*This newsletter is free, but if you want to support it, our podcast, or website, upgrade to the paid version for $5 a month here:

**If tables/charts are not showing up, click on the link to read the web version.

*Link to the spreadsheet for anyone interested in how we calculate returns

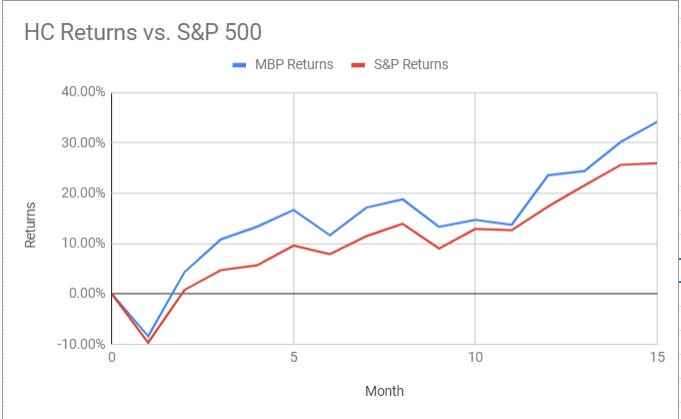

This is the 15-month update of Hypothetical Capital, or HC (we changed the name this month). It is a mock portfolio of our favorite investing ideas. Since it began in November 2018, HC is up 34.19% vs. the S&P 500’s 25.95%. All prior monthly updates can be found here.

One of, if not the best month for Hypo Cap so far (thank you Federal Reserve). In all seriousness, we got some solid outperformance from our largest holding, Square. The stock has broken out to a new 52-week high heading into earnings and is now up 34.8% for us. We also got some solid contributions from Teladoc and Activision Blizzard.

If you’ve read our previous updates (and if you have not, I’d recommend checking them out here) you know that beating the market for 15 months is not our goal. Our goal for HC is to show that spending 1-2 hours with one “trading” day a month can outperform heavily managed funds.

Here are the rules we have set to try and mimic a real portfolio as closely as possible:

We can only change our asset allocation on the 20th (or around then) of each month. All other days are off-limits, meaning we can only add or subtract from our allocation once a month. (We’re not the day trading type anyways, so this should not affect our investing philosophy).

No derivative securities (options or futures).

We are not reinvesting dividends, for calculation purposes. Although we highly recommend that you do so in a real scenario.

We cannot incorporate any commission fees so we will act like we are investing through Robinhood

We are competing against the S&P 500 so the benchmark for the portfolio will be how much it has beat or lagged the market since its inception.

Shares Held 1/20/20 - 2/22/20

*From initial purchase price, not time-weighted.

Top Performer

Like I mentioned above, Square delivered some fantastic returns for the HC this month. And, since Square is our largest holding, it provided the largest absolute returns for the HC this month. We are still very confident in Square and see no reason to trim our position unless it becomes an outsized part of the portfolio.

Worst Performer

A rising tide lifts all boats, so there wasn't really any negative performers this month. However, after earnings, Roku did dip a little and now sits below $120 a share. It is still up almost 200% for us though, so we are definitely not upset when it goes through a one month gully.

Dividends Paid

Buying and Selling

Schwab Short Term Treasury ETF: We sold some SCHO to get some cash for spending.

Match Group (MTCH): At $73.50 a share, Match is back down to the levels we bought at previously. They had a great (in our opinion) earnings report, and it is one of our highest conviction picks for the long-term. They now sit at about 5.5% of our portfolio.

Semler Scientific (SMLR): As outlined by this post from Brett and our show covering the stock, we love Semler's long-term potential.

Target (TGT): After a less-than-stellar quarter and a year of getting a valuation re-rating, we thought it was time to be done with Target, at least for now.

Allocation for Next Month

Our podcast going over the HC will be released soon. You can listen to the show here.

See you in a month,

Brett and Ryan