Not So Deep Dive: Spark Networks (Ticker: LOV)

Major concerns at this microcap dating app roll-up

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

Upcoming schedule: Match Group

As always, listen to the episode on Spotify, YouTube, or wherever you are subscribed to the show.

Charts

*Data is powered by Stratosphere.io

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

Show Notes

(Ryan) What they do: Spark Networks owns a number of online dating properties targeting the 40+ age demographic and certain faith-based daters. Spark is the 4th largest dating company globally by revenue. Here are its various digital properties:

Zoosk: Zoosk is its premier property which it acquired in 2019 for approximately $258 million. They have a website and an app and function similarly to Hinge in terms of profile creation and target demographic. However, users have to pay in order to message people which is a bit different. Zoosk operates in more than 80 different countries and my guess would be that they have just under half a million monthly average paying subscribers. Zoosk accounts for ~50% of Sparks’ revenue.

EliteSingles: This is the second largest property they have and it markets itself as “the go-to dating site for single, educated, and busy professionals”. You have to apply to become a member of EliteSingles and they have to manually approve you. This is another freemium model but the premium accounts are much more costly at around $60 per month. EliteSingles accounts for 27% of Sparks’ revenue.

SilverSingles: Fairly interesting approach here. SilverSingles is similar to EliteSingles except you have to be 50 years or older to join. Match Group recently launched a direct competitor called OurTime and it currently ranks higher than SilverSingles on the App Store. Accounts for 11% of revenue.

Christian Mingle: This is exactly what it sounds like. A dating site for Christians who really prioritize their faith and it accounts for 4% of revenue.

Jdate: This is the leading dating site targeted specifically for Jewish singles. Accounts for 2% of revenue.

Jswipe: Jswipe is quite similar to Jdate, except it’s a mobile app instead and tends to skew a little younger. Accounts for 1% of revenue.

eDarling: From what I can tell this is a pretty standard dating site that looks a lot like Zoosk but is just focused on the German market. These last 4 all account for less than 1% of revenue combined.

Attractive World: This one’s actually kind of a unique (albeit superficial) concept. “It's the only leading dating site that lets its members decide who gets in, so if individuals want to join, they first have to impress the Attractive World community.”

LDS Singles: Simple. Just an online dating service for members of the Church of Latter-Day Saints or Mormons.

Crosspaths: I think this is pretty much ChristianMingle just for mobile.

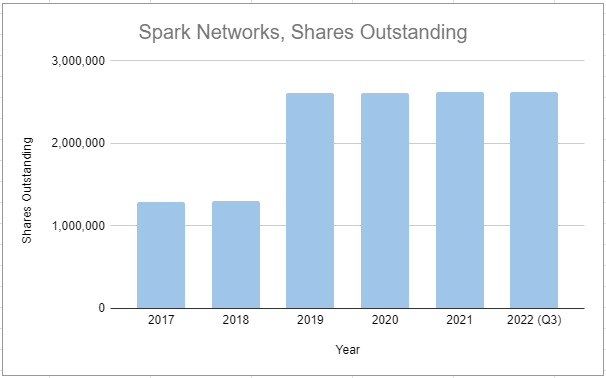

(Ryan) History: Spark Networks was technically formed in 2017 through the merger of two online dating businesses, Affinitas (German-based) and Spark Networks. Affinitas was founded around 2008 by an investor consortium that ended up owning eDarling. Spark Networks, at the time, only owned religious dating sites, most of which had been around for quite a long time. ChristianMingle was built in 2001, Jdate was built in 1997, etc. After the merger, they listed the combined stock on NYSE American (shortly after moving to NASDAQ), and a year later acquired Zoosk.

(Brett) Industry/Landscape/Competition:

Let’s go through the same numbers we have gone through for each online dating episode

Total global industry spend is around $5 billion. Spark Networks makes up around 4% of that

Competition: Zoosk competes with mainstream dating applications. In the United States, it is currently ranked 20th in downloads on the Google Play Store vs. 1 - 3 for the big three (Tinder, Bumble, Hinge). The older apps are losing in downloads to Match and Stir (Stir is a new single parent-focused app from Match Group) and the religious-focused apps are losing to their competitive peers as well.

Looking at the KPI charts, it is no surprise to see the Spark Networks portfolio losing in almost every download competition right now.

(Brett) Management and Ownership:

Looking at management is going to be a bit tricky as the company is basically in limbo right now

In January, board member Chelsea Grayson was appointed as CEO

The previous CEO was Erich Eichmann, who managed the company since 2019

The press release had the typical corporate-speak of every executive transition, but it is fairly obvious that Eichmann got fired for performance.

Looking at the 2021 proxy (2022 is not out yet) we do not know how Grayson will be compensated. However, executives get the standard base salary/variable incentives/stock options trifecta of almost every suite these days.

As you would hope, the performance bonuses were not earned in 2021. However, executives like Eichmann earned close to full bonuses on “individual performance targets.”

“Launched two new and differentiated social features on Zoosk in 2021” was one of the feats the proxy lists from Eichmann in 2021. Incredible stuff.

Eichmann also got a base salary of $625,000

Ownership is interesting given how small the market capitalization is. If I was interested in Spark Networks I would be researching who Osmium Partners and First Manhattan Company are. Osmium has been selling shares while First Manhattan is buying.

Grayson owned no shares as of the 2021 proxy filing

(Ryan) Balance sheet and liquidity:

Assets:

$13 million in cash

$22 million in LTM Adj. EBITDA

Liabilities:

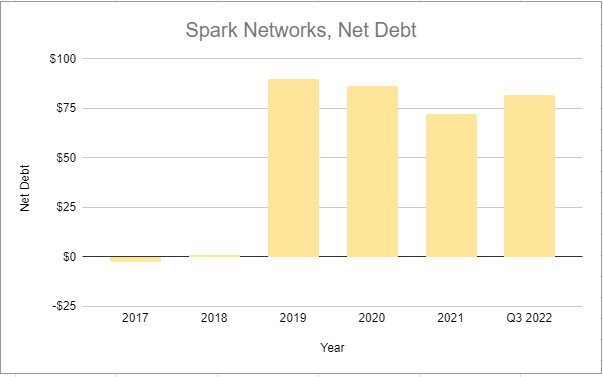

In order to finance the acquisition of Zoosk, Spark took out a $125 senior-secured credit facility in 2019.

This has since been converted into a term loan which today has a carrying value of $95 million.

However, the debt has been refinanced a number of times. Going into 2022, it was LIBOR + 8% and there were some covenants that said they couldn’t go past a 4.25x leverage ratio.

But in August of 2022, they refinanced again to expand that leverage ratio and there are some interesting points about it. Here’s the quote from the most recent 10-Q: “The Amendment revised certain financial covenants associated with the quarterly leverage ratio and requires the Company to maintain quarterly leverage ratio no greater than 6.50 to 1.00 through December 31, 2022, and 6.25 to 1.00 for the quarter ending March 31, 2023. The remaining quarterly leverage ratio did not change. The Amendment also requires the Company's minimum marketing spend for the twelve consecutive month period ending at the end of each fiscal quarter, commencing with the fiscal quarter ending December 31, 2022, not to be less than $80.0 million”.

As of the latest update, the effective interest rate on their debt was 12.6%.

So they’ve got a net debt position of just over $80 million and a leverage ratio of about 4x.

(Ryan) Earnings: (delayed their 10-K posting)

Last 12 months:

$201 million in revenue

38% gross margin

$35 million net loss (heavy goodwill impairments)

Negative $1 million in OCF

Most recent quarter:

$48.2 million, down 11% YoY (half of the decline was due to FX)

$8.3 million in Adj. EBITDA

Now, I’d be excited by that because in theory they could pay down the debt with that, but some of those adjustments come from backing out FX, which you can’t pay to debtholders.

Zoosk average paying subscribers grew by 3.4% YoY

Across the portfolio, they said they had 11% higher subscriber conversion (albeit from a smaller base of users)

(Brett) Valuation:

Market cap of

Enterprise value of

EV/s of 0.5

EV/OI @10% margin of 4.9

EV/OI @20% margin of 2.5

Anecdotal Evidence:

(Ryan) It feels like Zoosk could have been a good business, but they (more so than any other property I can think of) were hurt by the surge in the adoption of Hinge over the last 3-5 years. They seem to go after the same demographics.

(Brett) I downloaded Zoosk and it was an absolute shitshow (not because there weren’t any people on it, either). They are clearly driving people to the well-run apps because of an inferior product. Also, does this quote inspire confidence? “We are a leader in social dating platforms for meaningful relationships focusing on the 40+ age demographic and faith-based affiliations. Since our inception, we have had 110 million users register with our dating platforms (which includes inactive accounts). We currently operate one or more of our brands worldwide” - Q3 2022 10Q

Future growth opportunities:

(Ryan) I don’t know what you do here honestly. Auction off your properties for what you can? Run the business entirely for cash and pay off your lenders? I simply don’t know the answer here. This is a really good example of what a bad dating business looks like. If you begin to see some of these characteristics within Bumble or Match Group or Grindr, that’s when you know to get out.

(Brett) The only way out of this death spiral is modernizing the UI and differentiating your assets from the services with the clear lead on smartphones among people under 35 (what we refer to as the Big 3). This will require pain in hiring software engineers to fix all the technical debt as well as better anti-fraud/scam tools. Earnings will look bad in the short run. However, if they eventually can build up a portfolio of niche dating apps that work well for their target markets there is a business model here. I don’t know if it can be done as a public company.

Highlights and lowlights:

Ryan’s Highlights:

They do appear to be improving subscriber numbers at Zoosk, albeit it seems off of a low base. This is a big deal if they expect to get any sort of a premium in a buyout.

Ryan’s Lowlights:

I’m not a big believer in apps that focus on small groups. At this point, whether it’s Tinder, Hinge, Bumble, or Grindr, each of the large-scale players can be essentially retrofitted or customized to meet the goal of Sparks’ brands. Though you might not be able to explicitly filter, you can just manually select what you’re looking for and you know you’re getting a larger supply.

I’m going to steal a quote from a comment on a VIC post that I think describes Spark’s situation well. He says “Spark is a roll-up of inferior brands and with each acquisition, we're told “now we are at scale” yet it's never at scale. This has happened every time” He adds “They need huge advertising spend to keep the new users. The marketing spend is bearish not bullish. They need it to survive.”

Simply put, this is what a subscale online dating business looks like. It costs money to grow (no network effect) and you don’t have enough money to develop a competitive platform. If you’re large enough, online dating can be extremely profitable. But not if you’re this size.

Brett Highlights:

Hey, at least the huge amount of potentially dilutive securities will almost assuredly not vest ($4.77 average strike price on stock options outstanding with the current stock price below $1.00)

There is the possibility of a buyout at a huge premium to the current price. But to be clear, this is only a possibility.

They reduced fraud by as much as 80% at some of their brands. This is definitely not a bad thing.

Brett Lowlights:

In the words of management: “Since we acquired Zoosk, subscribers declined every quarter for three years until last quarter.” That is not confidence-inspiring for an acquisition that valued Zoosk at $258 million. Since 2017, the entire Spark Networks has generated a cumulative free cash flow of $26 million (not including acquisitions). The return on the Zoosk acquisition has been heavily in the red so far.

Hyping up that they are going to spend more money on marketing in North America. Yeah, that market is not crowded at all…

I could list a dozen lowlights with this one, but in reality, almost everything important we looked at (business model strategy, user experience, nurturing acquisitions, financials) was a lowlight. This is by far the worst business we have ever looked at. On the flipside, how do we think about Spark Networks ceding share to apps like Grindr, Bumble, Tinder, etc. Is that relevant for those companies?

Bull Case:

(Ryan) Really from here, the only reasonable bull case I can see is a buyout. The problem is, everyone knows they’re looking for one, everyone knows the assets are struggling, and the buyer would have to cover the debt. That’s a tough pill to swallow for a business that’s clearly in decline.

(Brett) The only upside I see is a private equity firm buying out some of these assets (can discuss the likelihood of that happening during this section).

Bear Case:

(Ryan) The downside is huge here. If these properties continue to decline, or if they pay so much for users that they burn too much cash, this business is going to be owned by their lenders. Obviously, Match Group and Bumble and all the rest have looked at this business and said it simply isn’t worth it because we’d just be buying a business that we’re already cannibalizing.

(Brett) All KPIs keep moving in the wrong direction, it burns cash, and then it goes out of business. Shareholders get wiped clean. The downside was/is zero here and is extremely likely (in my humble opinion) unless someone goes for the takeout. It is telling that the company is trading for an enterprise value of just $100 million and nobody wants to scoop it up.

Sources and Further Reading

Details on the Zoosk merger: https://www.spark.net/news-releases/news-release-details/spark-networks-se-closes-zoosk-inc-acquisition

2019 letter to shareholders: https://www.spark.net/news-releases/news-release-details/open-letter-shareholders-spark-networks-se-0

2022 Investor Presentation: https://www.spark.net/static-files/3fa57ce6-b2c2-48ef-9e04-0f75ff45417a