Not So Deep Dive: Philip Morris International (Ticker: PM)

The road to a risk-reduced future...

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

Upcoming schedule: Pepsi (next week) Nintendo (the week after)

YouTube

Spotify

Charts

Data powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: Phillip Morris International is the world’s largest tobacco company (excluding China) but is also seen as the global leader in reduced-risk products. The business is pretty simple and can be broken down into two segments – combustibles (or smoking) and smoke-free products.

Combustibles: This refers to their cigarettes business (but will also likely include cigars from their SWMA acquisition). The operations of the business are pretty straightforward. As of the end of 2022, PMI had 53 manufacturing facilities located all around the globe that source a variety of tobacco leaves typically from suppliers within their local market, and sell via a number of different distribution channels. The gross margins on this business are typically around the high 60% range.

As for the products, PMI sells a variety of different cigarette brands all around the globe. The most notable is Marlboro, which accounts for 39% of their cigarette sales, but they also own Parliament, Chesterfield, L&M, Phillip Morris, and a number of popular brands in Indonesia and the Philippines. In total, combustibles accounted for 68% of Phillip Morris’ revenue in 2022.

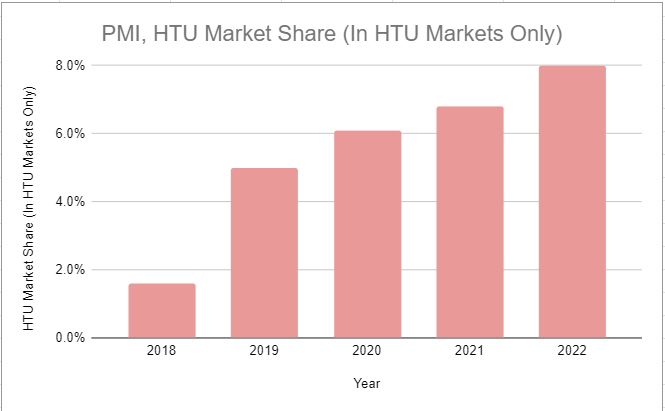

Smoke-Free: There are a number of different products here including heated tobacco, e-vapor, and smokeless oral, but the two big ones are really IQOS and now Zyn. IQOS has a number of different styles, but it is a pen-shaped device that heats tobacco instead of burning it. So the initial machine costs around $80 depending on the market, then customers buy the IQOS Heatsticks (basically cigarettes) on a recurring basis. Zyn, on the other hand, is the premier nicotine pouch brand in the US which they acquired in the Swedish Match deal. They tout 76% market share in the US, ~50% operating margins on a little over $1 billion in revenue, and shipments grew 35% in the most recent quarter. In total, smoke-free accounted for 32% of revenue in 2022, but management expects that to jump to 40% with the inclusion of Swedish Match.

(Ryan) History: Phillip Morris International’s founding actually dates all the way back to 1847 when a gentleman named (surprise, surprise) Phillip Morris opened a shop in London to sell tobacco and cigarettes. I won’t go through all the history today, since it’s pretty irrelevant to the investment but it is pretty fascinating to see how long the big cigarette brands have lasted.

In 2008, Altria decided to spin off its international arm amidst an onslaught of litigation, and that formed Phillip Morris International. Since that 2009-2011 time period, total unit shipments have slowly collapsed driven by overall declines in cigarette smoking and it wasn’t really until these last two years that volumes began to grow again thanks to the growth of their smoke-free category. IQOS officially launched in 2014, they acquired Swedish Match this year, and a couple of months ago they acquired the rights to sell IQOS in the US which Brett will talk about later.

It’s worth noting that over the last 10 years, Phillip Morris’ total shareholder return has only been 75%, well below Altria's.

(Brett) Industry/Landscape/Competition:

The tobacco/nicotine market is large and – maybe surprising to listeners – projected to grow at a 2.5% clip through 2027 worldwide and hit over $1 trillion in annual spending.

Statista has industry revenue growing worldwide mainly due to price increases

PMI operates in every major market except China and the United States. China is the largest market with $294 billion in annual spending

PMI has retained its total international market share with steady consistency, mainly due to the zero new competition entering the cigarette space. In 2020, 2021, and 2022 market share was between 27.2% and 27.6%.

For the competition, I do not think looking at the other cigarette brands is important. The market shares have been very steady for a long time now, and what is more important for the industry is any regulatory changes that can affect taxes, distribution, etc.

Competition in nicotine pouches: Altria Group (On!), British American Tobacco (Velo), Turning Point Brands (Rogue). Analyst projections for the industry vary but the general consensus is that it grows much faster than the overall nicotine space.

Vaping/RRPs inhalation product competitors: Pod-based vaping (Juul, NJOY, Vuse), disposables (Elf Bars, all the quirky ones), and many other smaller products. As we will no doubt discuss on the show, this industry is a lot harder to analyze than nicotine pouches.

(Brett) Management and Ownership:

Until May of 2021, PMI had Andre Calantzopoulos as either President, COO, or CEO. He led them through the spin away from Altria Group and through the huge investments into RRPs.

Now, Jacek Olczak is running things as CEO, and Calantzopoulos has bumped up to executive chairman. Olczak has been with the company since 1993 and is 58 years old.

Generally, the proxy filing was extremely boilerplate. This is good in the sense that there were no major red flags I could find at first pass-through, but also disappointing that they just use the standard compensation consultant gobbledygook

Executive compensation is (say it with me) a mix of base salary, annual bonuses, and long-term equity awards.

The only strange thing I saw was that some of the PSUs are based on sustainability targets and RRP volumes. Do we think that is a good incentive for PMI?

Overall, proxy filing is extremely boring with this one, and ownership table is also unsurprisingly all the index funds

(Ryan) 2022 Earnings:

$31.8 billion in total revenue, +1% YoY but +8% in constant currency.

Russia and Ukraine account for 8% of overall revenue.

64% gross margin vs. 68% last year

Number of things contributing to margin compression. Supply chain costs (mostly transportation), but also IQOS ILUMA device sales are lower margin.

$12.2 billion in operating income or ~39% operating margin

~$10 billion in free cash flow this year

They’ve halted buybacks at the moment and will likely be using the cash flow to pay down debt, pay out their dividend (5% yield), and likely some increasing capex.

(Ryan) Balance sheet and liquidity:

Debt:

$43.1 billion in total debt. The bulk is all fixed rate but they added some variable rate debt when they acquired Swedish Match.

In total, their weighted average cost of the debt was 2.5% in 2022. But shareholders should expect that to rise as management has outlined in calls.

The majority of the debt matures after 2029.

Assets/Cash Flow:

They’ve got $3.2 billion in cash and $4.4 billion in equity investments. I would exclude the equity investments in the EV calculation.

They generated $13.8 billion in Adj. EBITDA last year

So Net Debt to EBITDA ratio of ~2.9x or 2.75x if you include a full year of Swedish Match.

(Brett) Valuation:

Market cap of $155 billion

Enterprise value of $191 billion

EV/EBIT of 15.6

EV/FCF of 19.6

Anecdotal Evidence:

(Ryan) They’ve seen slower volume declines in combustibles than both British American and Altria. And they seem best positioned in the RRP space.

(Brett) We can talk nicotine pouches, vaping, and what the RRP market looks like 5 - 10 years from now. Generally, I like the international tobacco market (slower volume declines) and nicotine pouches. PMI is the leader in both.

Future growth opportunities:

(Ryan) I’ll take the other obvious one here, Swedish Match (or more specifically, nicotine pouches). Phillip Morris closed on their $16 billion acquisition of Swedish Match in November of 2022. PM paid basically 17x Swedish Match’s expected 2023 EBITDA. I think Zyn is one of the best businesses around and kudos to Phillip Morris for pulling this off. For reference, Zyn shipment volumes have compounded at 198% since Q4 of 2017 and they still grew by 35% in the most recent quarter. Management wants to begin deploying Zyn across its international distribution channels as well which should hopefully supercharge growth. This should also help slightly alleviate some of Phillip Morris’ currency concerns since they earn so much in USD.

(Brett) I don’t know if this is my favorite growth opportunity, but one that is important for the next decade: Entering IQOS into the United States. Originally, PMI had a distribution agreement to bring the innovative IQOS platform to the United States through Altria’s distribution network. Whatever the economics of the deal, it is now broken with the official closing date of April 2024. PMI is paying Altria $2.7 billion to get out of this deal. Now, they will be able to distribute IQOS (regulators willing, of course) throughout the U.S. through Swedish Match’s distribution network. The executives say this will let IQOS “live up to its full potential” in the market. Do we think this is a smart move?

Highlights and lowlights:

Ryan’s Highlights:

I like the economics and the competitive advantages of their combustibles business. The decline in smoking in their markets is quite low, pricing power is still strong, and it’s a really difficult market to enter given the regulatory hurdles.

Within the reduced-risk product category, which I think will see remarkably strong growth over the next decade, they seem to own the two best businesses. British American looks like a distant 2nd and Altria has consistently fumbled the transition.

Also, both IQOS and Zyn have better margins than their core combustibles business.

Ryan’s Lowlights:

Russia & Ukrainian exposure. They’ve said that they are trying to sell off this business but it has become increasingly difficult to do. Probably worth just valuing this at zero.

The increasing interest rate on their debt. Really wish they would’ve acquired Swedish Match with stock. Won’t be impossible to manage but it would’ve allowed them to be buying back right now instead of paying down higher-rate debt.

Brett Highlights:

They are in the parts of the cigarette-smoking universe (everywhere except the U.S. + China) that I think should be quite durable. Everyone knows that smoking is bad for you, and yet usage has not fallen off a cliff in a lot of these countries. Will that change over the next few decades? Maybe. But PMI has the products they will be switching to.

Nicotine usage (like caffeine) has seen rapid adoption since the industrial revolution. I see no reason why humans will not want to continue consuming these mild stimulants on a habitual basis for the next hundred years.

They have the two brands (Zyn and IQOS) in the RRP space with the best track records over the last 10 years in their portfolio.

Brett Lowlights:

As a U.S.-based investor, I worry about FX headwinds. It is a coin that can land on both sides in certain periods but it definitely adds uncertainty compared with a company like Altria Group.

What are the plans exactly for these “healthcare” businesses they just bought? I understand they have succeeded very well in the last few years with RRPs but I wonder if they are overstepping their circle of competence and wasting some capital with these new divisions. No doubt they present solid call option, but I don’t understand why they need to go “beyond nicotine”

Bull Case:

(Ryan) Not going to make the math too complicated. I think there’s a realistic scenario where cash flow grows by 10%+ annually over the next decade. It would come from strong volume and pricing growth at IQOS and Zyn, expanding margins because of their growth, and slow declines in combustibles offset by price increases. If that occurs, they’ll have tons of capacity to buy back and there will probably be some multiple re-rating.

(Brett) Management believes that consolidated margins will expand over the next few years as ramp-up headwinds subside. If they expand margins, grow the dividend, and see modest single-digit revenue growth over the next decade then the stock will perform well.

Bear Case:

(Ryan) Slower than expected growth within smoke-free. Could be from increased competition, unfavorable regulatory rulings, or it’s just a smaller market than I expect. If that growth begins to slow and cigarettes continue to slowly decline, this decade’s returns will probably look like the last decades (mid-single digit CAGR).

(Brett) I think they have the two leading brands in RRPs (Zyn + IQOS) but this industry has been known to be dynamic and it wouldn’t shock me if the market looked very different in RRPs 10 years from now. If so, PMI could have a declining cig business and brands in RRPs that showed to not be durable. However, I still think they are much better positioned than the other nicotine/tobacco companies worldwide.

More or less interested?

(Ryan) More interested. I like the business and I like the valuation, but the simple lack of earnings growth over the last decade gives me pause.

(Brett) More interested. Nicotine is a great industry to be in and PMI owns two of the leading brands for new-age nicotine products.

Sources and Further Reading

Devin LaSarre’s Write-up:

10-K: https://philipmorrisinternational.gcs-web.com/static-files/febc1b88-d260-4a7d-bf9e-106ab8f552f7

Q4 Slides: https://philipmorrisinternational.gcs-web.com/static-files/4a978a7c-4a8d-47fd-9573-3b7cfd649eb6

Acquisition of Fertin Pharma: https://www.pmi.com/investor-relations/press-releases-and-events/press-releases-overview/press-release-details/?newsId=24346

Tobacco is always interesting! 👍