelp, Palantir, Affirm, and more. I’ll go through the history briefly but if you’re interested in how the company was founded, I recommend the book The Contrarian by Max Chafkin (it’s more of a biography about Peter Thiel though.)

Anyways, the PayPal story started in 1998 when Peter Thiel, Max Levchin, and several others founded Confinity. Apparently, Confinity was marketed as a software-security program for Palm Pilots. However, after struggling to find a whole lot of success with that they switched their focus to sending and receiving secure (big emphasis here) electronic payments. In 2000, they merged with X.com, which was at the time run by Elon Musk, and ended up naming Musk their CEO.

But the team apparently didn’t like Musk or thought his vision was off, so when he was on his honeymoon they went to Seqoia Capital (their big investor at the time) and replaced him with Peter Thiel as CEO. Shortly after, PayPal went public and raised a bunch of money, only to be acquired by eBay about 5 months later for $1.5 billion. I won’t go into that much more detail because I think we’ve talked about this on the show before, but there is some additional context that’s important to call out to paint a picture of where the business is today.

While it was under the eBay umbrella, it still evolved as a business and made a number of acquisitions including Braintree in 2013 (which also contained Venmo). Then 2 years later, PayPal was spun out of eBay and began trading independently. Around this time Dan Schulman was named CEO and the years since have been rather underwhelming. This culminated in famed activist investment firm Elliott Management taking a stake in 2022.

(Brett) Industry/Landscape/Competition:

The digital payments industry is immense and has steadily grown for the last few decades. Analysts expect it to continue gaining share and then it will grow alongside the global economy. In the US, digital payments volume is estimated to hit $2 trillion in 2023 and continue growing to $4 trillion annually (give or take) by the end of the decade

Side note: Companies that earn revenue as a % of payment volume (PayPal, Visa, Mastercard, Adyen) are almost perfectly hedged with inflation

Defining competition for PayPal is difficult, but you need to separate the two segments into the merchant customers and the consumer customers

Merchant competitors: The payment buttons and payment processors. These include Shop Pay, Adyen, Stripe, direct credit card inputs. Essentially any method of paying for a product that is not using the PayPal checkout experience (this includes Braintree).

Consumer competitors (to PayPal and Venmo): Cash App, Apple Pay, Google Pay, Zelle, etc.

Today, the card networks (Visa, Mastercard, American Express, Discover) are more partners with PayPal than competitors. PayPal can work with them to get more spending volume across their respective card networks, which will boost everyone’s revenue.

Long story short: Any competitor of PayPal is a company that wants to steal a customer touchpoint where PayPal can be a toll road and earn a take rate on payment volume. This is true across the consumer side, but more importantly the payment processing side.

Finally, when looking at the industry, it should be noted that take rates have slowly come down over time, which makes volume growth very important. For example, here’s a screenshot of what Shop Pay charges compared to PayPal:

(Brett) Management and Ownership:

The CEO of PayPal is Dan Schulman, who has been leading this company since the 2015 spin

One thing all investors are watching right now is the major executive turnover. Schulman announced his intention to step down as CEO, and they will be looking for a new CEO in 2023. For clarification, he is still running the ship right now.

The CFO position is also up in the air. They recently hired the ex-COO/CFO from Electronic Arts (personally, I think that was a great hire) but unfortunately, he had to step down for personal reasons. Sounded like it may have been health-related. Now they have an interim CFO, so some uncertainty in that position as well.

Does this uncertainty around new management make you want to own the stock more or less?

Executive compensation, you’ll never guess this, has a base salary, annual bonuses, and long-term stock awards.

In 2022, annual bonuses were based on revenue and non-GAAP operating margin targets

Long-term equity awards are based on revenue and free cash flow CAGRs over three-year periods

For reference, they missed revenue and operating margin targets last year. The three-year targets were 16.5% for revenue (midpoint) and 13% for free cash flow (midpoint). They hit right around both targets in 2022.

I would like to see free cash flow changed to free cash flow per share. These incentive choices are important as they show what PayPal executives care about and what they may “push the scales towards” when running the business.

The ownership table is a bit quirky, as I think some of the information sources may be off. As you might expect, insider ownership is low and index fund ownership is high since this is a large-cap American stock.

Comprehensive Financial mgmt owns 2.6% of the stock and is a concentrated advisory firm. Whale Wisdom says the activist Elliott Mgmt now only owns 1 million shares, but I would watch this closely as reporting states they are still talking to management. I will be watching to see if they up their stake or ask for board membership soon.

(Ryan) Earnings:

2022:

$27.5 billion in total net revenue, +8% YoY

$5.1 billion in free cash flow, +4% YoY

$3.8 billion in operating income (they pay out ~$1.3 billion in stock-based comp)

Repurchased $4.2 billion in stock last year

Most Recent Q:

$354.5 billion in total payment volume, +10%

433 million active accounts, +1% YoY

Transactions per active account grew 13% YoY

Raised their full-year EPS guidance

Question: Will their earnings be higher or lower in 5 years?

(Ryan) Balance sheet and liquidity:

Reminder: PayPal’s balance sheet is a little unique in that customers often hold cash on their PayPal accounts. According to management, these customer cash balances tend to have a duration of 9-12 months. This means PayPal is able to invest that cash in short-term treasuries.

Assets:

Cash and Short-term Investments of ~$11 billion

They hold just over $35 billion in customer funds

Plus $4.6 billion in long-term investments (Half of these are AFS debt securities, other half are strategic investments which I believe are mostly comprised of MELI stock)

Liabilities:

$10.3 billion in total long-term debt.

That debt comes from 3 different issuances of fixed-rate notes:

2019 Issuance: $4 billion with a weighted-average interest rate of 2.8%.

2020 Issuance: $3.4 billion with a weighted-average interest rate of 2.4%.

2022 Issuance: $3 billion with a weighted-average interest rate of 4.8%.

The majority of the debt is due after 2027.

Net cash position of more than $5 billion

(Mention though that this morning they took on a bunch of Japanese debt. Potentially to juice buybacks?)

Because of the various interest-bearing assets they own, PayPal’s quarterly interest income now eclipses the interest expense from their debt. In the most recent quarter, they earned $72 million in net interest income vs. ($82) million in the same quarter last year.

(Brett) Valuation:

Market cap of $72.6 billion

EV of $67.1 billion

EV/OI of 17.5

EV/OI at 20% margin of 12.2

All ratios based on 2022 financials

Anecdotal Evidence:

(Ryan) Use Venmo on a regular basis. But I’ve been increasingly using Apple Pay. At first, it was for physical merchants, but the more I get used to it, the more I use it for online checkout.

(Brett) The Venmo moat is very impressive. Apple and Google are trying to attack it and it is still growing (check the newsletter for charts on this). I would analogize this to Tinder where you had a great early entrant, product-market fit, and fantastic network effect, but then rested a bit on your laurels.

Future growth opportunities:

(Ryan) Venmo? There is this quote that Brad (Stock Market Nerd) found that I think is pretty interesting, “We’ve been very cautious to ensure that when we add Venmo monetization features, we’re doing so in a way that resonates… the last thing we want to see is users start leaving the platform and we’re just not seeing that... there’s so much value to unlock and we’re early innings.” I think they can start to push the envelope here a little more in terms of features. I know they’re taking steps, but this feels like one of PayPal’s most durable properties.

(Brett) Braintree. As Ryan will talk about in the opening section, Braintree is another modern merchant acquirer that competes with the likes of Stripe and Adyen. Customers include all the big enterprises (they use Microsoft as an example a lot). In the annual report, they said this year “We are doubling down on Braintree." We do not have segment numbers (some analysts back into them) but we get anecdotes on every call that Braintree is growing quickly. I think this is a fantastic counterposition for PayPal as it gets increasing threats to “the button” from Shop Pay, Google Pay, Apple Pay, etc. Plus, something I think investors may underestimate is that when PayPal updates online checkout with Braintree or unbranded PayPal checkout they can make sure they get distribution for their consumer-focused services (PayPal, Venmo). According to management, merchants updating to its new unbranded checkout services see material uplift for consumers using PayPal or Venmo at checkout. This is an advantage they can use to counterposition Apple, Google, Amazon, etc.

Highlights and lowlights:

Ryan’s Highlights:

Activist investor involvement. When Elliott Management steps in, they seem to make some good changes. I imagine the chances of PayPal wasting any money on big acquisitions will go out the window.

Power users: “What insulates PayPal further from experiencing declining revenue scenario in the core business is 30% of active accounts generate 80% of transactions.” (Brett: Can touch on MAUs here, too)

Can earn interest on the float in a higher rate environment. A lot of people value them on an EBIT or EBITDA basis, which will miss out on the interest income that they’ll probably generate assuming rates stay where they’re at.

Repurchase program. Last year they spent $4.2 billion on buybacks out of $5.1 billion in free cash flow. They said they’ll do at least $4B this year, I think it’s possible they do more since they just took on some really low-rate debt. SBC is decreasing due to the recent layoffs. I think there’s a realistic path to them reducing share count by 6%-7% a year if the price stays where it is.

They are growing. They maybe aren’t taking share, but digital payments are growing globally and so too is PayPal.

Ryan’s Lowlights:

Competition within the branded checkout segment. Apple Pay and Google Pay both seem to be gaining steam and eating away at PayPal’s primary cash generator.

The incentive misalignment. I want to thank MBI for finding this, but over the last several years, management posted rather audacious guidance for investors while having ridiculously easy hurdles in order to reach their bonuses.

Brett Highlights:

This is a good industry to play in from a growth/durability perspective. Digital payments seem extremely likely to grow for at least the next decade and are inflation-proof. It is a perfect market.

Selling Xoom. According to the Information, they are looking to sell it.

Buyback program. They are keeping it consistent and deploying most of the free cash flow now into the buyback. At these prices, consistency can reap significant rewards for shareholders over the next five years.

Brett Lowlights:

This can be a tough industry to be in from a competitive standpoint. You have Stripe and Adyen competing with Braintree. Shop Pay, Amazon Buy With Prime, Apple Pay, and Google Pay compete with the core checkout button, and Cash App + others compete with Venmo. All of these companies are large and have great track records of execution. Can PayPal defend its position?

If you follow what management has done with capital allocation and how they “invested” in the business since the pandemic, a lot was a waste. Remember the Super App? They also had KPIs that were irrelevant, like total active accounts. Growing active accounts could actually be hurtful if the acquisition cost was high and they don’t spend much. However, they seem to be fixing some of these issues, which is something I think every investor is watching closely right now, especially once we get the new executive team in place and possibly some activist investors on the board of directors.

Bull Case:

(Ryan) I think the bull case is relatively simple. The payPal button continues to grow, albeit at a slow pace, and everything else grows a little faster and begins to contribute to profitability. If those two things happen, I would assume that PayPal grows its free cash flow somewhere in the ballpark 5%-10% annually. If you assume they spend 90% of their free cash flow on buybacks and SBC stays relatively flat, they’d grow FCF per share by ~16% annually.

(Brett) As of recording, PayPal is trading at 12x OI if you assume they could hit a steady state margin of 20%. So, all you need to assume is modest growth, consistent buybacks, and not terrible capital allocation in order for this to work. Can they do it? I think it is possible, especially if they dump some bad bets and focus solely on the PayPal button, Braintree, and Venmo.

Bear Case:

(Ryan) The Apple Pay risk is real and really starts to eat away at a lot of the transaction volume from the PayPal button.

(Brett) I see two bear cases. First, the competition continues to eat at them around the edges (outlined throughout this episode). Second, the management transition falls flat (there is major uncertainty whenever new leadership takes over).

More or less interested?

(Ryan) More interested. I don’t think it’s a business that will grow its market share of global transactions, but I think it can still be a good investment.

(Brett) I am very on the fence here. On the one hand, growth prospects look solid and the price you are paying here is not crazy. On the other hand, I think payments is a really tough market with tons of competitive threats that make me queasy, plus we don’t know anything about the new management. If I was confident in the competitive advantages here (I am not, but could easily be wrong) this would be an easy buy. Let’s discuss our philosophy on identifying watchlist stocks and how this is a perfect example of keeping a stock on your watch list when looking at the share price over the past few years.

Sources and Further Reading

StockMarketNerd Deep Dive:

Business Breakdowns Episode:

MBI Buy Thesis:

https://twitter.com/borrowed_ideas/status/1663684767076810753

Our interview on Adyen with MBI:

Digital payments industry projections: https://www.statista.com/outlook/dmo/fintech/digital-payments/united-states

Thats a fantastic analysis

The main risk is buyers going away due to Apple pay or Google pay. Google pay can also be paypal funded.

The super app is their best way out of competitive threats, getting more engagements and service for active users.

Check my articles and video on PayPal

https://www.youtube.com/watch?v=t8zAgglrsT8&t=1s

https://emergingvalue.substack.com/p/paypal-needs-a-market-place-and-to