Not So Deep Dive: Rocket Lab Stock (Ticker: RKLB)

A SPAC (somewhat) following through on its projections? Is that even possible?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: Rocket Lab is an end-to-end space company whose primary business is placing customers’ satellites into orbit. Here’s an example: Let’s say the Department of Defense would like to put a satellite into orbit and the entire payload will weigh 250 kilograms. The DoD can contact Rocket Lab and ask them to be their launch provider. Now here’s where the business breaks into 2 segments:

Launch Services: Rocket Lab has a “small” rocket vehicle (it’s 18 meters tall and weighs ~29,000 pounds) called the Electron. Electron can carry up to 300-kilogram payloads from either of its launch complexes (New Zealand and Virginia) and in fact, it has now successfully completed 32 missions since inception. On average, one of these launches costs customers $7.7 million. In most cases, the rocket isn’t recoverable and Rocket Lab has to build a new one for the next launch which means the cost of revenue is quite high. However, last year, launch Services as a whole only accounted for 29% of Rocket Lab’s revenue.

Space Systems: In addition to providing the actual rocket launch service, Rocket Lab designs and builds a number of the spacecraft components and systems required to run a satellite. This includes the Photon space capsule as well as manufacturing the solar panels or thrusters or even supplying on-orbit constellation management services. I’ll steal a quote from their 10-K: “We provide spacecraft solutions for government and commercial customers ranging from selling individual spacecraft components for use by customers in constructing their own spacecraft, to complete spacecraft design, manufacture and on-orbit operations.” This segment accounts for the bulk of revenue at 71%.

While executing their current launches, Rocket Lab has also been in the process of designing a second vehicle called the Neutron that would be more than twice as tall and potentially carry up to 15,000 kilos into lower earth orbit.

(Ryan) History: RocketLab was founded in 2007 by Peter Beck. Beck has been a rocket enthusiast and just a bit of a tinkerer in general for quite a long time. In fact, he was so eager to start working that he skipped college and moved to the US looking for engineering internships. During his time in the US, Beck realized the possibility of a lower-cost, smaller vehicle. So, after failing to get any internships, he actually just set up the company right then with this ambition in mind and set out to raise money.

He found the funding process incredibly difficult and it wasn’t until he apparently met a guy named Mark Rocket (yes, that’s his actual name) who helped him get connected and raise an initial $5 million. With that seed money, Rocket Lab was able to demonstrate that the idea was sound and they were named the first private company in the southern hemisphere to reach space after a 2009 launch. This put them on the map and helped raise follow-on funding. And a year later, they were awarded a US contract to basically come up with a low-cost space launcher. They had several funding rounds throughout the 2010s and in 2021, Rocket Lab merged with Vector Acquisition Corp to go public via a SPAC. Rocket Lab was valued at ~$4.8 billion and it helped them raise net cash of ~$700 million.

They’ve since used a decent chunk of that cash to acquire a number of other companies.

(Brett) Industry/Landscape/Competition:

Rocket Lab outlines the various addressable markets for the businesses it is targeting during its latest investor day (slideshow linked below)

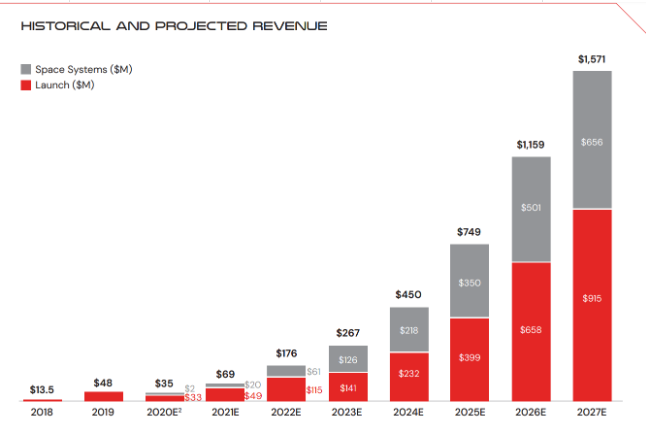

Management thinks there is a $20 billion opportunity in rocket launches and $44 billion in space systems (satellites, solar arrays, components, radios, software, and more). These are the businesses they operate in today. Total revenue in 2022 was $211 million

However, management thinks they have a huge opportunity to go after the “Space Applications” market which they say has a projected $320 billion TAM. These include things like satellite internet from companies like SpaceX and Amazon. Nothing material has come down the line though

By 2030, they believe the total industry TAM for the space economy will be $1 trillion. Does this seem reasonable?

Competitors in launch: SpaceX (especially once the larger Neutron rocket gets operational) and…not much else. There are a lot of start-ups like Astra, Relativity, and Virgin Orbit but they look destined to fold as they can’t seem to get anywhere near Rocket Lab’s launch cadence. And it isn’t like Rocket Lab is printing money at this launch frequency, either.

Competitors in Space Systems: Many, but mainly the defense contractors like Lockheed Martin, Raytheon, Boeing, etc., and then some start-ups like Rocket Lab and the companies it acquired. This is a much more competitive market as it takes less capital intensity, but Rocket Lab believes its vertically integrated solution that combines launch services gives it an advantage in winning contracts. I believe they are probably correct here.

(Brett) Management and Ownership:

The founder, CEO, and chairman of the board is Peter Beck, who started the company in 2006 and has raised tons of money to fund his vision for an integrated launch company. He is also the lead technical officer and led the design of the Electron rocket (the small load rocket), so he is a technical founder, not a managerial one. He had around 15 years of experience in engineering before starting this company.

Since the company is in a heavy start-up phase ($150 million cash burn in 2022 on $211 million in revenue), I thought it was important to look at the executive and board compensation with a bit more scrutiny

Total cash compensation among executives and the board was just $2.36 million in 2022, which I think was nice. The only gripe I would have is that Beck paid himself close to $750k last year when he already owns so much of the company

However, looking at stock comp, they are getting aggressive. In this case, I think it is probably fine but if you are underwriting an investment you probably want to include some heavy future dilution, even if the stock performs well. Total stock comp among the executive team and board was $18.8 million in 2022

(Ryan) 2022 Earnings:

$211 million in revenue, up 237% YoY

$19 million in gross profit or 9% gross margin

($135) million in operating earnings or -64% operating margins

All profit margin figures are trending in the right direction

This was what they guided to in their SPAC documents:

(Ryan) Balance sheet and liquidity:

Assets:

$399 million in cash and ST marketable securities

$48 million in non-current marketable securities (just longer-dated treasuries and corporate debt securities)

So call it $450 million in cash

Debt:

$100 million in a term loan from Hercules Capital. The loan is due in June of 2024 and it’s variable rate.

Could be paid down early but there’d be an early payment penalty.

Their net interest expense this quarter was $685,000 or an annualized rate of ~2.7%. But this will go up over time as the cash balance dwindles.

Over the last 12 months, they’ve burned through about $150 million in cash. At this rate, they’ve got about 2-3 years of cash burn, so they’re likely going to need to raise some more capital.

(Brett) Valuation:

Market cap of $1.96 billion

Add back $100 million in debt (can’t subtract the cash, it is all getting burned) and you have an enterprise value of just over $2 billion

I don’t have any valuation metrics to share. If they can hit their targets of, let’s say, $2 billion in revenue within five years or so and 50% gross margins the stock is likely much higher. The question is: How likely is it they safely get to this destination?

Anecdotal Evidence:

(Ryan) I find myself rooting for this company. The CEO seems tenacious. But in the back of my head, this feels like it’s never going to be profitable. What happens if the cost of a flight continues to come down? I feel like they won’t ever capture that operating leverage.

(Brett) The founder seems smart, and somewhat rational with his ambitions, but I still get the feeling his mission is to build a space company and not generally generate value for shareholders. But I think they can probably do both if they succeed with a highly reliable launch program. That is a technological competitive advantage that would be tough to compete with. Why would the United States (or the world) need dozens and dozens of rocket launching companies? You probably only need a few.

Future growth opportunities:

(Ryan) Increasing their rocket recovery rate. Electron has been successfully recovered from the ocean a number of times and they are apparently developing a system to recover the booster directly from the air via a helicopter. This has been done semi-successfully once. I don’t know the exact financial impact this would have but being able to repurpose recovered rockets instead of building rockets from scratch would have to reduce the cost of goods sold dramatically. This feels essential for RocketLab to get to profitability.

(Brett) Getting the Neutron rocket operational. If you are invested or are thinking of investing in Rocket Lab, the development process for the Neutron rocket is vital for the company to reach positive cash flow. The Neutron Rocket will have 50x the payload of the Electron Rocket. Estimates say it can generate $60 million in revenue per flight vs. well below $10 million for a typical Electron flight. This could lead to a revenue inflection for Rocket Lab once this becomes operational, but it is very capital and research-intensive to build. For example, they project their addressable market to inflect to over $10 billion in 2024 for just launch capabilities once they get Neutron operational. I would not want to be a shareholder watching the test flight of this thing.

Highlights and lowlights:

Ryan’s Highlights:

They already have a successful offering available with the Electron program. Many “Space Economy” companies can’t say the same.

Increasing demand for satellite launches. Today there are apparently around 7,000 active satellites orbiting Earth. According to our friend Simon Erikson, “The Federal Communications Committee (FCC) now faces an overwhelming 38,000 more applications for spectrum approval for satellite-based broadband internet.”

This one is a little speculative, but I think there’d be some incentive for the US government to help them out in a financial pinch. They’ve made a lot of progress and earned a reliable reputation for the smaller launch market which the US has benefitted from.

Ryan’s Lowlights:

Feels like shareholders are donors more so than investors here. Are they just footing the bill for these missions?

Hard to see a path to profitability any time soon.

Brett Highlights:

The success of the Electron launch program. They are the clear leader in smaller launches, and I think that bodes well for the move into larger launch vehicles like the Neutron (although the bigger the rocket the more difficult it is, generally, to operate safely).

The acquisitions into Space Systems look smart right now and give them the room to build up their launch programs, which will take many years. However, it looks like a lot of these are low-margin at the moment

The competitors are either flailing start-ups or bureaucratic incumbents. I think that gives them a fantastic operating environment as long as they can run a profitable business.

Launch is likely an oligopolistic market.

Brett Lowlights:

There is little evidence out there that a rocket launching company can be profitable. Why should Rocket Lab be any different?

The fact investors are betting on the launch of the Neutron program being a success is a risky bet. What if the first launch blows up? What if they can’t get it reliably working? The brand would be tarnished.

Bull Case:

(Ryan) I think they need to get to 20%-30% gross margins at least in order to make this business viable. A few of the things that would be required to get there: 1) High rocket recovery rate, 2) Continued adoption of Space Systems, 3) A higher revenue per mission (most likely through a successful Neutron program).

(Brett) There are a few key questions investors need to ask about Rocket Lab, and if they are right about them the investment will likely do well:

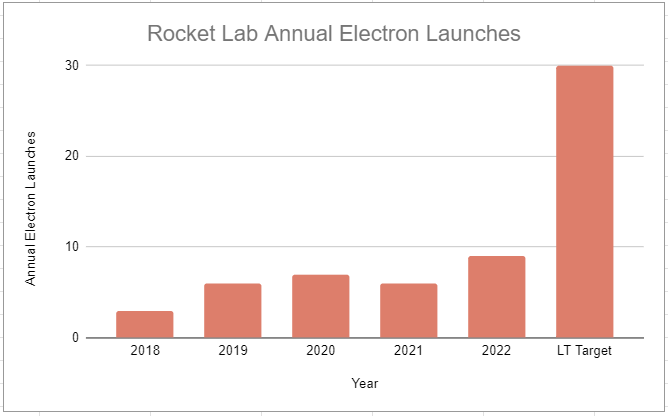

Can the Electron program hit 30 launches or more a year? (with no failures)

Can the Neutron program become operational at a regular cadence?

Will the Space Systems segment continue growing and expand margins? Or did Rocket Lab just buy some low-quality revenue with its SPAC money?

Bear Case:

(Ryan) Risks galore here. Obviously, a mission failure would be detrimental. Failure to build a successful Neutron rocket. Or the space systems market is more competitive than I think. If they continue to burn cash at the current rate, investors are obviously in trouble.

(Brett) The three questions I asked above get answered negatively.

More or less interested?

(Ryan) No. If I had to bet on a high-risk, high-reward company, this might be number one. But that’s not how I like to invest, so I’ll probably avoid this until there’s a couple years of proven profitability.

(Brett) No. I don’t like unproven capital-intensive companies. You need to prove years of positive unit economics first. However, I can see a world where this is a 100-bagger. Let’s revisit this one in five years.

Sources and Further Reading

2022 Investor Day Slideshow: https://s28.q4cdn.com/737637457/files/doc_presentations/2022/09/Final_Investor-Day-Presentation-2022_Sept-21.pdf

2022 Proxy Statement with Executive Compensation: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001819994/f22f0aa1-cc56-46c6-be85-7c0be7e5c88d.pdf

SPAC slideshow: https://s28.q4cdn.com/737637457/files/doc_presentations/2021/07/Rocket_Lab_-_Investor_Day_Slide_Deck.pdf

Completed Missions: https://www.rocketlabusa.com/missions/completed-missions/