Not So Deep Dive: Ubisoft (Ticker: UBI)

A French video game publisher that owns the Assassin's Creed and Far Cry franchises

Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/1GfuBiKmbItyrHbC8zok7gcnspHlzF_fu

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Ubisoft is a digital entertainment company made up of dozens of video game development studios located all around the globe. Ubisoft is home to several famous owned franchises including Assassin’s Creed, Far Cry, Rainbow Six, and Tom Clancy, but they also do license development on behalf of other companies’ IPs such as their recent launch of Mario + Rabbids.

The company is also the largest European game developer, but still generates the bulk of its sales in North America. And despite the company really getting its start in the PC market, console games now make up about 60% of Ubisoft’s revenue.

Within its most popular brand, Assassin’s Creed, the actual game typically costs upwards of $60 but users can also make in-game purchases to improve their characters’ outfits or ships. While Ubisoft doesn’t actually break out what percentage of its sales come from microtransactions vs. game purchases, it seems that the company is more dependent on actual game sales than other developers due partly to the story-mode style of gameplay associated with most of its brands.

(Ryan) History: Ubisoft actually started as a family business that belonged to the Guillemots and sold parts to farmers in the Brittany province of France. However, around the 1980s, the five Guillemot sons began to diversify into other products and eventually expanded into computer hardware/software. Known initially as Guillemot Informatique, the brothers launched their own business selling US computer hardware and software to french customers via mail orders. This ended up being a pretty big success, and they realized that the video game market was another burgeoning industry that they could capitalize on, especially given that they already had a good understanding of the distribution business in Europe.

They moved their offices into a chateau outside of Paris hoping to attract developers, which actually worked out fairly well and this was basically their springboard into video game development. At the time they had several partnerships to distribute games on behalf of US developers, but they also began developing games of their own. Since that time, it’s really been a story of acquiring small studios all around the globe and striking gold with the brands that I mentioned above. Ubisoft first appeared on the public markets in 1996. (If you want a more extensive history of the company, there’s a good podcast from TechStuff which we linked to at the end)

(Brett) Industry/Landscape/Competition:

The video game industry is large and quite diverse. It is estimated the industry did $178 billion in revenue in 2021 that is expected to grow to over $250 billion by 2025

However, in 2022 the industry is expected to actually contract (as of this writing) due to the COVID-19 consumer spending hangover. Industry spending is expected to get back on track in 2023 https://www.npd.com/news/blog/2022/2022s-video-game-market-declines-expected-to-continue/#:~:text=Mat%20Piscatella&text=U.S.%20consumer%20spending%20on%20video,8.7%25%20when%20compared%20to%202021.

The size of the video game console market is approximately $37 billion

The size of the PC video game market is also approximately $37 billion

The size of the mobile video game market is around $100 billion and has been the majority of growth for the last decade

Ubisoft mainly operates in the console and PC market. Competitors include: Microsoft/Activision Blizzard, Electronic Arts, Take-Two Interactive, Embracer Group, Tencent, Epic Games, and a bunch of smaller gaming studios

(Brett) Management and Ownership:

Ubisoft has been run and loosely controlled in various ways by the Guillemot brothers since the beginning, with all five still at the company in some capacity

Yves Guillemot is the chairman and CEO and has been leading the company for 35 years.

Executive compensation, as you might expect, is way too complicated. Ubisoft has a base salary, annual bonus, and equity incentives.

Long-term variable compensation is based on total shareholder return vs. Nasdaq Index (60%), growth in monthly active users (20%), and reduction in carbon intensity (20%). Frankly, I don’t care about any of these metrics as a potential investor in the business.

Annual variable compensation is based on non-IFRS EBIT (60%), net digital bookings (20%), and quality of life at work (20%). A little better but still strange metrics to be paid on

Total Board of Director compensation of $640.5k (Euros) last fiscal year, or only 0.03% of revenue. However, the Guillemot brothers get paid as board members which feels greedy.

Annual executive compensation of only $2.4 million (Euros) is not a large percentage of overall revenue. No egregious pay here although the target metrics are strange. However, it was concerning to see how little some of the executives were actually paid.

Overall, what all this comes down to is the Guillemot brothers still own a sizable chunk of Ubisoft, and they will benefit if the share price goes up over time.

They have fought off multiple takeover bids throughout the decades, including EA (the 2000s), Vivendi (2016), and rumors of recent takeover chatter. As the brothers age, it is plausible they will be looking to sell the company eventually.

(Based on 125,234,102 shares outstanding as of the latest annual report)

(Ryan) Earnings:

All 2022 Results:

$2.1 billion in revenue, -4% YoY (bookings were very similar)

87% gross margin vs. 85% the year prior

$241 million in operating income (they do have some interest expense though that’s not accounted for here)

$705.7 million in operating cash flow, down 26% YoY (big discrepancy between GAAP income and cash flow comes from Ubisoft having to amortize and depreciate their intangible assets)

Negative $282 million in free cash flow

(Ryan) Balance sheet and liquidity:

Liabilities:

$2.1 billion in total debt

$1.6 billion of the debt comes in the form of 3 different bonds

$486 million in zero-interest convertible bonds. Due in 2024.

$500 million in 5-year, 1.3% bonds. Due in 2023.

And $600 million in 7-year, 0.9% bonds. Due in 2027.

Assets/Cash Flow:

$1.3 billion in cash and bank balances

$200 million in short-term investments

All in all looks like they capitalized on the low rates throughout 2019 and 2020 while still having plenty of room for error.

(Brett) Valuation: (At a price of $46.01)

Dynamic valuation: https://docs.google.com/spreadsheets/d/1jFVFM9XMX8H7P2MQC7Oa6sox4pS3v2JE4_9Z4Iq8Dyw/edit#gid=985114541

Market cap of $5.6 billion

Enterprise value of $6.27 billion

EV/OI of 15.4

EV/FCF of -22.2

Multiples are not that useful for valuing a video game publisher. We like to look at the game's lineup (or catalog) and do some back-of-the-napkin math of what cash flow could look like with successful game releases over the next 3 - 5 years. Could paint a much brighter (or grimmer) story for Ubisoft this decade.

Anecdotal Evidence:

(Ryan) I watched a couple of long Youtube videos on the evolution of Ubisoft’s various gaming franchises, and they do a good job of telling stories. Especially with the Assassin’s Creed and Far Cry brands.

(Brett) Assassin’s Creed is a great asset but is mismanaged. The Avatar/Pandora game has a ton of potential to become the next big franchise for Ubisoft if executed well, riding the wave of major movie releases from Disney this decade.

Future growth opportunities:

(Ryan) Growth seems pretty cut and dry here. Continue to iterate on their core brands with new games and skate where the puck goes. Though it might not be worth the investment right now, Ubisoft’s brands feel really well suited for VR gameplay.

(Brett) The resurgence of the Assasin’s Creed franchise. This was/is Ubisoft’s best asset and had the potential to reach the same level as Grand Theft Auto or Red Dead Redemption in quality of storytelling and open-world gameplay. However, the franchise has fallen flat in recent years and may have hurt itself by releasing too many games too quickly. The company is announcing the updates for the franchise on September 10 (after we record), which I’ll be interested in watching.

Highlights and lowlights:

Ryan’s Highlights:

All of their franchises seem really unique, Assassin’s Creed in particular. Being the owner of some loved brands bodes well for adapting to industry changes.

Industry tailwinds. Console gameplay continues to become accessible, which means the potential customer pool continues to grow. And an increasing amount of games are being sold digitally which helps with margins as well as iterating on existing titles.

Given the media industry’s recent fascination with video game studios, I could see Ubisoft being an acquisition candidate.

Ryan’s Lowlights:

Compared to other publishers, Ubisoft’s games don’t feel optimized for in-game purchases.

Feels much less software-like than other game studios given the hit-or-miss nature of AAA games.

The overall focus does not seem to be on shareholders. Executives get paid for carbon footprint reduction, but that’s literally just a byproduct of the industry. As game sales move online, their carbon footprint is reduced.

Brett’s Highlights:

The quality of the Assasin’s Creed franchise. The ingenuity in coming up with this entertainment IP is one of the best moves from a gaming studio in the past two decades. If utilized correctly, this can be a $1 billion+ bookings-a-year franchise and should be the cornerstone IP for Ubisoft (like COD for ATVI, FIFA/Apex for EA, GTA/RDR for TTWO, etc.)

The Avatar/Pandora game has a ton of potential. New franchises are difficult to build, but if this becomes a popular seller it can have a material impact on net booking and help Ubisoft finally achieve some operating leverage. They are clearly pouring a ton of resources into the asset.

Brett’s Lowlights:

Mismanagement of franchises like Assasin’s Creed (talked about above)

Stretching resources too thin across what are supposed to be AAA titles. It is okay to have a lot of experimental Indie games but I don’t think it is optimal to have more than 1 - 2 big titles in development at one time. Why do you think Rockstar has had so much success the past two decades?

The Guillemot brothers have made some moves that I do not think highly of. This includes using Ubisoft to buy assets they already own, getting paid as members of the board of directors, and generally not seeming to have a focus on creating shareholder value

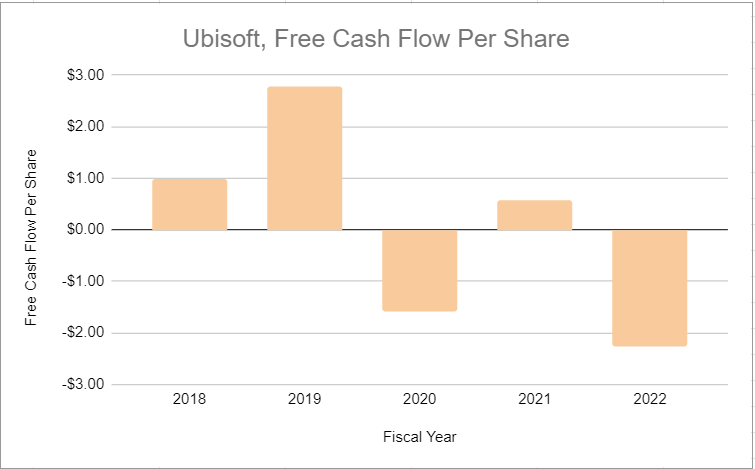

Inconsistent free cash flow generation compared to other large gaming publishers

Revenue per employee numbers vs. other large gaming publishers

Investments in Web3/blockchain gaming. This is not only a dumb idea in general but angered a lot of Ubisoft’s fans. https://cointelegraph.com/news/white-star-capital-raises-120m-for-ubisoft-backed-web3-investment-fund

Bull Case:

(Ryan) I think a realistic bull case is that Ubisoft’s game sales grow as more households gain access to their games. If they maintain relevance with their core brands, that could result in high single-digit to maybe even double-digit annual bookings growth over the next 5 years (will be lumpy though). Assuming 15-20% margins, that’s north of $1 billion in FCF. At its current enterprise value of $6 billion, shareholders would do well.

(Brett) The new Assasin’s Creed strategy is a success and they can elevate the franchise across console/PC in the same way other publishers have done to their flagship IP. Avatar/Pandora game is a huge success and new Star Wars games do well. This leads to bookings getting closer to $5 billion and operating leverage is finally achieved. At $1 billion in annual cash flow, it would be hard to lose money here.

Bear Case:

(Ryan) Several consecutive game flops leading to a diminished fan base feel like the biggest risk. Right now, I have to imagine there’d be some potential buyers for these franchises assuming the Guillemot brothers are willing to sell.

(Brett) They continue to mismanage Assasin’s Creed, be inefficient with capital allocation decisions, and alienate their fanbases.

More or less interested?

(Ryan) Less interested. Given the hit-or-miss nature of Ubisoft’s game development, I really have no grasp on what cash flow will be over the next 3-5 years.

(Brett) More interested. A lot would need to change with the Guillemot brothers getting out of the picture and better efficiency with spending, but there are some interesting assets at Ubisoft.

Stock for next week? (Xbox)

Sources and Further Reading

Ubisoft 2022 Annual Report https://downloads.ctfassets.net/8aefmxkxpxwl/44Uv9g0KnmBI5KlAghiJh/cdb36cc23a9930832acd8ecbb4dcbe61/UBISOFT_DEU_21-22_MEL_INTERACTIF_UK_160622.pdf

Ubisoft IR page https://www.ubisoft.com/en-us/company/about-us/investors#governance

The state of Assasin’s Creed (Pixelated Thoughts)

Ubisoft - Digging a Nice Hole

The Origins of Ubisoft:

Interesting breakdown, ty gents!