Not So Deep Dive: Warner Music Group (Ticker: WMG)

Will streaming help or hurt the music label business?

Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/1EqTjoMH5tMnpfQr7xQ1R6hr1MjIcIdTs

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Warner Music Group is one of the largest music entertainment companies in the world (2nd in revenue behind Sony Music Entertainment). Through its ownership of various record labels, WMG is home to more than 100,000 artists and composers and more than 1 million compositions. WMG houses many iconic artists such as Ed Sheeran, Bruno Mars, Dua Lipa, and plenty more, and the company generates revenue in pretty much two ways.

Recorded Music Revenue: Recorded music comprises more than 80% of Warner’s overall revenue, and it refers to the actual sound recording component of a song. This is also called The Master. Distribution/Streaming platforms like Spotify or Radio stations sign contracts with WMG for the use of their musical compositions, then depending on the number of listens and particulars in the contract, WMG gets a royalty pool for the plays of certain songs they own the rights to. ~80% of that revenue gets paid to the owner of the recorded music and the remainder gets paid to the publisher for the use of the composition. Within recorded music, WMG generates revenue from various channels:

(62%) Streaming: 46% from subscriptions and 16% from Ad-Supported channels.

(19%) Physical: CD sales, Vinyl, Cassettes, Records.

(11%) Performance rights: Broadcasters and public venues.

(6%) Downloads & Other digital: iTunes and anything non-streaming.

(2%) Other: Gaming, films, advertisements, etc.

Music Publishing Revenue: Music publishing is more focused on the IP. It’s the monetization of the actual musical composition, not the sound recording. In exchange for helping in the actual publishing process (promotions, marketing, creation, etc.), WMG shares the publishing revenue for songs with the artists. Last quarter, Music Publishing accounted for 17% of WMG’s overall revenue.

What value does a label provide to an artist? Labels provide a variety of benefits to artists including connecting them with the best genre-specific producers, helping them with branding, marketing, and PR, and getting their songs onto the right distribution channels.

(Ryan) History: Since Warner Music Group is an amalgamation of tons of different record labels, each one has its own origins. And in fact, the earliest, Chapelle & Co., dates all the way back to 1811. However, WMG’s real formation didn’t really come about until 1958. A couple of years prior, one of Warner Bros (the film studio) actors produced a hit song. But Warner had no record label at the time, so the actor had to go to a subsidiary of Paramount Pictures to get help publishing his music. Warner didn’t want to lose business on talent that they already had acquired so they opened up Warner Bros Records in 1958 and 5 years later acquired Frank Sinatra’s struggling label Reprise Records.

Now I won’t go through every corporate change, but Warner has acquired many other record labels since the 60s and has actually been bought and sold by many other companies as well. More recently, WMG was sold by its parent company Time Warner in 2004 to a group of private equity firms and was brought public a year later. However, in 2011, WMG was once again acquired, this time by Access Industries for $3.3 billion. Fast forward ~10 years, and WMG once again went public in June 2020.

(Brett) Industry/Landscape/Competition:

The global recorded music industry is estimated to be $25.9 billion in 2021 and has been growing at a 15% - 20% rate with the rise of streaming music subscriptions (and a bit of advertising-supported streaming as well). WMG has been able to ride this wave

The global music publishing industry is estimated to be around $6 billion and should grow along with streaming as they get a % of that revenue. WMG operates in this market as well

Competitors: Universal Music (32% market share), Sony (21% market share), and artists not at a major label (32% market share). WMG has an estimated 16% market share in recorded music according to the annual report, so it is the smallest of the Big 3 music labels.

A rising competitor is investment funds buying up music catalogs. For example, Blackstone is getting into the business with a partnership with Hipgnosis deploying $1 billion. https://www.reuters.com/lifestyle/blackstone-among-bidders-pink-floyds-catalog-sources-2022-08-24/

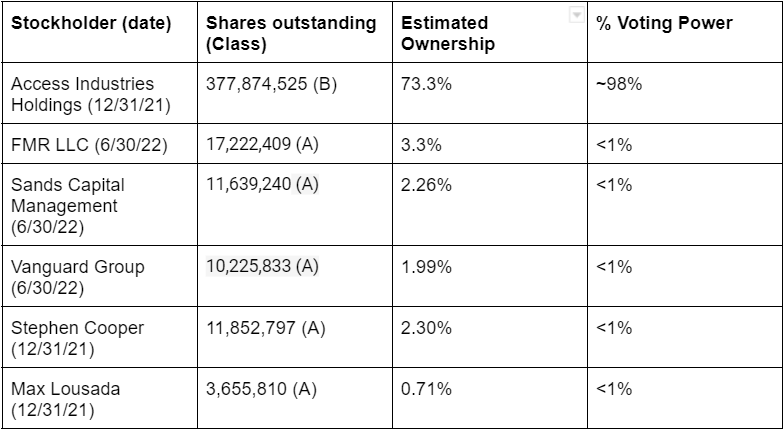

(Brett) Management and Ownership:

The most important thing to know about WMG is that it is majority controlled by Access Industries Holdings.

Access Industries was started by Len Blavatanik, and is a private U.S.-based investment group that has been running for decades. Blavatnik was born in Ukraine and is estimated to be worth $33.2 billion. He still sits on the WMG board and essentially is the one that controls the company.

Stephen Cooper, age 75, is the current CEO. He has been the CEO since 2011 and has tons of different experiences across finance and managerial roles. He actually was a temporary CEO of Enron after the bankruptcy. He announced he will be resigning and that the company is looking for a successor by the end of 2023.

This leads to the next most important person: Max Lousada, aged 48. Has been the CEO of recorded music (the largest financial segment) since 2017. Before this role, he was the CEO of Warner Music U.K. for four years and apparently had “record-breaking success.” I believe this means all of the top U.K. artists WMG has signed. He is rumored to be the leading candidate to get Cooper’s role, but nothing has been announced.

$1.96 million in total director compensation in FY 2021, or only 0.08% of the $2.56 billion in FY 2021 gross profit.

$32.2 million in total executive compensation in FY 2021, or only 1.23% of the total FY 2021 gross profit.

WMG does annual salary, annual bonuses, and long-term equity incentives to compensate employees

The annual bonuses and long-term equity incentives are generally discretionary as of this time. They do have a strange “free cash flow plan” where people can get compensated based on a % of free cash flow generation but it doesn’t look like many people make use of it.

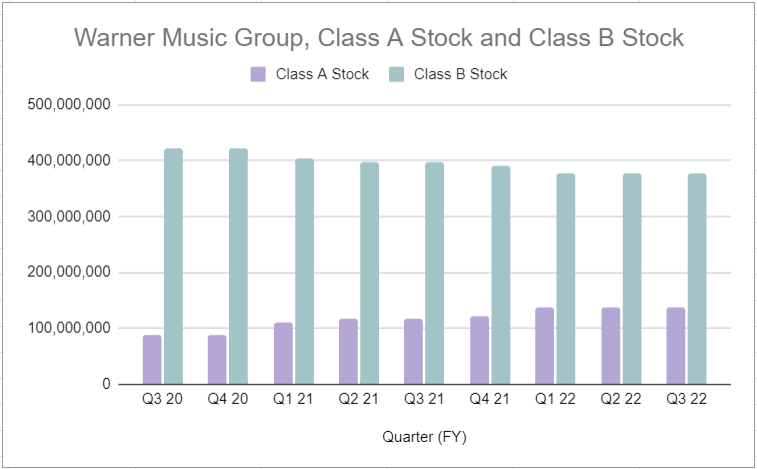

(Shares outstanding of 514,849,313 as of Q3 FY 2022)

(Ryan) Earnings:

Last 12 months:

$5.8 billion in revenue, up 15% from the 12 months prior

48% gross margins (most of their cost of revenue comes from royalty payments to artists)

$432 million in free cash flow over the last 12 months. They typically have just under 10% free cash flow margins.

Most Recent Quarter:

$1.4 billion in total revenue, up 7% YoY (12% in constant currency)

Recorded music up 3%

Publishing revenue up 30%

$128 million in free cash flow, up 80% YoY (9% free cash flow margin)

$233 million in OIBDA (operating income before depreciation & amortization) or 16.3% OIBDA margin

Digital revenue as a percentage of overall recorded music revenue actually decreased due to higher artists’ services and expanded rights revenue. Primarily due to concerts coming back in a big way. (Artist services revenue grew by 56%)

Artist services is lower margin which had an impact on WMG’s overall margin.

The overall advertising slowdown hurt their ad-supported royalty pool this quarter and they pushed a few big album releases into Q4.

(Ryan) Balance sheet and liquidity:

Access Industries did a really good job improving WMG’s debt structure over the last decade. They not only improved their credit rating and extended the maturities, but WMG’s weighted average interest rate declined from 10.5% in 2011 to just over 3% today.

Liabilities:

WMG has ~$3.8 billion in long-term debt, comprised of both senior notes and one senior term loan.

The earliest maturity is 2028 and the weighted average interest rate is 3.4%.

Assets/Cash Flow:

Cash and Equivalents of $345 million

Over the last 12 months, WMG has generated ~$1.2 billion in Adj. EBITDA

So its leverage ratio stands at just over 3x

(Brett) Valuation: (Stock price of $28.82)

Dynamic valuation: https://docs.google.com/spreadsheets/d/182AdPcNKg9RsCvNJ7ZpAQC52i-jZ2WR790emMeVulFs/edit#gid=485401412

Market cap of $14.8 billion

Enterprise value of $18.3 billion

EV/OIBDA of 20

EV/FCF of 38

Anecdotal Evidence:

(Ryan) I’m sure I’ve listened to some of their songs before. Beyond the value labels actually provide, there seems to be a big reputational moat. Artists want to sign with labels because it’s a bragging point and it feels validating.

(Brett) It seems like they have managed to keep their market share fairly well. I worry that the cat is out of the bag with the value of music catalogs and that this is a commoditized market. No user experience though, and there is almost a zero % chance it could or would want to go direct to consumer at this point.

Future growth opportunities:

(Ryan) Streaming. This has obviously been a boost to the business over the last decade, and in many ways, they don’t have to do anything to benefit from it. But as distribution becomes more competitive, it feels like their value in the publishing process should increase. Knowing what songs will succeed given changing listening habits, knowing how to leverage playlist inclusion, and digital promotions/marketing. I think that’s how they’ll provide increasing value to artists moving forward.

(Brett) The “emerging” segment of digital revenue. This is revenue that doesn’t come from streaming services and includes places like Peloton, Tik Tok, and Meta. At a June investor conference, an executive mentioned that this segment was at run-rate revenue of $100 million when WMG went public two years ago but is now at $345 million. If this rapid trajectory continues and music royalties start to get paid out across all consumer internet platforms, this could turn into a meaningful driver for the digital segment for WMG.

Highlights and lowlights:

Ryan Highlights:

They can basically skate wherever the puck goes. They own a massive library of content that’s becoming increasingly accessible to people around the world. They can just sit there and grow.

There’s a reputational advantage for artists to sign with a label. I can’t see a world where labels don’t exist and account for the majority of music listens.

Ryan Lowlights:

I don’t see what sort of competitive advantage they have in acquiring or identifying new artists compared to other labels.

I can’t tell if the ease of distribution in today’s world helps them or hurts them.

Brett Highlights:

Industry durability is a huge positive. I would bet a lot of money that humans are going to listen to music regularly in 2030, 2040, and probably 100 years from now.

The intellectual property advantage gives them a strong moat with the existing catalog, and there are definitely some scale/infrastructure advantages when attracting new artists.

The streaming music market still looks to be in the early innings, with small penetration rates around the globe. WMG can ride this wave for many years to come. Digital revenue has compounded at 16.3% since 2018, and I wouldn’t be surprised if that continued for the next 3 - 5 years.

Brett Lowlights:

Poor cash conversion on earnings. Streaming services paying cash monthly (typically), cash advances to artists, and the need to reinvest into new music catalogs/artists means a lot of “earnings” don’t actually show up consistently as cash on the balance sheet. This will give the company a tougher path to consistently return cash to shareholders.

The acquisitions seem unwarranted and strange. I get that UPROXX is a website about music, but I would rather see the company focus on what it does best and then return cash to shareholders.

The growth of Spotify’s promotional marketplace is by definition a headwind to WMG’s margins. If that becomes sizable (it is growing quite quickly) WMG may not grow its revenue as fast as the entire industry.

There is uncertainty around growing deal leverage for artists, whether established artists can go out on their own (although even someone as large as Taylor Swift decided to sign with Universal in 2020), the investment funds flooding the market for catalogs, and revenue share on future deals with streaming services. This makes margins unpredictable.

Bull Case:

(Ryan) They continue to grow their catalog and the growth of the overall industry gives them easy top-line growth.

(Brett) With its infrastructure, reputation, and IP, WMG is able to retain its market share and margin structure in the music industry globally and ride the wave of streaming and new monetization opportunities. At current prices, this should lead to good returns even with perpetually tough free cash flow conversion.

Bear Case:

(Ryan) The value that labels provide to the overall industry decreases over time. I think there are a number of ways that can happen, but ultimately if it does, I have to imagine that it would lead to gross margin pressure.

(Brett) Margins deteriorate due to worse deals with streaming services, artists, and the commodification of the catalog business. With poor cash conversion, it is hard to see where good returns come from at these prices. I think it all comes down to consistent margins (industry growth feels like a cinch), which means consistent leverage in the relationship with artists and streamers.

More or less interested?

(Ryan) More interested. Certainly worth tracking just to see how the music/audio space evolves. But I don’t think the valuation is too attractive here.

(Brett) More interested. They are riding a nice industry tailwind and have an IP advantage. However, I have some concerns about the current price, cash conversion, and acquisition strategy.

Stock for next week? (Ryan: Ubisoft)

Sources and Further Reading

Music Royalties 101:

History of Warner Music Group: https://www.musicbusinessworldwide.com/companies/access-industries/warner-music-group/

Fiscal Year 2021 Annual Report: https://investors.wmg.com/static-files/e3dcfc23-9ef2-4285-9df4-0272b814a7bf

2022 Proxy Statement: https://investors.wmg.com/static-files/405b324d-a2e1-4af3-a1b6-5712a29ee48a

Check out our upcoming CCM+ schedule:

If you have any suggestions for future themes as we head into 2023, please let us know.

Cheers,

CCM Team

Good write-up, thank you gents