*This newsletter is free, but if you want to support it, our podcast, or website, upgrade to the paid version for $5 a month here:

**If tables/charts are not showing up, click on the link to read the web version.

*Link to the spreadsheet for anyone interested in how we calculate returns

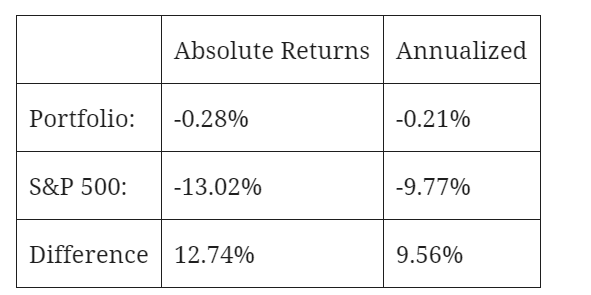

This is the 16-month update of Hypothetical Capital, or HC. It is a mock portfolio of our favorite investing ideas. Since it began in November 2018, HC is down -0.28% vs. the S&P 500’s -13.02%. All prior monthly updates can be found here.

It's been a tough month for anyone long stocks. As you can see from the chart above, the drop in market prices has been sharp and painful. Luckily we kept over 10% of HC in cash and treasuries, which we can put to work this month. A lot of our favorite stocks are trading at a 30%+ discount, and we fully expect to take advantage of it. Hypothetically, of course.

If you’ve read our previous updates (and if you have not, I’d recommend checking them out here) you know that beating the market for 15 months is not our goal. Our goal for HC is to show that spending 1-2 hours with one “trading” day a month can outperform heavily managed funds.

Here are the rules we have set to try and mimic a real portfolio as closely as possible:

We can only change our asset allocation on the 20th (or around then) of each month. All other days are off-limits, meaning we can only add or subtract from our allocation once a month. (We’re not the day trading type anyways, so this should not affect our investing philosophy).

No derivative securities (options or futures).

We are not reinvesting dividends, for calculation purposes. Although we highly recommend that you do so in a real scenario.

We cannot incorporate any commission fees so we will act like we are investing through Robinhood

We are competing against the S&P 500 so the benchmark for the portfolio will be how much it has beat or lagged the market since its inception.

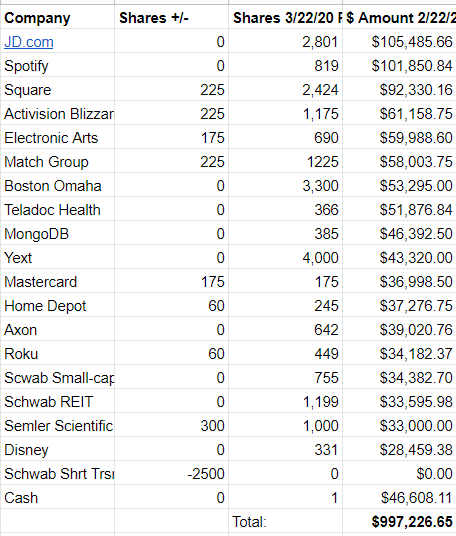

Shares Held 1/20/20 – 2/22/20

*From initial purchase price, not time-weighted.

Top Performer

Teladoc has gotten a boost from the increase in hospital visits and is now up 160% for us. People don't want to have to see a doctor physically for fear of spreading the virus, which they can do through virtual healthcare offerings. Teladoc now makes up a decent part of the portfolio, but we see no reason to sell shares right now as we plan on holding the stock for at least five years, barring any material changes.

Worst Performer

Basically every stock besides JD.com and Teladoc. The past month has been the fastest bear market in history, and it only looks worse from here. However, since we are in it for the long haul, there's no reason for us to sell any of the quality businesses, even with this (hopefully) short-term economic crisis.

Dividends Paid

Buying and Selling

Schwab Short Term Treasury ETF: We sold all of our Short Term Treasuries to raise cash.

Semler Scientific (SMLR): Semler Scientific is perhaps our favorite small-cap stock. Listen to the show we did on them here.

Roku: Down to the $76.13 a share, Roku now trades at a discount to what we believe its long-term potential is. Without getting too much into details, listen to our interview with Dhaval Kotecha to understand why their CTV platform is so promising.

Home Depot: This is one of the best-run companies in the world, and is trading at a trailing P/E under 15. Yes, with a recession there will be some impact on earnings, but in the long run Home Depot is not going anywhere.

Mastercard: A new addition to the hypothetical portfolio! Mastercard has been crushing it for years, and may have the strongest moat in the entire investing universe. It now trades at a P/E of 26 (trailing, but again, focusing on long-term here), which is a bargain for this fantastic business.

Match Group (MTCH): We bought last month at much higher prices, and see no reason why we wouldn't this month. Yes, people will not be going on physical dates during this quarantine, but they still will be spending time on dating apps.

EA and Activision Blizzard: This one is simple. These are the top video game makers in the world, both with war chests of IP. We like these businesses long-term, but think there is going to be an extra boost in the short-run, especially if the lockdown goes on for more than a month.

Square: A recession that targets SMBs will severely hurt Square's card readers. However, that is not their entire business. Here is a tweet from Ryan to help you understand how much of a discount they are trading form their intrinsic value at the moment.

Allocation for Next Month

Our podcast going over the HC will be released soon. You can listen to the show here.

See you in a month,

Brett and Ryan