Not So Deep Dive: Pinterest Stock (Ticker: PINS)

Where will growth come from for this mid-scale social platform?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: Pinterest is an image-based social platform that’s predominantly used as a mobile app (80% of engagement is on mobile). However, unlike other social media platforms where the common use case is to browse randomly, Pinterest is a higher-intent search. So for example, a common-use case on Pinterest would be a woman (76% of their users are female) types into the search bar “beach wedding ideas” or “vegan recipes”, and they will see pretty much an endless scroll of pictures or videos that other users have posted to hopefully discover new ideas for themselves. As you can imagine, this kind of search query lends itself fairly well to advertisements and that’s exactly how they monetize. With Pinterest, businesses or brands can run a variety of different advertising campaigns based on their objectives:

Build Awareness: These ads look like a typical pin and it’s either a series of images or a video. The goal of these ads are simply to drive awareness to their product or service, and advertisers pay for these on a CPM (cost per milli) or CPV (Cost per view) basis.

Consideration & Conversions: These are what Pinterest refers to as its mid-funnel, performance marketing solutions. The goal with running these ads is to generate clicks to a website or product listing and as you might imagine, advertisers pay on a cost-per-click basis for these. These mid-funnel ads also support “mobile deep linking” which just means that it can redirect customers to a specific page within an app and not just open the app.

Offline Sales: These are what Pinterest refers to as their “lower-funnel performance marketing”. Basically, advertisers only pay in these scenarios on a cost-per-action basis and it’s far more expensive than the other ad formats.

All of Pinterest’s ads are run in a digital auction format. So you can pick how much you’re willing to bid based on your chosen campaign (they set a floor), but they will give you the market rate.

(Ryan) History: From previous discussions on them “Pinterest was officially founded in 2010 by Ben Silbermann, Evan Sharp, and Paul Sciarra. Silbermann attended Yale University and worked at Google in its online advertising division immediately after.

Apparently, he wanted to build something of his own, so with the encouragement of his girlfriend, he left Google and started Cold Brew Labs with Paul Sciarra (college friend). Cold Brew Labs was an app development company and their initial product was a shopping comparison app named Tote. You could browse apparel and goods from 30 different retailers in one app. This app ultimately failed, but they learned that a lot of people came to the app simply for discovery.

This created the idea for Pinterest. Paul and Ben quickly came up with a Beta, and pitched the 3rd co-founder Evan Sharp to join in 2010 to fine-tune the app (he was credited with writing most of the code). Later in 2010, they officially launched Pinterest but had it as an invite-only platform to start. Obviously, they’ve now removed that and grown their user base. IPO’d in 2019.” However, since we last spoke about the company, users have been in decline, there have been lawsuits and walkouts due to alleged racism and sexism at the company, and CEO Ben Silbermann decided to step down and was replaced by Bill Ready. Around that time, Elliott Management was also announcing their stake, hard to say whether they were the ones that made it happen.

(Brett) Industry/Landscape/Competition:

Pinterest competes for people’s engagement/attention in their free time

So…the industry is vast. I wouldn’t necessarily describe them as competing just with social media (are they really competing with Twitter? Or more with all forms of commerce ads?)

We all know there is a ton of spending in this area. U.S. e-commerce spending is closing in on $1 trillion and should continue to grow.

Let’s compare social media companies’ user bases (i.e. eyeballs and engagement) vs. Pinterest

Facebook: 3 billion. YouTube: 2.2 billion. WhatsApp: 2 billion. Instagram: 2 billion. TikTok: 1 billion. Snapchat: over 500 million. Pinterest: 463 million.

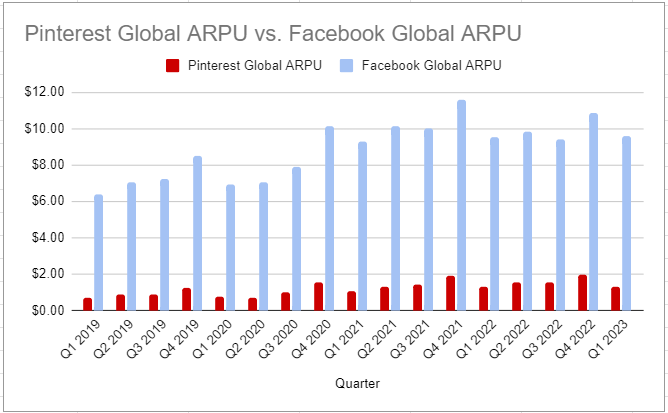

Let’s compare Facebook’s average revenue per user to Pinterest (charts above). Discussion question for this episode: Can this gap continue to close over the next five years?

(Brett) Management and Ownership:

The new CEO is Bill Ready who has been with Pinterest for around a year. He came over from Google Commerce, but before that he spent a long time at PayPal at the Braintree division (came over in the acquisition). Braintree is a checkout solution similar to Adyen or Stripe.

Side note: If he can’t get a checkout experience on Pinterest with these developers, they may just need to fire everyone.

They just hired a new CFO, who is from Wayfair. Do we think this can be a positive catalyst for capital allocation changes?

They do a simple executive compensation strategy where they pay a light base salary and give them all a lot of time vesting RSUs.

They claim this aligns the executives with shareholders. Do you agree?

Apparently, they had to give out a huge bag to Bill Ready in order to get him to sign on as CEO. He was given a $100 million stock award as he joined. Watch out for this to repeat or not in the coming years.

*Based on shares outstanding as of latest proxy filing

(Ryan) Earnings:

Over the last 12 months, Pinterest has generated $2.8 billion in revenue.

75% gross margins

-$309 million in operating income

$415 million in free cash flow (15% FCF Margins)

Most recent quarter:

463 million monthly active users, +7% YoY

Global ARPU down 1% YoY

(Ryan) Balance sheet and liquidity:

$2.7 billion in cash and equivalents.

All just in money market funds and short-term treasuries.

No debt

$24.9 million in interest income, 4% annualized yield.

(Brett) Valuation:

More charts to check out covering numbers in the newsletter

Market cap of $19.9 billion

I’m going to be a bit naughty and us EV/GP as a proxy for what the earnings potential of this business could be

EV/GP of 8.1

Anecdotal Evidence:

(Ryan) Girlfriend uses it on a regular basis. Says she always uses it for inspiration. Doesn’t do the shopping on the site, but has bought things that she’s found on there.

(Brett) Should I be confident engagement can be stable/growing over the next five years? I think this should be true but for some reason, I feel a little doubt in this assumption.

Future growth opportunities:

(Ryan) Amazon partnership. It’s really not entirely clear what this is, but their press release said “We’re pleased to have selected Amazon as our first partner for third-party ads.” This will take several quarters to implement and it will include “a seamless on-Amazon buying experience” but I’m not sure if it means they’ll just be selling some of their ad inventory to Amazon or what.

(Brett) Can I say the same things they have been saying every conference call since going public? The main layer of friction for Pinterest and making money is connecting its shoppers (how I would describe users) to merchants through Pinterest tools. This means increasing advertising effectiveness and making native shopping tools much more useful. For example, Pinterest said advertisers who adopted its new measurement tools have increased their spending by 30%. They also said that “mobile deep linking” – a tool that takes a user directly to a merchant’s checkout page – is growing quickly. These are all positive signs but will eventually need to start showing up in ARPU.

Highlights and lowlights:

Ryan’s Highlights:

I like Bill Ready. Feels like a great hire. Apparently, he was expected to be Dan Schulman’s successor at PayPal.

They’ve stated that they plan to expand margins by a couple percentage points this year and that they’re moderating costs, but it’ll take some time to trickle through. They have done 2 rounds of layoffs in the last 12 months, so feels like they’re getting there.

Network effect. The more people that use the platform, the more useful it becomes for other users. I think this kind of provides little returns at this point though.

Ryan’s Lowlights:

Feels like they really haven’t been able to make the most of the platform they have. I know people will say that’s the opportunity, but that’s been the opportunity since they came public and ARPU hasn’t come anywhere close to closing the gap with bigger social media platforms.

Seem pretty loose with stock-based comp. 18% of revenue.

Brett Highlights:

They have one of the easiest jobs in the world and a solid moat from a content perspective that will likely continue to grow this decade. Why do I mean easy? Because when someone goes to Pinterest they are telling you what they want to buy. Pinterest apparently has failed to monetize a lot of these queries with a UCAN ARPU of just $7.60 in Q4 2022 vs. Facebook’s $58.77. That gap should not be that wide.

New executive team could end up being a breath of fresh air from capital allocation, product execution, etc. The activist investor (Elliott) on the board also seems like a good sign to fix the problems they have.

Brett Lowlights:

The capital allocation and SBC mismanagement speak for themselves. The balance sheet also seems to be mismanaged. No buyback? Just sitting on cash? No convertible notes? Suboptimal.

Bull Case:

(Ryan) I think they have to drastically expand ARPU if they’re going to make this valuation work. If you assume they grow revenues by 15% a year (5-10% MAU growth, plus 5%+ ARPU growth) they’d be generating $5.7b in revenue, apply a 15% real operating margin on that and they’d be doing $853 million in OI. That means they’re trading at more than 20x theoretical 2027 operating income. That feels like not such great upside.

(Brett) If they manage expenses (seems like they are, but I don’t trust them), and ARPU continues to CAGR at 16% globally things will be fine.

Bear Case:

(Ryan) Just lack of profitable growth. Feels like in 5 years we could still be talking about how if they get better ARPU it would be such a great investment. The reality is they’ve rolled out tons of partnerships and nothing has come of it.

(Brett) What has happened in the past continues to happen over the next five years. Mainly: no monetization outside of UCAN, slow product rollouts, and anemic engagement growth. This is a company that seems to be stuck on the treadmill (working hard to stay in place) unlike other platforms (YouTube, Instagram) that seem to just float down the river and effortlessly grow.

More or less interested?

(Ryan) I’m less interested. It feels so difficult to turn a culture like this into one that generates lots of cash and prioritizes shareholders. Not to mention, the valuation isn’t attractive to me at all.

(Brett) Yes, more interested. This platform has so much potential and if they fix a few things (better trajectory on margins, product teams growth, buybacks) it could be a great buy at the right price.

Stock for next week? (Lyft)

Sources and Further Reading

2022 Annual Report and Proxy Statement: https://s23.q4cdn.com/958601754/files/doc_financials/2022/ar/proxy-statement-and-annual-report.pdf