Not So Deep Dive: WeWork Stock (Ticker: WE)

They wanted to elevate the world's consciousness...but what about generating positive cash flow?

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode!

YouTube

Spotify

Charts

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring our newsletter, podcast, or both.

Show Notes

(Ryan) What they do: The WeWork model is really quite simple. They enter into leases in commercial real estate areas (typically for long durations), then reconfigure the space and rent it out to individuals and organizations to work in. The average length of WeWork’s leases is 15 years and the average membership term is 19 months. If you strip out all of the costs associated with running the actual WeWork corporation – so looking just simply at what they are paying to operate their spaces versus the money they get renting it out – WeWork generates roughly a 10% margin. Now WeWork today has 613 locations across 33 countries and they generate revenue through three product offerings:

Space-as-a-service: This is really their core offering and it just allows people to rent either a dedicated desk ($300-$600), a private office ($400-$1,400), or in some cases even an entire floor. Members typically pay on a monthly basis and they can pick their rental duration. ~70% choose a plan for more than 12 months.

WeWork Access:

On-Demand: This is their Pay-as-you-go model, where people can book a co-working space or private office for a day or a couple hours without locking into a longer-term plan.

All Access: They introduced All-Access in 2020, and it’s essentially a cheaper plan that allows people to book desks across a number of locations depending on availability. So you get a lot of the benefits, but there’s no guarantee you’ll get space where you want.

WeWork Workplace: This is WeWork’s office space management software. So if they have a big enterprise renting out a whole floor it can help those companies stay on top of available desks and offices along with which employees are coming in on which days. It’s really meant for enterprises.

There’s also a mobile app that everyone can use to help book and plan everything.

(Ryan) History: People have probably heard the founding story before so I’ll be brief here but really try to focus on the post-Adam Neumann era.

In 2010, Adam Neumann opened a space in SoHo Manhattan and began renting the space out to other tenants. It was quickly adopted by startups because it was such a cost-effective way to find office space and they quickly became a phenomenon in New York, attracting investors such as JPMorgan, T-Rowe Price, Goldman Sachs, and several others. This was working ok, but the flood of funding I think gave Neumann a bit of a god complex and WeWork began to spend and grow in every direction and without any regard for cost, and this mentality was only amplified once Softbank showed up. In fact, in 2018, Softbank acquired a warrant for $3 billion worth of shares that valued the company at $42 billion and a year later pumped an additional $2 billion in at a $47 billion valuation. That was the height of their rise.

Later that year, WeWork filed an S-1 in preparation to go public and this was basically the beginning of their demise. It opened the company up to investors, and investors tore them apart. Softbank quickly realized the market wanted nothing to do with this company and so they stopped giving them money. They postponed IPO plans, removed Neumann as CEO, and began to go into cost savings mode. Here’s a direct quote from the 10-K: “With a new leadership team comprised of seasoned professionals in the public and private sectors, in 2019, we began to execute a strategic plan to transform our business. This plan included robust expense management efforts, the exit of non-core businesses and material real estate portfolio optimization.”

Here’s some of what they’ve done:

Reduced SG&A costs by $2 billion through layoffs, general cost savings, and selling non-core assets including Flatiron, SpaceIQ (workplace management software), Meetup (platform to bring people together for face-to-face interactions), Managed by Q (more workplace management software), 424 Fifth Venture (some real estate investment), and Teem (yet another workplace management software company).

Reduced future lease payments by more than $11 billion through amendments or exits of bad locations.

(Brett) Industry/Landscape/Competition:

WeWork operates in the global office space market, specifically in the coworking category the company helped popularize

The coworking market is estimated to be $17 billion in 2022 and expected to grow to $19 billion this year and $35 billion in 2027. If WeWork can maintain its market share there could be a nice industry tailwind to ride.

However, given the balance sheet and liquidity struggles that WeWork has, this will be virtually impossible unless they implement some sort of licensing strategy. Taking on a significant amount of new leases may be out of the question for a long time.

Competitors include Regus, Space, Impact Hub, the list goes on and on. When there is an endless amount of competitors for a company I am looking at, that is an indication the business may not have much to differentiate itself with.

IWG (parent company of Space and Regus) grew revenue 18% year-over-year in 2022, while WeWork grew revenue 26% year-over-year. However…IWG is profitable.

One other meta-competitor is the industry dynamics around returning to the office or work-from-home. Everyone seems to have an opinion on what will happen with this, but honestly I have no clue. The only thing I am sure of is that the U.S. office space market (less so around the globe) got reset to a lower demand base during the pandemic. It may grow from here, it may not, time will tell.

Glass half full: WeWork is gaining market share while the industry goes through a cyclical downturn. From the proxy: “At the market level, WeWork’s 2022 gross sales in Manhattan were equivalent to 18% of the traditional office market leasing on a square-foot basis, while WeWork’s portfolio accounts for approximately 1% of total office stock”

(Brett) Management and Ownership:

There has been a recent shake-up at WeWork’s executive suite after the stock collapsed this spring

Since Feb. 2020, the CEO of WeWork was Sandeep Mathrani

Mathrani led the analyst call for Q1 results in May and wrote a long letter for the Proxy statement filed in May saying things like “This is WeWork’s moment” and “At the end of the year, 68 of 99 total markets were over 70% including New York, London, San Francisco, São Paulo, and Paris, making up 75% of revenue.” Sounds nice, right?

Well. the board of directors didn’t think so…

On May 16th, WeWork announced that Mathrani would be leaving the company, effective on May 26, and getting replaced by an interim CEO from the board named David Tolley. Tolley actually only joined the board of directors this year

The board of directors is mainly made up of people from Softbank and VC firms

Other interesting notes from the Proxy:

Softbank can have no more than 49.9% voting power, even if they technically should have more

$1.5 million in total director compensation in 2022

Adam Neumann still owns 20 million Class C shares, but they have been voted to be equivalent to just one vote per share now

David Tolley owns zero shares

In 2022, the board paid the executives $3 million in cash bonuses for “hitting” strategic objectives

Mathrani was paid $6.5 million last year

*2,112,582,668 shares outstanding after debt extension and restructuring

(Ryan) Earnings:

2022:

$3.2 billion in revenue, up 26%

Occupancy rates went from 65% to 75%

Average revenue per membership declined slightly YoY

Operating loss of $1.6 billion or -50% operating margin

But they pay $500M+ in interest expense, so net loss was more than $2 billion

Most recent quarter:

Revenue was still growing year-over-year thanks to higher occupancy rates.

Operating margins did improve to -24% and net margins more like -34%.

They are guiding for positive adjusted EBITDA next quarter but it really doesn’t mean anything.

Management has laid out a business plan that assumes free cash flow positive by YE 2024, but they’ve constantly pushed that back.

(Ryan) Balance sheet and liquidity: They just did a big (and complicated) recapitalization with a bunch of convertible debt, so it’s a little complicated and the previous interest expense is not indicative of what it’ll be going forward.

Assets:

They don’t own their land (in most cases) so really the only important part of the asset side here besides property and equipment is the cash.

After this recent recapitalization, they will have $422 million in cash.

Liabilities:

Here’s where it gets complicated (1L = First Lien, LC = Letters of Credit)

WeWork has ~$2.4 billion in total outstanding debt. These are comprised of 9 different debt structures that in total have a weighted-average interest rate of about 13%.

This extended most of the maturities out to 2027, but it also pretty much tripled the share count.

I guess to summarize, WeWork has essentially $2 billion in net debt that’s mostly due in 4 years. They raised this money at the expense of shareholders and the stock has thus dropped 90% since. Management says they’ll be profitable in 2 years but they’ve consistently pushed that back. This is a bad balance sheet and they’ll probably end up entirely owned by Softbank.

(Brett) Valuation:

This is a difficult one given the strange debt restructuring and collapsed share price

The market cap is $486 million

Hypothetical: If WeWork was to return to its $10 SPAC price, its market cap would be $21 billion with the current shares outstanding

If we add the pro-forma net debt from the Q1 earnings presentation, WeWork has an enterprise value of $2.4 billion even with a share price of $0.23

Using Revenue - location expenses as a gross profit figure, we are currently at a TTM EV/GP of 5.7. So not even cheap unless you believe they will have significant pricing power on current leases or for some reason their landlords will significantly reduce their lease obligations

Confused yet?

Side question: What things do we look for to disqualify a growth stock from being investable?

Anecdotal Evidence:

(Ryan) I know lots of people that use WeWork. I can see how it’s a cost-effective solution to get office space. I buy the whole workplace flexibility/co-working trends.

(Brett) Seems fine for corporations, but already feels expensive for me. How tied to the start-up business cycle are they? How much “power” do they have when the biggest businesses in the world just use them whenever they need to easily spin up some more office space (or spin down).

Future growth opportunities:

(Ryan) Negotiating longer-term, lower-rate leases with their landlords. Landlords aren’t in an easy spot either, and I don’t think they want to have to deal with extra vacancies. They should be negotiating with literally everyone they can.

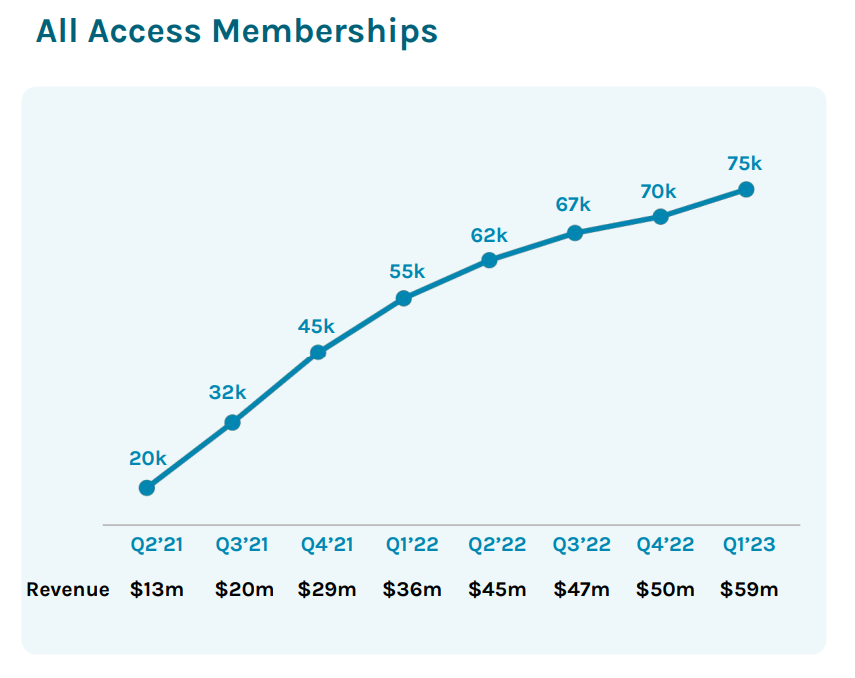

(Brett) They have to get more revenue out of the existing footprint. There is no other way to positive cash flow and covering interest expenses. One way to do this is expanding the WeWork All Access program, which hit 75k subscribers at the end of Q1. This membership program costs $150 a month (although I saw they were offering a 15% discount for six months when I checked the website) and it essentially lets you work at any of their locations any day of the week, you just have to book ahead of time. Last quarter it hit $59 million in revenue, or around 7% of overall sales.

Highlights and lowlights:

Ryan Highlights:

I honestly like the model, if it’s run properly. I think it’s a win-win for everyone and the economics can work.

Their largest supplier (the actual building owners) aren’t really in a great position either. So WeWork should be able to potentially negotiate lower rates.

Ryan Lowlights:

I think the previous management team was dishonest. One of the analysts called him out on the Q1 conference call. Alex Goldfarb (props to him) mentioned that they kept pushing back FCF and he pretty much said “no we’ve been consistent” and Alex’s response was “It hasn’t been consistent. This has been a topic that you guys know I regularly ask and focus on… This is a change from what you guys laid out before, and it’s a little troubling because the $90 million of cash interest savings was supposed to be an acceleration.”

The balance sheet is now incredibly complicated and it seems like bankruptcy is pretty likely at some point.

Brett Highlights:

The brand is still strong among the tech industry, start-ups, etc. People may be much more cost-conscious today but this brand is still valuable and could lead to some pricing power given their holistic offering. If you have the budget and you can go to WeWork for a one-time fee and they manage your entire office needs that seems pretty valuable to me. You can see this in the market share gains.

This business model does work if done rationally. If you take out long-term leases with a bunch of landlords, have a consistent membership base that you can consistently raise prices on (or upsell to WeWork All Access) this business could be profitable. IWG (Regus and Spaces) does it.

Brett Lowlights:

Do I even need to write these down?

The company is still working through the egregiously aggressive cost structure left by Neumann and the original team. With gross margins barely positive, high-interest rate debt, and at least some level of necessary operating expenses, it will be very tough for them to achieve profitability.

The overall “return to office” trend from 2022 has stalled out. This can be seen in WeWork’s vacancy rate stagnating in recent quarters. Data coming out of the U.S. cities for Q2 is not working in WeWork’s favor, either.

Paying a bunch of money to executives and board members while the balance sheet gets drained.

Softbank is now the majority owner of this business. This is not a shareholder base that I trust, and they screwed over all the other shareholders doing the restructuring deal this spring.

The previous CEO consistently talked about getting to positive free cash flow but consistently pushed back the timeline to do so. They are now not expecting to hit positive cash flow until 2024. Do they have the funds to make this happen?

Bull Case:

(Ryan) The old management teams’ most recent guidance indicated that they think they can be free cash flow positive by the end of 2024. If they’re able to do that, and they don’t have to raise any more money, I think there is a path to sustainability here. And here’s some of the dialogue from the most recent conference call:

Analyst: “Even with this new projection… you guys do not see a need to access an additional term loan or additional capital, right?”

Sandeep Mathrani: “Correct.”

If this is right, and they can get to 2%-3% free cash flow margins, that’s $75M+ in free cash flow. If they’re doing $75M in free cash flow, I would think the equity should be worth a lot more.

(Brett) With the share price so low, you need to expect that WeWork is able to pay off its debts without diluting your ownership that much more. In 2022, WeWork had $1.7 billion in SG&A, pre-opening, interest, and capital expenses. This excludes depreciation and impairment charges (non-cash). In 2022, they generated $331 million in gross profit (revenue - location operating expenses). Can the company achieve a run-rate of $2 billion in gross profit through price increases, better lease renegotiations, and occupancy rates? Maybe. But they are still a long way off.

Bear Case:

(Ryan) They can’t make it to profitability within the next year or two. Plenty of reasons why that could happen, but if it does, the equity will be a zero.

(Brett) Office space demand stays muted and we don’t get occupancy levels (especially in the United States) back up to pre-pandemic levels. This means they don’t get to positive cash flow and the company files for bankruptcy. Also, with Softbank now the majority holder, aren’t they incentivized to dilute existing shareholders even further? (because it will have less of an impact on their ownership stake)

More or less interested?

(Ryan)

(Brett) Less. The supply glut of office space in the U.S. is going to kill them, and I don’t trust the shareholders (Softbank).

Sources and Further Reading

Debt restructuring summary: https://www.reuters.com/markets/deals/wework-reaches-deal-convert-1-bln-softbanks-debt-equity-2023-03-17/

IWG quarterly earnings: https://investors.iwgplc.com/~/media/Files/I/IWG-IR/reports-and-presentations/2023/iwg-2022-results.pdf

WeWork All Access: https://www.wework.com/solutions/wework-all-access

Downtowns hollowing out: https://www.cnn.com/2023/06/06/business/global-companies-office-space-cuts/index.html

VIC long pitch on WeWork: https://www.valueinvestorsclub.com/idea/WeWork/6034316338

September 2022 Investor Presentation: https://s23.q4cdn.com/100276410/files/doc_presentations/2022/September-2022-NDR-Presentation-vF.pdf

Q1 2023 presentation: https://s23.q4cdn.com/100276410/files/doc_financials/2023/q1/1Q23-Earnings-Investor-Presentation-12.pdf

2022 proxy statement: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001813756/d58c9c5f-bcec-4279-9489-93bc948f8ee3.pdf

Great discussion! Can recommend WeCrashed from Wondery about the beginnings from WeWork