Not So Deep Dive: Rovio Entertainment (Ticker: ROVIO)

The Angry Birds maker is trading at ~5x cash flow. But is it investable?

Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/12DfGg340Cc2vzSan6_aVXcywO03rUp3l

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Rovio is a mobile-first gaming company responsible for developing the Angry Birds franchise. They’re headquartered in Finland, but now have 7 studios located around the globe. While there are some other titles in the company’s portfolio, nearly all of its revenue comes from Angry Birds games.

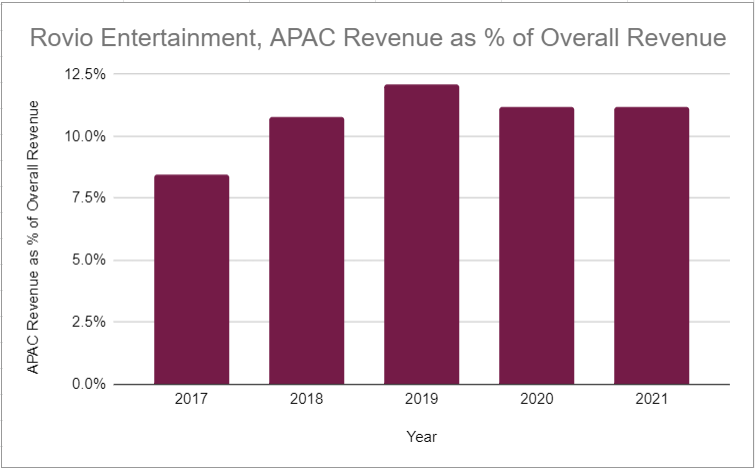

77% of revenue comes from in-app purchases (unlocking new birds), 18% comes from in-game ads, 2% from custom contracts (distribution contracts with places like Apple Arcade), and 3% comes from brand licensing. Rovio also has an Angry Birds theme park in Finland and they’ve produced several movies and TV shows over the years. Roughly 90% of their revenue comes from North America and Europe. In total, its games have about 7 million daily active users and they are the 3rd largest mobile publisher of all time in terms of downloads.

Rovio categorizes each of its games into 4 groups. Grow, Earn, Catalogue, and Hypercasual.

Grow: These are games that are in the process of scaling up. Often that means they are spending a lot to acquire users and running the games at a loss.

Earn: These are games that can still grow, but the focus is profitability. These games have teams still developing new content for them.

Catalogue: These are typically established games that are slowly declining in relevance. They allocate very few resources to these games and don’t spend to acquire new users.

Hypercasual: Rovio has been putting more emphasis on this category as of late thanks to its acquisition of Ruby Games. The games are fast and cheap to produce and go through the grow, earn, catalog cycle very quickly.

(Ryan) History: In 2003, three students from Helsinki University of Technology (Niklas Hed, Jarno Vakevainen, and Kim Dikert) joined together to take part in a mobile-game development competition that was sponsored by Nokia and HP. They won the competition with a game called King of the Cabbage World and decided to set up a company around the game. A couple of years later they sold the game and received their first round of funding from an angel investor. With the studio now set up, they continued to make games but were struggling with the distribution. This lack of successful games eventually led to financial struggles, and Rovio was forced to lay off the majority of its staff. In 2007, the iPhone was released and with 12 remaining employees, they decided to make this market their primary focus.

In trying to profile the potential iPhone customer base, they found that they needed to make games that catered to gamers with short attention spans. It needed to be something that could be played quickly and casually and had some sort of an icon that would stand out in the app store. Rovio’s artists came up with several designs, and the angry round birds that couldn’t fly really seemed to catch everyone’s interest. So the company developed Angry Birds as a bit of a background project. They officially launched the game in 2009, and it wasn’t very successful broadly, so they decided to try and market it in smaller countries to gain momentum. They made it to the top charts in Finland, and eventually replicated that success in some of the neighboring countries. Once it reached the UK, the game hit escape velocity. At the time, the game cost $0.99 to download on iOS and ran ads on Android.

Angry Birds quickly became the company’s main focus. They began selling merchandise around it to promote the brand and in 2011 they received $42 million in VC funding. Since then they’ve produced tons of follow-on Angry Birds games and they officially joined the public markets in 2017.

(Brett) Industry/Landscape/Competition:

Mobile video games now dominate the market (check the screenshot of the chart below). The industry is expected to be $136 billion worldwide this year. However, those estimates may come down as spending has stagnated in 2022, which was a bit unexpected

Projections are for this growth to continue. I remain a bit skeptical about the potential of the mobile games market to get much larger than it is today, but I think I would have said the same thing 3 - 4 years ago.

Competitors: King (Candy Crush), Niantic, Zynga, Roblox, Playtrix. The list can go on and on there are a ton of mobile developers out there given how much simpler the games are to build compared to console/PC (at least, for the market Angry Birds is in).

The Nintendo Switch could also be considered a competitor, at least until Rovio smartens up and (hopefully) releases a game on the device.

As I’ve said with a lot of gaming companies, Rovio is competing for time spent when someone is taking a break or doing a leisure activity.

(Brett) Management and Ownership:

CEO: Alexandre Pelletier-Normand. Nominated as CEO in 2021 from a VP role, which he had since 2019. Has a decade-plus of experience in the gaming industry. He is not on the top 100 shareholders list, which the company is required to update on its website: https://investors.rovio.com/en/share-shareholders/major-shareholders

Like the CEO, the other leadership team members have had short tenures, with a lot seeming to have been brought in to get a turnaround going

The three founders (Niklas Hed, Kim Dickert, Jarno Vaikaveinen) don’t seem to be associated with the company anymore except for Hed, who is a member of the board and owns 1.7% of the company.

From an ownership perspective, this has opened up the stock to have a very broad shareholder base.

Given the problems we will discuss and this heavy outside ownership, Rovio has the ingredients for an activist to come in and influence this business. I am surprised this hasn’t happened already

Employee compensation: they have what they call an “employee share saving plan.” On a simple level, it allows Rovio employees to save a portion of their salary and invest in Rovio shares. As a reward, Rovio will match one share for every two shares bought under this plan, upping an employee's compensation

Executive compensation: They have a performance share plan. Here are some quotes from the interim report with some important details:

“The performance criteria for the 2021 performance period were Rovio’s Sales Growth (%) and Rovio’s Adjusted Operating Profit Margin (%). Potential rewards based on the performance period 2021 correspond to a total maximum gross amount of 613,548 Rovio Entertainment Corporation shares [0.8% of shares outstanding], including the proportion paid in cash. The performance contributed to the realization of 23.64% of the maximum allocation. The performance period continued with a holding period covering the calendar year 2022. The rewards will be paid in spring 2023”

“The performance criteria for the performance period 2022-2024 are Group’s EBITDA (EUR) for the financial year 2024 (weight 50 %) and Group’s Net Revenue (EUR) for the financial year 2024 (weight 50 %). The rewards to be paid on the basis of the performance period 2022-2024 correspond to the value of an approximate maximum total of 11,000,000 euros. The potential rewards will be paid in spring 2025”

The executive compensation seems good but isn’t perfect. The only major red flag I saw was they like to change up the payout metric, and they are always suspect ones.

(Based on 75,539,652 shares outstanding as of latest Interim Report)

(Ryan) Earnings:

Last 12 Month Results:

$329 million in revenue (Up 14% in the most recent quarter, but down 1.1% organically)

Angry Birds 2 and Angry Birds Dream Blast account for the majority of revenue

75% gross margins

$66 million in operating cash flow

~$60 million in free cash flow

Their adjusted operating margin was 14.3%. They aim to pay out 30% of their adjusted net profit in dividends.

(Ryan) Balance sheet and liquidity:

Liabilities:

They have virtually zero debt except for $7 million in lease liabilities for office spaces.

Assets/Cash Flow:

$184 million in cash

$50-$60 million in free cash flow each year

Basically, they’ve got $180 million in net cash on the balance sheet sitting in bank deposits and money market funds.

(Brett) Valuation: (At a price of $5.52)

Dynamic valuation: https://docs.google.com/spreadsheets/d/12cit3qiu7KuP7Taab7e_fIeLsBiAMDfzEzHa8Xrjfbs/edit#gid=1310112245

Market cap of 416 million Euros

Enterprise value of 233 million Euros

EV/s of 0.81

EV/OCF of 5.3

Anecdotal Evidence:

(Ryan) Used to play Angry Birds all the time. I played a version of Angry Birds at Topgolf recently.

(Brett) I downloaded it when I was a kid. Seemed fine and not too surprising the brand has had some staying power.

Future growth opportunities:

(Ryan) Beacon. “Beacon allows our games teams to plug into a full suite of market-leading tech. To operate, optimize, and scale their game.” This seems to be a centralized database that’s shared across Rovio’s studios and helps teams really on the post-development side of games. Should be a useful asset when acquiring new companies. Basically seems like a best practices platform and it covers areas such as Player Identity, Analytics, Attribution, AB Testing, Live Operations, Payments, Cross Promoting, Privacy Framework, and the list keeps going.

(Brett) Getting Angry Birds games or game packages onto the Switch and Roblox. They highlighted a Minecraft DLC during the Investor Day, and it would only make sense to go after the other two large platforms where kids play. It is important for younger people to experience playing with Angry Birds which allows Rovio to capture the % of them who end up being paying users and have nostalgia for the Angry Birds brand. (Also, let’s get some other franchises out there huh?)

Highlights and lowlights:

Ryan’s Highlights:

They have some of the most loved characters in mobile gaming.

The overall growth of mobile gaming provides a nice tailwind for the Angry Birds brand.

Seems like the Beacon platform can really help with M&A.

Ryan’s Lowlights:

I can’t tell if this strategy of putting Angry Birds everywhere is good or if they’re exhausting the brand.

Because barriers to entry are so low, barriers to success are really high in the mobile market and that’s been shown by their inability to land any new successful IP.

This feels like a company that’s optimized for employee happiness over shareholder returns.

Brett’s Highlights:

The durability of the Angry Birds franchise. It is one of the few mobile brands that has stuck around for 10 years, and could easily stick around for another 10.

The licensing business (movies, toys) seems strong if they can slowly build that up over the years

The balance sheet is very conservative, which gives them freedom and flexibility if we go into a market downturn

Brett’s Lowlights:

This business has stagnated over the last five years. The new leadership team has been brought in to fix this, but it is unclear why I should believe in them.

It is unclear whether Rovio is just a one-hit wonder at this point. They haven’t proven they can diversify away from Angry Birds, which gives me pause.

Growth in developer count has been modest. With the strong cash position and all the discussions around expansion and these new studios, I would have thought they would be pressing the gas a bit more on employee expansion.

Bull Case:

(Ryan) They become a sort of Match Group for games. Lots of shots on target with hypercasual games, but hopefully one or two more successful franchises outside of Angry Birds. A successful investment from here would probably take what management laid out in its Investor Day – slightly better than market revenue growth annualized over the next 5 years and steady margins.

(Brett) Earnings and cash flow durability. There will always be a bit of lumpiness with a games business, but if Angry Birds can stay relevant among the paying users this business should do fine. The new ventures and acquisitions are completely unpredictable on whether they will be successful or not, but they could add some growth into the mix. If Rovio’s cash flow generation actually grows, the stock almost has to do well given the bombed-out share price.

Bear Case:

(Ryan) Mobile is too competitive and crowded for them to land any new franchises, and the Angry Birds fanbase dwindles over time. The crowded market will likely drive higher user acquisition costs, compressing margins.

(Brett) There are some concerning trends over the past few years (specifically: DAUs, MUPs, and Licensing Revenue). If the core user base doesn’t just stagnate but declines, the “one-hit wonder” risk could materialize with more downside risk. There is a margin of safety with the cash position and low earnings multiple, but it still gives me pause.

More or less interested?

(Ryan) Less interested. I don’t like the lack of predictability in mobile gaming. It makes me wary about Rovio’s ability to generate cash in the future.

(Brett) Less interested. I thought I was going to be interested because of the cheap earnings multiple, but the lack of execution and declining user base make me nervous about the durability of this business, combined with the fact it is currently a “one-hit wonder” games developer.

Sources and Further Reading

Evolution of Angry Birds (2009-2021):

Rovio Capital Markets Day: https://investors.rovio.com/en/releases-events/capital-markets-day#Yeartab

1st Half of 2022 Results: https://investors.rovio.com/sites/rovio-ir-v2/files/2022-08/Rovio%20Q2-2022_interim%20report.pdf

Article about the IPO: https://www.reuters.com/article/us-rovio-ipo-price/angry-birds-maker-rovio-valued-at-1-billion-in-ipo-idUSKCN1C31ZT

CEO announcement letter: https://www.rovio.com/articles/alexandre-pelletier-normand-appointed-as-the-new-ceo-of-rovio-entertainment-corporation/

Previous CEO leaving the company: https://www.reuters.com/article/rovio-ceo-idINKBN26Q0VC