[PODCAST] Evolution AB: A Misunderstood High Quality Stock (EVO)

Another wonderful conversation with Speedwell Research

YouTube

Spotify

Apple Podcasts

This week on the podcast, we brought back Drew from Speedwell Research to discuss Evolution AB. Links above to the podcast episode, find it wherever you listen to podcasts.

If you missed it, earlier this year we had him on to discuss Coupang (stock is up over 50% this year).

Evolution is a provider of online gaming solutions. If you are confused on what exactly that is, Drew goes into detail during the episode.

The stock is currently in a 40% drawdown:

Listen to the full episode to hear Drew/Speedwell analyze the company. There are a lot of good nuggets within this one.

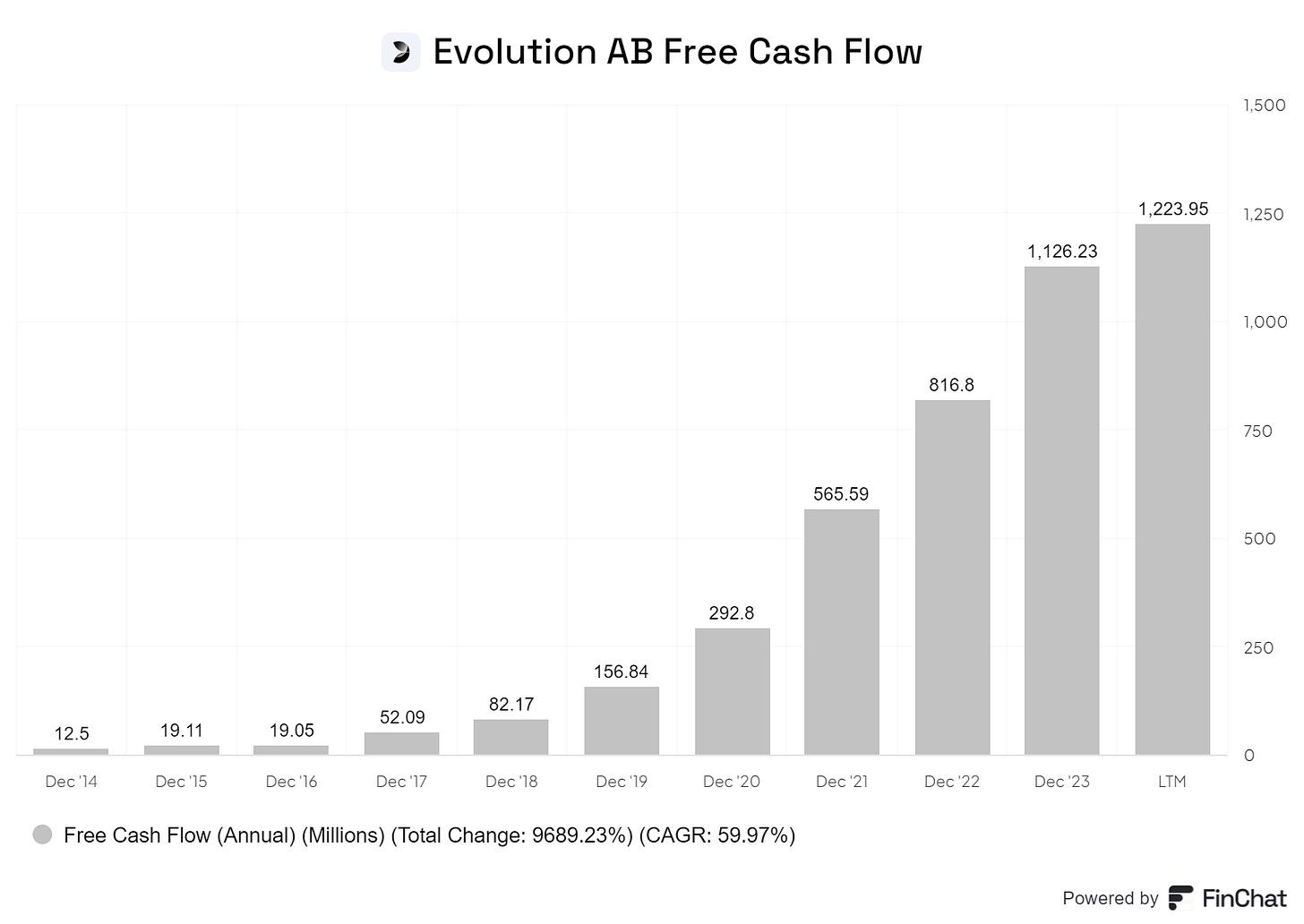

Here are some interesting charts about the business from our friends at Finchat.io (use our link and get 15% OFF any paid plan).

Gross profit has posted a 47% CAGR since 2014

Operating margin is above 60%

Trailing P/E is 16

Free cash flow has been consistently high

These four charts alone should have you interested in the stock. Enjoy the episode!

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.

There is one big question I have regarding Evo that I can't seem to answer, despite having researched Evo myself and read many people's write-ups on it (and asked them this question): what percentage of their revenue comes from standard casino games (blackjack, roulette, baccarat, poker, craps)?

I think this question is of utmost importance because, despite what management and other investors say, I just struggle to believe that they really have enough of a moat in this space that a well-funded, experienced competitor - like LV Sands - couldn't come and eat away at their insane profit margins. When I look at the incredible machines produced by industrial companies who have zero moat, it just doesn't make sense to me that running this live casino operation is harder.

On the other hand, I can much more readily believe that their proprietary games business (your Lightning whatevers, Starbursts and so on) have a pretty good moat.

Any idea?