*This newsletter is free, but if you want to support it, our podcast, or website, upgrade to the paid version for $5 a month here:

*Link to the spreadsheet for anyone interested in how we calculate returns

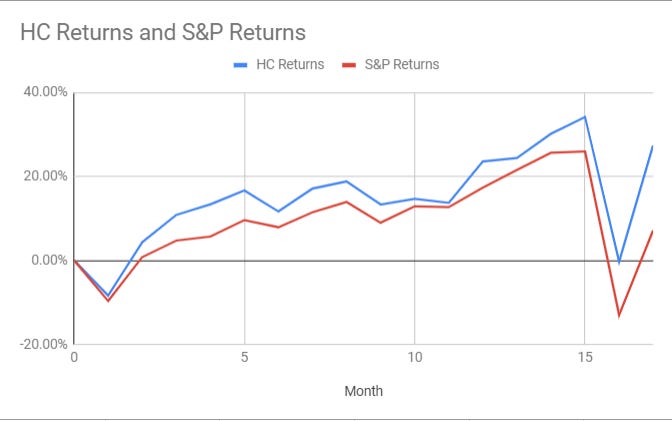

This is the 17-month update of Hypothetical Capital, or HC. It is a mock portfolio of our favorite investing ideas. Since it began in November 2018, HC is is up 29.03% vs. the S&P 500’s 8.47%. All prior monthly updates can be found here.

What a wild month. You can see it in the chart above, but all stocks have been extremely volatile in the past two months. Luckily, the last update we deployed a lot of our cash, and it has (so far) done very well. Roku, Teladoc, and JD.com have been crushing it, leading to 20% outperformance of the S&P 500.

But we are still staying cautious. We'll go over the changes we made below, but to summarize, we don't think it is an exaggeration to say these are very uncertain times. Sure, this is just a hypothetical portfolio combining both of our top ideas, but it is a proxy for how we operate our personal portfolios as well.

If you’ve read our previous updates (and if you have not, I’d recommend checking them out here) you know that beating the market for 17 months is not our goal. Our goal for HC is to show that spending 1-2 hours with one “trading” day a month can outperform heavily managed funds.

Here are the rules we have set to try and mimic a real portfolio as closely as possible:

We can only change our asset allocation on the 20th (or around then) of each month. All other days are off-limits, meaning we can only add or subtract from our allocation once a month. (We’re not the day trading type anyways, so this should not affect our investing philosophy).

No derivative securities (options or futures).

We are not reinvesting dividends, for calculation purposes. Although we highly recommend that you do so in a real scenario.

We cannot incorporate any commission fees so we will act like we are investing through Robinhood

We are competing against the S&P 500 so the benchmark for the portfolio will be how much it has beat or lagged the market since its inception.

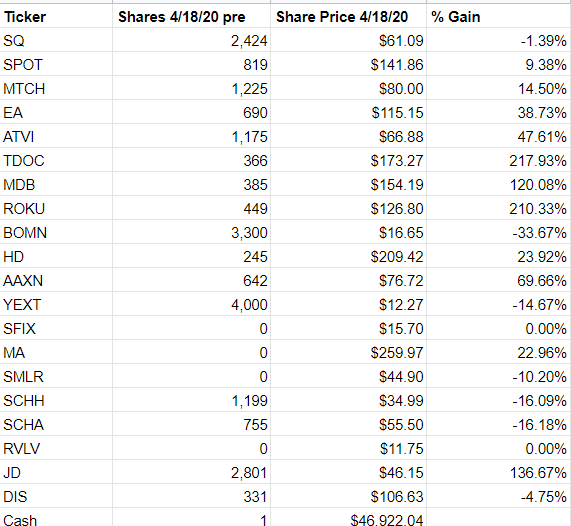

Shares Held 3/22/20 – 4/18/20

*Not time-weighted

Top Performer

Roku had the biggest monthly jump and is now again up 200% for us. They pre-announced and earnings beat, which caused the stock to skyrocket last week. We have no plan to sell our shares anytime soon.

Worst Performer

Boston Omaha has not recovered from the March sell-off and is still down over 30%. This was not because of any struggles within the business (although almost everyone is struggling right now), so we're unsure why the stock is down so much. We still like it as a potential long-term compounder and "mini-Berkshire," but we'll see how the business is looking in a few years.

Dividends Paid

Buying and Selling

Stitch Fix: We bought into Stitch Fix, and it now makes up a sizable position in the portfolio. We would have liked to get in when shares were trading at $11-$12, but $15-$16 is just fine. The company should get a market share boost since they are entirely eCommerce, and the stock is trading like a bargain if you think they can ever get 5% net margins. We think they can.

Revolve Group: A stock Brett is a big fan of, Revolve Group (Ticker: RVLV) is an online clothing retailer that sells high-end fashion stuff, mainly to younger rich women. Read about the bull-case here.

JD.com: So sad, but we had to let one of our top performers go. JD.com is a phenomenal business if the numbers are real. And at the moment, there's no way anyone should trust financials coming out of China. Also, the stock is not being priced like a recession is happening in the nation, which it most likely is. (read Brett's piece on why he sold JD.com here.)

Disney: When the facts change, you have to update your investment thesis, and that's what we've done with Disney. They operate cruises, theme parks, and have the biggest movie studio in the world. None of these will be even close to full capacity for at least 12 months and likely more. This is not being priced into the stock and is the biggest reason why we sold all of our shares.

Allocation for Next Month

On Monday the podcast going over the portfolio will be released. You can listen to the show here.

See you in a month,

Brett and Ryan