Not So Deep Dive: Smith & Wesson Stock (Ticker: SWBI)

Is there any predictability to firearm demand in the United States?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Apple

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in doing a sponsorship on our podcast network. Check out our media kit for more information.

Show Notes

Ryan) What they do: Smith & Wesson’s business model is quite simple. They are one of the world’s largest firearm manufacturers. They have 3 manufacturing facilities in Connecticut, Maine, and Massachusetts, and the MA facility doubles as the executive offices. At these facilities, they have costly machining equipment that they use to actually create the gun designs, and they utilize subcontractors for labor.

Once they finish the production, S&W sends their finished goods to a warehouse in Missouri, and from there, S&W delivers them to a variety of customers including distributors, law enforcement agencies, military agencies, and most importantly retailers (Walmart, Cabela’s, Bass Pro Shops, other sporting goods shops and local gun stores). ~92% of their sales go to domestic customers. And they sell a few different kinds of products:

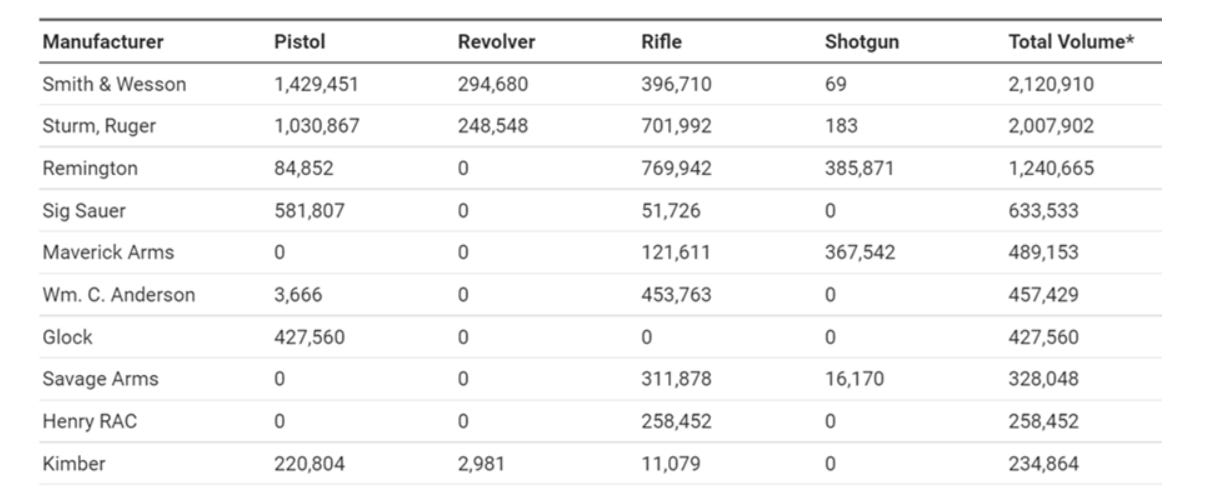

Handguns: S&W’s handgun segment consists of primarily pistols and to a lesser degree, revolvers. S&W is the largest producer of pistols in the US and pistols are the most common gun made and sold in America – accounting for 40%-44% of guns produced. In total, S&W has about ~20% market share in the handgun space, and handguns as a whole account for ~75% of revenue.

Long guns: The long guns segment consists entirely of rifles. Rifles are the 2nd most common gun in America and S&W is the 3rd largest producer here. Last year, rifles accounted for 15% of revenue.

Other products and services: This segment consists of firearms parts, suppressors, handcuffs, and manufacturing services. It’s not a big chunk of the business, but the replacement parts help maintain some brand loyalty among customers. In total, this segment accounts for 10% of revenue.

(Ryan) History: I think studying the history of this one is actually quite important. So Smith & Wesson’s roots date all the way back to 1852 when Horace Smith and Daniel Wesson formed their first partnership. Wesson had learned the firearm manufacturing trade as an apprentice under his brother, and he and Smith were working on developing a new style rifle called the Volcanic Rifle. I’m not entirely sure why things didn’t work out, but by 1855 sales were quite lackluster, so they sold the business to a man named Oliver Winchester.

A year later, there was a revolver patent set to expire, so the two partnered up again and set out to build the Smith and Wesson Revolver Company. Their manufacturing of the revolver coincided with huge growth in revolver demand from soldiers in the Civil War. This led to a surge in sales that ultimately gave Smith and Wesson the funding required to experiment with new makes and models. S&W found success with several new models over the following century and saw major demand during each post-war period. By the 1950’s they were really a recognizable brand in the revolvers market. In 1965, the Wesson family finally sold their stake in the business to an American conglomerate called Bangor Punta, and from that period forward it exchanged hands a number of times.

In 2000, however, I think there’s a moment worth examining. Smith and Wesson made an agreement with US President Bill Clinton that limited what gun manufacturers were able to do.

This led to major boycotts on all Smith & Wesson brands from gun owners. The CEO that helped create this deal was removed and Smith & Wesson was sold for $15 million from Tompkins PLC, who acquired them for $112 million two decades earlier. The stock traded at $0.19/share.

They eventually walked this back and were able to return to their previous standing. This has meant their returns look pretty good since the turn of the century (100 bagger since the lows). The most recent thing that happened was around 2020, they divested their Outdoor products business which sold a lot of hunting gear and gadgets. This was kind of a serial acquirer and there weren’t really a whole lot of similarities between the two businesses. They are now a pureplay firearms manufacturer and they changed their name from American Outdoor Brands to Smith & Wesson Brands.

(Brett) Industry/Landscape/Competition:

Demand for firearms in the United States looks to be cyclical and a bit unpredictable

Here’s a direct quote from the proxy statement:

“Historically, the firearm industry has been very cyclical, with past expansions and contractions driven, in large part, by unpredictable political, economic, social, legislative, and regulatory factors beyond the control of industry participants and their management teams”

So politics, the macro economy, and local laws can affect customer demand, all of which are generally outside of management’s control

Within Smith & Wesson’s spot in the firearm market, I think there is one thing that matters: they operate a virtual duopoly in handguns (pistols/revolvers). See the table below

Gun sales (see chart below) have generally gone up in the United States since the GFC. Notice the jump during the 2020 pandemic

As investors, you need to be able to predict handgun sales in the United States, and whether Smith & Wesson will be able to retain its market share. How confident can we be on either?

(Brett) Management and Ownership:

Mark Smith is 47, has been the CEO of Smith & Wesson since 2020, and has been with the company since 2010. He has been in a leadership position at the Smith & Wesson division since 2016, so a somewhat long tenure at the helm of this company

Management made the tough (maybe bold?) decision to move its manufacturing out of Massachusetts to Tennessee, which has enacted or been close to enacting laws banning its manufacturing. This likely put a lot of pressure on the management team. Here is an interesting quote from the press release:

“Total investment in the project is estimated at $120 million, will be funded from cash on hand, and is expected to be accretive to EPS by $0.10 to $0.12 per year once fully operational”

Frankly, Smith & Wesson had one of the most disappointing proxy statements I’ve seen (and I’ve read some disappointing ones). Here is a list of what stood out to me:

PSUs delivered based on relative performance to the Russell 2000 index

Bonus payments based on adjusted EBITDAS (don’t know what the “s” means) and net sales targets.

Not one mention of “per share” in the proxy statement. If I’m in an anti-ESG business, I want them to take advantage of the flows moving out of the stock. They don’t seem to care about this

Check out what gets adjusted in the adjusted EBITDAS:

(Ryan) Earnings:

$509 million in trailing 12-month revenue

33% gross margin

$50 million in operating cash flow

What’s happening?

Sales have slowed significantly following 2020.

Inventories have built up

And they are relocating their main facility which has been really costly

So they’ve gone from generating $120 million in annual operating cash flow (average from 2012-2020) and spending roughly $30 million on annual CapEx to just $50 million in OCF with $100M+ in CapEx.

(Ryan) Balance sheet and liquidity:

Assets/Cash Flow:

$55 million in cash

$170 million in inventory. Starting to come down quarter-over-quarter.

Liabilities:

$25 million in notes and loans payable. This is a revolving credit line that they have. Can borrow up to $100 million. The interest rate is 6.8%.

$36 million in finance leases. Wouldn’t include that in the EV calculation.

This balance sheet is fine. I like that they don’t use much debt at all given that they are so cyclical. However, they said at their 2021 investor day that they don’t want to go below $100 million in cash and yet they’re well below that.

(Brett) Valuation:

Assumptions: average operating margin 10%, normalized revenue of $600 million

P/OI of 10.8 based on these assumptions. Is this cheap?

Anecdotal Evidence:

(Ryan) Seems like they’re here to stay. Feels like a very valued brand. Should have pricing power.

(Brett) Longstanding brand. I don’t know much of anything about the firearm industry. I don’t have any confidence in betting whether firearm sales will be the same, double, or cut in half over the next decade in the United States.

Future growth opportunities:

(Ryan) Well, they’ve been doing the same thing for 160 years so I think the formula is pretty simple here. Launch a few new products each year and maintain good relationships with the sellers and gun community. I don’t really want to see them do any acquisitions.

(Brett) I am struggling to figure out what they can do to grow the business. I don’t see anything they can do except react to changes in customer demand. Can they go DTC? No. Can they go international? No, no one buys guns outside the United States. Can they go online? No. I struggle to find ways they can be proactive to spur customer demand.

Highlights and lowlights:

Ryan’s Highlights:

Good brand and they seem to have pretty strong relationships with their customers.

Inventory build-up isn’t really the end of the world for them like it might be for other manufacturers. They’ve been through this before. The guns eventually sell and they have pretty strong pricing power, so depreciation isn’t a massive worry.

The new HQ should reduce days in transit for inventory.

Ryan’s Lowlights:

Said a couple things in their 2021 Investor Day that haven’t really materialized. Here’s a quote “I think what I’m hearing is that you could do 20% EBITDAS margins even with revenues in the mid-400 range…is that what you guys are saying here?” Mark Smith: “Absolutely. Yes”. Well, they’re in that range and margins are at 15%. They also said they wouldn’t want to dip below $100 million in cash ever.

Political/regulatory risk. 1) Federal regulations can and it looks like have hampered gun sales. 2) S&W had to move HQ because of the MA business climate around firearms manufacturing.

Uncertainty around end-demand.

Brett Highlights:

A longstanding brand (they came out before the American Civil War)

Brett Lowlights:

The political risk. Unlike tobacco, I could easily see regulation getting much worse for Smith & Wesson. As well, they have shown no signs of building risk-reduced products, to use the tobacco analogy. This presents a much bigger risk than the tobacco stocks in my eyes.

Management has bad incentives.

Industry demand is unpredictable. Can you predict what political party will be in office? No. This has a major impact on sentiment and sales.

The population tailwind is running out (maybe). Rates of ownership have been in a relative band of around 40% since the 70’s (with a few swings). The only thing that could impact sales is if the core owners start owning more. Do I really want to make a bet that the average gun owner will own 12 guns in 2027 vs. 9 today? What evidence is there that this would happen?

Quote from the conference call: “We will likely use promotional dollars to drive some of that volume, and therefore, we anticipate a 5% to 10% drop in ASPs versus what we saw in our first quarter”

Bull Case:

(Ryan) Capex from relocation rolls off, demand bounces back, flexible structure limits trough margins, and they operate a little leaner on inventory. If they do all that, I think they generate the same kind of cash flow over the next 10 years that they did over the last 10. That’d be roughly twice their market cap in cash.

(Brett) I am underrating the bullwhip effect and the “normalized” revenue is higher than $500 million - $600 million now. With inflation, I could buy this. This would put the earnings multiple at sub-10, which with some consistent buybacks would mean some pretty good returns

Bear Case:

(Ryan) They’re underestimating the spending that the relocation will take (seems like a very real possibility) and something happens to worsen demand. That could be self-inflicted (like 2000) or changes to the regulations.

(Brett) The forward earnings multiple is actually not that strong (i.e. sales do not grow much from here) and they are poor stewards of capital

More or less interested?

(Ryan) Less interested. I don’t really see myself owning this stock unless it gets absurdly cheap, and I’m not really sure what price that is. I just struggle to estimate what this business could actually earn over the next 5 years.

(Brett) Less interested. They are a price taker, not a price maker. They are in a cyclical industry. They are in a risky industry from a legal/political perspective. They don’t trade at a dirt-cheap valuation. Why would I buy this over a 9%+ divvy yielding tobacco stock?

Stock for next week? (Diageo)

Sources and Further Reading

VIC write-up from 2022: https://www.valueinvestorsclub.com/idea/SMITH_andamp%3B_WESSON_BRANDS_INC/7791388648#description

Spin-off and distribution: https://ir.smith-wesson.com/news-releases/news-release-details/smith-wesson-brands-inc-announces-record-and-distribution-dates

New headquarters: https://ir.smith-wesson.com/news-releases/news-release-details/smith-wesson-relocate-headquarters-tennessee

I guess you discovered that EBITDAS means earnings before unwarranted exclusion of a lot of expenses. :)

"Pistol" means handgun. Since you contrast pistols with revolvers, I think what you mean is "semi-automatic pistols." I don't know of a single word to designate that variety of handgun.