[PODCAST] Am I Buying Celsius Stock? (Ticker: CELH)

Down 70%, this one has gotten a whole heckuva lot cheaper in 2024

YouTube

Spotify

Apple Podcasts

This morning, we released a podcast on Celsius Holdings. Below, you will find the show notes I made with charts to help visualize my analysis. Give the episode a listen, I hope you all enjoy it.

-Brett

“Our strategy of positioning Celsius as a global beverage leader for health-minded consumers remains our top priority. We continued our expansion further in traditional retail with great success. And we positioned the company for future growth with expanded roles within our ranks. In addition, we brought on high-performance individuals with diverse backgrounds and experience.” - John Fieldy, Celsius CEO. 2018

History: Why has Celsius succeeded? Why did they break through and become the third-category leader in energy drinks?

In order to tell the modern history of Celsius, we need to look back at when current CEO John Fieldy took over as CFO in 2012. From a GQ interview:

“January, 2012. And the company was struggling, right? In the first 90 days after I started, we got delisted out of Costco, which represented about 60 percent of our revenue. Then we got delisted out of other retailers. At that point, I didn’t think I was going to have a job in six months. We went back to the basics. We knew that we needed to build a strong foundation of loyal consumers. Loyalty is the only name of the game in consumer products. You can get trial, but if you can’t build loyalty, you won’t be able to build a brand. So we focused on continuing to build this loyal consumer within the fitness community. That’s a slow road. It’s not flashy for investors, but Carl saw the bigger opportunity. We wound up getting the company to be profitable in late 2015.”

Back in 2012, new management took over Celsius Holdings. They decided the brand needed a turnaround and better positioning in the energy drink category. Ever since, Celsius energy drinks have been focused on fitness, health, and being a “good for you” energy drink.

Progress was slow at first. The small enterprise was also spread too thin trying to manage distribution in North America as well as Europe and China. It then decided to get out of China and do a licensing deal for the brand in the country.

For the last 5 - 7 years, Celsius decided to:

Focus on the United States market

Build brand loyalty and awareness through fitness (gyms, influencers, etc.)

Focus on distribution through Amazon

It worked wonderfully. The counter positioning vs. Red Bull and Monster worked like a charm. Many people – especially women – are turned off by the brand perception of Monster and Red Bull. There is a certain “stink” to it similar to cigarettes. Loaded with sugar, tasting funky, marketing across extreme sports loved by a lot of “bros.”

Celsius is the opposite. And this is why revenue has soared in the last 10 years.

Just an incredible chart.

Revenue in 2014: $14.6 million.

Revenue in the last twelve months: $1.49 billion.

That is a 100x in revenue in around a decade.

What I want to highlight with these quotes is the consistency and scalability of the Celsius strategy. In 2012, Fieldy and the new management team decided to focus on fitness and health. They have not stopped this messaging ever since. Consistency is key when building brand loyalty. At first, they worked with gyms and small-time social media influencers. Today, they have brand deals with college football athletes and Inter Miami.

Success in sugar-free has spawned a ton of copycats to Celsius. They are getting attacked from above (Red Bull, Monster) and below with many upstarts trying to get in on the sugar-free energy drink game. We will get to the competitive threats later in the episode.

But first, let’s talk about the wider energy drink category:

Why is the category so attractive?

What is happening in 2024 to cause the stocks to fall?

What drives growth for the Celsius brand? Understanding category pressures

Energy drinks were popularized when Red Bull was invented in 1987 and reinvigorated when Monster Energy took off in the 2000s. For around 35 years now, the category has grown its share of ready-to-drink (RTD) spending.

Monster Beverage's revenue has grown from $180 million in 2004 to $7.4 billion over the last twelve months.

The entire energy drink category has grown by taking share from other RTD categories. Fewer people are drinking soda, orange juice, Gatorade, you name it. They are opting for things like seltzers (remember the La Croix craze?) and stuff with caffeine. They are replacing morning coffee for other people because of the caffeine connection.

Along with other CPG brands, energy drinks have been able to employ consistent price increases to drive revenue growth, at least over the long term. So not only is it a volume story, but a pricing power story.

You can see the category stealing share in drinks from this chart on the Celsius investor relations page.

In 2022, 2023, and so far in 2024, demand for other drinks has declined in value while energy drinks have grown.

However, 2024 has been a very slow year in energy drinks. Monster Beverage said it was the slowest year besides a short blip in COVID and the GFC in 2008.

Why? This is a tough question to answer.

Is the category losing share? No, look at the rest of the beverages. They are struggling worse.

Is it the weight loss drugs? No, I doubt it. Energy drinks are embracing sugar-free due to Celsius.

Is it a K-shaped recovery? I think so. Energy drinks are big in the convenience store and play bigger among poor people. Monster has said this is likely the cause. The dollar stores are struggling. It would also make sense as to why Celsius is gaining more share of category growth since it targets a wealthier customer.

All this to say, I don’t think the slowdown is a long-term problem for the category or Celsius. We are still seeing a transition to sugar-free caffeinated seltzer (essentially what Celsius is), it is just a cohort of the economy that may be struggling at the moment. I don’t think people are going to stop drinking caffeine, and I don’t think people will stop wanting an RTD product in a can with minimal calories.

What’s great about Celsius is it not only generates growth from the category tailwind and pricing power but from taking share within the energy drink category (a big tenet of the Peter Lynch philosophy, for what it’s worth).

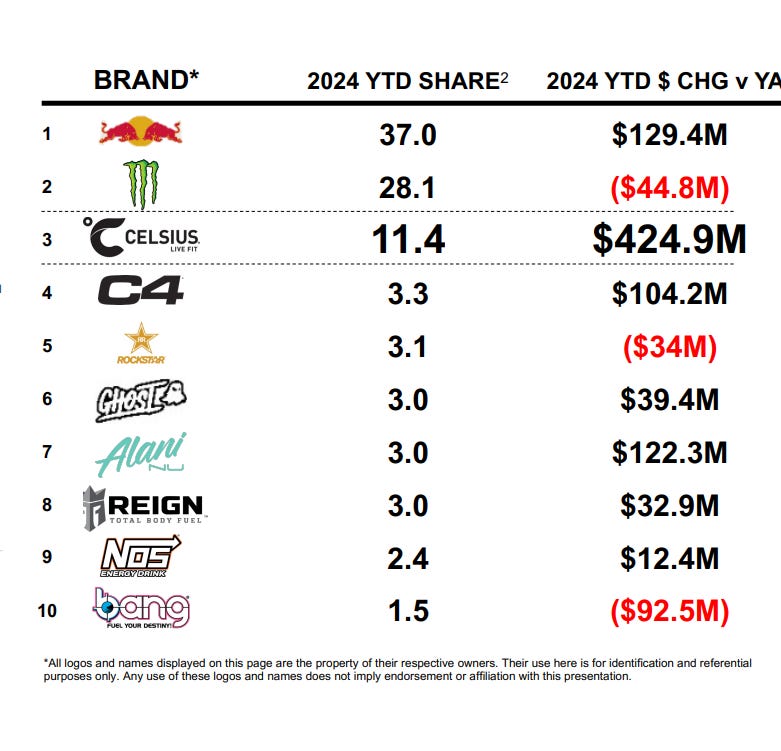

Share across physical retail + online such as Amazon (the MULO+ estimates) has looked great for Celsius over the long term. They now have around 12% market share and are the clear #3 player in the space.

This is due to more people wanting sugar-free energy drinks, the brand perception of Monster and Red Bull (women actually drink Celsius), and the focus on health and wellness among younger generations.

Half of the category growth now comes from Celsius.

Discussion Question: Will the growth continue?

Unit economics: What profit/cash flow margins should we expect as we near maturity?

Costs and profits are easy to understand with Celsius.

Cost of revenue (variable): raw materials, packing fees, warehouse expenses. According to the annual report, the majority of these costs are the raw materials.

Celsius's gross margin is now at 50%. It has gotten closer to Monster’s in the last five years. I would not expect margins to climb much higher from here. Maybe we can slot in 55% as a ceiling.

Selling, general, and administrative expenses: Marketing and corporate overhead. From the definition, it is all things associated with sponsorships, marketing, and corporate overhead. Everything looks in place here.

SG&A expense was $413 million over the last twelve months, or 28% of revenue. It was 41% of revenue in 2020. I expect to see slight leverage continue with this segment as we scale.

These are the basic unit economics that gets us down to operating income, or EBIT (earnings before interest and taxes).

Celsius has an operating margin of 22.4%. Monster has an operating margin of 28% which was well above 30% historically. Given the similarities of the businesses, I do not think it is crazy to assume Celsius can get to 25% operating margins with just a little more scale.

Last note: free cash flow conversion has been fairly poor. I expect this to close over time (inventory turnover should be high), but it is something to watch out for. Cash flow conversion matters, and if it isn’t converting as fast as we’d like returns will suffer over the long haul. I want cash returned to shareholders, not earnings stuck in working capital.

Importance of the Pepsi deal and mismatching revenue volatility

Approximately two years ago, Pepsi and Celsius entered a large partnership.

Celsius got:

$550 million in cash

On Pepsi’s distribution network in the United States (Pepsi now manages most of the distribution, which has likely contributed to better and more stable gross margins for Celsius)

Opportunities to hop on the distribution network internationally (Pepsi gets first dibs in any new markets)

Pepsi got:

1.5 million shares of Series A preferred stock. The preferred stock pays a 5% annual dividend ($27.5 million in 2023)

The conversion ratio is one-to-fifteen to the common stock. So, it is equivalent to around 22 million shares of Celsius common stock. It had 233.3 million shares outstanding at the end of last quarter, so about a 9.4% potential ownership by my math. \

The deal makes a lot of sense for both sides. Celsius is taking market share from PepsiCo products (they own Rockstar, which is dying), and this is a hedge against that. Celsius would like better distribution in stores.

A problem materialized this year with the deal. Pepsi overbought (or did Celsius oversell?) inventory into the distribution system in late 2023. This is why revenue growth accelerated in late 2023.

Then – combined with the category pressures of 2024 – revenue growth has decelerated to 23.4% last quarter and may get worse this quarter.

From a recent investor conference:

“Yes. So last week, John Fieldy, our CEO and I were in Boston at a conference and we announced that ahead of earnings that we wanted to try to be as transparent as we could with our investors in the street that Pepsi, our largest individual customer, about 55% or more of our purchases in North America, That so far this year, if you look at our growth year over year, quarter to date we're up about 10%. Our market share is up close to a point year over year. So one would assume that their purchases would line up with that growth that we've seen. Unfortunately, what's happened is not necessarily the reality of the situation, which is they purchased about $100,000,000 to $120,000,000 less in Q3 this year versus Q3 last year.

They were holding quite a bit of product back in 2023, which was their 1st full year with Celsius, which at the time, listen, we don't manage their inventory as much as we wish we could. That's up to them. And they were keeping us in stock in their 1st full year. But as they've begun to optimize and listen, cash is king, if they can carry less inventory and so effectively merchandise and keep product on the shelf, which they're doing, then they've drawn down their inventory levels. And we're very comfortable with the amount that they're carrying right now that they can still service the account.

But it is impacting our Q3 numbers when their orders are not matching up with what's actually happening at the register.”

This means that sell-through to the customer has been fine, but revenue was elevated and now normalizing. You can see this with the revenue estimates chart:

Revenue for Celsius in Q3 of 2023 was $385 million. The consensus estimate for Q3 of 2024 is $305 million, even though the company is gaining market share.

Trying to do the math to normalize this is difficult. How much was the oversell? How much is getting under-sold right now? I am not sure.

According to management, Pepsi purchased around $120 million less this year than last year. My best guess at the normalization is dividing this number by half and then adding 10% growth to account for market share gains. That brings us to $371 million if that consensus figure is correct.

Personally, that feels too low to me. However, according to that quote, the volatility around this deal is a bit unpredictable, so I wouldn’t be shocked if revenue is lower.

What’s important is that the brand continues to gain market share in the sell-through data.

International expansion: why so slow?

Investors have gotten nervous about Celsius's international expansion. Revenue outside of North America is still under $70 million for the last twelve months, so under 10% of overall sales.

I think this is explainable and not an issue (yet). Celsius decided to focus on North America when it was smaller and “win” this market before looking elsewhere. I like the focus. You don’t need to spread yourself thin when you’re smaller, especially when North America is such a big market for energy drinks.

Now, they are finally going to run the full Celsius playbook in new countries.

2025 is a big year for international expansion. It has made deals for international distribution in Australia/NZ, the United Kingdom, Canada, and France. If Celsius can execute its same strategy in these markets, there is a chance for international revenue to grow to a much larger portion of sales. All these markets combined probably have similar wealth/populations to the United States.

2025 should tell investors A LOT about what revenue growth to expect from 2026 - 2028. International markets could provide a huge boost, or Celsius might not work in other areas. TBD.

Discussion question: Do you have any confidence in the Celsius brand going global?

Can I trust management?

Fieldy has a fantastic track record. Celsius was on the brink of bankruptcy and he was a part of the team that saved them. He seems sharp and focused on the right things in his interviews. They have stayed focused on building the brand of fitness/health/sugar-free for a long time and are not stopping.

There has not been any money wasted on acquisitions (to my knowledge). Making a deal with PepsiCo is very smart and should not lead to too much dilution. It will be worth it in the long run and separates them from other upstart brands in sugar-free (more on that below).

GQ interview link: https://www.gq.com/story/gq-clout-john-fieldly

I see no reason NOT to trust management today. The execution has been phenomenal. Why should I doubt them right now?

Competitive risks: Is this just a fad? Do copycats matter?

Celsius has grown the energy drink category and taken share from everyone else. It is now a $1.5 billion revenue business.

Given the unit economics, capitalism is trying to do its thing: competitors are emerging on a regular basis. There are a lot of potential profits to be had. You have the influencer-backed brands, other new “healthy” energy drink upstarts, and competition from Red Bull and Monster to try and hit on the sugar-free category.

I would not worry about Red bull and Monster. There is too much of a brand perception with them, and I think Celsius can win if the transition to sugar-free continues.

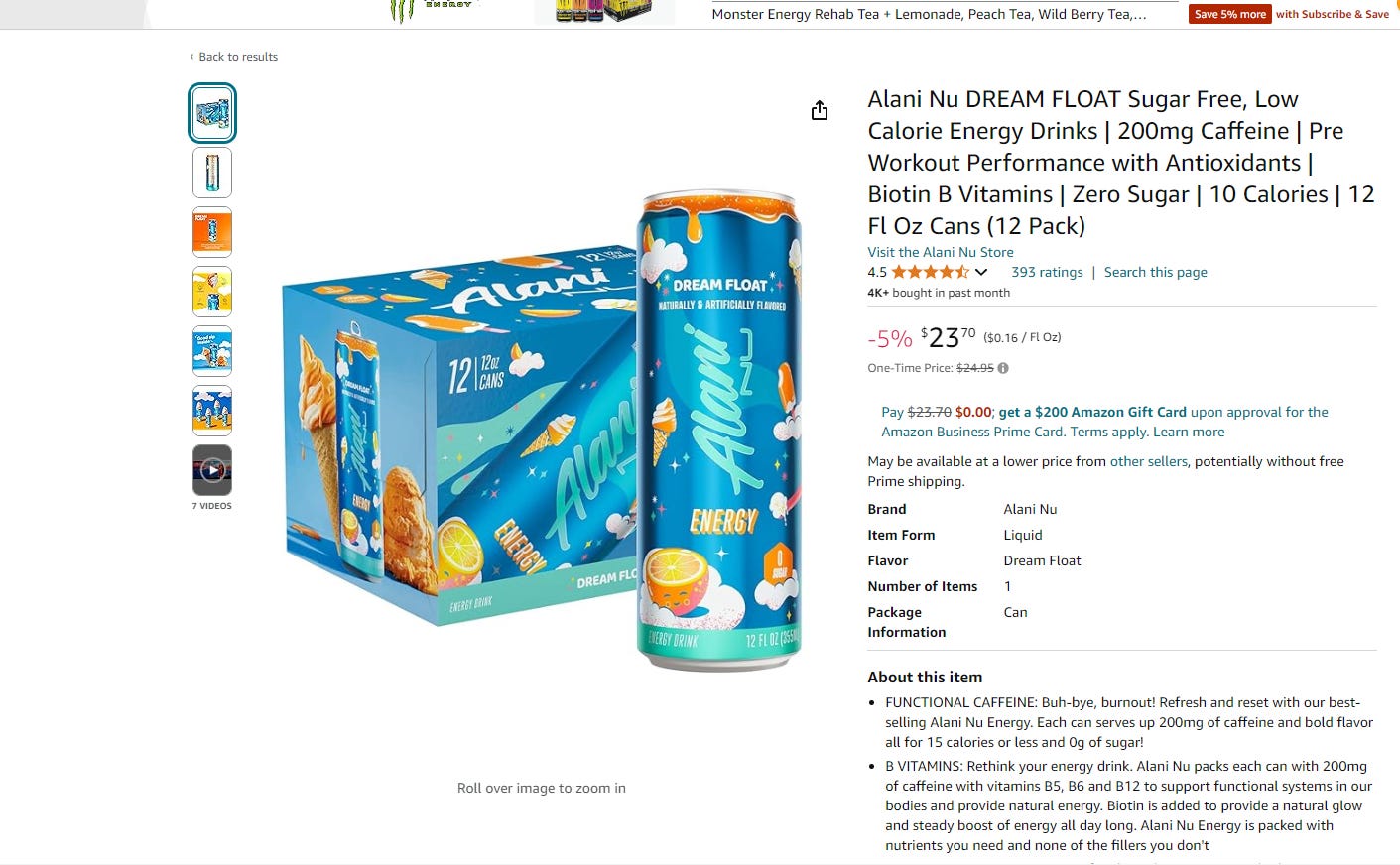

But what about these upstarts like Alani Nu?

Alani Nu now has a 3.0% share in the category and is gaining dollars from others such as Monster and Bang Energy. Why isn’t this going to Celsius?

For one, I think the Amazon marketplace is going to prove competitive. If you search “energy drinks” you get a lot of different brands and a lot of sponsored listings. I don’t know how Celsius can differentiate itself for someone who starts their journey on Amazon.

But the good thing is this is only a small part of the market. I do believe Celsius can fend off competitors due to its deal with PepsiCo. Distribution at stores matters a lot, and Celsius is now front-and-center for a lot of shoppers. Alani Nu does not have this luxury.

There will be a lot of fitness/health energy drink copycats. In fact, there have already been a ton of them. So far, Celsius still has over 10% market share. With the Pepsi deal, I think they can still gain some market share and “lock in” shelf space at important retailers.

Discussion Q: What market share can Celsius achieve in the United States?

Valuation: Is the stock cheap? Financial estimates

Given what we discussed today, I think that Celsius can grow its sales by 20% annually from 2024 - 2027 and maintain a 25% operating margin. Why?

Category growth

Taking share

International expansion (low hurdle to gain share, at least for the next few years)

I also want to price in the dilution of the preferred shares. Using the fully diluted share count + assuming the preferred gets redeemed, we get a market cap of $8.2 billion at the current share price.

In my assumptions, I kept the share count flat from 2024 - 2027. I assume that the company will be cash flow positive and will repurchase stock to offset dilution.

Under these assumptions, the stock trades at these price-to-operating income (P/OI) levels:

2024: 24.9

2025: 18.2

2026: 15.2

2027: 12.7

Will I be purchasing shares?

Listen to the episode to find out.

Summary: Risks I Will be Watching

The Pepsi situation.

Market share stagnation.

Category growth.

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.

Hi, any commend on distribution outside North america, such as UK, Australia that Celsius choose to partner with Suntory instead of Pepsi?