Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Listen to the episode wherever you get your podcasts!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: Shift4 is similar to PayPal, which we discussed last week, in that they are a bit of a hodge podge of different payment solutions stitched together. Today, Shift4 is an end-to-end payments processor for mostly enterprise clients but they’ve gotten there through a number of acquisitions.

Historically, Shift4 has focused on being the payments “gateway”. That means when someone paid at let’s say a giant resort, Shift4 would collect the payment data, encrypt it, tokenize it, then send it to a merchant acquirer. I’ll quote Scuttleblurb here because I think he gives a really good example: “The payments gateway for, say, a casino resort is embedded in dozens of software systems, from the MICROS (Oracle-owned) POS used by the restaurant to the Microsoft Dynamics POS used by the gift shop or spa. It creates a token that updates the original payment authorization as a guest transacts at different venues inside the property so they can get a single bill at the end of their stay, and delivers to the casino resort a consolidated reconciliation of transaction activity across all their software systems.”

However, in a transaction, much of the value for the intermediaries is accrued to the Merchant Acquirers, whose responsibility is to process and settle the payments. These often include companies like Adyen, Stripe, JPMorgan, and others. But because Shift4 has acquired a number of different “gateways”, they are now able to offer their big customers merchant acquiring services as well (don’t ask me how). This is what they now call end-to-end payment processing. From collecting payment data all the way to settling. This conversion from a gateway to end-to-end provider drastically enhances the gross revenues that Shift4 can pull from its merchants.

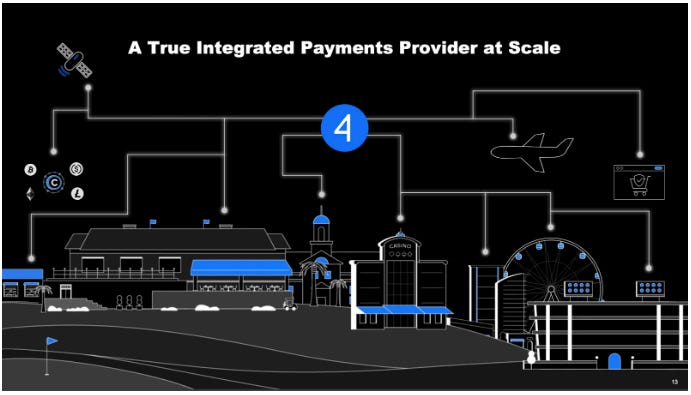

And Shift4 is able to attract enterprise clients because they have more than 500 different integrations with the kinds of legacy software solutions that big complex organizations might use. For context, their customers include companies like Ceasar’s, Hilton, Levi’s Stadium, etc. Here’s a visualization of the different transactions they process:

(Ryan) History: Jared Isaacman started what would eventually become Shift4 (they’ve changed their name 4 different times) in 1999 when he was 16 years old. The company was initially called United Bank Card and its primary business was reselling TSYS payment processing functionality. They grew because they would help businesses get their processing set up much faster than other resellers and frankly, it sounds like the customer service was just better overall. During those first 10-ish years, they partnered with lots of different software vendors and then in 2008, launched HarborTouch. HarborTouch was simply a point-of-sales system designed primarily for small retailers and restaurants. This was really their introduction to the POS business.

Between 2014 and 2017, Shift4 (then called HarborTouch) acquired several other payments processing and point of sales businesses including the company Isaacman worked for before he started the company. In 2018, they acquired Shift4. In 2020, they acquired Merchant Link. And they’ve since acquired a number of other businesses. They joined the public markets in June of 2020 raising $345 million during its IPO.

(Brett) Industry/Landscape/Competition:

Going through Shift4’s industry size is difficult as there is not very reliable data (or, in reality, all the “TAM” estimates are wildly different)

However, I have tried to do some math to give a reasonable estimate of Shift4’s payment volume opportunity (remember, this will be much higher than its revenue/gross profit potential)

First, I looked at Visa’s $11.6 trillion in payments volume in 2022. Then, I divided that number by 0.4 given that Visa has 40% global market share. That turns into an approximately $29 trillion annual international cashless payments opportunity. In reality, Shift4’s opportunity is going to be lower than $10 trillion since it is not going to be in every region and will not be targeting every vertical. Still, it is a massive opportunity to go after.

Shift4 did $71 billion in End-to-End payments volume in 2022, so it has a lot of whitespace to grow, especially if it starts investing in more international countries (something management explicitly stated on the latest conference call). It currently operates in Japan, Europe, and North America.

We can put the Shift4 competitors into two categories

First, non-integrated payment processors, which include Chase Paymentech, Fiserv, FIS, and Global Payments

Second, integrated payment providers like Shopify, Square, Toast, and Adyen.

Here’s an operations map

(Brett) Management and Ownership:

For this section, I want to hit three topics I think are important for any investor in Shift4:

How Isaacman controls this business

Executive incentives

Related party transactions and some governance yellow flags

Shift4 has three classes of common stock (A,B,C). B and C shares have 10-to-1 voting rights

Isaacman owns all of class B and C shares, therefore giving him 82% voting power as of the latest proxy filing

99% of the CEO compensation is in restricted stock units. As a 32% owner of the business, is this really necessary to “incentivize” Isaacman to do a good job?

Cash bonuses for other executives are based on payment volume, gross revenue less network fees, and Adj. EBITDA targets. It should be no surprise then to see them be a heavy acquirer and use stock-based compensation a lot. Yellow flag.

There were a lot of strange things within the proxy filing and annual report:

Multi-million dollar payout to step sister.

Company pays $1 million a year to use Isaacman’s plane.

Isaacman’s dad is on the board.

With the holdco structure, there is a deal where all tax loss carryforwards get paid to an entity called “Shift4 LLC”, which is not the stock you are buying. It is listed in related party transactions. I am not going to try and spend 10 minutes explaining the dense lawyer-speak paragraphs and probably will get some things wrong but I never like seeing these things. If a capital structure is extremely confusing/opaque, I always want to ask…why?

Generally, I came away very disappointed in this proxy statement/ownership structure.

*Based on 83,175,790 shares outstanding as of the latest proxy filing

(Ryan) Earnings:

2022:

The 2 important top-line figures to pay attention to are end-to-end network volume and gross revenue less network fees.

End-to-End volume ~$72 billion, up 53% YoY.

Gross network minus network fees was $727.5 million, up 37.5% from last year.

$290 million in Adj. EBITDA but frankly that means nothing

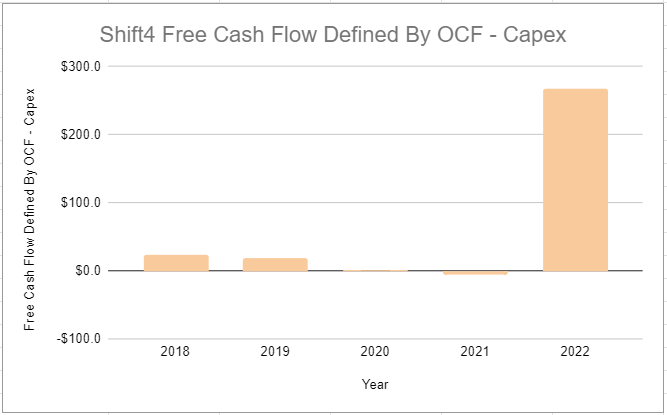

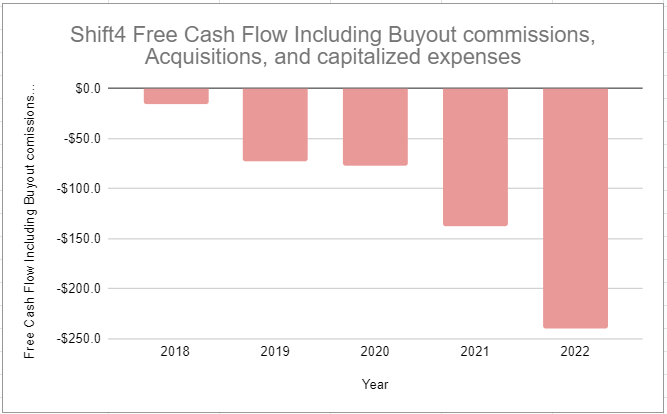

FCF has been hard to come by for them. If you exclude acquisition costs and settlement timing, about 46% of EBITDA would convert to FCF. So call it $133.4 million or 18% FCF margins.

Worth noting they are repositioning costs from the cost of goods sold to the cash flow statement by acquiring their distributors. This gets recorded as “residual commission buyouts” under the investing portion of the cash flow statement. Earnings would look worse if they didn’t do this.

(Ryan) Balance sheet and liquidity:

Assets:

$744 million in cash and cash equivalents.

$56 million in long-term investments in securities, I believe a big chunk of this is SpaceX.

Liabilities:

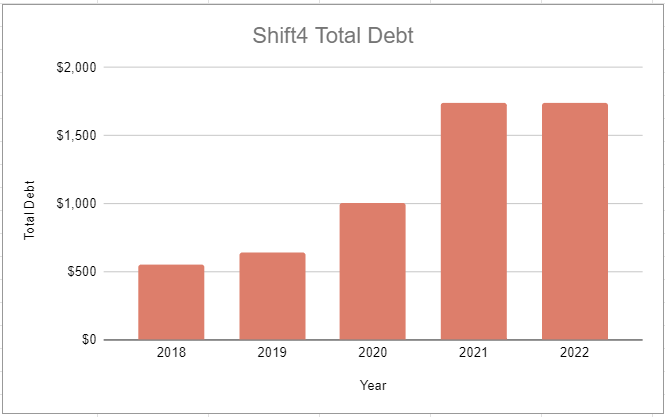

$1.74 billion in true debt. All issued when rates were incredibly low. So good for them.

A 2025 Convertible note: No interest, convert at $80.48. $690 million coming due in two years.

A 2027 Convertible note: 0.5% interest, convert at $123. $633 million.

And a 2026 Senior Note: 4.625% interest, $450 million.

Net debt to their Adj. EBITDA figure is ~3x.

(Brett) Valuation:

Market cap of $5.2 billion

EV of $6.1 billion

EV/net revenue (gross revenue less network fees) of 8.4

EV/OI of 64.7

Anecdotal Evidence:

(Ryan) I don’t usually like companies that feel like a patchwork of random different businesses. There’s always acquisition and integration costs backed out and it feels like they’re constantly talking about fake cash flow.

(Brett) To me, Adyen shows that the acquisition strategy in payments is a flawed long-term approach. I think all of these products are generally commodities but instinct says they have pretty strong switching costs as long as they work well for the merchants.

Future growth opportunities:

(Ryan) Europe or Venuenext. Venuenext is apparently a white-label solution for stadiums to adopt where people can pay from anywhere. Seems like that could be a big winner for them. And they continue to expand to Europe. But the name of the game is pretty simple, win more end-to-end volume from both new and existing customers.

Also, obviously up selling to the merchant acquiring services as well. I will steal a line from scuttleblurb though that talks about this process. “There are several challenges converting gateway-only sellers to end-to-end processing. First, large merchants are busy managing the complexities of their core business and consolidating gateway functions with merchant acquiring is understandably the last thing on their minds. Second, merchants will often take Shift4’s consolidation proposal to their existing acquirer(s), who will respond by cutting processing fees to keep the business. Third, the large enterprises that Shift4 caters to will often have banking relationships bundled with merchant acquiring”.

(Brett) I really don’t have anything special to say there except “sell to more merchants around the globe.” They seem to be winning with large entertainment venues, the end-to-end ecosystem, and have the chance to move more internationally (the last one is what every payments company says, though). I wouldn’t be surprised if they keep growing net revenue at a double-digit rate for the next five years.

Highlights and lowlights:

Ryan’s Highlights:

The push for End-to-End flows should help the top and bottom lines grow quickly.

They seem to be a pretty well-run sales organization. Consistently bringing in large new customers.

Ryan’s Lowlights:

I’ll try to consolidate all this down to one, but Jared Isaacman strikes me as a little “pumpy”. In December of last year, when the stock price was down considerably from its highs, Isaacman said he was incredibly frustrated with its public market valuation and suggested he might take the company private. If you’re interested in driving long-term value, don’t you want a discount so that you can buy back accretively? It feels like he thinks “well if the public shareholders aren’t going to foot the bill for us, there’s no point in being public”. Also, he may have felt like saying this because he’s taken out margin loans with his shares as collateral.

Lots of related party transactions and there was a material weakness in internal controls. CFO left during that time or he was fired, however you want to look at it.

CEO could die in a rocket accident and he’s important to the thesis.

Brett Highlights:

Going after larger venues should have higher switching costs. The complexity of managing payments at a sports stadium should make it difficult for someone to rip out Shift4’s infrastructure

They seem to have fine unit economics.

Inflation proof (take rate business).

Brett Lowlights:

Governance red flags (discussed in the ownership section)

The cash flow generation is not what it seems. $275.4 million in operating cash flow minus $8 million in capex equals $267 million in “FCF.” But, if you include acquisition commissions, acquisitions, equipment leases, and capitalized software costs they burned $240 million in 2022. And, they are getting incentivized on adj. EBITDA. Are they actually creating value for shareholders?

Going for the acquisition strategy vs. build-it-yourself like Adyen.

The unit economics of these payment processors are not as strong as many think. You have high network fees, customer support, hardware costs, sales staff, and implementation costs. Can they still generate a positive ROIC if the product is sticky with these large merchants? Yes, but it is not as good as someone may make it out to be.

Bull Case:

(Ryan) Continued conversion of gateway customers to E2E customers, big growth in new customers, and real 18% FCF margins (that’s on gross revenue minus network fees). If they continue to land new customers and are truly as profitable as they say, this will probably work out to a solid return.

(Brett) At 8.6x net revenue you need to expect strong double-digit growth (probably 15% average CAGR for five years), better margins than people think, and smart capital allocation for this to work. The expectations are generally high for this business, and I think if you want to buy shares you need to have even higher expectations than the market. What happens once they finish the end-to-end conversion with existing customers? What happens when the “war on cash” tailwind eventually ends?

Bear Case:

(Ryan) The cash flow is really inflated and what little they have is all going to go towards paying down debt over the next couple of years or they’ll have to roll that debt at much higher rates. Blue Orca’s short report states that they think their net leverage ratio is 5.3x Adj. EBITDA. That’s hefty.

(Brett) My bear case is all multiple compression. I think people overrate the unit economics of these payment processors and it is tough to see how they will come close to generating their current EV in FCF (cumulatively) within 10 years. Why am I buying this thing today?

More or less interested?

(Ryan) Less interested. Too many governance red flags, unclear how levered they truly are, and not the most attractive valuation either.

(Brett) Less interested. This is a business in a highly competitive industry with yellow flag governance issues and a steep multiple. I don’t know why I should have confidence this is a good risk/reward opportunity at these prices.

Stock for next week? (Bill.com)

Sources and Further Reading

Scuttleblurb Post: https://www.scuttleblurb.com/four/

Blue Orca Short Report: https://www.blueorcacapital.com/terms-of-service-greendollar

2023 Proxy: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001794669/ff7aae62-55db-4165-8a9d-6f666e4d7057.pdf

Visa market share: https://www.moneycrashers.com/credit-card-market-share/

Visa annual payment volume: https://annualreport.visa.com/financials/default.aspx

Brett tweet asking about competitors:

https://twitter.com/CCM_Brett/status/1666642184668594176?s=20