Not So Deep Dive: Visa Stock (Ticker: V)

A moat so strong that governments haven't been able to break it

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Listen to the full podcast for all our analysis!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) History: It feels like there are a lot of misconceptions about what Visa truly does and its role in the payments ecosystem, so I think it’s better to start with the history and how Visa actually came to be. I want to start by giving some credit to a blog called Mine Safety Disclosures (MSD). I think he does the best job of anyone I’ve seen so far explaining Visa’s business.

Let’s set the groundwork. At the start of the 20th century, borrowing money wasn’t very easy. Credit wasn’t available to most people, and there was a popular quote at the time: “A bank is the place for a poor man to put his money so that a rich man can get it when he wants.” Insert, installment credit.

To help more people be able to afford goods, merchants and manufacturers started letting people buy items without putting all the money down at the time of the purchase (BNPL doesn’t sound so innovative anymore). But this wasn’t very sustainable for individual merchants, as MSD states: “lending money was not without cost: merchants had to asses each individual customer's creditworthiness; bear the risk of late or nonpayment; and shoulder all of the back office headaches and expenses that came with managing thousands of individual accounts.” It wasn’t easy on the customer side of things either. Every time they wanted to make a purchase they had to basically appeal for credit and demonstrate that they were creditworthy. This was why most banks wouldn’t write these kinds of loans. In fact, pretty much the only bank that would was Bank of America.

Bank of America became the largest bank in the US because it made so many of these loans. However, it was coming across much of the same pain points that merchants were, so in order to make the process more efficient, in 1958 Bank of America introduced the BankAmericard credit card. Instead of having to settle up at the end of each month though, it was revolving credit. You could pay it all off on a monthly basis or defer it further but pay the bank interest. The next step was getting people to use it. This introduces the chicken-or-egg problem.

So the best way to solve this was to hyperlocalize. And they started by pre-approving everyone in Fresno, CA because 45% of the residents there banked with BofA. And they actually began to have a lot of success getting smaller merchants on board. They said they were grateful because of the headaches BofA would be solving. This quickly expanded to other cities in California and after some early issues (fraud, too many late payments, etc), BankAmericard finally started generating profits about 3 years into the program.

They wanted to expand this internationally but due to laws developed during the great depression, banks weren’t allowed to have out-of-state customers. Instead, Bank of America decided to franchise out the BankAmericard program to other banks around the country. But the program began to fall apart due largely to the authorization process. Authorizing a transaction was pretty easy when the merchant and consumer had the same bank. That wasn’t the case however with the franchise system: Here’s a snippet from MSD: "The merchant had to call his bank, who then put the merchant on hold while they called the cardholder's bank. The cardholder's bank then put the merchant's bank on hold while they pulled out a big printout to look up the customer's balance to see if the purchase could be approved—all while the customer and merchant stood there in the store, waiting for the reply. And that was when the system was operating smoothly. Sometimes the merchant got a busy signal. Other times his calls went unanswered”.

The second problem was the interchange. I want to hammer down on these two problems because this is where much of the value of Visa comes in. In describing a cross-state transaction (prior to computers) this is what MSD says: “In order to settle with one another, the merchant bank had to physically mail cratefuls of paper and sales receipts to customer banks all over the country, on an almost-daily basis. The cardholder banks then had to manually match up the sales drafts with their customer's accounts, reimburse the merchant's bank, and then finally bill the cardholders… It was one thing to settle accounts with five banks or even twenty-five. It was another thing to settle accounts with 150 banks, with millions of cardholders, billions of dollars in sales”.

As you can imagine this was a huge issue and in 1968 Bank of America held a meeting with all its member banks to sort out the issue. The resolution was to turn BankAmericard into its own independent entity co-owned by all the member banks. This new organization was given the order of making the credit card system run smoothly and they started doing just that. Here’s one more snippet from MSD: “In 1973, BankAmericard used computers to automate the authorization process. Three years later, they did the same to interchange. The “digitization” of these processes immediately bore fruit: transactions could now be processed 24/7/365; authorization times dropped from 5 minutes to 50 seconds; banks cleared and settled transactions overnight (instead of a week or more); and postage and labor costs were reduced by $17m ($79m today) in the first year alone.”

After automating pretty much the whole process, the organization was finally in a good place. That is when they chose to change their name to Visa.

(Ryan) What they do: I realize that was a lot, but I hope that paints the picture of what Visa has become. Visa is the largest connector (or the rails) between banks globally. Let’s use the example that MSD lays out, then I’ll stop referencing it:

“Consider a small merchant bank in Thailand that wants to enable their clients (i.e., merchants) to accept credit cards from tourists. For a transaction to take place, the Thai bank must have a way of communicating with each tourist’s bank so that the transaction can be approved, and money can be transferred. That means developing software that integrates with every single one of the tourist banks, and every single one of the merchant point of sale systems. There has to be support for hundreds of languages and currencies, all while ensuring compliance with thousands of local laws and regulations. Operating standards must be established so that the banks can settle merchandise returns, cardholder disputes, and fraudulent transactions. And the entire process has to be automatic, real-time, and operate with zero failure or downtime. The truth is, most banks simply don't have the resources to do this with more than a few other banks—let alone thousands. So Visa does it for them.”

Now let’s go through the actual revenue drivers. Visa makes money in 3 different ways:

Service Fees: In order to be a part of Visa’s network, banks pay a small percentage of each transaction to Visa. This is the % part of Visa’s take.

Data Processing Fees: This is a fixed fee that Visa gets for the settlement and transfer of funds behind every transaction. Keep in mind, this used to be costly every time due to shipping costs, but today it’s all up-front costs in equipment and technology, so there are very few variable costs to each transaction.

Cross-Border Fees: Similar to service fees, Visa takes a percentage of each transaction on cross-border purchases. However, when the merchant bank and the cardholder bank are in different countries, Visa ramps up its take rate significantly. Cross-border transactions are more complex due to currency conversions and higher rates of fraud among other things.

(Brett) Industry/Landscape/Competition:

The global payments industry is ginormous. Estimates vary but in consumer-to-business (C2B) transactions, which is what Visa mainly operates in, annual volumes are in the tens of trillions of dollars

Visa is estimated to have a 40% global market share of credit card volumes and over 60% in the United States. They did $11.6 trillion in payments transaction volume last fiscal year

However, the payments volume “TAM” is larger if you include Visa’s ambitions to get into other payment processing like business-to-business, peer-to-peer, and government-to-consumer. Plus, the value-added services on top. Industry volumes grow along with the global economy, pretty simple.

Competition is hard to fully encapsulate because Visa operates in so many countries and in so many form factors

Direct competitors in the United States today: Mastercard, American Express, and Discover. These are very easy to understand as the card networks generally run the same business model as Visa, they just are smaller.

Direct competitors outside of the United States today: UPI/RuPay (India government-sponsored networks), UnionPay (China solution), and other state-sponsored payment platforms.

Looming competitors in the United States and globally: Apple Pay and Google Pay (if they try and circumvent the networks), BNPL solutions (again, if they try and circumvent the networks), cryptocurrency platforms (if they circumvent Visa), peer-to-peer platforms like Zelle or PayPal (if they try and circumvent Visa), and government solutions like FedNow (if they try and circumvent Visa).

What’s strange to think through is that today, a lot of the fintech solutions out there are actually driving growth across Visa. However, if they get too big (eg. Apple Pay or 15 years ago PayPal) there are worries of a schism.

What is the biggest threat to Visa in your opinion?

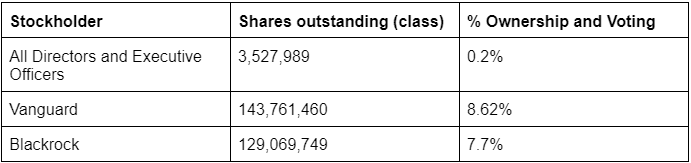

(Brett) Management and Ownership:

This section is going to remain short. Frankly, management is not the most important part of the thesis to me. All I want to know is if they are consistently returning cash to shareholders and not trying to move into markets outside of their core competency (i.e. Coca-Cola in the ’80s or something like that)

Capital returns box gets checked off. They return a growing amount of money to shareholders each year, mainly through share repurchases. Can we discuss how this makes a stock like Visa that much more attractive at 15x earnings vs. 25x?

Executive compensation is boilerplate. Look, the management team is going to get overpaid every year, and it will be fine. The company is large enough that it won’t matter unless we get an Elon-type in here to give absurd stock grants to themselves (very unlikely).

Executive comp is based on a bunch of metrics like net revenue growth, EPS growth, transactions growth, and some qualitative ESG-type stuff. Generally, looks like the growth hurdles are in the double-digits, so no creation of low bars to jump through and get a $10 million bonus.

There was nothing on the proxy statement that would get me to invest in this company, or anything to keep me away. Incredibly boring.

*Based on 1,627,853,381 shares outstanding as of latest proxy filing

(Ryan) Earnings:

Processed $14 trillion in total volume in 2022.

$31 billion in LTM net revenue. Since 2003, revenue has compounded at 15% per year.

36% Data Processing Revenues

34% Service Revenues

25% International Transaction Revenues

5% Other Revenues

“long-term contracts with financial institution clients, merchants and strategic partners for various programs that provide cash and other incentives designed to increase revenue by growing payments volume”

98% gross margin

$18.2 billion in free cash flow. In 2010, Visa had 30% free cash flow margins. In the last 12 months, they’ve had 59% free cash flow margins.

Over the last 10 years, Visa has generated $100B in free cash flow. They’ve spent $71B of that to repurchase shares. Over that time, shares have come down by 18%.

(Ryan) Balance sheet and liquidity:

Between cash, short-term investments, and long-term investments, Visa has just under $20 billion. The vast majority of that is all treasuries and money market funds.

No real short-term debt, but they do have $20.6 billion in long-term debt.

The long-term debt consists of 14 different types of senior notes, with 15% of that debt denominated in euros. Pretty much all the notes have between 1% and 3% interest and don’t mature until beyond 2030.

So basically they have about as much cash as they do debt, and they are earning more interest on that cash than they’re paying out on their debt. That’s great!

My question, however, is do you think they should be buying back stock right now at an earnings yield of 3.4% or investing the cash in treasuries that mature in less than 2 years which earn ~5%?

(Brett) Valuation:

Market cap of $470 billion

EV of $471 billion

EV/OI of 24

Anecdotal Evidence:

(Ryan) Seems impossible to disrupt. Everyone just partners with them. Anecdotally, I think there’s a misconception among merchants that they are taking more than they deserve in transactions when that’s typically more the issuing bank.

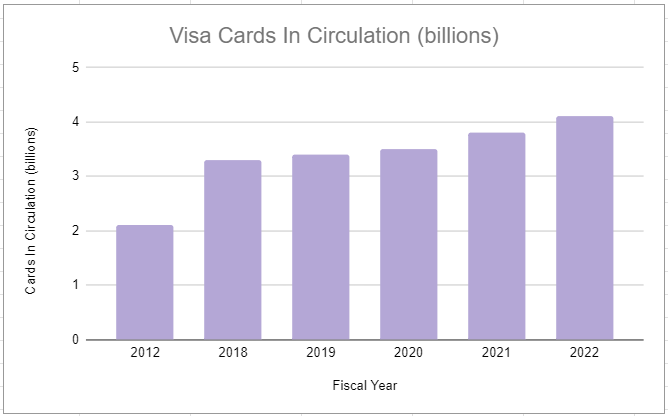

(Brett) This is not some contrarian take, but I think this is one of the strongest moats in the world that only will get larger the more cards in circulation they have. However, maybe a contrarian feeling I have is that Amex is actually poised to do well over the next decade and may not cede as much market share as people think.

Future growth opportunities:

(Ryan) B2B payments. Keep in mind, throughout its history, Visa has focused primarily on consumer-to-business payments, but they seem to be eager to get into the B2B side as well. B2B payments are apparently a 4x larger market and one where Visa has less than 1% share. “Visa B2B Connect's multilateral network delivers B2B cross-border payments that are predictable, secure, and cost-effective for financial institutions and their corporate clients.” This would still leverage the same network, just in different wrapping. Last quarter, CEO Ryan McInerney said “While Visa Direct is growing fast, B2B is the largest component of new flows.” (Visa Direct is the plugin for partners to access Visa’s network. It’s what things like Venmo and Zella run on.)

(Brett) Everything…only half joking. On a more specific note, Visa Direct looks very promising and should be a solid growth driver this decade. We will leave a link in the newsletter to look at more details, but Visa Direct is a service that is a part of Visa’s “network of networks” strategy that allows other financial service solutions to push and pull money to any other Visa-connected card (and beyond). Easy examples of customers include Remitly for international remittances and peer-to-peer apps like Venmo. Visa Direct transactions were 5.9 billion in FY 22, growing 36% year-over-year. The importance of Visa Direct may not be how it impacts earnings (at least in the near term) but as a moat expander.

Highlights and lowlights:

Ryan’s Highlights:

A wonderful competitive advantage that only gets better with time. Has survived several “moat attacks”. Every company that people would think could be a competitor actually just latches onto the Visa Network.

Inflation protected and very high incremental margins, so wouldn’t be too crazy to imagine margins actually expanding from here.

There are plenty of verticals to expand into.

Simple capital allocation philosophy.

Ryan’s Lowlights:

Everyone seems to think they’re taking too much money from merchants. I realize that isn’t the truth, but perception is important.

Brett Highlights:

Competitive advantage is easy to see and easy to track if it is getting better. All it comes down to is whether more cards are in the network, everything will feed off that.

Expansion to all these value-added services (tokenization, foreign exchange, fraud/security, Visa Direct, etc.) should only widen the moat.

Consistently returning cash to shareholders.

I could go on and on about the highlights of this business, but from an industry/TAM perspective, there is still a ton of growth left to be had for the overall cashless payments space. International travel is only expected to grow, tap-to-pay in the US (which on average drives more transactions) is way below global levels, e-commerce growth, digital wallets, the list could go on. Almost everything we cover in payments, from Adyen to something more specific like Bill.com, drives growth for Visa.

Brett Lowlights:

I struggle to find lowlights (a major positive indicator for me to put a stock on the watchlist). My major concern is the state-sponsored entities like UnionPay or the stuff going on in India that can drive international adoption of another card network and lessen Visa’s moat. This could eat into payment volumes over time.

Bull Case:

(Ryan) More of the same. They continue to trade at a 25x-30x earnings multiple, and grow FCF/share north of 15% a year. Seems like a very realistic outcome.

(Brett) We (we as in investors as a whole) are underrating the terminal growth/industry potential, and the consistent capital returns strategy continues. 10%+ revenue growth, stable margins, and returning capital to shareholders at 25x earnings is a good scenario for solid long-term stock returns.

Bear Case:

(Ryan) Multiple contraction. It’s actually still below its average multiple from the last decade, but that was also at a time when investors weren’t able to get 5% on risk-free bonds. If the multiple comes in, there’s probably a path to mid-single-digit annual returns instead of the double-digit returns shareholders are probably used to.

(Brett) I don’t want to sound too confident in this episode, but my only concern is sustained deflation or little-to-no inflation around the globe combined with multiple compression. Stock probably doesn’t work very well from these prices in that scenario.

More or less interested?

(Ryan)

(Brett) Yes, more interested. Maybe I’m being too greedy, but I am waiting for this to eventually (please?) get to 15x trailing earnings and then I would buy shares.

Stock for next week? (Airbnb)

Sources and Further Reading

MineSafety: https://minesafetydisclosures.com/

Net Interest:

Visa S-1: https://www.sec.gov/Archives/edgar/data/1403161/000119312508036833/ds1a.htm

What is Visa Direct? https://usa.visa.com/run-your-business/visa-direct/capabilities.html

Merchant Customer Exchange: https://en.wikipedia.org/wiki/Merchant_Customer_Exchange

Credit card market share: https://www.moneycrashers.com/credit-card-market-share/

India government disruption: https://www.outlookindia.com/business/visa-mastercard-to-enter-upi-space-soon-what-does-this-imply-for-the-payments-industry--news-252482

Greenskeeper pitch on Visa: https://www.greenskeeper.ca/wp-content/uploads/2022/06/GreensKeeper-SumZero-V-Final.pdf