*This newsletter is free, but if you want to support it, our podcast, or website, upgrade to the paid version for $5 a month here:

**If tables/charts are not showing up, click on the link to read the web version.

*Link to the spreadsheet for anyone interested in how we calculate returns

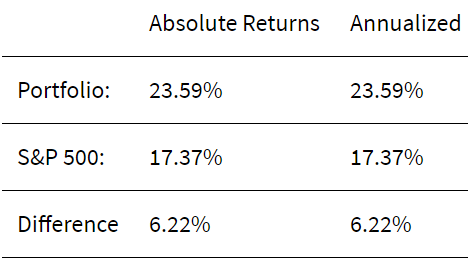

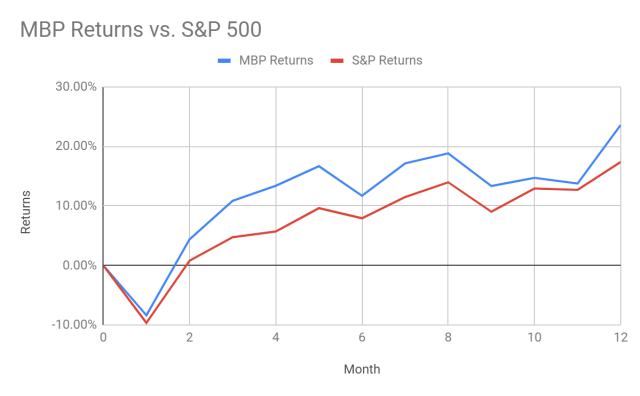

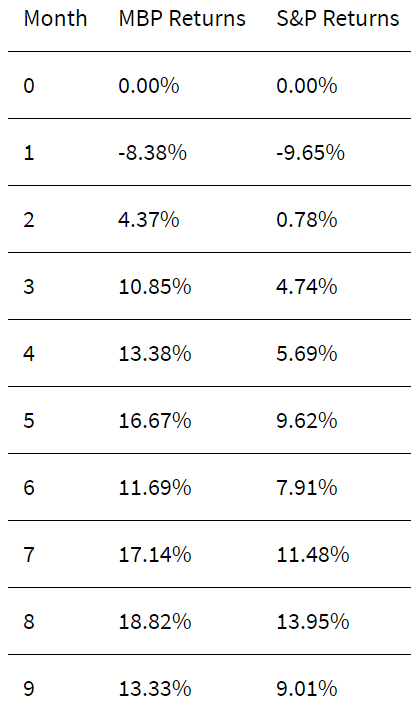

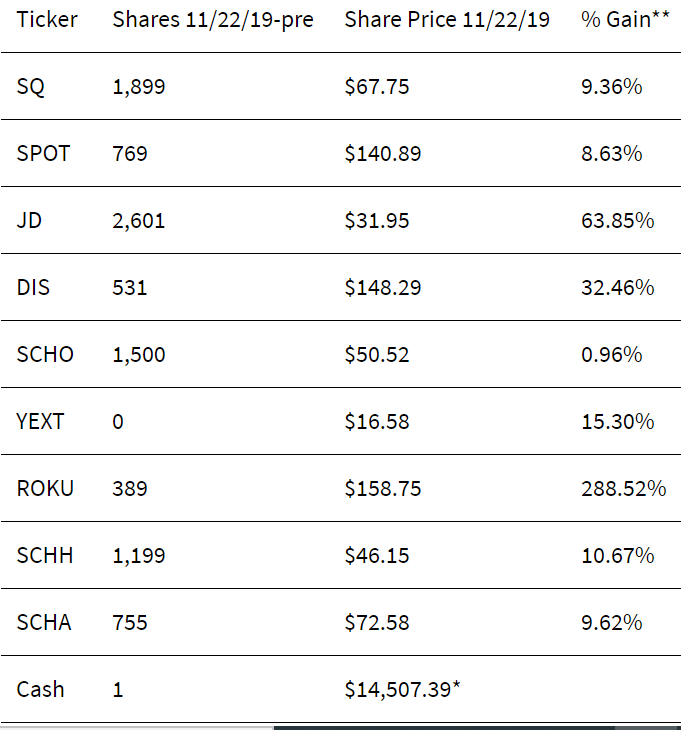

This is the one year update of the Market Brothers Portfolio, or MBP. It is a mock portfolio of our favorite investing ideas. Since it began in November 2018, the MBP is up 23.59% vs. the S&P 500’s 17.37%. All prior monthly updates can be found here.

Our returns, even with the market hitting a new all-time high, were strong this month. Plenty of stocks we own had fantastic earnings, leading to 20%+ pops. However, this does not mean we are selling any of our positions to try and time any potential pullbacks. That has been shown to be a fool's errand.

If you’ve read our previous updates (and if you have not, I’d recommend checking them out here) you know that beating the market for nine months is not our goal. Our goal for the MBP is to show that spending 1-2 hours with one “trading” day a month can outperform heavily managed funds.

Here are the rules we have set to try and mimic a real portfolio as closely as possible:

We can only change our asset allocation on the 20th (or around then) of each month. All other days are off-limits, meaning we can only add or subtract from our allocation once a month. (We’re not the day trading type anyways, so this should not affect our investing philosophy).

No derivative securities (options or futures).

We are not reinvesting dividends, for calculation purposes. Although we highly recommend that you do so in a real scenario.

We cannot incorporate any commission fees so we will act like we are investing through Robinhood

We are competing against the S&P 500 so the benchmark for the portfolio will be how much it has beat or lagged the market since its inception.

Shares Held 10/19/19 - 11/24/19

*Including Dividends

**Not time-weighted. From the initial purchase price.

Top Performer

Axon Enterprises: The Taser and law enforcement software company beat on earnings and saw their shares rise 33% this month. Here is an article I wrote on the stock.

Worst Performer

Home Depot: The retailer missed estimates from the Street (don't know what because I really don't care), causing the stock to drop a few percentage points. We tend to stay away from large businesses because of the law of large numbers but like Home Depot, Disney, and Berkshire Hathaway because they are "forever businesses".

Dividends Paid

Buying and Selling

The Top Three: We want the portfolio to be more concentrated on our favorite picks, so we decided to add shares to Spotify, JD.com, and Square.

Yext: Our fifth favorite business for the long-term, we doubled our position in Yext.

Match Group: A new addition! Match Group owns Tinder, the dominate dating app for millennials. We think it has a long run ahead of it and tons of potential from a user and cash flow perspective. We did a fundamental analysis show for the stock which you can listen to here.

Schwab International ETF: This ETF has been in the portfolio since the beginning, but we couldn't come up with a reason why we should own it.

Tencent: Impossible (or very hard) to understand the business.

iQIYI: The Chinese video streamer has seen user growth come to a halt. They are also being regulated heavily by the Chinese government, which is a huge red flag, at least to us.

Allocation for Next Month

Our podcast going over the MBP will be released soon. You can listen to the show here.

See you in a month,

Brett and Ryan