Research folder with show notes, charts, and transcript

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you subscribe to the show.

Show Notes and Charts

What they do: Poshmark is an online resale marketplace for clothing, shoes, and accessories. In order to make the platform more discovery-based instead of a direct search, Poshmark was designed in a social media-like format to encourage interactions between buyers and sellers. This not only helps create a more engaged user base but also increases the likelihood of converting transactions (In 2019, 87% of items purchased were preceded by a like, comment, or offer on the marketplace).

There are two sides to the platform:

Sellers: To sell an item, a seller uploads photos of an item or multiple items and enters some relevant information (category, quantity, size, brand, color, original price, etc.). From there the seller selects its listing price. He/she can also use some Poshmark features to promote their listing such as Posh Stories, Bundles, Drops Soon, or Reposh. After listing, the seller will likely get some sort of social interaction (like, comment, offer, or share) until a buyer agrees to purchase. Once the transaction is agreed upon, a shipping label is sent to the seller’s email address. The seller has to print the label and ship the item within 5 days. Sellers get to determine whether the shipping is paid for entirely by the buyer, or if they want to discount it in some way. At checkout/transaction, Poshmark takes a straight 20% fee for orders above $15.

Buyers: Buyers get a curated feed of listings relevant to the information they submit while signing up, as well as purchasing and search history. They can use social tools to negotiate prices or save items for later, but once agreed upon and purchased, the buyer will receive the item shipped by the seller. Once received, they have 3 days to let Poshmark know if the item is damaged or incorrect in some way. If Poshmark approves a return, they’ll send a shipping label for the buyer to return the item to the seller.

Poshmark has 7.8 million active buyers and an estimated 5 million sellers. Over time, many buyers become sellers (around 34%), and many sellers become buyers (39%).

History: Probably worth providing some history on Manish Chandra (current CEO) first. Manish grew up in India and attended the Indian Institute of Technology Kanpur where he studied computer science. He moved to the States to get his master’s degree and after graduating went to work at Intel and eventually various database startups until about 2005. In 2005, he started a social shopping website called Kaboodle which was more home decor focused out of his garage. The company was acquired two years later at a rumored price of around $30M.

4 years after the sale, the team from Kaboodle, plus a fashion industry expert named Tracy Sun founded Poshmark. Poshmark had very much the same model then that it does now, and thanks to their previous success with Kaboodle they had a pretty easy time raising venture capital and within a year they had more than 1,000 users who were all visiting the app more than 7 times a day. They’ve raised plenty of VC money since (as Brett will mention) and they officially went public on January 19th, 2021.

(The stock closed at $102 on its first trading day, now at ~$10)

Industry/Landscape/Competition

There are three different industries I believe investors in Poshmark should be interested in: secondhand apparel, social commerce, and general apparel.

The secondhand apparel market was valued at $96 billion globally in 2021. With $1.8 billion in 2021 GMV, Poshmark has just under 2% market share. The industry is expected to more than double by 2026 (source: Statista)

The social commerce market was valued at $500 billion in 2021, according to multiple third-party reports. It is expected to grow substantially this decade.

The global apparel market is valued at $1.7 trillion in 2021 and is expected to steadily grow this decade (source: Statista).

Poshmark has many different competitors that can be grouped into 5 categories:

Online marketplaces. These include Depop, Mercari, RealReal, ThredUp, and eBay. Some of these are focused on similar clothing categories, while others are broader marketplaces. The key way they are all competing with Poshmark is having individual sellers of secondhand items.

DTC resellers. Many companies including Lululemon and Nike have started their own secondhand reselling programs. They do not have the social element of Poshmark and are small, but could be a long-term competitive threat.

First-party e-commerce. These are whatever brands/retailers you can think of. While not direct competitors to Poshmark from a resale perspective, they are still competing heavily for wallet share.

In-person shopping. The traditional stuff everyone knows about. Again, these are not typically direct competitors on resale but are competing for wallet share and mindshare.

Social commerce. This would include things like Instagram and TikTok. This is small competition in Poshmark’s markets right now, but given the size of these platforms, it is definitely something to consider/track as an investor.

Management and Ownership

Founder/CEO: Manish Chandra. He is a veteran with multiple decades of work as an executive, mainly in the technology industry. The salary was “only” $736k last year, which looks like minimum wage compared to what a lot of CEOs get paid.

CFO: Rodrigo Brumana. Joined in December of 2021. He worked as CFO of Amazon’s private brands’ division, so has experience in the industry. One of the key people to watch for capital allocation decisions in the next 1 - 2 years. Was granted $9.2 million worth of RSU signing bonus.

Executive bonuses based on GMV growth and adj. EBITDA.

Serena Williams is on the BOD and is a user of the platform/brand ambassador.

*As of 2022 Proxy Filing

Valuation

(stock price: $10.90, 78,123,756 shares outstanding)

Market cap of $851 million

Enterprise value (EV) of $255 million

Trailing EV/GP of 0.9

Trailing EV/FCF of 12.3 (a lot of this comes from working capital and Stock-Based Compensation)

There were 10.6 million potentially dilutive securities outstanding at the end of Q1, or 13.5% of the current shares outstanding. They have granted 1.1 million RSUs through Q1 2022.

In May of 2022, they granted an additional 3.56 million RSUs

Earnings

1st quarter Gross Merchandise Volume (GMV) was $493.4M, up 12% YoY and up slightly quarter over quarter

Revenue was $90.9M, up 13% YoY

83.5% Gross Margins (excludes customer support, including would be 66.6%)

Marketing is their largest expense. Accounts for 47% of revenue.

They have historically been EBITDA positive. In fact, they had 14% Adj. EBITDA margins in 2020, and even higher at various points.

That has historically converted well to cash flow. They had $85M in 2020 FCF vs. $36M in adjusted EBITDA.

However, over the last few quarters, the IDFA changes + advertising associated with entering new international markets have led to negative adjusted EBITDA.

Q1 Adj. EBITDA margin was -5%

They did however generate positive free cash flow thanks to their working capital advantage. (They hold funds payable to customers)

Balance sheet and liquidity

(funds raised from IPO are on page 81 of the 10-k)

Their balance sheet is pretty simple.

They went public just over a year ago (Jan. 19th, 2021) and raised $292.3 million.

Today, they have cash/cash equivalents of $596.6M.

No true debt, but $148.6M of their cash balance is owed to customers.

So they have net cash of $448M (52.6% of their market cap)

Anecdotal Evidence

(Ryan) I liked the platform as a buyer. It would be the first place I’d go if I were clearing out my closet.

(Brett) I’ve tried out the platform to get some anecdotal evidence. As a seller, it was fairly easy to get going (although I’m not a core audience) and get people to sell to. However, getting the items to the store to ship is a hassle, and there are a ton of spammers that follow you and/or like stuff that makes notifications with the app unusable. Plus, they email spam you stuff so much that I had to block all of their accounts. I don’t think that is a good look for them.

Future growth opportunities

(Ryan) Official Brand Closets (OBC). This is a relatively new, enterprise-oriented tool that allows brands to list on the platform. As of Sep. 2020, they had more than 9k brands on the marketplace. This really increases the assortment of products that buyers are offered. OBC allows buyers to determine whether a product was actually listed by the brand itself. On the earnings call, Manish Chandra said Brand Closets GMV grew 2.5x quarter over quarter.

(Brett) Shop By Trend. This is a new feature/product for the buyer side of the equation, which personalizes the Poshmark feed for users and gives them trends to look at. With so many items on the platform, personalization feels like a key way to improve the user experience (I personally found it overwhelming).

Highlights and lowlights

(Ryan) Highlights:

Asset light platform. They don’t list, manage, sell, or ship any of the inventory which has really helped insulate them from a lot of the supply chain problems other retail places are experiencing.

They’ve reached a decent level of scale which is always a big challenge for marketplaces.

They roll out new products quickly. Constantly making changes to enhance the platform for buyers and sellers.

(Ryan) Lowlights:

They don’t seem to be willing to address the bot problem.

They’re still having problems navigating the IDFA changes. This is forcing them to invest more in marketing and explore other channels. It’s also creating pressure on revenue growth.

No buyback. Kinesic Capital recently wrote a letter to management emploring them to buy back shares but nothing has been announced. To me, it says that they think they need the cash.

(Brett) Highlights:

The zero inventory and marketplace business model gives Poshmark great unit economics and a permanent working capital advantage.

They are the clear leader in the online resale market right now and have a unique proposition with the social aspect of the platform. This also might give them a long-term competitive advantage.

The close to $600 million in cash on the balance sheet gives the executive team tons of optionality with their capital allocation decisions.

The business has a multi-year track record of top-line growth, leading me to believe it can continue on this trajectory if the industry grows as analysts think it will.

(Brett) Lowlights:

Management’s capital allocation decisions post-IPO give me a huge pause. Not using the cash on the balance sheet to buy back stock at these prices seems like a wasted opportunity.

The spammy nature of the platform that I addressed in anecdotal evidence. This will likely keep me away from the platform forever as a consumer. However, I am definitely not the target audience.

The amount of dollars the company is spending on sales and marketing is high compared to how fast the business is growing.

I believe there are tons of looming competitive threats (other marketplaces, DTC resellers, social networks) which make Poshmark’s durability unpredictable.

Bull Case

(Full tables and calculations can be accessed in the research folder)

(Brett) The bull case is pretty simple. They will either see operating leverage through marketing spend (reducing from 50% of revenue down to 30%, as an example), or they won’t. If marketing spending is not unsustainably propping up GMV growth, then shareholders will do quite well here over the long run, no matter how you slice it. The stock is that cheap.

(Ryan) I think there are two ways to think about the bull case. Either (A) they stop trying so hard to grow, get to 15-20% EBITDA margins, and start buying back shares. They would be trading at an EV/EBITDA of 6x. Or the longer-term bull case, (B) They find a way to get back to their previous return on advertising spend, reach scale in their international markets, and grow GMV by more than 10% over the next 5+ years.

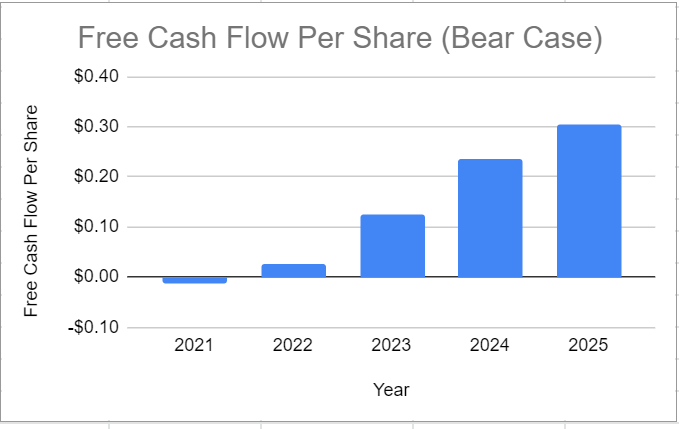

Bear Case

(Full tables and calculations can be accessed in the research folder)

(Ryan) They try to combat the IDFA changes, can’t, and burn through a big chunk of their cash pile. Or competition eats away at their customer base.

(Brett) I have two concerns. First, as outlined above, it is unclear whether marketing spending is propelling Poshmark forward, or keeping them treading water. Second, with GMV and adj. EBITDA as management’s compensation targets, I worry they will focus on growing customers and balloon the share count in the process with no focus on free cash flow power share (you could make the argument they are doing this right now).

More or less interested?

(Ryan) More interested. If they sustain some level of GMV growth and return to profitability, the shareholder returns would be great given the current valuation.

(Brett) More interested. I love the cheap valuation and the business model. However, I have concerns about management’s execution, share dilution, and capital allocation decision.

Stock for next week (Brett: Warby Parker)

Link to Episode Transcript

Sources and Further Reading

CEO Manish Chandra at Code Commerce in 2019

ValueInvestorsClub February 2022 https://www.valueinvestorsclub.com/idea/POSHMARK_INC/1796950124#description

Most recent quarterly earnings: https://investors.poshmark.com/news/news-details/2022/Poshmark-Inc.-Reports-First-Quarter-2022-Financial-Results/default.aspx

10-K (page 76 for financial statements): https://d18rn0p25nwr6d.cloudfront.net/CIK-0001825480/3ac217c9-d89d-4a41-b741-f261b26ba1b5.pdf