Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/151Vz2H1zA9ug1dA1DyLzUVQ8K_1MyavM

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Uber has several business lines under its umbrella that can each be segmented into 3 groups.

Mobility: This is the original ride-sharing service that Uber was built upon. Consumers pretty much anywhere in the world (10,000+ cities) use the uber app to connect with a network of drivers (independent contractors) to go to their target destination. Consumers pay a price for each ride that varies depending on a number of factors including distance, fuel costs, rider demand, etc. On each ride, Uber charges a 25% service fee and the driver gets the remainder. This segment also includes Uber’s minority-owned affiliates such as Didi, Grab, and Yandex.taxi.

Delivery: Delivery has quickly become a meaningful driver of Uber’s business since the onset of the pandemic. With Delivery, consumers can search for restaurants, order a meal, and have it delivered to their respective location by a driver in Uber’s network. In certain locations, consumers can also order groceries, alcohol, and other convenience store goods. With delivery, consumers pay fees to Uber and the driver, but the merchants also give a percentage of each order to Uber depending on which pricing plan they choose (30% for premium).

Freight: Uber’s freight offering leverages its core network and connection platform to help shippers find carriers. So let’s say a medium-sized business needed to ship some cargo across the country, they could find available carriers using Uber’s freight offering. The compelling part for carriers is demand curation. Sometimes carriers have to deal with “dead-head” miles where they carry nothing in between shipments. This is designed to limit that. To help boost this offering, last year Uber acquired Transplace which was the leading global transportation and logistics network for $2.25 billion in cash.

(Ryan) History: Uber has probably the most iconic Silicon Valley founding story in recent history. Pretty much embodied the “move fast and break things” approach. The company was founded in 2008/2009 by two friends Travis Kalanick and Garrett Camp. The two of them both had prior success in the tech realm with both of them eventually selling their companies. One night while attending a tech conference in Paris, they were unable to get a cab and had the idea to be able to request rides from your phone.

When they both went back to San Francisco, Camp bought the domain name UberCab.com and got Kalanick to join in on the idea, naming him “Chief Incubator”. In 2010, they officially launched in San Francisco and also named Kalanick CEO. At the time it was basically an on-demand limo service, but it quickly gained steam and they raised TONS of money from venture capital. In fact, by 2015, they were valued at $51 billion after raising money from the Saudi Sovereign Wealth Fund. And with the money, came pretty reckless behavior. They were known for throwing wild parties including giving Beyonce restricted stock units to perform at a corporate event. They were also ordered to stop service by regulators several times, but refused.

There were several scandals along the way including allegations of a very hostile and sexist culture. Investigations came and several top staff was asked to leave, including Kalanick who resigned in 2017 amidst shareholder unrest. 2 months later, Dara Khosrowshahi filled the role after stints as the CFO of IAC and CEO of Expedia. Fast forward 2 years to 2019, and Uber made history as the largest first-day dollar loss in IPO history.

(Brett) Industry/Landscape/Competition:

Industry Total addressable markets (TAM):

Mobility: $5 trillion. This is defined as all passenger vehicle and transportation trips in 175 countries. Do with this information what you will.

Delivery: $5 trillion. This is defined as global spending on retail restaurants and grocery delivery in the markets it serves.

Freight: $4 trillion. This is defined as global logistics costs.

The big takeaway for the industry: Uber defines it as the entire markets they are going after when they only get a take-rate on every transaction. Think of these as a TAM similar to a payments company. It may be in the trillions, but the potential for cash flow is much, much lower.

Competitors:

Mobility: Lyft (United States), Ola (India), Didi (Asia, Australia, LatAm), Gojek (SouthEast Asia), Grab (SE Asia), and many others

Delivery: DoorDash (U.S.), Instacart (U.S.), Grubhub (U.S.), Deliveroo and other JustEatTakeway companies (Europe), Rappi (Latin America)

Freight: C.H. Robinson, Total Quality, XPO Logistics, the status quo of small pen-and-paper companies. There are also tons of smaller start-ups in this space.

(Brett) Management, Ownership, Compensation:

CEO: Dara Khosrowshahi. Brought on after the Kalanick scandals a few years ago. Previously was the CEO of Expedia and has a decade+ of experience working with travel brands as a part of IAC.

CFO: Nelson Chai. He looks to have been brought in as a mercenary in 2018 to help steer the company towards a public offering. He has experience in the finance and insurance markets, but not a big technology background that you might expect.

There are 10 total executive officers according to the company’s IR page.

Board of Director compensation was $3.4 million in 2021 or only 0.055% of the year’s contribution profit

Executive compensation is based on these factors:

20% of PRSU awards are based on diversity, equity, and inclusion (DEI) goals

Annual cash bonuses based on: 20% gross bookings, 40% adjusted EBITDA, and the rest as some strange metrics that were hard to parse out

Generally, most of the compensation is based on revenue/bookings, adjusted EBITDA, and DEI

Total executive compensation of $52.8 million in 2021, or 0.85% of 2021 contribution profit

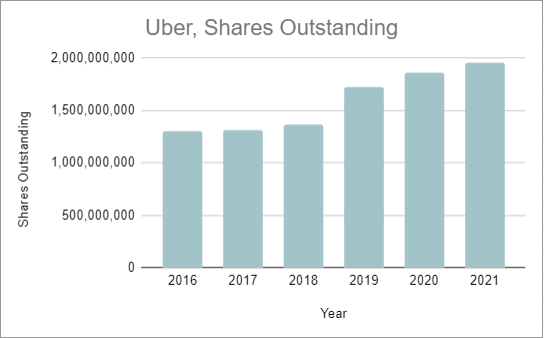

(Based on 1,954,620,957 shares outstanding in the Proxy that was filed in 2021)

Big takeaways:

There are no huge controlling shareholders with Kalanick and all the venture capital firms selling their stakes. Management has little control over voting rights here.

The influence of the Saudi Investment Fund is something to note.

Board and executive compensation are based on suspect metrics but are not egregious relative to the size of the company

(Ryan) Earnings:

Last 12 Months:

$21.4 billion in revenue, up 98.3% from the 12 months prior (lapping covid)

36% gross margin

-$1.9B in EBITDA (-9% EBITDA margin)

Most recent quarter:

$26.4 billion in gross bookings, up 35% YoY

$6.9B in revenue, up 136%

Revenue composition: Mobility 37%, Delivery 37%, Freight 26%

115 million Monthly Active Platform Customers, up 17% YoY

$15 million in operating cash flow, but $359 million in stock-based compensation

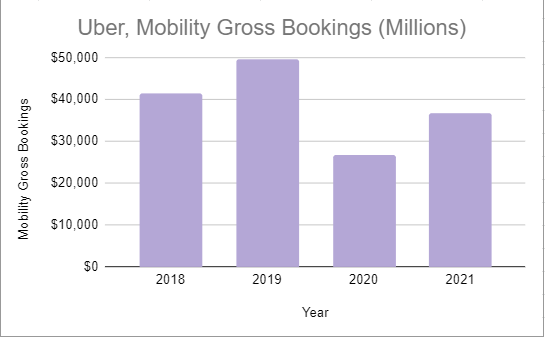

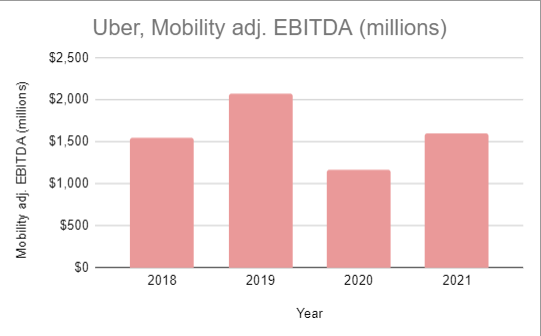

Excluding corporate G&A costs, each segment is adjusted EBITDA positive. Mobility leads the way with 25% Adj. EBITDA margins

(Ryan) Balance sheet and liquidity:

Assets:

Uber has $4.2 billion in unrestricted cash and cash equivalents

They also have $6.2 billion worth of investments. This balance is comprised of equity and debt securities in several privately held companies. Given a lot of this value comes from Uber’s own judgment and it’s difficult to liquidate, I would give this a value of less than half their stated value.

$624 million worth of “equity method investments”. This comes from Uber’s share of income or losses on their Yandex.Taxi joint venture

$3.4 billion in restricted cash held as collateral for insurance policies

Liabilities:

$9.3 billion in total debt (almost entirely long-term). All the debt is due between 2025 and 2030 and most of the debt comes in the form of senior notes.

The interest rates are mostly fixed and vary widely. The highest rate is 8.1% and the lowest (excluding their convertible notes) is 4.7%

$4.1 billion in insurance reserves. Uber uses a combination of 3rd party insurers and its own in-house insurance subsidiary to provide auto insurance on behalf of drivers. This pretty much only covers accidents since drivers are considered independent contractors.

Liquidity:

If you assume that half of Uber’s stated investment value (equity investments included) could eventually be converted to cash, they would have $11 billion in cash-esque value.

Between their debt and insurance reserves, they have $13.4 billion in liabilities. Leaving a net debt position of $2.4 billion.

Let’s assume Uber generates $1 billion in Adj. EBITDA this year (if they meet Q2 guidance, they will have generated $423 million over the first 6 months), Uber’s Debt/Adj. The EBITDA ratio would be 9.3x.

(Brett) Valuation:

Dynamic valuation: https://docs.google.com/spreadsheets/d/1HJL4N2yF6YwGLrvppO57cekFb7gq0p-A_WViVNWihUU/edit#gid=48868214

Market cap of $45.4 billion, ticker UBER

Enterprise value of $43.6 billion

EV/CP of 7.0. I am defining contribution profit as gross profit - operations and support costs.

EV/FCF would be 16 assuming they convert 3% of gross bookings to free cash flow (they do not right now). This is around what management’s long-term goal is.

Potentially dilutive shares outstanding of 100 million at the end of 2021, or around 5% of shares outstanding.

Anecdotal Evidence:

(Ryan) I use it when I have to go somewhere and I might be drinking. I always price compare them and Lyft, but more often than not pricing is quite similar.

(Brett) I rarely use the services, Uber is a better product in my mind though. The path to convincing people to give up car ownership has tons of hurdles that make it extremely difficult.

Future growth opportunities:

(Ryan) Dispose of international investments and downsize. I know that’s a lame growth opportunity, but I think it’s the most practical way to reach a reasonable level of profitability which they’ll need to pay down their debt. As of their latest 10-K, they had 29,300 employees. Sorry if it sounds inconsiderate, but there is no way they need that much. Square, Spotify, and Shopify, all have 10,000 employees or fewer. If they can transfer their international investments to other investors, they should.

(Brett) Advertising. They believe this can be a $1 billion business by 2024 and should have way higher margins and fewer operating hiccups. These are in-car advertisements, promotions on Uber Eats, and other stuff they are just working on. The segment is quite small but if scaled can give them operating flexibility and a price advantage vs. competitors (if Lyft doesn’t have advertisements, Uber can offer a lower price and still make a profit).

Highlights and lowlights:

Ryan’s Highlights:

Brand notoriety. Uber is essentially a verb. They and Lyft have a clear duopoly on the ride-sharing space in my area.

They’ve shown an ability to raise prices without decreasing the number of trips.

Ryan’s Lowlights:

Management’s capital allocation decisions + lack of focus. They’ve acquired and divested so many businesses it’s hard to count.

Feels like they’re way over-employed. I don’t see why they need to spend 32% of their gross profit on sales and marketing. They already have incredible brand recognition.

Delivery feels more competitive. Seems like they have to constantly provide discounts to reacquire the same customers. I don’t like that.

Brett’s Highlights:

There is a clear network effect, at least on the mobility side of the business. It is possible one is forming on the delivery side, but the jury is still out. With Freight, there is a ton of promise to form a sticky marketplace for carriers, and shippers, but it is still early days.

Dara seems to have a solid head on his shoulders, even though he had a very tall task rightsizing this business over the last few years along with the wrench that COVID-19 threw in the mix.

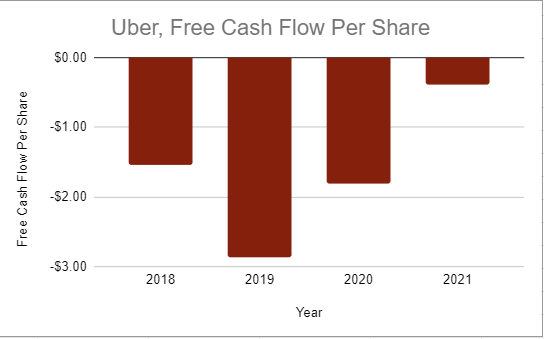

They have made consistent progress on cash burn over the last few years, coming from the divestitures and employee costs. Still a long way to go here.

The advertising product market fit seems strong and could help separate Uber from other competitors. There is also the potential for Uber One to do this with the subscription service. However, I’m not sure how large these segments can become relative to Uber’s enterprise value.

The legal and regulatory barriers to entry actually give them a competitive advantage now.

Brett’s Lowlights:

They are exposed to energy costs (fuel) and labor inflation (drivers). The higher the minimum wage at an Amazon warehouse, the higher the hurdle it is to join Uber and start earning money.

Turnover from drivers has been abysmally high.

The adjusted EBITDA number they tout and target is not indicative of true cash flow potential at all. This misaligns incentives with executives and can make it seem like they are earning money when the true value is not being created for shareholders. There are 16 adjustments on their adj. EBITDA line.

They are still paying out huge incentives. According to the risk factors on the 10-K, this amounted to $2.4 billion in promotions in 2021 or 38% of contribution profit. What happens if this goes away?

Indicative of their need to continually acquire companies (Drizly, Cornershop, and Transplace are the latest examples), Uber has to work really hard to get supply and demand on its platform. Compare this to Airbnb, where supply and demand generally take care of themselves.

They have made poor capital allocation decisions in the past with all their equity investments. You can see that in the write-downs this quarter. While this could just be because we are in a bear market, it worries me as a potential shareholder. Can we bet on their equity portfolio having any value?

The risk of eventually having to pay app store fees. They have been excluded from Apple and Android’s commission fees in the past, but if regulation passes evening the playing field for companies operating through app stores, this could add another 5% - 10% to Uber’s cost of revenue. Low probability of happening, but would devastate the business.

The low-hanging fruit has been eaten within mobility and delivery. In 2021, 23% of mobility bookings came from the five biggest cities (Chicago, Miami, NYC, London, and Sao Paulo). Thinking about those markets, they are likely much more profitable than a city of 250k people in the Great Plains, which is where a lot of Uber’s growth is supposedly going to come from. I have trouble equating this with the company’s goal of expanding its margins. The same could be said for food delivery.

Bull Case:

(Ryan) Uber hyper-focuses on mobility and delivery. According to their investor day, they think they could reach a 7% adj. EBITDA margin as a percentage of their gross bookings between those two businesses. Combined, delivery and mobility have generated just under $100B in gross bookings and $17.7 billion in revenue over the last 12 months. That would mean ~$7B in Adj. EBITDA assuming no growth. At 10x Adj. EBITDA, you’d have okay returns.

(Brett) Through advertising and the subscription service, Uber is able to maintain itself as the low-cost provider (for both supply and demand), insulating itself from the competition while also achieving free cash flow margins approaching 3% - 5% as a percentage of gross bookings. After researching, the key here is rationalizing the mobility market, fully embracing advertising with Uber Eats, and continuing to go for rapid growth in Freight. This could equate to solid long-term returns for shareholders at current prices.

Bear Case:

(Ryan) All their cash flow goes to debt holders over the next 5-7 years. They never reach their lofty goals and sustained profitability is always a “what if”.

(Brett) The bear case is incredibly simple: The unit economics do not work across mobility and delivery. Uber and really no other business in these industries have proven they can consistently generate positive cash flow for shareholders. If not now, when? Combine this with steady share dilution and Uber looks like a prime candidate to “run on a treadmill” for eternity.

More or less interested?

(Ryan) Less interested. The path to profitability required to make this thesis work is simply too complicated for me.

(Brett) Less interested. Why would you invest in this over Airbnb?

Stock for next week? (Brett: YETI)

Sources and Further Reading

Mostly Borrowed Ideas: Uber (Paywall): https://www.mbi-deepdives.com/deep-dive-on-uber/

2022 Investor Day (Presentation): https://s23.q4cdn.com/407969754/files/doc_presentations/2022/Uber-Investor-Day-2022.pdf

2022 Investor Day (Transcript): https://s23.q4cdn.com/407969754/files/doc_presentations/2022/Uber-Investor-Day-Transcript_February-10-2022-(2).pdf

2021 Annual Report (page 113 for the debt information): https://d18rn0p25nwr6d.cloudfront.net/CIK-0001543151/c94d88c9-fe59-4487-8e68-ccb030ea49b0.pdf

2022 Proxy Statement: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001543151/e21ec708-5e83-4113-8963-782b66d94a6a.pdf

Uber Deep Dive: Innovestor