Not So Deep Dive: Zillow Group (Ticker: Z)

What's next for the internet marketplace after the iBuying debacle?

Research folder with show notes, charts, and valuation: https://drive.google.com/drive/u/0/folders/1lMsck6SeNB2EhFQPX9TstPecKQq1nNpk

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report.

As always, listen to the episode on Spotify, Apple Podcasts, or wherever you are subscribed to the show.

Show Notes and Charts

(Ryan) What they do: Zillow is the most visited real estate website in the US. They have a number of brands under their portfolio including Trulia, StreetEasy, Hotpads, and OutEast that in total attract 234 million monthly unique users. In order to get its data, Zillow has partnerships with tons of local MLSs, access to county records, and tons of users and agents that manually enter their information.

Today, Zillow has basically two reporting segments that contribute to its revenue:

Internet, Media, and Technology (IMT): IMT is the bulk of Zillow’s business and it consists of a number of products including Premier Agent, Rentals, and several real estate advertising and business software solutions (Dotloop, Display, ShowingTime).

Premier Agent: Within Premier Agent, Zillow basically sells advertising space to agents who are trying to generate leads to sell homes to prospective buyers. Historically, Zillow sold these ad slots on a CPM basis, however, they’ve begun changing to a revenue model called “Flex”. Flex pretty much changes the payment structure from up-front to commission-based. So now, once a transaction closes, Zillow receives a percentage of that transaction volume. Some sources report that it’s between 30%-35%.

Rentals: Zillow generates revenue within its rentals segment by selling advertising space to property managers on a cost-per-click basis. Essentially, if you’re trying to rent out your space, you pay Zillow for distribution.

Mortgages: Mortgages are pretty much exactly what they sound like. If you’re looking for a home loan, you can go to Zillow Home Loans and receive a mortgage origination. Most of the time, Zillow then sells that mortgage into the secondary market so they don’t have to take the balance sheet risk.

(Ryan) History: In 2004, Zillow.com was founded by Rich Barton and Lloyd Frink, two former Expedia executives. The two gathered a small team and launched Zillow.com in 2006. In a 2016 interview, Rich Barton said “it was pretty much a logical extension to what we did when we built Expedia. With Expedia, we were giving power to the people, giving travelers the power to plan their own trips, to make decisions for themselves, to see all the prices and all the choices, and be able to take the time they wanted in planning something that was so important to them, a trip.” Expedia was bought in 2003 by IAC, and Rich and Lloyd needed something to do. The two of them were going through the home-buying process themselves and thought there needs to be a marketplace for consumers to look at all their options.

So they launched and explored a couple of different revenue models. There was a point when they thought about trying to be the brokers themselves, but realized there’s a lot of value that agents provide that Zillow wasn’t very good at. So they opted to go with the advertising model. Since then, Zillow has acquired tons of different smaller businesses and explored different ways to monetize the platform, including most notoriously, iBuying. They entered the iBuying business in 2018 and amassed a more than $1.5 billion deficit, then exited the business in November of 2021.

(Brett) Industry/Landscape/Competition:

Zillow operates in a unique position in the housing market, so it is tough to estimate its addressable market

Luckily, management shared that it currently only monetizes approximately 3% of the real estate transactions that it potentially could.

Assuming all these revenue opportunities have the same gross margins, that is a $58 billion gross profit opportunity (taking 2021 revenue and dividing it by 3%). So clearly, the real estate brokerage/transaction market is huge

Competitors: specifically outlined in the 10-K as iBuyers (like Opendoor, who are frenemies), other real estate marketplaces (like Redfin, Compass, Apartments.com), and legacy players in the brokerage space, including institutional buyers.

For example, you could consider last week’s company NVR and its more integrated model as a competitor because it builds to own and does mortgages itself, with the home likely not becoming relevant on Zillow until it is sold for a second time.

Essentially, Zillow is competing to win all the ancillary fees and revenue streams from a real estate transaction. After it gave up iBuying, this includes everything but the transaction itself.

(Brad) Management and Ownership – Classes A and C are the commonly traded classes of stock. Class B is where executives maintain their voting power and class B gets 10 votes per share. I don’t believe class c shares have voting power so they’re sort of a quasi-preferred stock class.

CEO is Rich Barton since 2019:

Co-founder and was also CEO from 2004 to 2010 but chairman between then

Netflix Board member

Co-Founder of Glassdoor

Founder of Expedia

General Manager at Microsoft

CFO is Allen Parker since 2018:

Was the VP of Finance at Amazon in various departments for 13 years

Former director at General Electric

Former CFO of American Standard

COO is Jeremy Wacksman since 2021 (with the company for 14 years and had been President and CMO before this

Advisor/Board member at GoFundMe, Rover, and Dollar Shave Club

(Brett) Valuation:

Dynamic multiples: https://docs.google.com/spreadsheets/d/1N-ecTt6Y1hqEf2rh_rWIX3Zy6Zrt-AE2A9BFljCE0As/edit#gid=257234201

Market Cap of $7.1 billion

Enterprise Value of $5.3 billion

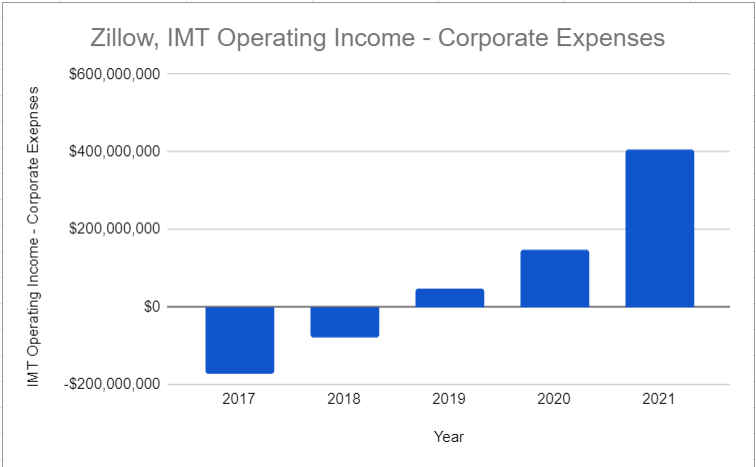

EV/GP of 3

EV/IMT Operating Income - Corporate Expenses of 13

I’m using IMT operating income as an earnings multiple because it is the largest earnings driver for this business. However, I wanted to include corporate expenses in the calculation because management has started to back out a lot of its spending when it breaks out segment profitability.

(Ryan) Earnings:

Last 12 months (Includes iBuying business):

$10.9 billion in revenue, up 174% YoY

$1.2 billion in operating cash flow

Cash flow is elevated right now as Zillow is selling through all the homes on its balance sheet without purchasing any. They officially closed the iBuying business during the 3rd quarter.

Most recent quarter (Without iBuying):

$504 million in revenue

IMT revenue was $475 million, flat YoY

Mortgage revenue was $29 million, down 49% YoY (mortgage business originally serviced iBuying customers, so volumes declined in line with iBuying closure)

Earnings before taxes were $31 million

Adjusted EBITDA was $165 million

But they spent $102 million on stock-based compensation this quarter so the adjusted EBITDA number is not a great proxy for true earnings to shareholders.

(Brad) Balance sheet and liquidity:

It has $2.2 billion in cash and equivalents vs. $2.6 billion YoY, but it now has $1.4 billion in short-term investments vs. $500 million YoY. So that’s where the cash went.

Just $55 million borrowed under credit facilities

$1.7 billion in convertible senior notes with rates between 0.75% and 2%

About 4% of equity dilution is available to the company via current shares authorized vs. outstanding.

It looks like it settled $1.1 billion in long-term debt earlier this year. Part of the unwinding of its “Zillow Offers” business.

Anecdotal Evidence:

(Ryan) I browse it occasionally. I’ve never transacted through there though.

(Brett) It has phenomenal brand awareness, as we all know. However, if I’m imagining myself buying a home, I don’t know whether I would use any of Zillow’s services that make money. I think this is the issue that is keeping them at only 3% of real estate transactions right now.

(Brad) That’s where I go to find homes to get rich and then get off the grid. Kidding. But I did use it a lot in undergrad to set up housing.

Future growth opportunities:

(Ryan) Partnership with Opendoor. This was established in August of this year. If you’re looking to sell your home, you can receive an automatic bid through the Zillow platform but from Opendoor. Zillow gets a referral fee on sales while Opendoor takes the balance sheet risk.

(Brett) The ShowingTime acquisition. This was made for $512 million, so a hefty price for what is supposed to be a strategic purchase. The service helps people manage walk-throughs and tours of real estate properties. As CEO Rich Barton says, they want to make ShowingTIme the “OpenTable for real estate,” and also integrate it into the Zillow app. This could be helpful if it drives more users (on both sides of the transaction) to start using revenue-generating products from Zillow.

(Brad) Easing macro. Mortgage rates will not just continue to set new ATHs week after week. We will get to a point where the hawkish cadence slows and the housing market again enjoys a tide lifting all boats. It should be able to take advantage of this as it did during the last fun period for real estate… Metaverse real estate?? (kidding)

Highlights and lowlights:

Ryan’s Highlights:

Still the leading real estate marketplace. 234 million unique users across their apps and sites.

Their core IMT operations are durable and profitable, and they had the good sense to shut down iBuying before everyone else.

$1.7 billion in net operating loss carryforwards. Should help offset taxes for a couple of years.

Ryan’s Lowlights:

They’re implementing the new commission-based flex model right at a time when housing transactions look poised to implode.

They constantly find new ways to lose money.

Brett’s Highlights:

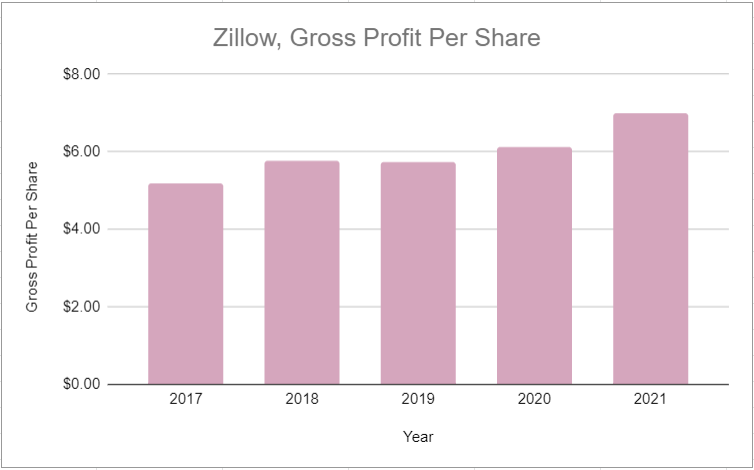

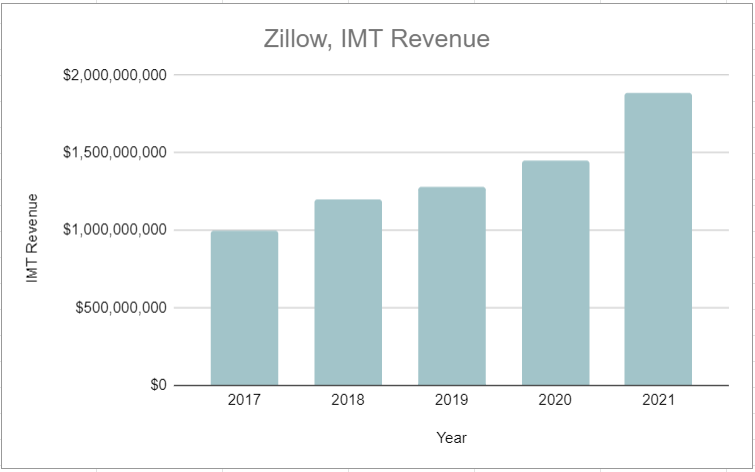

Brand awareness. The company has won on the app side, word of mouth, everything vs. its internet competition. It is no surprise to see MAUs and site visits growing year after year. From my point of view, this should make it easier for them to add these new revenue generators and why IMT revenue has grown over the last five years.

The “internet” opportunity within the real estate market is still large, and much larger than other industries that have made the switch earlier. However, it is telling how much friction and switching costs there are that a lot of the real estate market is still analog.

Hitting goals set five years ago. Looking at an earnings release from 2018, management did what it set out to do in the IMT segment (iBuying, not so much). This gives me some confidence they can hit these goals in the future. Press release: https://investors.zillowgroup.com/investors/news-and-events/news/news-details/2019/Zillow-Group-Reports-Fourth-Quarter-and-Full-Year-2018-Results/default.aspx

Brett’s Lowlights:

Capital allocation. It has been very poor since Zillow went public, and the decisions from management have lost shareholders money. All these acquisitions and the $1.57 billion iBuying “experiment” (cumulative operating loss from that segment) do not leave me confident in management.

The acquisition strategy (from a product perspective). It is unclear to me why Zillow doesn’t just try to build all of these products within its crown jewel, the actual Zillow app. It seems to me like management is wasting time, resources, and employees to try and mash everything together to create a “Super App” which is risky.

To sum this up, here’s a list of Zillow’s acquisitions over the years:

Postlets (unknown price)

Diverse Solutions ($7.8 million)

StreetEasy ($50 million)

Trulia ($3.5 billion)

Naked Apartments ($13 million)

ShowingTime ($512 million)

Have any of these been worth it?

As another data point, Zillow’s stock price is only up 146% since going public coming out of the Great Financial Crisis. Its market cap? Up 863%.

Brad’s Highlights:

The leadership team has been around forever and features impressive backgrounds. They also showed great leadership in my view by ending their home-buying business before it became a cool decision to do so. Shows me they’re willing to move fast and break things but also admit when swings were misses.

Asset light approach makes any moat that could potentially exist all the more lucrative.

Brad’s Lowlights:

The business is and always will be wildly cyclical. It’s very difficult to assume rates of compounding or run rate margins here. As much as leadership can help steer the ship, they are very much so at the mercy of macrocycles.

It also relies on capital market funding supply which is fickle with extremely volatile pricing.

Bull Case:

(Ryan) Basically, you’re buying this for the IMT business and hoping they don’t hemorrhage cash in this mortgage segment. Over the last 12 months, IMT has generated $1.9 billion in revenue and $444 million in earnings before taxes. That business has grown ~50% since 2019. At today’s enterprise value, investors are paying just under 13 times EBT for that business. I think this business needs to grow the top line by high single digits and maintain its margins for investors to get a good return here.

(Brett) The IMT segment profitability turns into actual cash flow once all the iBuying and one-time expenses go away. If this occurs, the company could be generating north of $500 million in free cash flow a year and has a clear path to consistent top-line growth. At the current enterprise value, this could equate to great returns over the next five years or so.

(Brad) Seems like this is well covered above. So I’ll just say that the world has been extremely unkind to housing in 2022. The bull case is that Zillow has preserved (even grown) its market share and so now is perfectly positioned to take advantage of the next hot housing market.

Bear Case:

(Ryan) A big slowdown in the housing market over the next few years coupled with continued poor capital allocation. If they keep finding ways to destroy the cash their golden goose (IMT) generates, returns are going to be underwhelming.

(Brett) Management capital allocation decisions. I don’t think I’m understating things when I say it has been horrendous over the last 10 years. Why should I expect this to change in the future?

(Brad) The buying experiment turns into another failed experiment and then another. And this eventually becomes a clear one-trick pony without any kind of optionality. Not the end of the world considering housing is a massive market, but still.

More or less interested?

(Ryan) Less interested. I am really discouraged by the poor capital allocation decisions over the last decade.

(Brett) Less interested. This business clearly has a strong competitive advantage with the Zillow marketplace, but I cannot trust management.

(Brad) Less. If I had to pick between this company, Redfin, and Opendoor, I’d choose Zillow every day of the week. But I wouldn’t pick any of them.

Stock for next week? (Dream Finders Homes)

Sources and Further Reading

Aug. 2022 ValueInvestorsClub Writeup: https://www.valueinvestorsclub.com/idea/ZILLOW_GROUP_INC/0857420337

Q2 2022 Shareholder Letter: https://s24.q4cdn.com/723050407/files/doc_financials/2022/q2/Zillow-2Q22-Shareholders'-Letter.pdf

Q2 2022 10-Q: https://s24.q4cdn.com/723050407/files/doc_financials/2022/q2/f0f59f3e-d400-4d9a-a4ed-50acdbf6acac.pdf

Recent Executive Transcripts (need Koyfin login). March 2022 Investment Conference outlines current strategy: https://app.koyfin.com/news/ts/eq-zxwwye