Not So Deep Dive: Ryanair Stock (Ticker: RYAAY)

Can this low cost airliner dominate the European skies?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: Ryanair is Europe’s largest airline by number of flights. The company focuses on being a low-cost provider of short-haul point-to-point flights. So Ryanair has 558 planes (95% of which are Boeing 737s, the remainder are leased AirBus A320s) and they offer more than 3,000 different routes per day with an average flight duration of just over 2 hours.

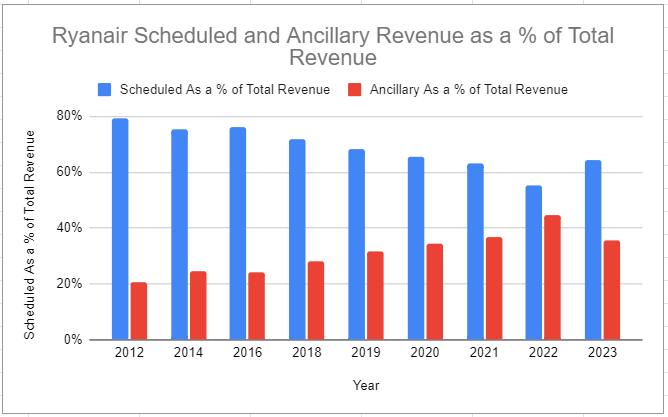

Now since most airlines are fairly similar, let’s talk about the basic fundamentals of an airline, and then I’ll dig into how Ryanair is different. So there are actually a couple of ways Airlines generate revenue, the most obvious being selling seats on a route, but they also make money in what Ryanair calls ancillary revenues (travel insurance, fast track services, parking and airport transfers, car rental deals, offering accommodations on its website, etc.). As for the typical costs, there’s a lot. Airlines have to pay for:

Staff (pilots, crew, admin)

Ground handling fees

Route charges (prices paid to airports)

Marketing

Maintaining or renting aircraft

Depreciation expenses

Fuel

Here are some of the ways Ryanair saves money:

No frills (no in-flight infotainment, no free internet, no free food, no free checked bag, you have to check in online or you’ll have a boarding pass reprint fee, they even once considered making the bathrooms coin slot operated).

Operates a single aircraft type (limits training, maintenance, and part procurement expenses)

Tickets are purchased through Ryanair directly (no travel agent commissions)

Better rates from airports because of their passenger volume

Better rates for buying airplanes

Here’s how Michael O’Leary described it in his book: “We have the lowest cost base of any airline in Europe. Business is simple. You buy it for this, you sell it for that, and the bit in the middle is ultimately your profit or loss. We have low-cost aircraft, low-cost airport deals, we don’t provide frills, we pay travel agents less, our people are well paid but work hard and we deal in efficiencies.”

(Ryan) History: Ryanair was founded in 1985 by a wealthy Irish family called the Ryan’s. Initially, it was just a single propeller plane that seated 15 people and flew people from Waterford, Ireland to London. They challenged the pricing from many legacy companies early on and this allowed them to expand their fleet. However, by the late 80’s the company was struggling financially as a full-service operator, and decided it was time for a change to try and be the low-cost provider. They literally tried to copy Southwest. Just before that transition, Ryanair also made a crucial decision that really helped shape the company. In 1988, they hired Michael O’Leary as CFO while he was still in his late 20’s. This model was far more successful for them and little by little they began to add more planes and routes. In 1994, they promoted Michael O’Leary to CEO. Around that same time, they began taking deliveries of Boeing 737 planes. Keep in mind, the EU was formed in 1993 and after that, it became much easier for carriers to expand routes across the continent.

One of the biggest moments in the company’s history came in 2001. Shortly after 9/11, Ryanair made a substantial order for new Boeing 737s and got them at a major discount. This helped the company expand and save big on costs. Since that time, O’Leary has really tried to replicate that same playbook. In a recent interview he did he literally said “All of our aircraft orders have been placed during moments of great crisis. We bought after 9/11, bought after the Gulf War, bought tons after the financial crisis, and renegotiated their existing aircraft deal during COVID to order more planes at lower prices.” Over the last two decades, this low-cost model allowed them to continuously steal market share and put many other operators out of business.

(Brett) Industry/Landscape/Competition:

Ryanair operates exclusively in Europe, mainly serving Ireland, the U.K., Spain, and Italy (among other options). The chart below has all of its airport locations.

Last fiscal year, it had 169 million passengers and flew ~950k sectors (believe this just means flights)

It is hard to get a market size for its specific industry (flights within Europe) but I found that Europe flight numbers were estimated to be around 11 million in 2019 and are expected to grow to 16 million by 2050. Who knows for sure how many flights there will be though. Ryanair has around 10% market share of flights based on the 2019 figure.

Two things to note: On a dollar value, Ryanair will have a much lower market share. Second, a lot of the growth for Ryanair specifically will be determined by how many planes Boeing can deliver to them.

Competition: The most important competitor is EasyJet, the other dirt-cheap airliner in Europe. If you look at reviews/blogs the experience is fairly similar between the two companies for consumers, so it will all come down to winning routes and cost advantages.

CEO Michael O’Leary believes that the industry will consolidate into three premium players (British, Air France, and Lufthansa) and a low-cost producer. He obviously believes the low-cost producer will be Ryanair, but EasyJet is still quite large as well.

The European airline industry is much less consolidated than in the United States. In the EU there are 135 total airlines, while in the U.S. there are 59. This likely means there is plenty of room to take market share for someone like Ryanair.

(Ryanair airport location map)

(Brett) Management and Ownership:

The CEO of Ryanair is Michael O’Leary, who has been with the company since 1988 and has been the CEO since 1994. He is 62 years old and has a contract extended many years into this decade.

I couldn’t find much on specific executive compensation criteria for Ryanair but I am not concerned with O’Leary at the helm. He is one of those executives I understood cared about all stakeholders (including shareholders) after listening to a 30-minute podcast with him. It is a tough industry but the management box is checked off for me.

Note: The ADR trades at a premium because of a weird restriction where foreigners can’t own the regular shares. Not really anything we can do but I would look at the valuation specifically for whatever shares you can buy.

The share base is very diversified. Should give them plenty of firepower to repurchase stock if/when that happens again over the next few years. O’Leary owns around 4% of the stock.

*Based on shares outstanding as of latest filing

(Ryan) Earnings:

$13 billion in trailing 12-month revenue (lapping Russia invasion of Ukraine)

95% load factor this quarter

Average fares are up 42% YoY

Delivery delays from Boeing

Traffic grew 11%

$2 billion in TTM net income

Ryanair wants to reach 800 planes and 300 million passengers over the next decade

Average operating margins the decade leading up to covid were 17%

(Ryan) Balance sheet and liquidity:

Assets:

$4.8 billion in cash and equivalents

Liabilities:

$3.6 billion in total debt, $2.8B is due after the next 12 months

Most of the debt is fixed-rate unsecured bonds with a weighted-average interest rate of 1.4%.

Their debt rating just got upgraded from BBB to BBB+. Helps with aircraft leases.

(Brett) Valuation:

More charts to check out covering numbers in the newsletter

Market cap of $19.7 billion

P/PAT of 11.7

Anecdotal Evidence:

(Ryan) I’ve never flown with them, but the people I know who have say “it does the job” and it’s usually the cheapest. Also, as crazy as some of their cost savings stuff is, they’ve garnered tons of PR for it which I really think has served as free marketing.

(Brett) I’d definitely fly them around Europe. We have more of an outsider perspective as people who don’t go to Europe often, and when we do it is coming from outside the country (which Ryanair doesn’t touch). It seems like the geography is much more suited to the low-cost “economies of scale” player than in the United States.

Future growth opportunities:

(Ryan) New aircraft order with Boeing. This quarter, Ryanair announced a $40 billion purchase agreement with Boeing for 300 737 MAX 10’s. These planes apparently have 21% more seats, require 20% less fuel, and are 50% quieter. This is going to be critical for Ryanair to meet its customer volume goals over the next decade.

(Brett) Moving into the first-tier airports. Originally, Ryanair targeted gates at cheaper second-tier airports in order to save costs. However, as they have scaled up they are now moving into the bigger airports in Europe. They will need to do this in order to become the truly ubiquitous cheap daily airliner on the continent. This should further help with economies of scale and provide an opportunity to increase annual passengers. It also will be encroaching more on EasyJet’s turf.

Highlights and lowlights:

Ryan’s Highlights:

Controls their own distribution. Without having to pay OTA’s huge fees, they can really pass through the cost savings and build that self-reinforcing competitive advantage.

Michael O’Leary might be my favorite CEO in the world. Funny as hell to listen to.

Being the low-cost provider seems like the only truly sustainable way to win in the airline business.

Ryan’s Lowlights:

So many moving parts (no pun intended). Delivery delays, fuel prices, union strikes, regulatory slowdowns, staffing shortages. It always feels like a total guessing game for margins because there are so many variables.

Brett Highlights:

Clearly, management is a highlight. It is a breath of fresh air when the management box can be checked off. So many times, we find ourselves looking at a high-quality business trading at a cheap price but management seems to not care about shareholders or not know what they are doing. O’Leary and this culture are not that.

The economies of scale should give them a competitive advantage and one that can widen this decade. For the Todd Combs (was it Combs?) question of “can this moat widen over the next five years?” I think the answer to Ryanair is yes. It would be hard for someone to replicate this route map and frugality with expenses and only gets harder the bigger they get and the more savings get passed onto consumers. The most similar business model from this standpoint would be Costco.

Much more ability to take market share from the 100+ airliners in Europe as opposed to Southwest in the United States which has less of an opportunity.

Brett Lowlights:

While the strategy is similar to Costco's, I believe the industry is much lower quality. This is in regards to the demand side (travel demand can be cyclical) and the cost supply side (fuel costs the big one, plus unions getting the silver medal). A retailer such as Costco has much less to worry about when it comes to consumer demand and supply costs, although they are obviously there to some degree.

It is clear that Ryanair is ready to consistently grow its flights, but I’m not sure its other stakeholders are. These are local governments, airports, Boeing, etc. My feeling is that these relationships could hold things up for them and slow growth. This is not necessarily the end of the world because they will just generate cash, but it would hurt their reinvestment runway.

Bull Case:

(Ryan) More of the same. Here’s a quote from the recent conference call that I think genuinely encapsulates it well. “All of our incumbent competitors have been emerging out of COVID with materially higher unit costs than Ryanair is. I’m astonished, never cease to be amazed. I looked at the numbers last week. Our PE multiple currently is 11. The PE multiples of Wizz and EasyJet, which can neither match our profitability, our growth, nor our unit costs are also 10 and 11. So either we’re materially undervalued or they’re materially overvalued.”

(Brett) Two things go right: The ability to grow supply unconstrained (i.e. Boeing doesn’t give them fits) and the European economy stays afloat. I’m assuming oil prices are not substantially higher if the European economy is doing fine. If this occurs there is a clear path to growing revenue with stable margins that should lead to a lot of cash to get paid back to shareholders vs. the current market cap. Shareholders probably do well here.

Bear Case:

(Ryan) I think the macro issues in the industry will find a way to work themselves out over time so I think the only way they end up underperforming is if someone finds a way to compete on cost and experience. People say Wizz is doing that but I think Michael O’Leary would disagree. Here’s what he had to say recently “There will still be idiot analysts out there later on today, producing research that says Wizz will have lower cost than Ryanair. And it won’t happen in this decade or the next decade or the decade probably after that because what nobody factors in is the materially different price at which we buy our 737s compared to the ludicrous prices they pay for A321. And that gap is never going to close.”

(Brett) My worry for investors would be buying a cyclical stock at a shiny-looking P/E when the industry is in a boom like today. A P/E of a tad over 10 may not be the average they would earn on this level of flight routes through a cycle. But, they should have a much higher level of flights flown 5 and 10 years from now.

More or less interested?

(Ryan)

(Brett) More interested. I like the business model and management, I think it brings a competitive advantage that can grow. One hold-up is I don’t know what price I would pay for this stock, it is very hard to value. These types of businesses are ones I kind of like to see a situation where you can earn the entire market cap in cash within five or so years if things go right.

Stock for next week? (Royal Caribbean)

Sources and Further Reading

2019 VIC Writeup: https://www.valueinvestorsclub.com/idea/Ryanair_Holdings_plc/1458601026

EasyJet vs. Ryanair for flyers: https://www.sanspotter.com/easyjet-vs-ryanair/

Ryanair destinations: https://www.ryanair.com/us/en/cheap-flight-destinations