Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Listen to the podcast for a full analysis!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

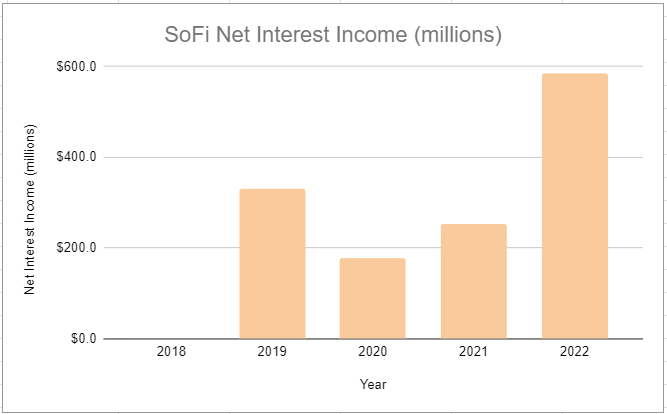

(Ryan) What they do: The first line of their annual report “We are a member-centric, one-stop shop for financial services”. This is probably the most succinct way to actually describe the business. Today, SoFi is a mix of a consumer finance app, a bank (which they got the charter through an acquisition last year), and an enterprise software business. I’ll go through each of these but I think I should start with how they actually fund their operations. They have more than $20 billion in cash available to lend out. About 40% of that is from consumer deposits (they pay about a 4% annual percentage rate on those), 35% is from a credit warehouse facility (institutions lending them money at about 6% currently), and the remaining 20%-25% is equity capital and cash on the balance sheet. That’s where they get the money to lend, now let’s look at where they actually loan out money.

Lending: This is the most important segment. They officially acquired a bank charter last year so they’ve now got a fairly diverse loan book but the bulk of their lending comes from 3 segments. On top of originating the loans, SoFi is also the servicer for most of their loans. Servicing includes “the actual distribution and collection of money, maintenance of financial records, and a central dashboard for borrowers to interface with during the payback period” among other things.

Personal loans: These are your higher yield/higher default loans. If someone needs to finance a wedding or a family trip, they might apply for a personal loan. On average, these loans bear interest at 13% and have durations anywhere from 2 to 7 years.

Student Loans: This is their much lower-risk loan portfolio. They help both active students and graduates refinance their student loans. The average interest rate they get on these loans is about 6%, but delinquency rates are much lower and these are typically longer-duration loans.

Home Loans: Pretty standard home loans. This is a tiny fraction of their loan portfolio, and demand has really dwindled as of late so it’s probably not worth even talking about it.

The rest of the business can be bottled down into 2 segments:

Consumer App: The SoFi app offers consumers a ton of different products. These include checking and savings accounts, an investing platform, a credit card, a personal finance management tool, and an insurance product directory. The motto they mention to consumers here is “Get Your Money Right”. They earn some revenue from this segment in the form of fees or commissions, but it’s really meant to be more of a customer acquisition funnel.

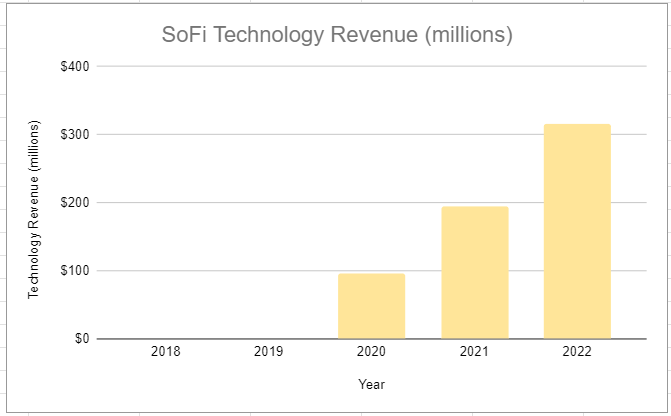

Enterprise Tech: This is comprised of 2 businesses: Galileo and Technisys. And frankly, it’s pretty unrelated to the rest of their operations. Galileo makes APIs primarily targeted toward fintech startups that help their customers set up accounts and transfer money. Their customers include Robinhood, Wise, Chime, and SoFi themselves. Here’s how they describe Technisys: “Technisys’ Cyberbank Platform is strategically critical as a cloud-native, multi-product, extensible modern digital banking core”. Lol. It sounds like they help banks rebuild their operating systems in the cloud.

(Ryan) History: SoFi, which is short for social finance, was originally founded in 2011 by four different Stanford grad students. And the goal at the start was just to be a platform where students could refinance their loans. It was originally a Stanford pilot program where 40 different alumni provided $1M to help students receive lower-cost financing. They quickly received a bunch of private funding and expanded into other lending areas and even began to build out additional functionality in their mobile app. All was going pretty well until 2017, when the then-CEO Mike Cagney resigned amid sexual assault allegations, and the company brought in Anthony Noto. They paid for the naming rights to SoFi Stadium in Las Vegas in 2019 for basically $30M a year for 20 years, and 2 years later they went public via a de-SPAC. The most important recent news for the company is that it acquired Golden Pacific Bancorp last year and received approval for its bank charter.

(Brett) Industry/Landscape/Competition:

I would classify three areas SoFi is trying to compete:

Acquiring assets (i.e. customer deposits, brokerage accounts, etc.)

Making loans (personal, student, mortgage, etc.)

Powering other fintechs/neobanks (Galileo, Technisys)

In acquiring assets, there are $19 trillion in total bank deposits in the United States. We could go more granular here and add in investing stuff, crypto, etc. but I think listeners get the picture. There is a huge market.

However, in acquiring assets there are endless competitors. You have the big legacy banks, other neo banks, brokerage firms (we personally hold pretty much all our excess savings in our Schwab brokerage accounts, outside the fund), and direct treasury options. The list goes on and on. SoFi’s goal is to convince people to park their money in a SoFi account instead of somewhere else.

Making loans to consumers is also a ginormous market. In the United States, it is estimated there are $17 trillion worth of consumer loans outstanding. As more and more get originated, SoFi is going to target individuals (likely their app users) for these loans.

In the fintech competition (Galileo, Technisys), there are some competitors like Marqeta, Ncino, etc. I have no insights into the size of this market, this is not a business model we have any circle of competence around.

(Brett) Management and Ownership:

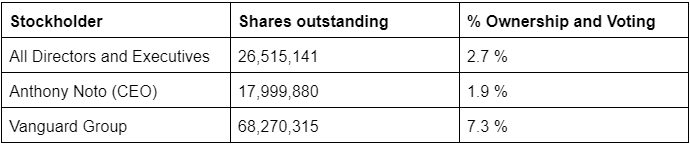

The CEO is Anthony Noto. Noto has had an interesting career focused mainly in finance departments. He was the CFO of the National Football League, became a partner at Goldman Sachs, and worked as the CFO/COO of Twitter for a time (is that a good thing?). He became the CEO of SoFi in 2018 according to his LinkedIn (proxy admittedly is confusing).

Executive compensation is (say it with me) based on base salaries, annual bonuses, and long-term equity awards.

Annual cash bonuses are based on adjusted net revenue, adjusted EBITDA, NPS, new members, and new product targets. Do we like these incentives?

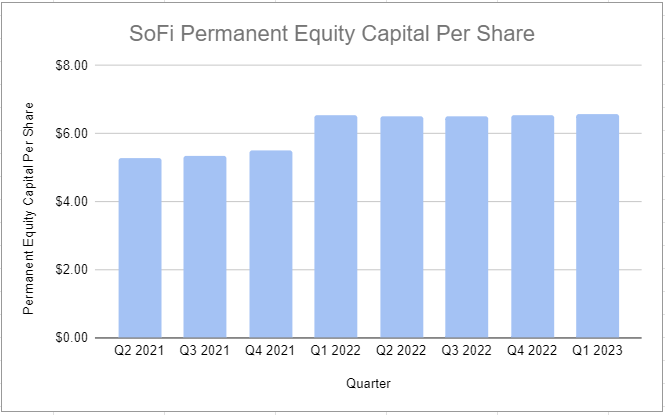

A lot of the ownership stake from Noto is in the form of options/equivalents. He and others were given extremely “healthy” option packages when SoFi went public. Maybe we can give them a pass for now but this is something to track as major share dilution from insiders can hurt long-term growth in per-share fundamentals (check the charts above).

*Based on shares outstanding as of latest proxy filing

(Ryan) Earnings: This is an awkward company to look at on an earnings basis because it’s basically a bank and a software business put together and those two industries have very different ways of reporting.

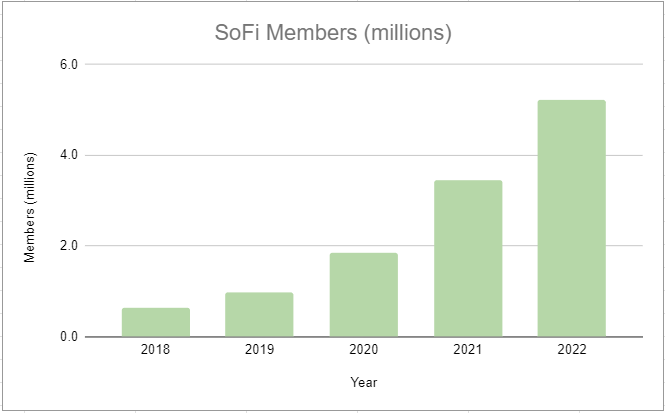

They finished the 1st quarter with 5.7 million members which is up 46% YoY

They have now $10 billion in deposits which are growing really fast. Up 37% QoQ. They are growing really fast because of the spread between their savings rate and big banks’ savings rates.

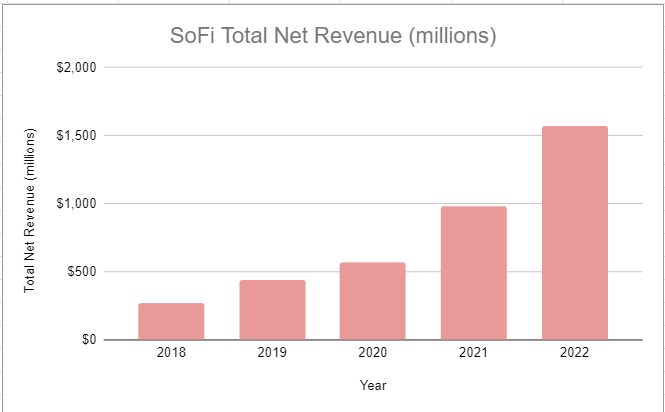

I’ll mention revenue, but remember, banks can grow revenue as fast as they want, so you have to trust management. Adj. Net Revenue was $460M this quarter, up 43% YoY.

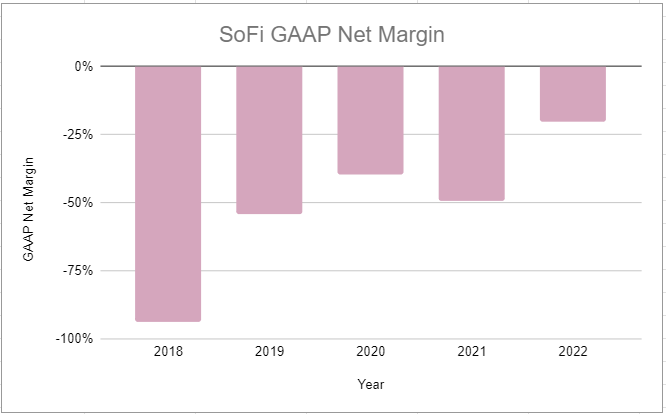

They had a $34 million net loss. They report Adj. EBITDA profitability but it doesn’t really mean anything.

They are at an operating loss, plain and simple. It’s moving in the right direction though.

I guess to summarize here, SoFi is growing but it’s really tough to know what they’re truly earning. In 2022, they generated $1.6 billion in revenue and they claim 10% Adj. EBITDA margins. Maybe there’s a scenario where they can get to a true 10%+ level of profitability but I don’t know when that’ll be.

(Ryan) Balance sheet and liquidity:

For a bank, there are really only two things that matter. Where do they get their money? And what do they do with it? For SoFi, we talked about the funding at the start. Their weighted average interest rate for money coming in is about 5%, and steadily more and more of that is coming from deposits.

On the lending side of things, which is the assets side of their balance sheet, SoFi holds about $16 billion worth of loans. $10 billion of that is personal loans, $5 billion in student loans, and a tiny amount comes from their home loans segment. The average rate they earn on their loans is a little over 8%.

(Brett) Valuation:

Market cap of $8.3 billion

I struggle to value this company because it is not only a financial stock (and therefore should be valued on book value per share + growth in book value per share) but also has the asset-light technology segment

However, since they are not profitable right now I want to value them on price-to-book.

Based on the current share price of $8.84, SoFi trades at a price-to-book value of 1.34 using permanent equity value as the book value.

Anecdotal Evidence:

(Ryan) The savings rate is pretty attractive. Haven’t used the app but everyone I talk to says it has pretty much everything.

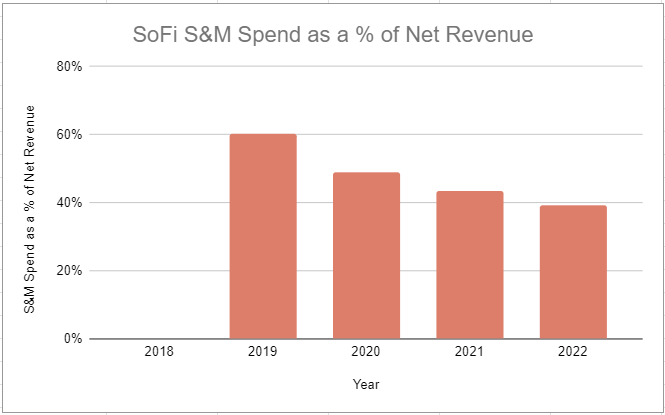

(Brett) My friend signed up for their savings account but said he doesn’t know why he chose them over others. This is my big worry for SoFi over the long-term, that the brand is not differentiated. However, the growth in depositors/members speaks for itself so I wonder whether this high marketing spend will be worth it over the long run if they can attract a lot of members that stick with them for a long time (high lifetime value).

Future growth opportunities:

(Ryan) Hard to point to one. The name of the game is attracting depositors and not being stupid with the money they give to you. So far they seem to be doing that. So continuing to build out new products on the app should help attract more customers. Maybe a peer-to-peer payments solution.

(Brett) Returning of student loan refinancing and originations. SoFi is a big refinancer of student loans, this was its original product. However, over the last few years the government in the United States has put the famous moratorium on student loan payments. This has hurt SoFi’s ability to grow this segment. Generally – as long as the loans are being underwritten intelligently – a growing loan book is a good thing for the business. A quote from the Q1 2023 press release: “First quarter student loan volume of over $525 million was down more than 50% from the average pre-pandemic volume as the moratorium on federal student loan payments continues to weigh on the business.”

Highlights and lowlights:

Ryan’s Highlights:

They’re on the right side of the innovator’s dilemma. Don’t have the overhead costs of traditional brick-and-mortar banking which allows them to pass through cost savings in the form of a higher yield on savings accounts.

They do offer a pretty comprehensive suite of services now.

If they continue to scale fast while also being smart about their lending, then there should be positive economics. After all, it is a bank.

Ryan’s Lowlights:

They haven’t been selling their loans lately because buyers apparently aren’t willing to pay enough. Couple of ways to look at this, but the skeptic would say that buyers don’t think SoFi’s loans are as high of quality as SoFi says they are.

Feels like they’re focused on “growing market share” across their loan products and their deposits but they are taking a lot of delinquency and interest rate risk in the process.

One negative of being a bank is that you’re regulated like one. This comes with regulatory capital constraints, the need for additional compliance support, and lots of other factors.

Brett Highlights:

The return of the student loan industry and the unfreezing of the housing market (which has to happen eventually) will help them.

Growing depositors is great, and they are able to offer very strong interest rates to depositors along with other financial services without breaking their unit economics. If they keep growing deposits at $2 billion+ a quarter, it will be hard to screw this up.

Brett Lowlights:

Growth through a ton of acquisitions scares me. Why the need to move so quickly? Are we buying growth here and not worrying about creating per-share value for shareholders? I wonder why they don’t want to build these things in-house. The technology acquisitions seem smart, but I don’t get acquisitions into the financial services/lending side of things.

The history of unprofitability scares me when looking at a financial stock. Maybe that gets fixed soon but these are businesses I generally would think can grow without losing money. Yes, they have the customer-acquisition costs to the SoFi App but I don’t think that means they need to be running at a loss.

I struggle to get confident around a competitive advantage. On the flip side, this means that if you believe SoFi can take this minimal competitive advantage and greatly expand it over the next decade, stock returns will likely be strong due to strong growth in the fundamental performance + multiple expansion.

Bull Case:

(Ryan)

(Brett) With a difficult route to doing a simple valuation, I think at current prices you need to be confident SoFi can steadily grow its deposits (i.e. also grow its members) and keep making loans that perform adequately. If this occurs, the stock will likely do well over the long term.

Bear Case:

(Ryan)

(Brett) You are buying a financials stock with stagnating book value per share, and no history of generating a profit, in a hypercompetitive industry that leaned into the “growth at all costs” mindset. What happens if they stop pouring money into acquiring customers and acquiring new businesses? I think they would start generating strong profits but there could be risks here we are not seeing. It is likely that unit economics are fine but I think there is major uncertainty on what the steady state margins look like for this business on a consolidated basis.

More or less interested?

(Ryan)

(Brett) Very interesting growth, but I am not interested until they have a longer track record of profitability, which I have a higher bar for when looking at financials. Why would I own this over Ally Financial or American Express at these prices?

Nice episode. Very informative showing both sides of the bull-bear case. Thanks!