Not So Deep Dive: SiriusXM (Ticker: SIRI)

Is streaming going to help or hurt the internet radio monopoly?

Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/16EWeoC-JTjWfRxhAkoS0bypv8yWdxBCs

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: SiriusXM is a leading audio entertainment company in North America. The bulk of their sales are generated by subscriptions and advertisements on their core satellite radio business, but they’ve also added other audio offerings in recent years including Pandora and Stitcher. Sirius breaks its business into two parts:

SiriusXM: SiriusXM is the only remaining satellite radio provider in the United States. Once subscribed to SiriusXM, subscribers get a collection of channels covering music, sports, entertainment, comedy, news, traffic, weather, and more. Though subscribers can now access SiriusXM on most internet-connected devices, the company still relies heavily on automotive partnerships to drive customers. Today, SiriusXM is enabled in approximately 145 million cars on the roads and 84% of all new cars produced. The average monthly price for subscriptions is just under $16 and Sirius touts 34 million total subscribers.

Pandora and Off-Platform: As for the Pandora side of things, Pandora operates a freemium audio streaming platform that allows listeners to create personalized stations and playlists. However, unlike SiriusXM, the bulk of Pandora’s revenue comes from advertising. Pandora also has an agreement with Soundcloud to be its exclusive ad sales representative. Sirius’s other off-platform products include:

AdsWizz: AdsWizz is a programmatic audio advertising platform. They help connect advertisers with ad inventory that they collect through both their own audio productions as well as third-party content.

Simplecast: Simplecast is a podcast management and analytics platform that helps give podcasters better insights on their audience.

Stitcher: Stitcher is a holistic podcast business that consists of its own production studios, a midroll advertising network, and an app for listeners.

(Ryan) History: SiriusXM was officially formed in February of 2007 through a merger of the only two satellite radio companies in the US, Sirius and XM. Both companies had their own unique founding stories, and Sirius was largely responsible for actually creating the industry, yet neither company had ever turned an annual profit. The thought was that this merger would eliminate expenses from duplicate stations and marketing costs. Once the agreement finally passed in 2008, the company was still on the brink of bankruptcy when Liberty Media stepped in and provided a $530 million loan in exchange for a 40% equity stake in the company.

After making it out of that tough period, SiriusXM had a little over 20 million subscribers thanks to growth primarily through partnerships with automakers. And in 2012 Liberty Media gained a 49.5% stake in the company, replaced the CEO, and effectively took over. Since then the company has added plenty of debt to the balance sheet, steadily grown subscribers, purchased Pandora for $3.5 billion, and bought Stitcher for $325 million.

(Brett) Industry/Landscape/Competition:

The audio industry in North America (which is where SiriusXM is mainly competing) is tough to find a consolidated dollar figure

However, the recorded music industry is estimated to be around $9.8 billion in North America in 2021, the podcast industry is expected to hit $4 billion by 2024, and the radio broadcasting industry is estimated at $22.9 billion in 2022

From a SiriusXM perspective, I would think the total market opportunity for audio in the United States is in the $30 billion - $40 billion range. This includes their radio, podcasting, and streaming audio ambitions.

Competitors: traditional broadcasting radio, iHeart Radio, TuneIn, Spotify/Apple Music and other streamers. Apple Podcasts and other podcast platforms. Essentially, any service that is competing for audio listening time for people in the United States, especially in the car, is a competitor to SiriusXM.

(Brett) Management and Ownership:

CEO: Jennifer Witz. Became CEO in January 2021. She has worked at the company for 18 years.

Chief Content Officer: Scott Greenstein. It looks like he has been in a similar role since 2004. He has had a very long tenure at SiriusXM and all the different ups and downs it has gone through.

Note: the board of directors has 15 members, which is a lot, especially for a company of this size. For example, the Warner/Discovery CEO David Zaslav is on the board, I wonder how much time he has to give any insights into SiriusXM’s strategy.

$6.8 million in total board of director compensation in 2021, or only 0.15% of trailing gross profit. So even though the board is large, the compensation is quite reasonable vs. the profit SiriusXM is bringing in.

Total executive compensation was $53.5 million in 2021 or ~1.2% of trailing gross profit. Total compensation has fluctuated when different executives get large bonuses, but it has generally not been egregious vs. the size of its gross profit generation.

Executive compensation has a typical three-tier structure of salary, annual bonus, and long-term equity awards. The annual bonuses have no formulaic approach and the long-term equity awards are based on free cash flow targets and total shareholder return.

Note: They own 70% of SiriusXM Canada, which has 2.6 million total subscribers that have been fairly stable the last few years.

(Based on 3,939,610,596 shares outstanding, 2022 Proxy Statement)

(Ryan) Earnings:

Over the last 12 months:

$8.9 billion in revenue, 5.8% from the 12 months prior

50.5% gross margin

$1.54 billion in free cash flow, flat YoY

Most recent quarter:

$2.25 billion in total revenue, up 4% YoY

$1.7 billion in SiriusXM revenue, +5%

$403 million in Pandora and Off-Platform revenue, +5%

SiriusXM total subscribers declined 1.3%, while ARPU increased 7%

Pandora total subscribers decreased 4%. And both ad-supported listening hours, as well as revenue per ad-supported listening hour, shrank.

Free cash flow was $435 million (19.3% free cash flow margin)

Results came in worse than expected due to fewer cars being produced.

(Ryan) Balance sheet and liquidity: (page 19 of the 10-Q)

Liabilities:

In total, they have just under $10 billion in debt comprised almost entirely of senior notes.

~90% of the debt is due after 2025 and the average interest rate is 4.3%

Sirius also took on $193 million worth of convertible notes in its acquisition of Pandora and has a $510

Assets/Cash Flow:

Only $126 million in pure cash and equivalents

But expects to generate $1.55 billion in free cash flow this year and has just under $2 billion in operating cash flow over the last 12 months

Their credit facility has a covenant stating they must stay below a total debt to operating cash flow ratio of 5x.

(Brett) Valuation: (Based on a stock price of $6.41)

Dynamic valuation: https://docs.google.com/spreadsheets/d/1-NGmiRYc9Jo8vsVu2pHBNRhIN8Z2TKFRccIDWz7uQqk/edit#gid=120023681

Market cap of $24.9 billion but enterprise value of $34.7 billion

EV/OI of 17.1

EV/FCF of 22.5

Stock options and RSUs as a % of shares outstanding have hovered around 6% - 7% the last five years. This is why share count has only gone down by 3.3% a year even though the company has spent over $15 billion buying back stock.

Anecdotal Evidence:

(Ryan) Still seems like one of the best options for audio in the car. I think most people probably prefer Sirius over terrestrial radio thanks to coverage everywhere and ad-free music channels. I also know a lot of people who subscribe to both Sirius and Spotify (or whatever their preferred streaming service is) because there is content you can only get on Sirius.

(Brett) The exclusive content strategy seems to have worked wonderfully, and the 30 - 60-year-old cohort in the United States consistently subscribes. Doesn’t seem like too expensive of an add-on when buying a new car, especially if you are on the wealthier side. However, I worry about usage among people under 30, which anecdotally is pretty nonexistent. They explicitly call this out in the Proxy Statement.

Future growth opportunities:

(Ryan) Acquiring production teams. At this point, I think the tide is pretty much going against their core offering, and acquiring the actual content gives them the most flexibility moving forward. They just acquired Conan O’Brien’s podcast company Team Coco for $150 million. I think those are the right kind of moves.

(Brett) Trying to succeed by getting the service available everywhere. In order to counterposition vs. the streaming services, SiriusXM will need to make its service available outside of the car, which management has discussed (they are likely doing this because of the threat of streaming services coming into the car more easily). This includes all internet-connected devices that aren’t a car. Management has discussed success with this initiative but looking at the subscriber count they are clearly still losing to Spotify/Apple/Google/YouTube.

Highlights and lowlights:

Ryan’s Highlights:

It sits in a unique spot that seems difficult to disrupt. It’s hard for streaming platforms to get into live sports, and terrestrial radio can’t compete on the subscription side.

They own a lot of valuable content. And no matter how the industry evolves, content is still king. They can adapt if needed.

Ryan’s Lowlights:

Pandora isn’t a great business. I think they just need to run that for cash flow at this point.

Big chunk of their cash flow will be going to debt holders over the next decade.

The shift to streaming is simply an overall headwind for their business.

Brett’s Highlights:

The moat/monopoly for satellite radio seems impenetrable, with no one willing or even thinking of disrupting their exact business model. Also, their royalty payments are a lot more favorable than the streaming services.

Low churn along with rising ARPU is a good combination that I was pleasantly surprised to see. If streaming hasn’t killed their core audience in the United States, what competitive threat will?

The growth of the podcast/advertising business is from a position of weakness compared to the huge players (Spotify/Apple), which makes it all the more impressive.

Brett’s Lowlights:

They are in a weaker position compared to the pure play streamers, and you can see that in the subscriber numbers. With minimal young people using SiriusXM, I worry about the durability of the subscriber base this decade, especially as the “available everywhere” moat erodes.

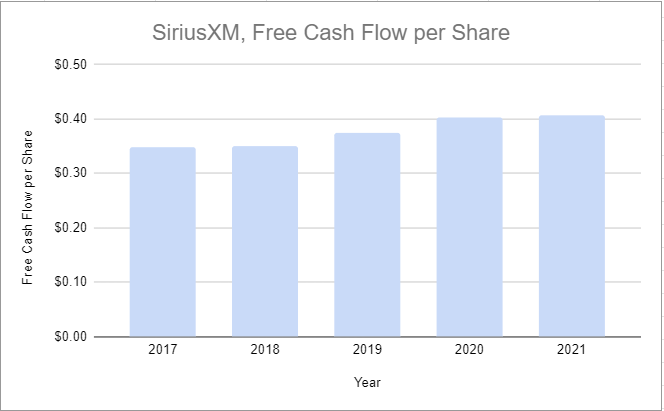

The Liberty Media debt strategy and using the stock as their toy for buybacks is a negative for me. The debt load is steadily growing while free cash flow has not grown very much. Sure, the debt ratios are not that concerning, and churn remains low, but it adds risk just to juice buybacks ever so slightly. Adds fragility I don’t want to see.

Pandora/Other segment is pretty clearly in a bad spot outside of the strong content acquisition strategy within Stitcher/podcasts. I struggle to see how it will create much shareholder value for SiriusXM shareholders, if at all.

I don’t know how to square the circle with the advertising strategy. With Pandora and SoundCloud steadily losing customers, it is hard to see what the end game for the podcast content strategy is. All the listeners are on Spotify and Apple, and until that changes it feels like a tough spot to be in, even though they have seen early success. It is like someone buying up some strong YouTube channels. Sure, you may have a good formula, but where is all the value going to accrue? YouTube.

Bull Case:

(Ryan) Over the next 5-7 years, if Sirius gets to around 40 million subscribers (~3% CAGR) and reaches a $19-20 month in ARPU (4-5% CAGR), that’d be ~$9.6 billion in subscription revenue from SiriusXM. Assuming cash flow margins can stay at about 20% and they redeploy that cash into a mix of new audio content, buybacks, and debt payments, I think there’s a decent chance shareholders can get 10% returns.

(Brett) With low churn and strong ARPU flowing through, I think you can get single-digit top-line growth from SiriusXM at least for the next few years. Add on a fast-growing advertising segment and overall revenue growth could hit 10%. If margins stabilize and the buyback program is utilized (although the Liberty Stake adds some complications), then free cash flow per share could grow at 12%+ annually. At the current EV/FCF this would likely equate to solid returns.

Bear Case:

(Ryan) The shift to streaming slowly eats away at SiriusXM’s subscriber base, Pandora continues hemorrhaging subs, and the recent content investments aren’t enough to replace the revenue from the core offering.

(Brett) Streaming finally catches up to subscriber count, similar to what has happened to traditional video subscriptions compared to streaming in the last decade. Pandora is a bad asset that goes to zero and the podcast advertising business never becomes sustainable because SiriusXM doesn’t own the end customer.

More or less interested?

(Ryan) Less interested. I think the business is going to face headwinds over the next decade, and it doesn’t trade at too compelling of a price.

(Brett) Less interested. The subscriber growth has been meek and the usage among younger people (or lack thereof) concerns me.

Stock for next week? (Brett: Warner Music Group)

Sources and Further Reading

VIC Pitch (Long LSXMA – One of Liberty’s tracker stocks for SiriusXM): https://www.valueinvestorsclub.com/idea/LIBERTY_MEDIA_SIRIUSXM_GROUP/2874890786

Most recent 10-Q (Debt maturities and interest rates are on Page 19): https://investor.siriusxm.com/sec-filings/all-sec-filings/content/0000908937-22-000025/0000908937-22-000025.pdf

Details on music royalties: https://www.siriusxm.com/usmusicroyalty#:~:text=Important%20Notice%3A%20Effective%20January%2015,Mas%20plans%20are%20provided%20below.

2022 Proxy Statement (executive compensation and ownership): https://investor.siriusxm.com/sec-filings/all-sec-filings/content/0000930413-22-000719/0000930413-22-000719.pdf