[PODCAST] 2 Small-Cap Grocery Stocks with Big Upside Potential

But is Ryan buying for his portfolio?

YouTube

Spotify

Apple Podcasts

Today, we released a podcast episode that is a two-stock research report from Ryan. The stocks are Grocery Outlet and Sprouts Farmers Market (tickers GO and SFM).

One stock — Sprouts Farmers Market — is a good case study in finding an undervalued durable compounder. Grocery Outlet may share some of the same characteristics as Sprouts Farmers Market in 2020 and 2021.

Listen to the full episode to see if Ryan is buying either of these stocks today!

Below are his show notes from the episode.

Sprouts Farmers Market

How are they unique?

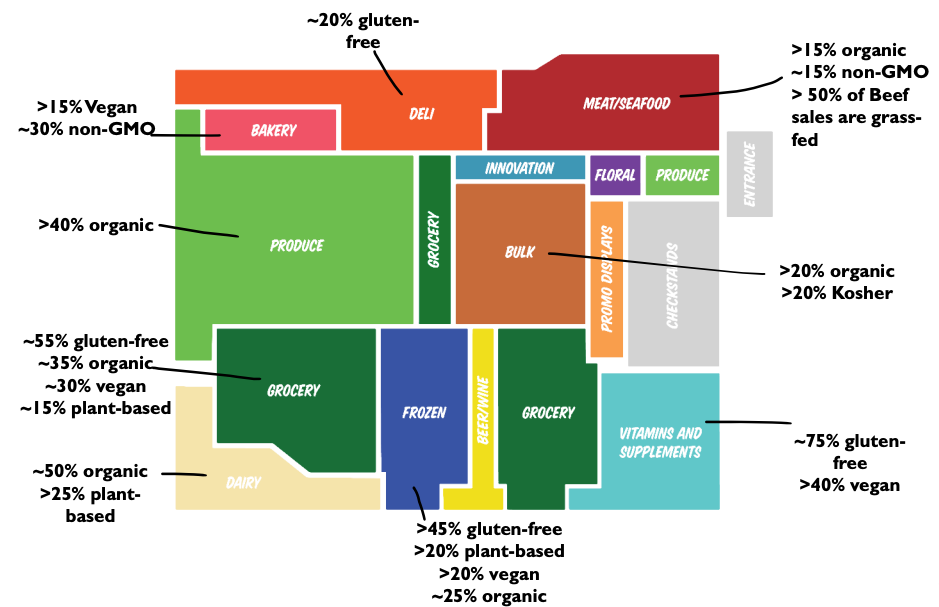

We were shareholders of Sprouts Farmers Market starting in 2021 and we’ve talked about them a couple of times on this show. But for anyone who isn’t familiar, Sprouts is a health-focused grocery chain with smaller sized stores (27k square feet) located primarily throughout the Western and Southwestern United States. They source locally and 70% of the items they sell are attribute-based.

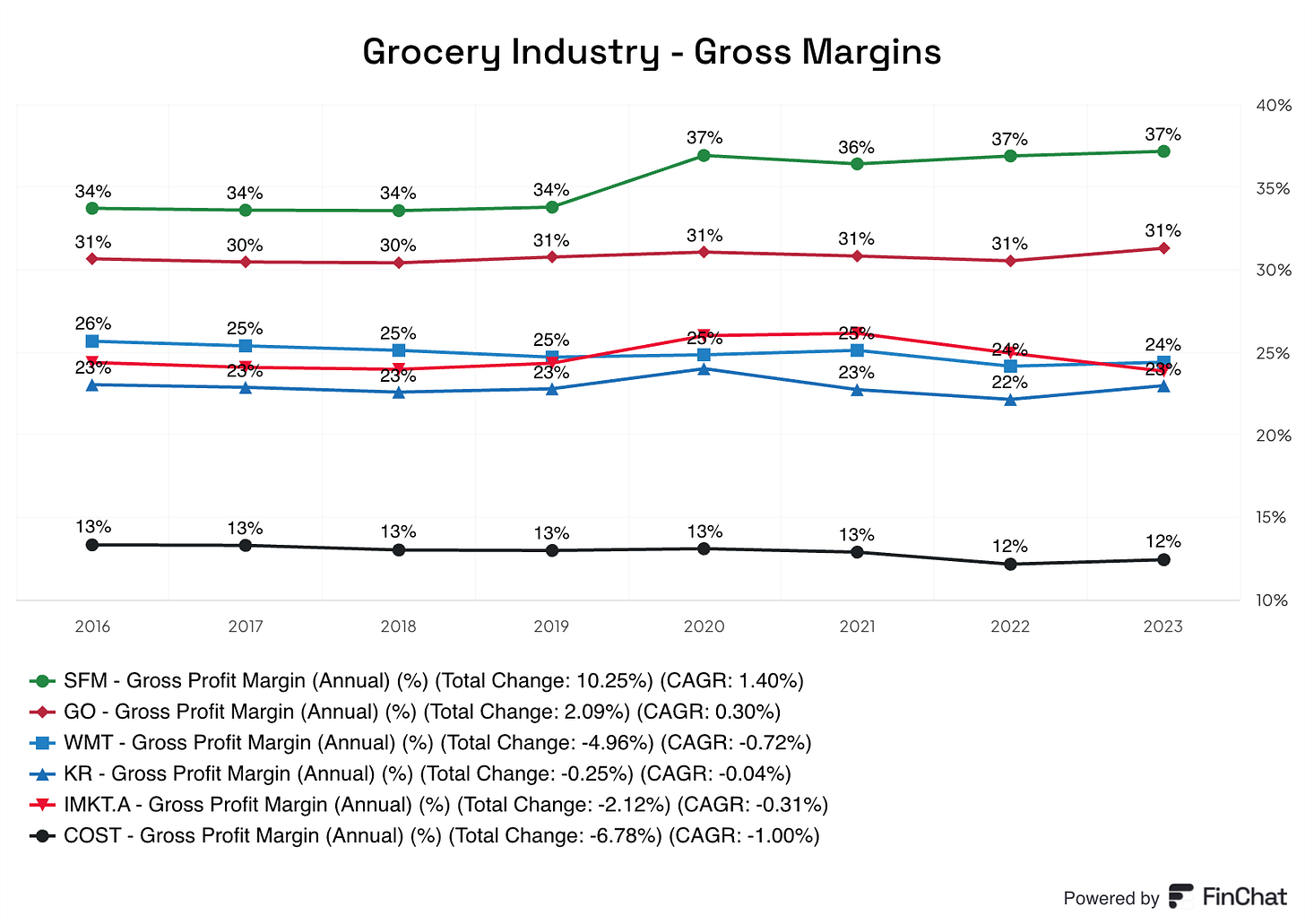

Since they sell primarily to “health enthusiasts” they aren’t really trying to be the low-cost provider. This means that they are able to generate best-in-class gross margins among grocers.

History & Management:

The first SFM store was opened in 2002 in Chandler, AZ. Over the first decade of operations, the business grew slowly but in 2012 it merged with Henry’s (which actually was founded by the same family), and in 2012 it bought Sunflower Farmers Market and rebranded all the stores to the Sprouts banner. A year later Sprouts went public.

However, over the first ~7 years of Sprouts being public was highlighted by rapid expansion. So much so that they were having a hard time supporting their own growth. Certain stores in some of the expansion markets lacked a nearby distribution center which led to lower quality goods and they were targeting any kind of customer they could get, aka “coupon clippers”.

Fast forward to 2019, and they decided to replace the CEO and bring in Jack Sinclair. Sinclair had been the head of grocery at Walmart and did a really impressive job running that business. When he stepped in, he pushed the shift towards being a more health-focused brand.

They shut down some underperforming stores, added a distribution center (DC), and made sure that all stores were within 250 miles of a DC. He also eliminated the mail coupons that Sprouts had become somewhat popular for, which took a short-term hit to sales. In hindsight, I think we can now officially say that this worked.

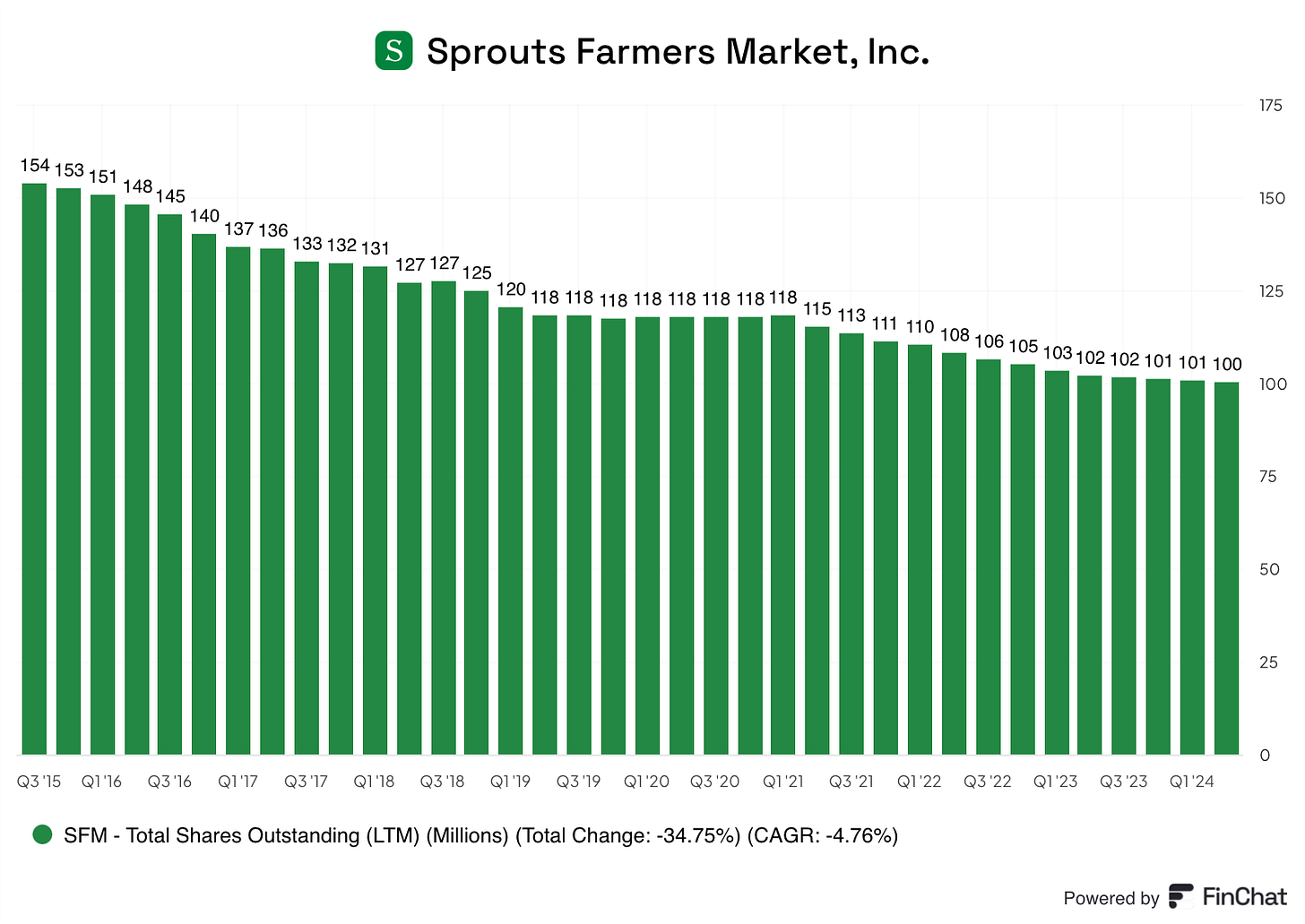

Comp-store sales are trending positively again and gross margins went from 29% in 2015 to 38% over the last 12 months. And somewhat unsurprisingly, there was actually quite a lot of skepticism around this time that they were going to be able to differentiate themselves and really become this “health-enthusiast” brand. So at the time, SFM’s stock traded at an EV/EBITDA of 6x. They had lots of cash on hand so they began to buy back shares and actually seemed to prioritize buybacks over store count growth for a while.

Long story short, a lot of things went right when investors didn’t think they would.

By the numbers:

In July of 2021, Brett wrote a detailed writeup on Sprouts at ~$24 per share highlighting why it was one of our largest holdings. Here was the summary:

Summary of Why We Own the Stock

- 10% annual store growth with a long runway for reinvestment unencumbered by competition (Update: Increased store count at 5% per year)

- Recovered margin profile and comp-store sales growth (Update: Operating margins have expanded from 5.5% to 6.1% (that’s a lot for a grocer) and Comp Store Sales growth has gone from -9.7% when lapping COVID to +6.7% last quarter.)

- Smart initiatives in marketing, store formats, and supply chain (Update: Gross margins have expanded and average store size is down 3%)

- Consistently dropping share count (Update: Share count has dropped ~5% per year since)

- High current and forward earnings/FCF yield (Update: EV/EBITDA has nearly tripled since the writeup)

With a high margin of safety due to the clean balance sheet and years of proven cash generation, we believe SFM stock has a high floor along with a high ceiling, allowing us to make this a concentrated position in our portfolio.

Long story short, Sprouts looked somewhat distressed a while back. New management came in, changed the target customer from coupon clippers to health enthusiasts, expanded margins, bought back stock, and added new stores. Today the stock is at $115, a 383% return over 3 years.

What’s the valuation look like today?

Obviously, it’s more expensive today than it was a few years ago, so it’s easy to feel like the returns are in the past. But that’s not the right way to invest. We need to look at the potential today relative to our opportunity cost.

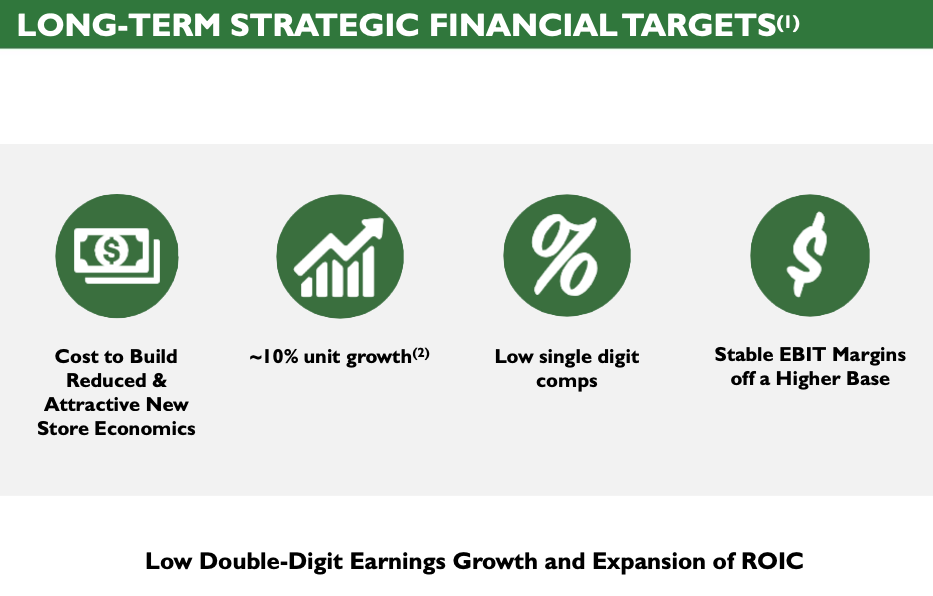

Here are their targets:

They are projecting 10% annual growth in store count, low single digit comp store sales growth, flat EBIT margins, but lower cost to build so potentially higher ROIC.

I think 10% is pretty optimistic (they’ve done 5% for like a decade), but let’s just say they hit all these targets. They’d be doing around $13 billion in revenue and just under $800 million in EBIT. Let’s say at an EV/EBIT of 20x, you’d get a 4% annual return. At 25x, you’d get ~8%.

Unfortunately, I think those are pretty optimistic assumptions, and it gets you less than a 10% IRR. Not sure I like that risk/reward.

Grocery Outlet Bargain Market

Grocery Outlet has a $1.6 billion market cap, and while the growth blueprint might appear similar, it operates a very different model from that of Sprouts Farmers Market.

What makes Grocery Outlet unique?

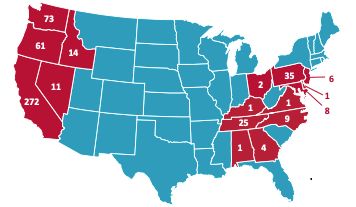

Grocery Outlet is a leading extreme-value retailer with just over 500 stores located primarily throughout the West Coast of the US.

To give some sense of what the typical store looks like, they aren’t too pretty, to be frank. They average 14,000 square feet of selling space, which is very small, but the discounts are significant. Grocery Outlet targets 40% average discounts relative to the prices at standard grocery stores, and they offer normal name-brand items.

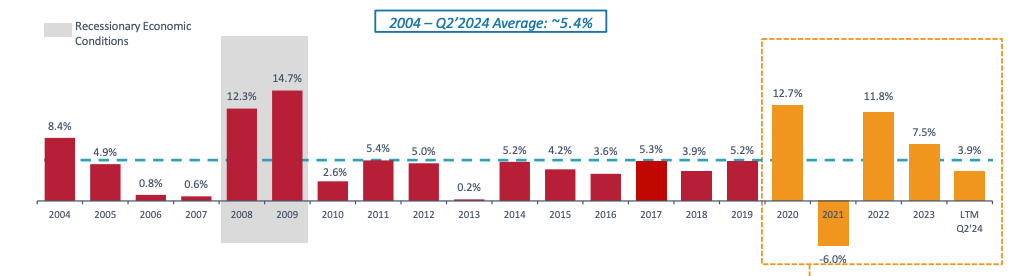

This deep-discount, “treasure hunt” style experience is quite resilient regardless of economic conditions. Aside from lapping COVID, they have reported positive comp sales growth every year for the last 20 years. And in 2008 and 2009, they delivered two of their best years ever.

How do they offer everything at such low cost?

Step 1: When a brand has excess inventory from packaging changes or manufacturing overruns, they call us.

Step 2: We buy these excess products for pennies on the dollar, passing the savings on to you.

Step 3: Each local store owner chooses products from our inventory that their customers will love the most, personalizing each store’s selection to its local community.

Step 4: We move the products into our stores and onto our shelves, where customers come back week after week looking for new finds, new brands and new and exciting ways to save.

So to break things down a little further, Grocery Outlet operates a franchise model at the store level. So each store is independently owned and operated by local entrepreneurs. They’ve found that this works out well as it allows the independent operators (IOs) to order the inventory that’s best suited for their community. They also probably have relationships in the community and might know many of the customers personally.

Importantly, these IOs contribute some initial capital to help get the store setup (inventory, staffing, etc.) but Grocery Outlet is responsible for funding the build-out of its store footprint, not the IOs. Grocery Outlet then collects a 50% share of the store-level gross profits.

The supply chain side of things on the other hand, is run at the corporate level. So they have a dedicated team responsible for finding excess inventory, closeouts, and overruns from suppliers all over the world. They bring these products into their distribution centers (couldn’t find an exact count, but looks like it’s ~7-10 across the country) and then the store operators can order from the Grocery Outlet inventory.

Interestingly, according to an interview with a former Grocery Outlet executive, GO already acquires ~30% of all close-out CPG inventory nationally. So it’s probably the biggest buyer already of this discounted inventory.

What are their ambitions? Can they get there?

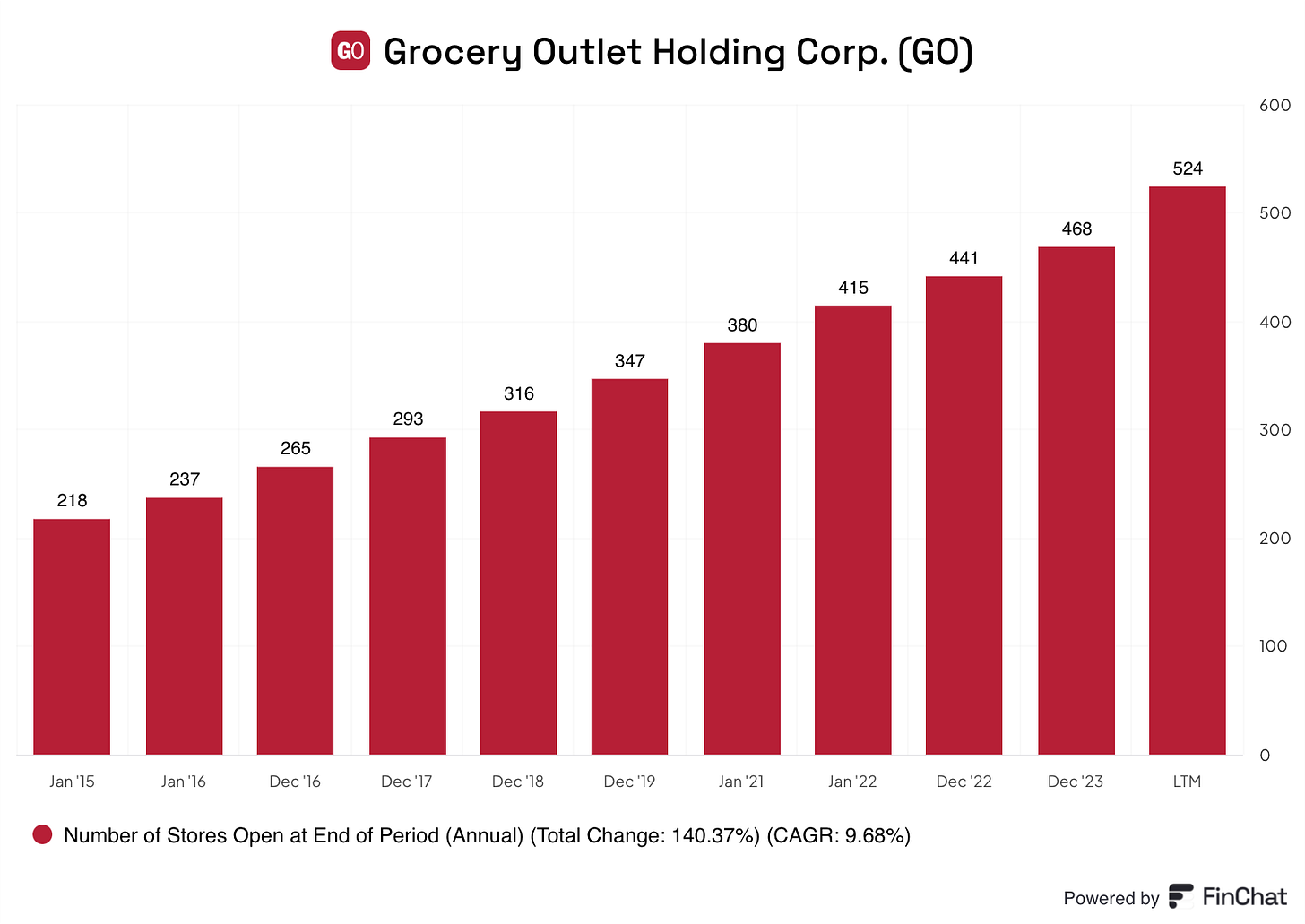

According to their latest investor presentation, Grocery Outlet is targeting 10% annual store growth over the long run and believes that they have the potential for 4,800 stores in total. That’s ~10X the current store base.

If you look at their historical results, the 10% target doesn’t seem too far-fetched.

They’ve grown store count by 9.7% since 2015. However, this number is slightly inflated as last year they acquired a company called United Grocery Outlet for $62 million in cash. United operates 40 stores and 1 distribution center across Tennessee, North Carolina, Georgia, Alabama, Kentucky, and Virginia. They also run a similar buying strategy to Grocery Outlet so in theory, it should be a decent strategic fit.

But here’s where I get a little concerned about them hitting this target. For starters, their independent operators are only allowed to own and operate one store. Generally speaking, I’m ok with this as it means the IOs are able to focus all their efforts on that one store. But if you’re trying to grow store count by 10% per year, right now that means you’ll be adding 50 new stores every year so you’ll have to recruit 50 new IOs to meet that target. That’s not easy to do.

My second concern is that they’re already a massive buyer of CPG closeouts. If they 10x their store count, there won’t be enough inventory to support that, so they’ll potentially have to adjust their buying strategy as they grow.

Current Economics? What could they earn? What’s the valuation look like today?

On average, over the last 10 years, Grocery Outlet has generated ~31% gross margins and ~3% operating margins. Free cash flow conversion is quite poor as they are responsible for building out their stores, so they tend to be valued on an Operating Income or Net Income basis.

They do have a little bit of debt through a term loan, so there’s some interest expense. So I’d probably use net income as the preferred metric here to value them on. Over the last 12 months, net income has been a little understated as they had a costly one-time ERP system transition, which makes margins look worse than they should be moving forward.

So if you add that $33 million back, GO is trading at a P/E of ~19x.

Let’s get into some assumptions. I think the following are realistic targets:

7% annual store growth

3% comp store sales growth

Long-run Net Margins of 2%

If that happens, they’d be earning around $134 million in net income in 5 years. We don’t do really elaborate models here, so let’s use the old “slap a multiple on it” approach.

I do think this is a recession-resilient business and one that should translate well into new states (people love low prices everywhere). So I don’t think a mid-teens earnings multiple is unrealistic. Let’s assume it trades at 15x in year 5, well then you’ve got probably a low to mid single-digit annual return.

Discussion:

Margin expansion?

Comp sales historically compared to assumptions?

What could go right?

There is the possibility that they way overshoot my estimate on the profit margins side of things. Let’s say the new stores (including the recently acquired ones) are just as successful as the existing ones, there’s maybe a path to 3% net margins. And that would make a world of difference in my valuation. But I wouldn’t be super comfortable investing in that thesis.

What could go wrong?

I think the outcome of this investment pretty much comes down to one big risk, either A) They’re unable to grow new stores at the rate they want or B) They open new stores aggressively, but the new stores don’t perform as well.

Here’s a quote from a short report on the company: “Our diligence suggests GO’s recent IO cohorts have struggled to make an acceptable ROI on their stores. There is evidence that GO’s systemwide AUVs are becoming increasingly bifurcated between “legacy core” markets and “new” markets, where legacy market AUVs remain healthy while newer store AUVs are increasingly challenged. We can see signs of this in GO’s new-store-productivity (NSP) metric trends and we have also spoken with several IOs who have described the wide performance differential between top quintile and bottom quintile stores, with a disproportionate amount of the newer stores falling into the latter category.”

Which one would I feel more comfortable buying here?

Listen to the episode and find out!

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.