Not So Deep Dive: Xbox (Microsoft's Gaming Division)

How valuable can this segment become for the tech giant?

Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/1wDaPAJYpRLAx1D6cq9aUwNsB9CcRRyF9

Reminder: these are show notes that should be read in conjunction with the podcast.

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Xbox is Microsoft’s gaming division that focuses on delivering entertainment to consumers in a variety of ways. Xbox has its own studios and games, its own consoles, its own live services, and even a cloud gaming division. Collectively, we refer to these as the Xbox ecosystem. Let me highlight some of the services:

Xbox GamePass: GamePass is a $10/month subscription that gives members access to hundreds of downloadable games (both 1st and 3rd party), as well as Xbox Live Gold. GamePass is also supported on mobile devices as well as PCs.

Xbox Series X: This is the newest generation of Xbox consoles. In terms of technical specs, the Series X delivers games in 4K and gets up to 120 frames per second. The console costs $500 at a minimum and contains a disc drive that’s compatible with games for previous generations.

1st-Party Games: Xbox has several of its own studios located all around the globe including Alpha Dog Games, Bethesda Game Studios, and soon, Activision Blizzard’s various development studios. These studios are responsible for the development of many globally loved games including Minecraft, Forza, Halo, Age of Empires, DOOM, Fallout, and if the ATVI deal closes, Call of Duty, World of Warcraft, Candy Crush, and plenty more.

Similar to iOS, the Xbox ecosystem generates revenue in a number of ways including the sales of hardware (consoles, controllers, headphones, etc.), the sales of 1st party games, a revenue share for the sales of 3rd party games, subscriptions to GamePass, and advertising on the Xbox store.

(Ryan) History: Microsoft actually got its start in gaming well before they introduced the Xbox. Games were initially designed for the Windows operating system, and their longest-running game still in development is Flight Simulator. The name Xbox itself wasn’t introduced until 2001 in response to Sony’s success with the PlayStation2. Microsoft saw the PS2 as a threat to its PC business since the PS2 branded itself as a centerpiece for home entertainment.

In 2001, Microsoft rolled out the original Xbox (which eventually sold over 24 million units) and just prior to the launch, Microsoft bought development studio Bungie – the maker of Halo – for $3.6 billion. A year after, Xbox Live was introduced allowing players to connect with their friends. The 2nd version of the Xbox console was the Xbox 360 which was introduced in 2005 and was largely seen as a big success. Microsoft eventually sold more than 80 million copies and even added the Kinect System to emulate the Wii.

In 2013, the Xbox One was introduced and the real differentiation of this generation of consoles was its focus on live offerings. The following year, Microsoft bought Mojang – the studio behind Minecraft – and Minecraft has gone on to become the best-selling video game of all time. The Xbox One was really Microsoft’s go-to console over the last decade until 2020 when they released the Xbox Series X and S. The Series S is a cheaper version of the X, with the only real difference being the lack of a disc port. Roughly a year later, in Jan. of 2022, Microsoft announced its intention to buy Activision Blizzard for just under $70 billion making it the largest gaming acquisition ever, and by a long shot. The deal is still going through a regulatory overview.

(Brett) Industry/Landscape/Competition:

As discussed in previous gaming episodes, the video game industry is estimated to be around $178 billion worldwide

Consoles (Xbox’s core segment) does $37 billion in annual sales

The console industry has been very stable but hasn’t grown much in the last 15 - 20 years. However, right now the two big players (Xbox and Playstation) are facing supply chain issues due to the inability to source semiconductors

Players not being able to secure a console not only leads to less hardware revenue but less spending on games as well (you’re not going to buy a new game until you can get a console)

All this is to say: Let’s see what the console industry looks like in 2025. If spending is still stagnating, then maybe the industry has hit maturity. But I expect it to be larger than right now.

Another industry note: The cloud gaming market is expected to grow at a 40%+ annual rate through 2029. Xbox is the leader in this market so far.

Competitors: There is Playstation and everyone else. Everyone else: Nintendo, Amazon (Luna cloud gaming), Google (Stadia), EA (game publishing), Take-Two, Steam (game distribution), and Meta/Oculus.

Source: https://www.matthewball.vc/all/audiotech

(Brad) Management and Ownership:

Phil Spencer is the CEO of Gaming at Microsoft:

He has been climbing the ladder since 2003

Tim Stuart is the CFO of Xbox who has also been with the company for 2 decades

For Microsoft as a whole, Satya and Amy Hood are arguably the strongest 1-2 punch of leadership in public markets.

In terms of ownership, gaming and Xbox executives own a very, very small piece of Microsoft overall. They’re not able to own Xbox outright for the same reason we can’t own shares of Instagram today.

(Brett) Valuation:

No dynamic multiples this week since this is a subsidiary

However, we do have some nice charts trying to outline what Xbox + Activision Blizzard is worth to Microsoft.

Assuming an operating margin of 20% for the combined entities and a P/OI of 20, Xbox + Activision Blizzard would have a market cap of $101 billion

Gut check: this feels much too low for the combined companies. But we all should remember that Xbox sells its hardware at break-even or a loss, which will keep consolidated margins down

What multiple of operating income (assuming margins are currently 20%) would you pay for Xbox + Activision Blizzard today? (Can save for the end but we all should think about this during the show)

(Ryan) Earnings: (Lots of estimates here)

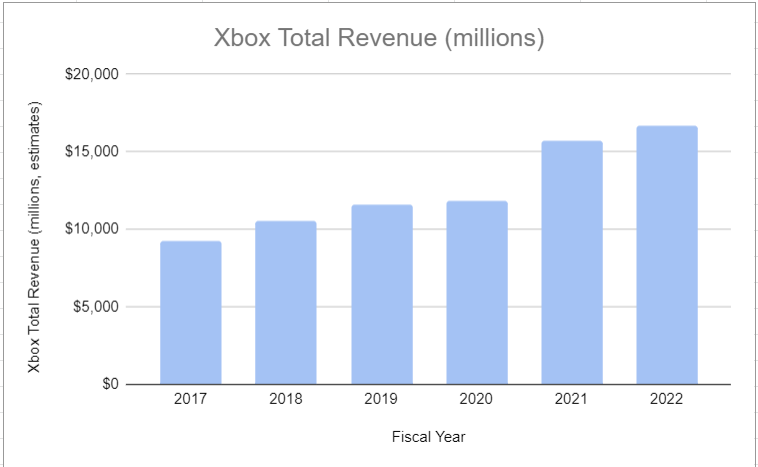

Microsoft’s gaming revenue was $16.7 billion in 2022, up 6% YoY

~75% of that revenue comes from content and services, with the remainder coming from hardware sales

Activision Blizzard’s most recent full-year revenue was $8.8 billion

Combined, the two businesses would be generating more than $25 billion in revenue.

Since we don’t have any profitability numbers on Xbox, we’ll have to take a guess at what the blended margins would be.

For reference, Activision has ~25% free cash flow margins. So let’s assume the two together would have 20% operating margins. That would mean $5 billion+ in operating income.

Xbox Series S/X has sold about 16 million units so far, and as of last reporting (Jan. 2022), GamePass has more than 25 million subscribers.

(Brad) Balance sheet and liquidity:

Xbox enjoys one of the strongest balance sheets in the world with its parent company which has:

Over $100 billion in cash and short-term investments.

$47 billion in extremely affordable long-term debt.

A company buying back shares like it’s their business.

Anecdotal Evidence:

(Ryan) I played the Xbox growing up, though I don’t play it much anymore. And if you’re going to buy Xbox Live you might as well buy GamePass. If I was able to play Xbox directly from an app on my smart TV for $10-$15/month and didn’t need to buy a console, I would.

(Brett) It would be hard to convince me to try any console that was not Xbox or Playstation. I think cloud gaming has a chance to 10x the potential player base for AAA games over the next decade or two and it seems like Xbox has the best infrastructure to make that happen.

(Brad) NCAAF ending was a sad, sad day in the Freeman household. So excited that it’s coming back. I was never the person to go out and buy the console and games, but my roommates always had one and we always played NHL or FIFA or NCAAF. This is a duopoly of a select group of consoles.

Future growth opportunities:

(Ryan) In-game advertising. Microsoft has reportedly been exploring how to put ads into free-to-play games. They’ll already receive a decent mobile advertising business with the Activision acquisition, but very few PC and Console games have ad inventory. Feels like highly valuable inventory for advertisers and could really juice the ARPU of Gamepass. Microsoft is a bit of an overall sleeping giant in the advertising space. The company had more than $10 billion in ad revenue last year, and they’ve recently partnered with Netflix to help power their ad-supported offering.

(Brett) Cloud gaming. This project is in beta right now and has only started rolling out to one smart TV manufacturer, Samsung (and in select markets). Cloud gaming is exactly what it sounds: console/PC level gaming without the need for an associated computing device since all the computing is done in the cloud (i.e. powered by Azure). Why is this so important? Because it has the potential to greatly expand the total addressable market for AAA-style games. If you don’t have to spend $500 on a console anymore, a lot more people will start playing these games.

(Brad) More subscriptions around Gamepass. Lowering friction to create sticky, new users is the way to go and up-selling with a la carte items is very doable. Get away from selling games every year and sell annual subscriptions (like they’re already doing, but more of that)

Highlights and lowlights:

Ryan’s Highlights:

Lots to like. The console business itself is really sticky, hard to disrupt, and monetizable in a number of ways. I think it actually possesses very similar characteristics to the iOS ecosystem.

Feels like Xbox is the front-runner of the cloud gaming space right now. They’ve got the benefit of working closely with Azure, they have the first party IP to build a compelling offering, and they have an advertising business that could allow them to underprice competitors while still generating similar ARPU.

The financial backing and actual focus from Microsoft give them a sizeable advantage over others in the space.

Ryan’s Lowlights:

The stickiness of the console business hurts them as much as it helps them. People that use PlayStations today probably won’t be switching any time soon.

The risk of pissing off the gaming community. Playstation’s CEO Jim Ryan recently said this: “Microsoft has only offered for Call of Duty to remain on Playstation for three years after the current agreement between Activision and Sony ends. After almost 20 years of Call of Duty on PlayStation, their proposal was inadequate on many levels and failed to take account of the impact on our gamers.”

Brett’s Highlights:

The console market (excluding Nintendo, which serves a different market) has turned into a duopoly, and Xbox’s position feels extremely secure along with Playstation’s.

The Game Pass/Cloud/vertical integration can drive margin expansion + revenue growth for years to come

So far, Xbox has a better market share vs. Playstation with this current generation of consoles. Playstation is still leading though, but a lot of this could be muddied by supply chain issues.

Brett’s Lowlights:

The supply chain issues for hardware are showing that selling the actual consoles is not a good business. The majority of Xbox’s revenue doesn’t come from hardware sales anymore, but it still is a crappy part of the segment.

The console market has been stagnating for years. Xbox looks to be changing this with Game Pass, these next-generation devices, and eventually cloud, but progress has been slow.

The threat from Meta Platforms. I am not a believer in VR gaming, but Meta is throwing a ton of money at Oculus and other computing devices which are competing with Xbox. This could erode the player base over time.

(Brad)

Highlight – you get to lean on the resources, elite leadership, and brand of Microsoft. There’s not much better stability than that. Add to that the lengthy leadership tenures and there’s a lot to like here in terms of stability and culture.

Lowlight is Oculus and the VR movement. If that takes a dent out of core gaming businesses, it would hurt Xbox specifically. Microsoft will likely be a prominent piece of this evolution, but it has a guaranteed piece of the current fad and there’s no certainty it will enjoy success in VR.

Bull Case:

(Ryan) The console business remains steady for the time being and Xbox Cloud becomes usable enough that it drastically expands the potential player base for console games. If gaming without a console becomes a big hit, I could easily see a world in which Gamepass has well north of 100 million subs. Assuming no price increases, that’d be $12 billion a year in pure subscription revenue.

(Brett) If market share is retained, the content division takes the next step up after the Activision merger and the explosive growth of Game Pass, and cloud gaming takes off, I think the Xbox division can grow its top-line by 10%+ for the foreseeable future. Also, demand for the current generation consoles could be much higher than we are assuming (artificially suppressed by supply chain issues). They are still out of stock on Amazon when I checked today.

(Brad) NCAAF is back and now Brad is happy. But also gaming is a clear secular growth story and Microsoft has been the most consistent performer within that to date aside from maybe Nintendo. The bull case? Keep doing what you’re doing.

Bear Case:

(Ryan) I think the worst-case scenario for Xbox is that in 10 years the gaming landscape looks a lot like it does today. Player bases remain fragmented by device type and there is no clear one-stop-shop solution for all kinds of gamers. They’d have to maintain spending across almost all categories, while not reaping the returns they could if they had one, unified solution.

(Brett) The only bear cases that come to mind are if console/AAA gaming sees disruptive innovation in VR/cloud (but not mobile, which is different) and Xbox isn’t there to capture it. This is an industry with tens of billions of dollars being spent to disrupt the incumbents that seem to go through major changes every five to ten years.

(Brad) Aside from VR which Brett is going to get into, the only thing I can think of is rights to sports games becoming more expensive as we’re seeing with TV rights. But even then, Microsoft can afford to pay up. Tough to identify a strong bear case here.

More or less interested?

(Ryan) More interested. Would love for this to be an independent business. It’s growing, sticky, and has tons of optionality.

(Brett) More interested. I think Xbox is an amazing business and would not be surprised if this is worth $500 billion someday. It is a shame this is not its own publicly traded stock.

(Brad) More interested. If this ever spun off from Microsoft I’d be extremely interested in owning it… just like YouTube… just like Instagram etc. This is an iconic brand with a dominant market share and clear margin expansion ahead.

Stock for next week? (Capcom)

Sources and Further Reading

Phil Spencer (CEO of Xbox) Interview at Bloomberg:

Video game console lifetime unit sales estimates: https://en.wikipedia.org/wiki/List_of_best-selling_game_consoles

Microsoft Segment Results: https://www.microsoft.com/en-us/Investor/earnings/FY-2022-Q4/productivity-and-business-processes-performance

Xbox promises to keep Call of Duty on PlayStation: https://www.theverge.com/2022/9/2/23334619/microsoft-sony-call-of-duty-playstation-letter-commitment-activision-blizzard