Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts

Check out even more charts on PepsiCo at Stratosphere.io! (click on images to more easily read them)

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: Pepsi is a leading global provider of convenience foods and beverages. Though they got their start in the cola category, today, 58% of their sales come from convenience foods and 42% come from beverages. They own a vast portfolio of different products, so I’ll try to rip through some of the popular ones.

Convenient Foods: Cheetos, Cap’n Crunch, Cracker Jacks, Doritos, Fritos, Grandma’s Cookies, Lays, Quaker, Rice-a-Roni, Ruffles, Rold Gold, Stacy’s, Sun Chips, Tostitos, and a bunch more.

Beverages: Aquafina, Bubly, Mountain Dew, Gatorade, LifeWater, Mug Rootbeer, MuscleMilk, Pepsi, Propel, Rockstar, 7UP, Sierra Mist, SodaStream, etc.

If you’re reading their financial statements, you’ll see a different method of reporting. They break it out into 7 different groups (Frito-Lay, Quaker, Pepsi, LATAM, EUR, AMESA, and APAC), but I think that’s a bit of a funky way to report so I just broke it down into their two product types. It does do a good job however capturing their international markets. 61% of their revenue is earned in North America and 39%, or ~$34 billion, is earned abroad.

On the logistics side, they’ve developed a pretty complex distribution network over the years, but the majority of their products are brought to market via their Direct-Store-Delivery network (DSD). This means Pepsi delivers the products directly to their retail stores and merchandises them themselves. They also sell through some distributor networks and e-commerce channels where it makes sense.

(Ryan) History: In 1898, a pharmacist from North Carolina named Caleb Bradham developed a soda formula in hopes of replicating Coca-Cola’s success. He named it Pepsi-Cola and after some solid success, he officially formed a company around it in 1902. They did well until just after World War 1 when they began to struggle. In 1931, a man named Charles Ruth acquired Pepsi’s trademarks and assets and really established what’s become the modern Pepsi-Cola company.

The company took off during the Great Depression, when they began running their now famous 5-cent 12-ounce campaign. The company built on its success in the 50’s when a former VP of Coke became CEO and in 1965 they merged with Frito-Lay. They’ve made tons of acquisitions since including at one point buying Pizza Hut, Taco Bell, and KFC but have since divested those. The last real big acquisition was in 2001 when they purchased The Quaker Oats Company for $13 billion. Quaker owned their famous oat-based products, as well as Gatorade, Snapple, and several other brands.

Since 1994 (the year Berkshire completed its purchases of Coca-Cola stock), Pepsi is up 17-fold versus Coke up 11-fold.

(Brett) Industry/Landscape/Competition:

You can separate the PepsiCo business into two categories: drinks and snack foods

In the insightful slide show presented at a recent consumer conference (linked in our sources), the company goes into the industries and market share

Funny enough, both of these industries are around the same size, at around $600 billion in global annual spending and growing 5% year-over-year

In convenience foods, PepsiCo has an 8% market share and a 9% market share in global beverages

Competitors: Coca-Cola, Monster Beverage, Starbucks, Mondelez, and other food/drink companies. Like when we talked with Monster Beverage, PepsiCo is competing for what consumers choose to eat and drink in their day-to-day lives.

According to the proxy filing, the company gained share in food in the U.S, Brazil, the U.K, China, and India. In Beverages, they gained share in Mexico, Brazil, Australia, China, and India. I think these are great signs for growth over the next decade if they are gaining share outside North America.

(Brett) Management and Ownership:

The current chairman and CEO is Ramon Laguarta, who rose through the ranks since joining the company in 1996 to become the CEO starting in 2018.

I’m going to be frank: I think the executive team at a company like Pepsi is not very important. There is really only one question I want to ask for a CPG stalwart like this: Is he being smart/rational with capital allocation (dividends, buybacks, acquisitions, investments, etc.)

Absurd executive compensation, Pep+ (which we can go over), a cloud transition, or many of the other things the executives may talk about on the conference calls are not going to move the needle one way or the other.

However, credit where credit is due, Pepsi has accelerated revenue growth since Laguarta took over. Part of me thinks he should be thanking inflation for that, though.

Executive compensation is very complicated and just boilerplate compensation consultant philosophy that you would expect from a Fortune 100 company.

Annual bonuses are based on constant currency revenue growth, free cash flow, constant currency EPS growth, and constant currency net income growth.

The LT stock awards are all performance-based and are based on 3-year EPS growth, 3-year organic revenue growth, and 3-year TSRs vs. industry peers.

One of the most boring shareholder tables I’ve ever seen. Serious question: Who is selling this thing? https://whalewisdom.com/stock/pep

(Ryan) 2022 Earnings:

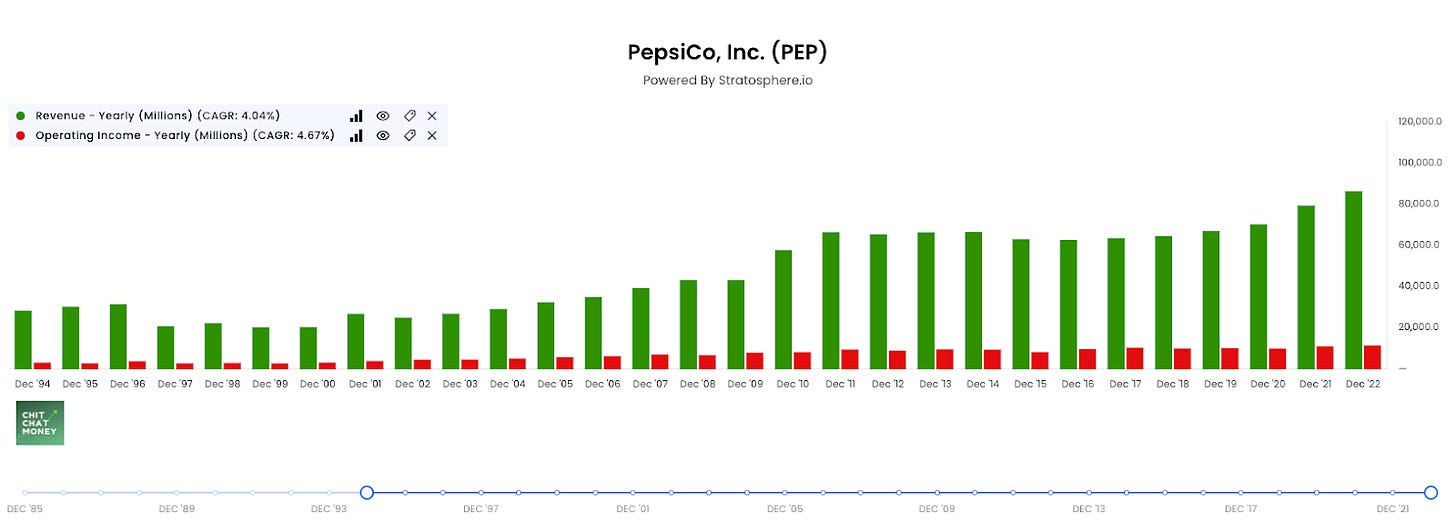

$86 billion in revenue, +9% YoY (Excluding foreign exchange, acquisitions and divestitures, and the 53rd reporting week, “organic growth” was +14%)

14% growth in pricing this year

0% growth in volume

53% gross margin (this has basically been flat for the last 15 years)

$11.5 billion in operating income or 13% operating margins. They had a $3 billion goodwill impairment this year.

$10.8 billion in operating cash flow (working capital grew and management said “We basically had a timing issue one that we're doing some IT implementations.”

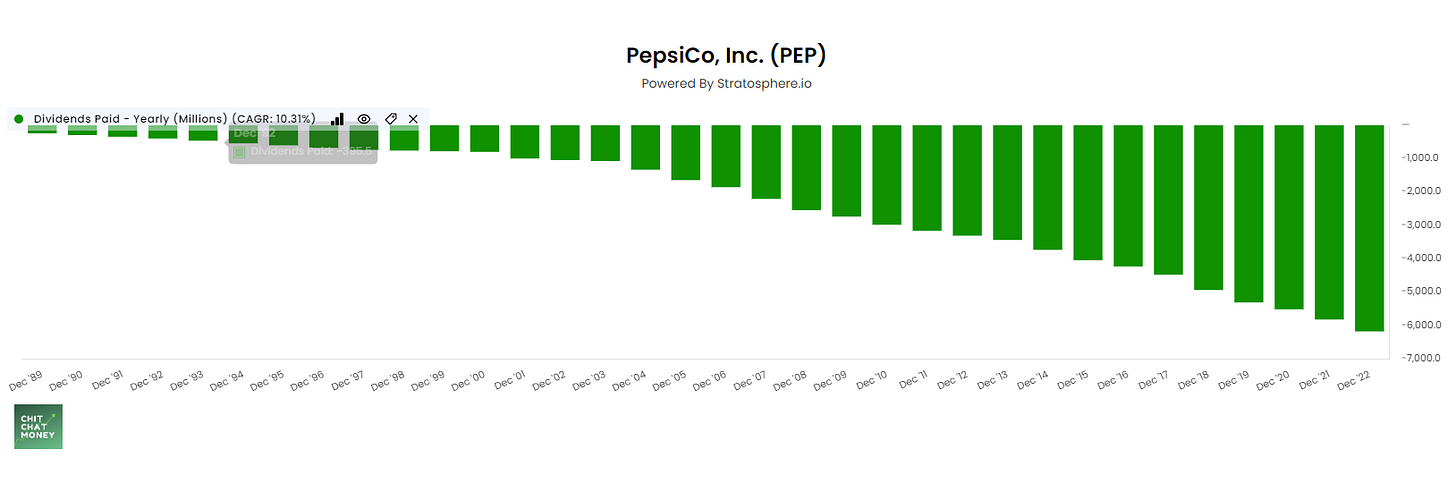

Returned roughly $8 billion to shareholders ($6.2B in dividends and $1.5B in repurchases).

They’ve increased their dividends for 51 consecutive years.

2.5% dividend yield currently.

Here’s what their long-term growth has looked like since 1994, the year Buffett completed his purchases of Coke. So for the last 30 years:

Revenue has compounded at 4%, Operating income at 4.6%, and EPS at 6.5%.

(Ryan) Balance sheet and liquidity:

Assets/Cash Flow:

$5.3 billion in cash and short-term investments

$5.2 billion in inventories, +20% YoY

Generated $13.1 billion in EBITDA this year

Debt:

$36 billion in long-term debt, $3.4 billion in short-term. Almost all of it is fixed-rate.

Their weighted average interest rate on their debt is currently 2.65%.

And according to their 10-K: “A 1- percentage-point increase in interest rates would have decreased our net interest expense in 2022 by $48 million due to higher cash and cash equivalents and short-term investments levels, as compared with our variable rate debt.”

$34 billion of net debt. Net Debt to EBITDA of 2.6x.

(Brett) Valuation:

Market Cap of $260 billion

Enterprise value of $293 billion

EV/OI of 25.5

I think EV/OI is the best metric to look at for a company like PepsiCo

Anecdotal Evidence:

(Ryan) I consume a lot of their products. Gatorade, Celsius, Doritos, Ruffles, Tostitos, you name it. And I think for each of them, I’m really not that cost-conscious. I’m buying them for the brand.

(Brett) I’ll eat some of their chip brands from time to time, and people are lying to you if they say Gatorade doesn’t taste amazing after some intense exercise. I do worry that some of the core Pepsi customers will erode (soda is less popular as a day-to-day drink among younger people I think) and move to other choices but Pepsi is making some investments in order to disrupt itself if that is the case.

Future growth opportunities:

(Ryan) Partnering and leveraging their DSD network with fast-growing brands, as they’ve done with Starbucks, Dr. Pepper, and now Celsius. Their distribution is a real advantage over pretty much everyone except Coke. Hard to say what they do to margins, but I’d have to think it’s revenue accretive since they’re driving those routes anyways. I think that the Celsius deal could frankly end up looking a lot like Coke’s 2014 purchase of Monster. It’s only an 8.5% stake but I think they got some favorable terms too.

(Brett) I think the most important growth drivers this decade (aside from maybe pricing power in North America, if inflation runs rampant) is growth in the Asia, South Asia, Middle East, and Africa divisions. These only make up 13% of consolidated revenue but have by far the largest overall populations and potential for market share gains in both food and beverages. Revenue in these divisions has grown at 10%+ since 2017 despite major foreign exchange headwinds last year, which I believe masks the success they are having in these markets.

Highlights and lowlights:

Ryan’s Highlights:

Their direct store delivery network affords them opportunities many other companies don’t have. “We are the number one supplier to most of the retailers in the US. That gives us a seat at the table in terms of sharing data, joining infrastructure, talking five years out versus just next quarter.” This also gives them the ability to launch new products quicker, since they can just add them to the existing routes.

The pricing power is quite evident, especially at Frito-Lay.

Diverse and durable. There’s no single-product risk like you might have with Phillip Morris or Monster. If I were making a bet on simply which business today is likely to be here in 50 years, Pepsi would be pretty high on that list.

Ryan’s Lowlights:

Investing in some weird initiatives. Such as Direct to consumer platforms like gatorade.com and Snacks to You. They also said, “We are investing a lot in food trucks and more, giving consumers the opportunity to buy our products beyond a bag in a much more holistic food experience.”

Feels like they’ve really taken price at an unsustainable rate. In the fourth quarter, volumes declined by 2% and they raised aggregate pricing by 16%.

5% of revenue comes from Russia, and it looks like they’ve actually been investing heavily there throughout the 21st century. Acquired Russia’s largest juice manufacturer in 2008.

Brett Highlights:

Clearly a great business that speaks for itself. Dividend growth for 50+ years, a diversified portfolio of brands like Lays, Pepsi, Gatorade, that have won the minds of consumers for many years along with new investments into brands like Bubly and Celsius set themselves up for the next decade if we truly get “healthier” as a society (I doubt it, though).

Investing in new product lines for all of their main brands that are “healthier” seems very smart to position themselves in the market.

They have competitive advantages in distribution (shelf space, global supply chain) and brand that allows them to retain market share without spending immense amounts of money on marketing. A simple strategy that seems to be the core reason the best CPG brands crush the stock market over the long-term.

Brett Lowlights:

Minimal exposure to the energy drink market, which is the best spot to be in drinks today (they are trying to fix this with Celsius, potentially).

Law of large numbers. Excluding inflation, can this business double over the next 15 years?

I worry that CPG brands have had such strong pricing power forever and that this could be one of those “things you know for sure that just ain’t so.” When do we ever run into a wall with pricing power with these brands?

Bull Case:

(Ryan) I find it hard to imagine this being a big home run at current prices. The stock has basically tripled over the last 10 years, but a big chunk of that is multiple expansion. Their EV to EBIT has increased by 50% since 10 years ago, whereas earnings per share has only compounded at 5% annually for the last decade. I think the bull case here is that you get high single-digit EPS growth and the multiple doesn’t contract.

(Brett) The stock trades at 25x earnings, give or take. Management is guiding for long-term revenue growth of 4% - 6% with slight margin expansion every year. I think to be bullish from here you need to think the company trades at 25x earnings or higher in almost all time periods. Which, to be honest…doesn’t it deserve to?

Bear Case:

(Ryan) Multiple reverts to its long-run average and earnings grow at the same pace they have for the last 25 years. If that’s the case, I think you’ve got a low-single-digit return.

(Brett) I think this is one of the best businesses in the world, so the only bear case I can come up with is multiple compression. Real risk though!

Sources and Further Reading

February 2023 Consumer Conference Presentation: https://www.pepsico.com/docs/default-source/investor-relations/events-presentations/2023/cagny-2023-presentation.pdf?sfvrsn=43231fc5_3

Fizz: How Soda Shook Up the World: https://www.amazon.com/Fizz-How-Soda-Shook-World/dp/1613747225

2022 Annual Report: https://www.pepsico.com/docs/default-source/annual-reports/2022-pepsico-annual-report.pdf?sfvrsn=9d046f4c_10