Not So Deep Dive: Salesforce (Ticker: CRM)

A dominant software business that has let its expenses run a little too loose

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming schedule: Alphabet/Google and then a month covering financial stocks

As always, listen to the episode on Spotify, YouTube, or wherever you are subscribed to the show.

Charts

Data powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental investors.

Stratosphere.io has made it easy for us to get the financial data we need with beautiful out-of-the-box graphs that help us do research for Chit Chat Money.

🎉Stratosphere.io just launched their brand new platform and you can give it a try completely for free.

It gives us the ability to:

Quickly navigate through the company’s financials on their beautiful interface

Go back up to 35 years on 40,000 stocks globally

Compare and contrast different businesses and their KPIs

Easily track insider transactions and news updates for any stock we follow

Get started researching on the Stratosphere.io platform today, for free, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: Salesforce is the world’s largest customer relationship management platform. It enables businesses of pretty much any kind to centralize their customer data (what they call their Customer 360) and leverage that data in a number of ways. Here’s how they separate their revenue:

Sales: I think this is probably what people think of as the most logical use case. With the CRM Sales Cloud, customers manage their entire sales process on one platform. So from the initial lead or outreach to the sales process to the actual billing. A company can see the entire sales journey for all its customers. (Accounts for 22% of revenue)

Service: This is the customer service module where customer service agents can see and respond to customer feedback from any channel. Basically, all feedback gets funneled here. It also has a field service component where dispatchers and response teams can stay in the loop. (Accounts for 24% of revenue)

Platform: Platform helps customers manage and automate business processes. It’s meant to connect different systems and as I understand it helps different teams work together. This is also where Slack gets included. (Accounts for 22% of revenue, but growing the quickest)

Marketing & Commerce: This one is pretty intuitive. Similar to the Sales module, Marketing helps companies manage the entire marketing journey with their customers. For example, you could see if they clicked on a social media advertisement and you could see how many emails you’ve sent them, which ones they’ve opened, etc. So that you can make better-informed marketing decisions next time. Same for commerce. You can see the customer’s whole omnichannel experience, what they’ve bought, returns, etc. (Accounts for 14% of revenue)

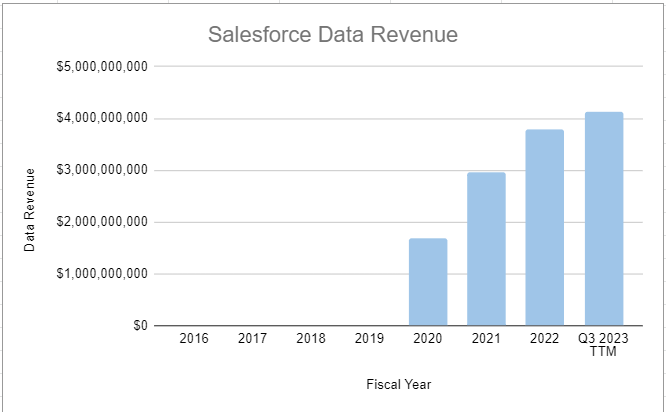

Data: They break this one down into analytics and integration. Analytics includes Tableau, which helps customers prepare and aggregate data in a way that makes it more useful. Integration includes Mulesoft and honestly it’s not a segment I understand all that well but it’s more for your systems engineer. I’ve linked to a 6-minute Mulesoft tutorial if people are dying to understand it, but it’s not a massive part of the business. (Accounts for 13% of revenue)

Additionally, depending on which plan you choose, the Salesforce platform is really flexible and customizable. You can add tabs or sections to optimize it for your business. Pricing varies on a number of factors as well. Each subscription is charged on a per-user basis, but the price per seat depends on which edition a customer chooses (basic, professional, enterprise, unlimited) and which modules they subscribe to. Right now only 20% of their customers subscribe to 4 or more modules.

(Ryan) History: I’ll make this one brief because I don’t think it’s super relevant to the investment case today but Salesforce was initially started in 1999 by Marc Benioff along with 3 others (Parker Harris, Frank Dominguez, and Dave Moellenhoff). Marc was a former Oracle executive and the others I believe all worked at a company called Left Coast Software. At the time, the Salesforce concept of using a web browser as your CRM was pretty revolutionary. They were sort of the pioneer of this Software as a Service concept and they even advertised the platform with the tagline “end software” in the early days. They were initially funded with some of their own capital as well as investments from Larry Ellison and some others.

It didn’t take long to grow. They first officially launched Salesforce.com in 2000 and by 2001 they had $5.4 million in revenue. By 2003, they surpassed $100 million in revenue and a year later they joined the public markets. I guess in terms of other important moments in their history, they began building the Salesforce Tower in 2013 and it reportedly cost more than $1 billion. They’ve also made some large acquisitions. Most recently, Mulesoft in 2018 for $6.5 billion, Tableau in 2019 for $15.7 billion, and Slack in 2021 for $27.7 billion.

(Brett) Industry/Landscape/Competition:

Salesforce operates in the CRM industry but also in the broader enterprise software market, hitting a ton of different categories with its product suite

The CRM market is quite large, with $44.9 billion in annual revenue just in the United States

Competitors: Microsoft, Oracle, SAP, Adobe, Hubspot, Zendesk, and tons of other smaller software vendors. There are apparently very few barriers to entry to becoming a CRM vendor.

Salesforce is the clear leader in the CRM market, with an estimated 22.9% market share, well ahead of Microsoft in second with a 5.8% share

Projections are for the CRM market to grow steadily this decade, so if Salesforce can continue taking market share it will likely grow its revenue at a steady rate as well

(Brett) Management and Ownership:

The founder, CEO, and chairperson of the board is Marc Benioff. He has led this business for multiple decades.

The executive team was 15 people strong (with Benioff apparently having a chief of staff) according to its website. However, two of those people have left recently: Co-CEO Bret Taylor and Slack founder Steward Butterfield. The Tableau CEO has also left the company.

The board has 13 members, including General Colin Powell. I’m sure he can give great insights on how to navigate the enterprise software market.

Executive compensation has a base salary, annual bonuses, and long-term stock awards.

Annual cash bonuses are based on revenue, non-GAAP operating income, and operating cash flow. These seem fine but they are no “growth in free cash flow per share”

There are some standard stock options that are given out, but also some performance stock units that are based on total shareholder returns for CRM vs. the Nasdaq 100. They also don’t get the PSUs if CRM has negative absolute returns. These seem pretty solid to me.

No major red flags from the proxy outside of Benioff paying himself a lot when he owns 3% of the business. I get he might deserve some pay but it is not a good look when you are the founder and just giving out more stock to yourself year after year.

One other note on ownership, Salesforce has three activist investors nipping at its heels at the moment. It is unclear exactly what these funds want, but there are some stories saying some standard stuff like getting board seats, reigning in expenses, etc. It will be important to watch how this plays out and whether these funds can exhibit so much influence on a company of this size.

(Sources: Proxy Statement and Whale Wisdom. 1,000,000,000 shares outstanding end of Q3 FY 2023)

(Ryan) Earnings:

Last 12 Months:

$30.3 billion in revenue, +21.3%

$5.6 billion in free cash flow or an 18% FCF Margin

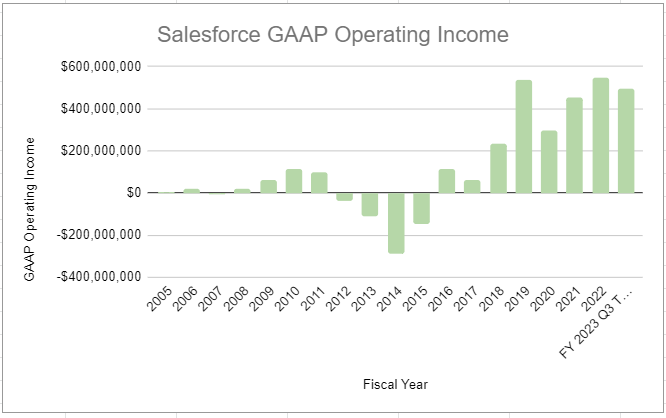

Just $500 million in GAAP Operating Income (They’ve recorded about $3.5 billion in depreciation & amortization and just over $3 billion in stock-based compensation)

Most Recent Quarter:

$7.8 billion in revenue, +14% (19% in constant currency)

Remaining performance obligations are growing a little slower though. Current RPO was $21 billion, up 11%.

Bret Taylor mentioned that customers are prioritizing 3 things in the current buying environment. 1) Time to value on tech investments 2) Need to drive cost savings and 3) Are looking to consolidate their vendor relationships.

Non-GAAP operating margin was 22.7%. The two reconciliations here are just SBC and D&A expenses. Basically, Non-GAAP OI is essentially operating cash flow.

Management said they target Adj. Operating Margins of 25%+ by FY 2026 (seems like an easy goal).

Repurchased $1.7 billion worth of shares.

(Ryan) Balance sheet and liquidity:

Assets:

$12 billion in cash and short-term marketable securities

$5 billion in strategic investments

This is just a mix of debt and equity investments in public and private companies where they are not the controlling shareholder.

They did record a gain on these investments, but 94% of them are comprised of private investments so take that with a grain of salt.

If you want to be conservative, don’t include these in their liquid assets.

Liabilities:

$11 billion in total debt, 90% is long-term.

In fact, 80% of their debt doesn’t mature until 2028 or later.

And the rate on all this debt is really low. Their weighted average interest rate is 2.5%.

I’d call it $1-$2 billion in net cash. Maybe higher if you want to include the strategic investments, but either way the EV is going to be really similar to their market cap.

(Brett) Valuation:

Market cap of $164.5 billion

Enterprise value of $158.3 billion

EV/GP of 7.2

EV/OI of 319

EV/FCF of 28.5

Anecdotal Evidence:

(Ryan) Had a friend who told me he uses it every day, so I had him show me around the platform. Basically, the bulk of his day exists on Salesforce. It was customized for his company and he said there’s actually a group of people at the company whose sole job is to optimize salesforce for the rest of the staff.

(Brett) Not much, but as a contractor for the Motley Fool I can see how the Salesforce bundle could be an easy sell to a larger enterprise with high switching costs.

Future growth opportunities:

(Ryan) As Brett said, the growth equation is pretty straightforward. So I’ll just harp on something they’re doing well which is the Salesforce by vertical or what they call their “industry clouds”. This is just them taking the Salesforce essentials and layering some industry-specific processes on top that work right out of the box. This was initially launched in 2020 and right now covers 13 industries (Communications, Energy & Utilities, Financial Services, etc.). CFO Amy Weaver mentioned on the last CC that “7 of our 13 industry clouds grew ARR above 50% this quarter”.

(Brett) Salesforce+? No, never, but I actually had a hard time coming up with one besides “continue to sell more seats for all of your products as you have in the past” because the track record of growth for all segments is great (except maybe Slack). However, I think the future growth opportunity to take it to the next level and increase its competitive advantage (switching costs) is to continue to work on the bundling of products to enterprises through whatever name they are calling it at the moment. Getting an enterprise to adopt five of its products instead of just the basic CRM service can make the Salesforce cloud the second Office 365 for enterprises. Plus, the App Exchange helps with this competitive advantage by connecting all the different software programs to Salesforce.

Highlights and lowlights:

Ryan’s Highlights:

Deeply engrained within the entire business world. 90% of Fortune 500 companies rely on Salesforce and the only real alternative is an in-house solution. If you’re cutting your software budget, I imagine this would be one of the last ones to go.

The sheer growth over the last two decades. It’s easy to poke holes in the company today, but it’s hard to argue with its past results. Free cash flow per share has grown by nearly 3,000% since 2007 or 30% per year.

The activist investor’s involvement – primarily. Funny how all the news leaks about Benioff are coming out right after this.

Ryan’s Lowlights:

Executive turnover. In the last 3 months, several high-ranking executives at the company have departed. Here are the ones I know of: Co-CEO Bret Taylor, Slack CEO Stewart Butterfield, Tableau CEO Mark Nelson, the CTO of Security, and the Cybersecurity executive VP.

Benioff in general. Here’s a quote from the financial times: “Benioff has long cultivated close relationships with a number of high-profile figures to help further the company. But the fondness for surrounding himself with celebrities, including on corporate business, has also raised concerns. According to one person familiar with the company, both musician Will.i.am and actor Matthew McConaughey are frequently involved in strategy discussions at the company, distracting from normal business. An outsider who has attended internal Salesforce meetings also expressed surprise at bumping into celebrities in high-level corporate discussions.”

Brett Highlights:

They have a phenomenal track record of growth. Gross profit per share has compounded at 26.5% a year since 2005, which I can guarantee is better than almost every other company in the world. Plus, there looks to be a clear path for growth in all of its end markets this decade.

There are clear competitive advantages, which generally come down to switching costs (the core, in my mind, like Microsoft Excel) and bundling (a nice addition that can be an enhancer). This should give them consistent pricing power whenever they need it.

Brett Lowlights:

Wasteful spending. Maybe this will change when the activist investors come in and shake things up but it is horrendous right now. Chief of Staff, Dreamforce, all the real estate leases, Salesforce+, and that is only naming a few. And don’t get me started on Benioff’s addiction to acquisitions. There’s no reason this company should just break even on an operating income level at this point in its life.

Executive turnover. I think of Benioff the same way I do Bob Iger or Howard Schultz, which is not high for building an executive culture. The uncertainty around the activists could leave Salesforce in a better spot, but it also adds a lot of risks that things go poorly.

The culture of the company in general is the epitome of a San Francisco company that doesn’t care about shareholders. If you are interested in what we mean by that, take a look at the first few pages of the annual report. Here is a quote:

"Finally, Salesforce continues to be a global leader in protecting our largest stakeholder – our planet – as we face an urgent climate emergency"

I worry about a software recession over the next few years. Did we have a major bubble in software companies and software companies operating expense lines in the last decade? If so, how much did that help Salesforce grow last decade?

Bull Case:

(Ryan) Let’s just make it really simple and say they hit their 2026 Investor Day Targets. That’s $50B in revenue and 25% Adj. Operating Margins (call it 90% FCF conversion). They’d be doing $11.3B in annual free cash flow in 2026. At 20x FCF, they’ll have a market cap of $225 billion. Now they’re committed to buying back at least $10B in shares. So I think you could say the share count stays at least flat. That’s a ~45% premium to today’s price over the next 3 years. Returns would be pretty good.

(Brett) The majority of its software programs are necessities and not “nice-to-haves” in a bull market, which lead it to Microsoft Office levels of durability. At $22 billion in gross profit, I see no reason why Salesforce cannot be generating north of $10 billion in free cash flow a year. At an EV of around $150 billion for a business with pricing power and a steady industry tailwind, that would equate to some solid returns for shareholders this decade.

Bear Case:

(Ryan) I think it’d be tough for them not to grow. I think the real concern is that expense growth outpaces revenue growth and they don’t ever optimize for shareholders.

(Brett) No matter how fast gross profit compounds, the executive team still has this faux “ESG” mindset that leads to low growth in free cash flow per share. At this current EV/FCF, that will lead to poor returns going forward. Is Benioff the CEO at this time next year?

More or less interested?

(Ryan) More interested. However, I’d need to see some management changes before taking a position.

(Brett) More interested. This is a great business with strong competitive advantages, but I am concerned with the obvious executive red flags.

Sources and Further Reading

Executive turnover: https://www.techtarget.com/searchcustomerexperience/news/252527893/In-stunning-move-Salesforce-co-CEO-Bret-Taylor-steps-down

Activist investors: https://finance.yahoo.com/news/salesforce-now-faces-two-activist-investors-amid-layoffs-slowing-growth-135747452.html

Activist investors: https://finance.yahoo.com/news/salesforce-elliott-management-tensions-heat-up-with-looming-board-nominations-230925018.html

Latest Proxy Statement: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001108524/243f7184-0562-4c64-8edc-105ab299fbe9.pdf

Salesforce acquisitions: https://www.salesforce.com/news/stories/salesforce-acquisitions/

Salesforce market share: https://www.salesforce.com/news/stories/idc-crm-market-share-ranking-2022/

Activists story in the Financial Times (Benioff advice from celebrities) https://www.ft.com/content/9c9299d9-314f-4381-9378-ee008035fab5

Investor Day Presentation (37 slides): https://s23.q4cdn.com/574569502/files/doc_presentations/2022/FY23-Salesforce-Investor-Day-2022-Sept-21-(1).pdf