Not So Deep Dive: Royal Caribbean Cruises (Ticker: RCL)

Are you ready to bet against America's appetite for gluttony?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts

Definitions

Net Yield: Net Yields represent Gross Yields less commissions, transportation and other expenses and onboard and other expenses per Available Passenger Cruise Day (i.e. pricing)

Available Passenger Cruise Days represent double occupancy per cabin multiplied by the number of cruise days for the period

Gross Cruise Costs represent the sum of total cruise operating expenses plus marketing, selling and administrative expenses

Passenger Cruise Days represent the number of passengers carried for the period multiplied by the number of days of their respective cruises

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: Royal Caribbean is the largest cruise operator by market cap and the 2nd largest on a passenger volume/revenue basis behind Carnival Cruise Lines. A little context for how the industry works. Like the airline industry, the cruise operators don’t do any of the manufacturing themselves. There are 3 major shipyards across the globe that are able to build vessels of this size, so there are quite long lead times when it comes to adding new ships to their fleet.

Today, Royal Caribbean operates through 3 different brands that combined account for 64 ships and more than 150k “berths” (word for a place to sleep on a ship). The 3 brands are:

Royal Caribbean International: RCI is the largest individual cruise brand in the world. They’ve got 26 ships and account for 63% of all of Royal Caribbean’s room capacity. These ships are significantly bigger than the other brands and they cater to more of a family-friendly experience.

Celebrity Cruises: This is the 2nd largest segment for RCL. 15 ships, accounting for 22% of overall capacity. It’s a little bit of a more luxurious experience with what they call a destination-rich itinerary.

Silversea Cruises: These are their smallest ships and they are ultra-luxury. 11 ships, but only accounts for 3% of passenger capacity. “Fine dining and exotic itineraries”. So these go to places like Antarctica and the Galapagos Islands.

They also own 50% of a German cruise operator, but it isn’t too material to RCL’s results.

Royal Caribbean makes money in two ways, passenger tickets & onboard revenue. Passenger tickets account for ~2/3rds of revenue and this is fairly straightforward. The only things that I think are worth mentioning are that (1) RCL relies heavily on travel advisors for sourcing passengers, and they give those advisors incentives & commissions (however, direct sales are growing quickly), and (2) Reserving a spot on a trip requires a deposit, which is typically made 6 months to a year in advance. At the end of last year, they had more than $4 billion in customer deposits, so they’re able to earn some interest on that in the interim (unless they take it to pay liabilities).

Onboard revenue just includes the sale of all things on the ship that aren’t included in the actual ticket price. This makes up about 1/3rd of their revenue and includes things like gambling revenue, sale of alcoholic drinks, gift shop items, internet services, etc.

There are also a couple of unique advantages that cruise lines benefit from. First off, they often get cheap debt from export credit agencies to buy new ships. These typically account for 80% of a ship’s costs and local governments I believe like to supply these because it leads to recurring work across their shipyards.

The other benefit is that there are virtually no taxes. Here’s a snippet from Cruise Law News “Cruise lines take advantage of an obscure provision in the U.S. tax code which permits shipping companies to evade taxes by incorporating overseas and flying the flags of foreign countries. That’s why Carnival is incorporated in Panama and Royal Caribbean is incorporated in Liberia.”

(Ryan) History: Royal Caribbean was founded in 1968 by a hospitality entrepreneur from Wisconsin named Ed Stephan. Ed had served in the Korean War as a radar technician in the army and when he came back, he worked his way up in the Miami hospitality business, eventually joining a small cruise line. At one point Ed had ambitions to build his own cruise line, so he traveled to Oslo, Norway in search of backers. There’s apparently a big shipping culture there. Here’s a quote from his adventure “I went to Norway to look for principals to build new, safe ships. I was having a lot of bad luck. One evening it was snowing like crazy and someone said, ‘There is a guy who basically sleeps during the day and drinks brandy at night, but he’s very interested in this.’”

That night turned into a meeting of 3 Norwegian ship owners named Anders Wilhelmsen, Sigurd Skaugen, and Gotaas Larsen, who would eventually become co-founders of Royal Caribbean along with Ed. From there Ed designed the first ship and it set sail from Miami in 1970. Then they slowly added new ships over the years.

(Brett) Industry/Landscape/Competition:

The cruise industry is projected to hit $25 billion in revenue in 2023

Market penetration had grown across its three key markets (North America, Europe, and Asia Pacific) from 2015 - 2019. This means the % of people in those markets who are cruisers.

NA: 3.36% to 3.89% (2015 to 2019)

Europe: 1.25% to 1.41%

Asia Pacific: 0.08% to 0.20%

Typically, companies will plan their shipbuilding 18 - 28 months in advance. There is a ton of forward planning within the industry.

Should we expect the industry to grow along with growing GDPs in these regions?

The cruise industry has two unique characteristics that make it cheaper than traditional travel (obviously, everyone’s definition of “value” can be subjective):

They don’t have to pay taxes due to a maritime tax loophole (also headquartered in Liberia)

They have very cheap labor, usually from India and Southeast Asia (data from the annual report)

Competitors: Carnival, Norwegian, and everyone else. Carnival has just under 40% market share, Royal Caribbean just over 20%, and Norwegian at just over 10% market share. These companies dominate the industry by volume.

There are also some luxury competitors as well as Disney/Virgin that should be watched out for, but they are much smaller than Royal Caribbean’s consolidated brands today.

Do the barriers to entry to getting a cruise line operational give these companies any advantage?

(Brett) Management and Ownership:

Royal Caribbean is run by Jason Liberty, who became CEO in early 2022. He was previously the CFO and had generally worked in Royal Caribbean’s finance department for 16 years. Before that, he was at KPMG.

So, yeah, he is an accountant running the company. Maybe the best thing for them right now given the balance sheet struggles?

Royal Caribbean’s executive compensation is incredibly complicated. I don’t think any of the executives could recite how they get paid if you asked them.

One thing to note, and this is an example of misaligned incentives, is one of the largest weightings for performance compensation is adjusted earnings per share

Royal Caribbean’s adjusted EPS in 2022 had 13 adjustments. An example:

“loss contingency recorded in connection with the ongoing Havana Docks litigation inclusive of related legal fees and costs”

This makes me worried that Royal Caribbean executives will get paid by the company for growing adjusted EPS while not actually creating value for shareholders.

The ownership table is interesting. They have some sizable outside owners who are not index managers, including the Wilhemson Family in Norway. That family runs a longstanding maritime operation.

*Based on shares outstanding as of latest filing

(Ryan) Earnings:

As you can imagine, COVID hit the cruise industry pretty hard so YoY comps are kind of meaningless right now.

LTM Revenue of $12B, which is finally back above their 2019 levels.

Prior to COVID, RCL was averaging 18% operating margins.

Most recent Quarter:

105% load factor in the most recent quarter (3 people to rooms can push it above 100%)

$1.4B in operating cash flow on $3.5B in revenue

Using all that cash flow to pay down debt. Plus some capex. New ship orders get categorized as Capex.

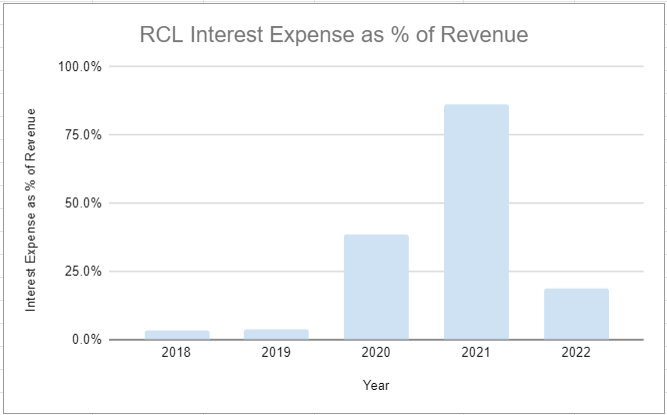

(Ryan) Balance sheet and liquidity:

Here’s where it gets a little difficult.

Liabilities:

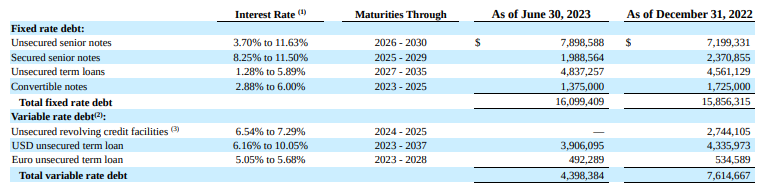

They have pretty much $20 billion in total debt. 56% of it is due after 2026.

The vast majority of the debt is fixed-rate. But the interest on some of it is quite high.

Their weighted average interest rate was just over 7%

Customer deposits are now up to $5.7B. They earn a little bit of interest income on that, but not very much.

Assets:

They’ve got just over $700M in cash. They’ve used most of it to pay down their expensive debt early.

~$30B in property and equipment value from the ships

Prior to COVID, they were doing just under $4B in operating cash flow. They’ve done $3.2B over the LTM. If you think they can get back to that then they are probably trading at a net debt to OCF multiple of like 5x. I think they are in a manageable position now and the equity seems to reflect that.

(Brett) Valuation:

I want to use a few different metrics for RCL given that is in a unique situation from an earnings inflection and balance sheet perspective

Note: always use enterprise value given the high debt

EV/E is going to be meaningless since TTM profits are essentially 0

EV/FCF is 24.7, but is helped by an inflection of customer deposits

EV/OI with a 15% margin (pre-COVID they got slightly higher) is 24.6. This is my favorite metric. However, need to take into account interest expense too.

Anecdotal Evidence:

(Ryan) I think the surge in demand that they are currently seeing could be around for a while. A lot of people delayed their cruises during COVID. It’s a unique adventure and the cost gap between cruises and land-based vacations is wider than it was pre-covid.

(Brett) Cruises are fine. Some people may scoff at them but people enjoy the packages these companies put together and I think demand will grow as long as the global economy continues to get wealthier. Has COVID put a permanent dent in demand for cruises?

Future growth opportunities:

(Ryan) Icon of the Seas. This is a pretty cool-looking ship and it’ll be the second largest in their fleet. They’re receiving this boat in Q4 of this year and sailings will start in January 2024. Commentary from the recent CC “There is incredible demand for our new ships and Icon will certainly break and has broken, I think probably every record in the book.”

(Brett) Land-based assets. Pre-COVID they were investing heavily into exclusive land-based excursions for their passengers. The brand is called Perfect Day at CocoCay and essentially lets people go off the boat and have fun at a beach-themed club (obviously will cost passengers more money, too). Apparently, millions of guests have visited Perfect Day, with plans to open up more of these in the Caribbean in due course. For the right customer (probably the typical cruise customer) these places could be a great way to widen the customer value proposition for Royal Caribbean vs. any upstart. I would like to see them invest more into these if they have the firepower. Widen that moat baby.

Highlights and lowlights:

Ryan’s Highlights:

No taxes are nice. Same with the cheap debt.

Feels like adding the luxury brands helps eliminate some of the previous cyclicality cruises have had.

Ryan’s Lowlights:

Obviously very indebted due to COVID. This means they need things to continue going right for them to be in any sort of real comfortable position.

Brett Highlights:

There is a long-term industry tailwind that should see no signs of slowing down over the next few decades for the broader cruise industry (barring global depression of course)

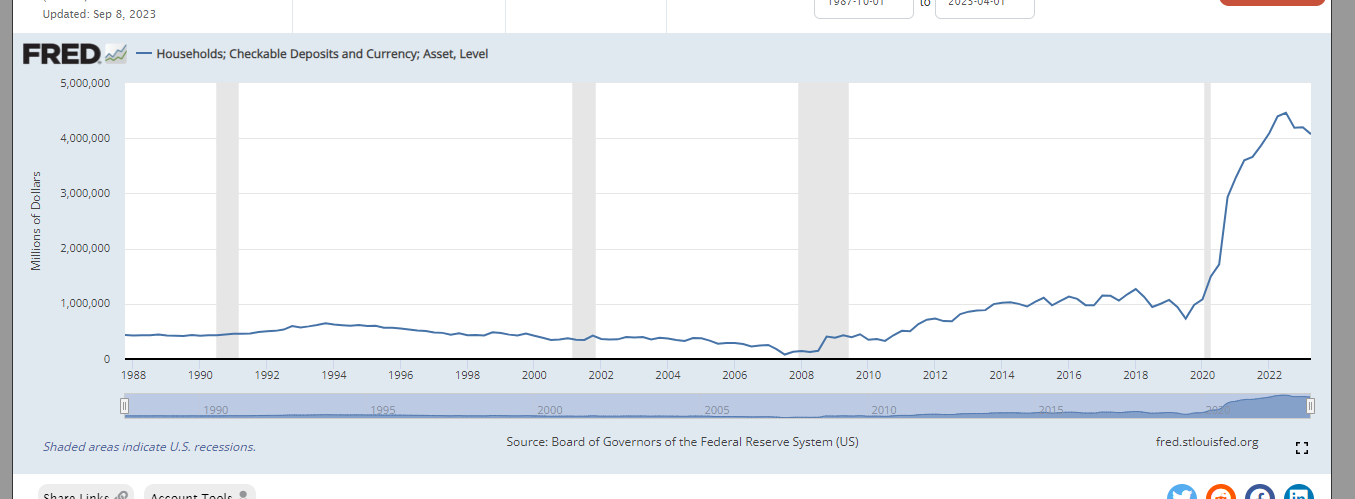

With U.S. checkable deposits at close to all-time highs, I think there is plenty of demand left for the post-COVID surge (link).

Given the capital intensity of the industry, it may be tough for upstart competitors to succeed and replicate RCL’s value proposition.

Brett Lowlights:

Europe and especially APAC markets seem to be struggling. China could be a pimple for them for a while (small part of the business though)

Large debt pile an obvious risk

The cyclical nature of the industry (cruising a very discretionary purchase) makes it a tough cookie to estimate financially

The fact they have to make capital outlay decisions 18 - 28 months in advance makes this a very tough company to run when combined with cyclical consumer demand.

Bull Case:

(Ryan) Pricing growth + moderate capacity growth + continued load factors above 100%. If those 3 things happen, I think there’s a path to them generating a legit $1-$2 billion after-tax profit in the next 2 or 3 years.

(Brett) As I mentioned above, this is extremely hard to predict financially. I think if you assume more pricing power, they will be able to easily pay down the debt and start generating around $2 billion in earnings that can be returned to shareholders. In that scenario, the stock looks cheap.

Bear Case:

(Ryan) Fed raises interest rates. It Tightens consumer spending and hurts them on their variable debt. Double whammy.

(Brett) I mean this one is easy and why so many people short RCL (check out historical VIC write-ups). You have a cyclical industry with a ton of operating leverage and a teetering balance sheet. If even one of the next three years is a down year, they could be in a lot of trouble.

More or less interested?

(Ryan) Less interested. It hasn’t created great returns historically, and I don’t see why it’d be too different starting from today’s valuation.

(Brett) Less interested. This is not a good business.

Sources and Further Reading

How Cruise Lines Avoid Taxes: https://www.cruiselawnews.com/2011/02/articles/taxes/no-taxes-the-cruise-lines-dirty-little-secret/

2019 VIC Writeup: https://www.valueinvestorsclub.com/idea/ROYAL_CARIBBEAN_CRUISES_LTD/3143776885

It seems to me that more and more towns are banning cruise ships, at least in Europe (Venice, Amsterdam, etc). I also have the feeling that young people are less attracted to cruises, perhaps because of the pollution. Nevertheless, your figures seem to show that market penetration is increasing.