Not So Deep Dive: Procore Technologies (Ticker: PCOR)

We take a look at a fast growing software provider for the construction industry

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming Schedule:

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Procore is one of the leading providers of cloud-based construction management software. Their stated goal is to “connect everyone in construction on a global platform.” On any given project, there are typically a number of different stakeholders that have to work together (general contractors, specialty contractors, architects, engineers, and owners) and they’re often working from disparate locations. With Procore, all project members can communicate, access important project information (procedures, etc.), and use the platform as a system of record. In a way, this feels similar to Dropbox for the construction industry. And they cover a number of important areas for their customers:

Preconstruction: In order to get work, construction teams submit bid proposals to potential projects they can work on. This includes GCs to owners, but most often SCs to GCs. A bid is just you telling a potential client what you can do for them and how much it will cost. Procore’s preconstruction product allows customers to manage all their bids from one dashboard.

Project Execution: This is where Procore started and it includes their core offering today which is still project management (51% of ARR comes from their project management solution). Within project management, customers have a pretty holistic platform. You can upload models, pictures, or drawings, and you can add data and specifications as you go along, so those in the field or at the office can both access and contribute to the shared space.

Workforce Management: This one’s pretty straight forward and I think it’s an easy upsell. This helps users measure field productivity and plan out their work. Easy replacement to whiteboards.

Financial Management: This consists of project financials (editing and revising budgets throughout a project), invoice management (creating and managing invoices), and accounting integrations (connecting to a customer’s external accounting systems, like Quickbooks or anything else they use).

44% of Procore’s customers utilize 4 or more products, and Procore prices its product based on an ACV (Annual construction volume) model. So each contract has custom pricing based on the number and value of projects they have in their portfolio. This helps with adoption so customers can enable access for as many people as they need on a project, including partners. Today, Procore has more than 14,000 customers and as far as I can tell is the market share leader for CM software.

(Ryan) History: Procore was founded in 2002 by Tooey Courtemanche. Prior to Procore Tooey had worked in several construction roles throughout high school and college, but always had a technology interest. So when he was ~23-24 years old a family friend took him under his wing and taught him about telephony software, which sparked his interest to build an internet business of his own. By 1996, he started his own company in Silicon Valley called Webcage where he sold custom web interfaces to HR companies. This became a decent success, but his family was tired of living in San Francisco so they started to move down to Montecito and build their own house.

As the story goes, this is where Tooey realized that communication on construction projects was basically non-existent, so he had some of the software developers that had been working for him at Webcage create a system for Tooey to manage the project remotely. This apparently worked well enough for other builders to ask him if they could license the software. But it didn’t really take off the way many people probably think it would have. Adoption was slow until about 2008 when internet-connected devices on the job site became commonplace. By that time the software seemed way more valuable and sales began to grow. The 2010s were a pretty straightforward decade of growth as far as I can tell, and in 2021 they joined the public markets at a ~$12 billion valuation.

(Brett) Industry/Landscape/Competition:

They put out a lot of interesting addressable market and industry numbers in the 2022 Investor Day presentation: https://s27.q4cdn.com/467206001/files/doc_presentation/2022/11/2022-Investor-Day-Deck-[FINAL-FOR-UPLOAD].pdf

$11 trillion in global construction spending in 2020 that is expected to grow to $15 trillion in 2030.

Procore’s opportunity is not in the trillions but should be thought of as a low single-digit % of overall construction spend. Right now, less than 2% of industry spending is spent on IT and it is one of the least digitized industries in the world (only agriculture and hunting are behind it).

If, through all its different products, Procore has the potential to capture 2% of industry spending as it transitions to software, that equates to a $300 billion TAM in 2030. Putting my common sense hat on that seems a little high but I still think there is a huge opportunity in construction software relative to the size of the market today.

Competitors: Microsoft, Oracle, and standard workplace management and communications software. However, the main competitor with pure-play construction software is Autodesk with its Autodesk Construction Cloud. Autodesk launched its construction solutions much later than Procore but now has very similar products. We will be discussing them on a show soon!

(Brett) Management, Ownership, Compensation:

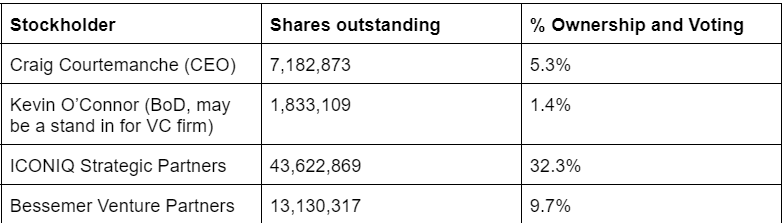

Founder, CEO, and chairperson of the board is Tooey Courtemanche. He has been running this ship for around 20 years. He owns ~5% of the company but does not have voting control, which is important to note.

There are nine members of the board, which are a mix of other software executives and venture investors in Procore. Tooey is the only Procore executive on the board.

BOD pay in 2021 totaled $3.2 million or 0.6% of gross profit

Executive compensation from the three listed executives on the proxy statement (there are 15 execs and SVPs listed on the IR page) totaled $20.2 million, or 3.8% of 2021 gross profit. A lot of this was in stock options/RSUs but for some reason, the goals for achieving stock awards could not be found on the Proxy statement.

Compensation practices are very standard (not necessarily a good thing). There are cash bonus pools that were based on dollar values of new subscriptions, operating income, and “individual objectives set by the compensation committee”

I could not find any big red/yellow flags (which is a good thing). However, I do get a little nervous about companies with a heavy VC influence, as they have employee compensation and hiring philosophies that don’t necessarily align with public shareholders.

At the end of 2021, there were 12.6 million potentially dilutive securities (stock options and RSUs), or just under 10% of shares outstanding at the time.

(135,169,909 shares as of 2022 Proxy)

(Ryan) Earnings:

2021:

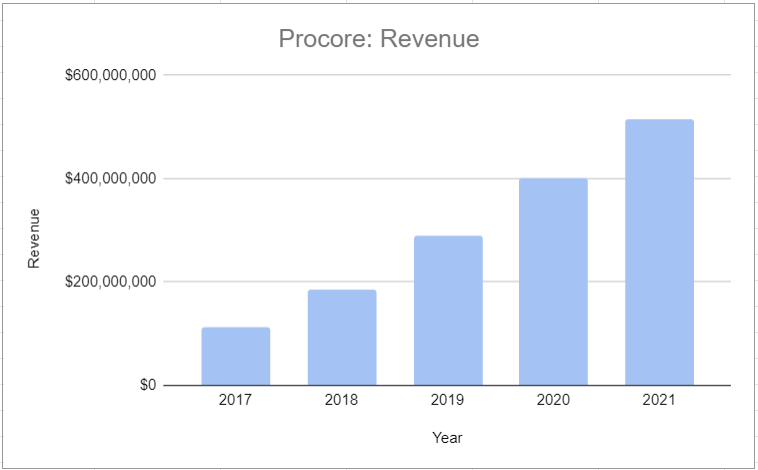

$515 million in revenue, +29%

81% gross margins

$37 million in operating cash flow

Most recent quarter:

$186 million in revenue, +41% (+34% excluding the Levelset acquisition)

~80% gross margins

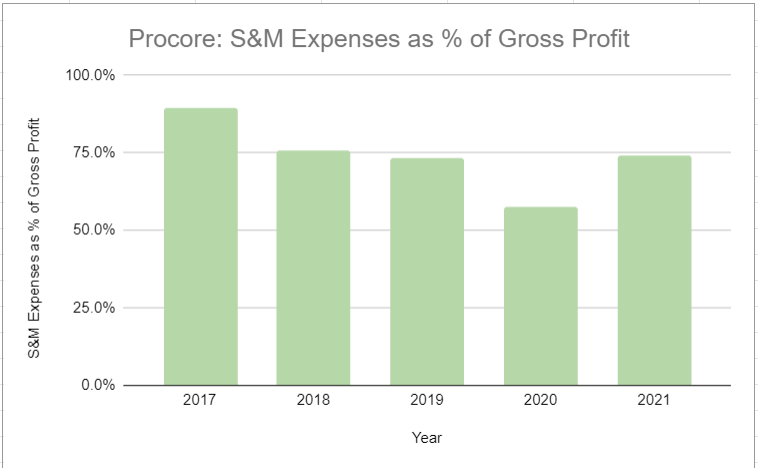

But they spend all of their gross profit and then some on operating expenses, primarily sales and marketing.

Opex is 50% S&M, 32% R&D, and 18% general & administrative. And 1/5th of those operating expenses are paid in SBC.

Negative 39% operating margins

More than 14,000 customers, up 21%

$715 million in remaining performance obligations, +44% YoY. 70% of the RPO is expected to be recognized as revenue in the next 12 months.

95% gross retention

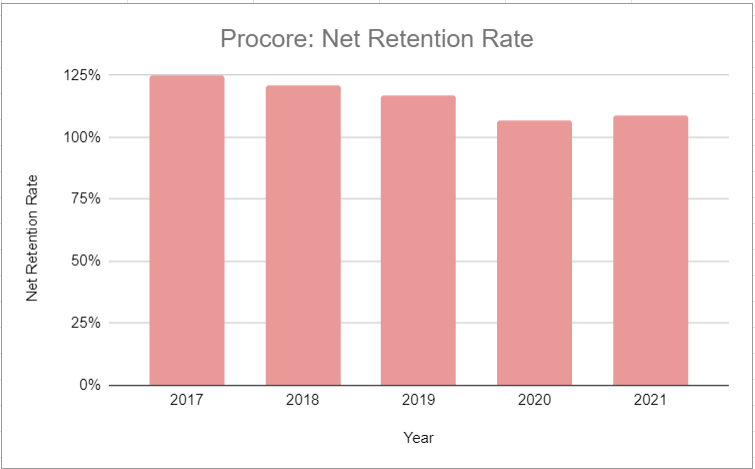

116% net retention

(Ryan) Balance sheet and liquidity:

$558 million in cash and marketable securities

No debt

The only other noteworthy line item is their deferred revenue. This is a recorded liability, but it’s just cash they’ve collected from customers in advance of servicing them.

Given that it’s a software business and not very costly to service that contract, it’s not much of a risk. In fact, you really want to see that RPO growing.

(Brett) Valuation:

Market cap of $6.7 billion

Eneterprise value of $6.2 billion

EV/s of 9.3

EV/GP of 11.7

Can’t use any earnings or cash flow metrics because they are all negative

Anecdotal Evidence:

(Ryan) I have a couple of friends that work for general contractors, and they all swear by it. They say they spend a lot of time on the platform and it makes their lives easier.

(Brett) Any of my friends in construction say they love using Procore. I think this bodes well for the construction software market in general, as a lot of people are using highly inefficient pen and paper right now. The value added for giving 2% of your project dollars for a huge increase in efficiency seems like a great proposition.

Future growth opportunities:

(Ryan) Procore Pay. On any construction project, there are lots of invoices going in and out for things like materials or labor, and a lot of those documents are being uploaded to Procore’s platform, so being the facilitator for those payments seems like a logical next step. During their investor day, they mentioned that they’re planning to launch Procore Pay in 2023. This could obviously enhance their financial management solution, but I’d think it could also be applied to workforce management.

The Levelset acquisition should help here as well. Last October, Procore announced that they acquired Levelset for $500 million. Levelset helps construction companies stay lien compliant. Here’s what I wrote when the deal was first announced, “the construction industry has a "median of 90 days sales outstanding and 74 days payables outstanding, the slowest of all industries surveyed across the globe. Given this complexity and delay in the payments process, a tool that's often used and relied upon by construction groups is known as a lien -- in particular a mechanics lien. This tool ensures that the parties involved in a construction project get paid appropriately for their work by using the physical property as backing.”

(Brett) This is the cop-out answer for a lot of businesses and is usually a yellow flag for executive teams that hype it up too much, but I think international expansion has a lot of promise for Procore with its high net retention rate. International revenue as a % of revenue went from 8.2% in 2017 to 14.6% in 2021. With how many markets they are pushing heavily into now (talked about on Investor Day) and with a more loaded product suite, I wouldn’t be surprised if international revenue grew at 30% - 40% annually for many years.

Highlights and lowlights:

Ryan’s Highlights:

It seems like there’s still a ton of low-hanging fruit in terms of potential customers. “50% of the customers we reach out to are still relying on pen and paper.” I believe Tooey said that in his interview with us.

All my “channel checks” give me the sense that Procore is really appreciated by its customers and it’s difficult to replace once big customers are relying on it.

Procore Pay seems like it could be really additive to the platform and margin accretive.

Ryan’s Lowlights:

I think Autodesk might have a leg up internationally and they’ve made it clear that they’re going to go after this opportunity.

95% gross retention isn’t quite as high as I would’ve pictured for this business.

Brett’s Highlights:

The industry tailwind is one of the best out there and it is easy to see how a company like Procore can “ride the wave” as more and more customers adopt construction software programs. I would not be surprised to see revenue grow at 20%+ for five to seven years.

Its “land and expand” and net retention numbers are strong, which leads me to believe they have a great sales culture

I think the switching costs for these software programs are high, especially with all the new products they have launched and are getting customers to adopt.

Brett’s Lowlights:

The income statement looks ugly, with 74.1% of gross profit spent on S&M in 2021 and 57% of gross profit spent on R&D. On the latest conference call, management said this will change and that they are looking to grow more efficiently, but they have not proven they can generate consistent profits.

Competing with Autodesk in one of the sectors that it is putting its heaviest focus on seems daunting given how large Autodesk’s global presence is.

Revenue per employee was much lower than some other software companies we looked at, at only $178k in 2021. This easily could change five years from now if NRR is still well above 100%, but it gives me minimal confidence they can hit 20%+ cash flow margins within three years. Maybe they could in five.

Bull Case:

(Ryan) In 5 years, they have twice the number of customers globally (15% CAGR), and whether it’s through product expansion, volume increases, or price raises, customers increase their spending with the company by let’s say 8% annually. That’d be $2.2 billion in annualized revenue. I believe they’ve said before on their investor roadshow that they project long-term Non-GAAP operating margins to be ~20%. That’s $440 million/year in non-GAAP operating income. Assuming 20x, that’s an $8.8 billion price tag. Versus a $6.5 billion EV today. A lot really has to go right for this to make a good investment.

(Brett) We are at the early stages of a multidecade tailwind in construction software spending, similar to how the engineering software markets may have looked 20 - 30 years ago. This could lead to durable double-digit revenue growth for 10+ years. I still think you need very strong margin expansion given the current sales multiple, but it would be hard for the stock not to work if revenue grows by 15%+ for 10 straight years. Procore is probably in the 99th percentile of companies I think can do that, though.

Bear Case:

(Ryan) Multiple compression, dilution, and slower-than-expected attach rates on new products feel like the biggest 3 risks to me. Really feels like they have to keep growing that top line at insane rates to justify the valuation.

(Brett) If you get to $2.5 billion in revenue ($664 million today) and a 20% cash flow margin that is $500 million in cash flow, which is likely still a 15x - 20x multiple a few years from now with how fast share count is rising. Revenue growth needs to stay high for many years.

Stock for next week? (PTC)

Sources and Further Reading

Recent Investor Day: https://s27.q4cdn.com/467206001/files/doc_presentation/2022/11/2022-Investor-Day-Deck-[FINAL-FOR-UPLOAD].pdf

Interview with Tooey on Chit Chat Money:

S-1 from 2020: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001611052/c47364f5-0f7d-4727-baa1-8da343a190c5.pdf

P/S < 4 . Sell