[PODCAST] Kelly Partners Group: The Next Constellation Software? (Ticker: KPG)

An interesting roll-up. An interesting CEO.

YouTube

Spotify

Apple Podcasts

Today, we released an episode on Kelly Partners Group. The stock has the ticker “KPG” in Australia and KPGH.F in the United States.

Ryan gives a full research report on the stock for this episode. It is an acquirer of small accounting firms with an interesting playbook that can lead to (I think) non-zero-sum outcomes.

Below are some show notes from this week’s episode.

-Brett

Backstory: How was Kelly Partners Group formed?

Brett Kelly has a somewhat unique back story. He started in investment banking but eventually got fired because he “didn’t work well with the other team members”. So he moved on and decided to get his CPA and completed his master’s in Tax. At this point, he had a pretty solid business acumen and believed accounting firms could be good businesses if they were operated correctly. One of his friends approached him and asked him to help him set up an accounting firm. Here’s it in his own words:

“In March 2006, a friend of mine asked me to set up a firm with him. He said, Brett, you have 75% and run the business, I’ll have 25% and run the clients. Could that work? I said, sure. He said, I don’t know anyone that knows more about business than you, and I’m a really good accountant. And so that was kind of the basis of a partnership and really that was the preview of what would become Kelly Partners.”

At the time that he had set up this partnership, he was working at a larger accounting firm, on the premise that he would be made partner if he completed certain responsibilities. As the story goes, he completed the tasks and they went back on their word. When they went back on their word, he decided he didn’t want to work there anymore. So he set out to start his own firm along with two other partners and he was able to take some of the clients with him.

That firm ended up being very successful and springboarded what became Kelly Partners. At some point, he decided that he wanted the split to be more equitable so that the minority partners would have more control. He went back to Scott and made it a 51/49 ownership split where he got 51% and the other partner got 49%. This is the structure of their current operating businesses today.

What does the business look like today? What is their “acquisition strategy”?

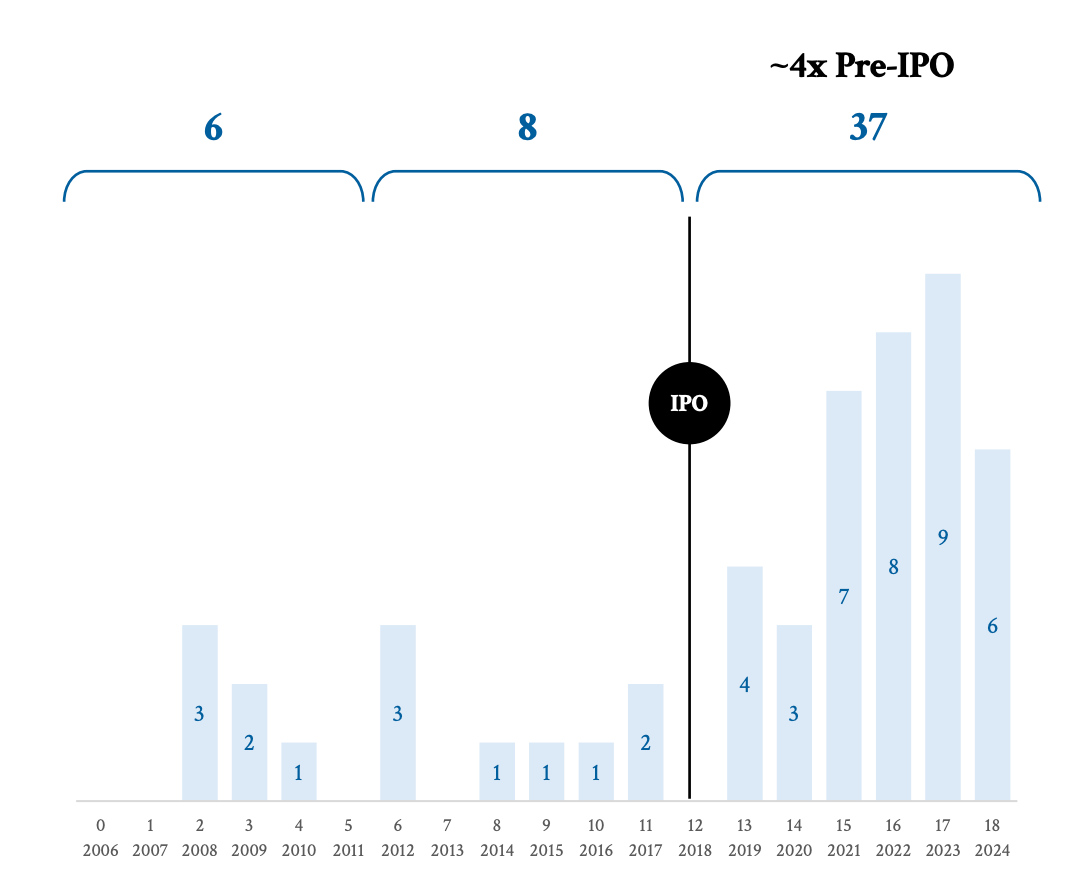

Kelly Partners currently has 37 operating businesses. The majority of those operating businesses are located in Australia, but they’ve recently acquired a few in the US. These businesses are chartered accounting firms that primarily service small to medium-sized businesses. Operating businesses typically generate $1-$2 million in annual revenues.

As for the acquisition strategy, it’s a bit unique. So far, they have committed to and have only used debt to acquire new accounting firms, never shares. The debt is then put into the operating business and is typically paid out over the following 4 to 5 years. Reportedly, they have a strict valuation model and will only pay 4x-5x earnings on acquisitions.

The other part that’s kind of interesting here is that when they acquire the company they are acquiring 51% of it, but they’ll pay out the acquisition price over two years. One-third of the purchase price is paid out in year one and the other two-thirds is paid out in year two.

Once they have become a Kelly operating business, they pay out 9% of annual revenues to Kelly. That sounds like a lot, but for small accounting firms, that can be well worth it and I’ll touch on why in a second. But, according to Kelly Partners that 9% goes directly to Kelly’s Central Services Team which reinvests all the money into the Kelly Operating Platform.

To reiterate, when KPG acquires a firm, it owns 51% of the shares, while the previous owners retain 49%. KPG then receives 51% of the profits and 9% of total revenue.

This overall strategy is what they call their Partner-Owner-Driver model. This is not just a “send us a check in the mail every month” type of roll-up. It’s more hands-on. The company they acquire becomes a 49% owner of Kelly Partners subsidiary and they rely on Kelly for certain business systems.

Why would an accounting company sell to Kelly Partners Group?

This is the first question I had. Let’s say you’ve got a 4-5 person firm, you’re doing $1.5 million in annual revenue. After all your expenses, you’re generating around $250,000 in annual profits. Why would you want to sell half your business and pay a 9% fee every year to Kelly Partners?

As I mentioned earlier, Kelly offers a standardized operating platform. This takes out a big chunk of the responsibilities required for actually running the business. You no longer need to pay for your own systems. HR, IT, Marketing, Training, etc., all get handled by Kelly which allows the partners to focus more on actually serving customers. It also gives them more free time to handle more customers if they are working at capacity.

“This investment has freed up accountants to spend 40% more time with clients, which has improved the quality of service and allowed the company to handle more clients.”

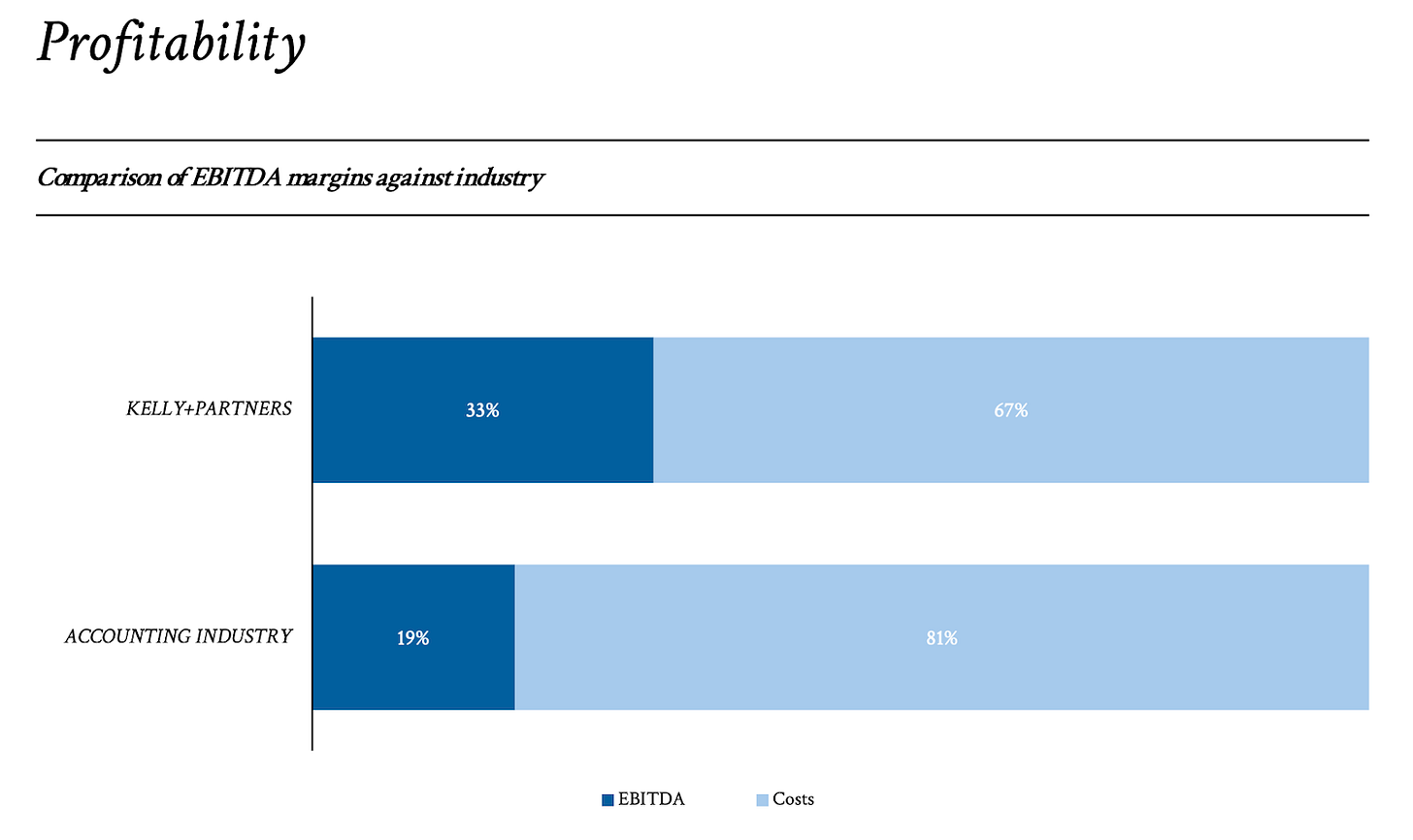

All in all, Kelly reports that on average this reduces the operating companies’ working capital by two thirds and profit margins nearly double. On average, they state that accounting firms go from 19% to 33% margins once they’re with Kelly.

Ultimately, the take-home earnings for the partners don’t actually drop by that much and they get a nice payout in the meantime.

A lot of the rationale for selling is typically more quality of life aspects for the partner. Apparently, a lot of the acquisitions that Kelly makes are from partners looking to retire and find a successor. Kelly promises to find successors for the firm but it also allows the current partners to work a little longer. They don’t have to manage the business as much. They can get a nice payout, reduce their hours a bit, keep the company alive, and still service clients while they ease into retirement.

Discussion Q: How do they find these accounting firms with retire-ready owners?

What’s attractive about the actual operating businesses?

There are a few things I like about the companies that KPG acquires.

Durable industry. Tax law, and therefore tax complexity, tends to grow. SMBs always need this service.

Great customer retention. Clients tend to be loyal to their accounting firms, which is due in part to the personal relationships that develop between clients and accountants. Accountants come to understand the intricacies of each client's business, which makes it time-consuming and costly to switch to a different firm.

Organic growth. The operating businesses under KPG’s umbrella tend to grow. With KPG taking some of the responsibilities, it often frees up the partners/accountants to take on more clients.

What are the economics like? What do KPG’s financials look like?

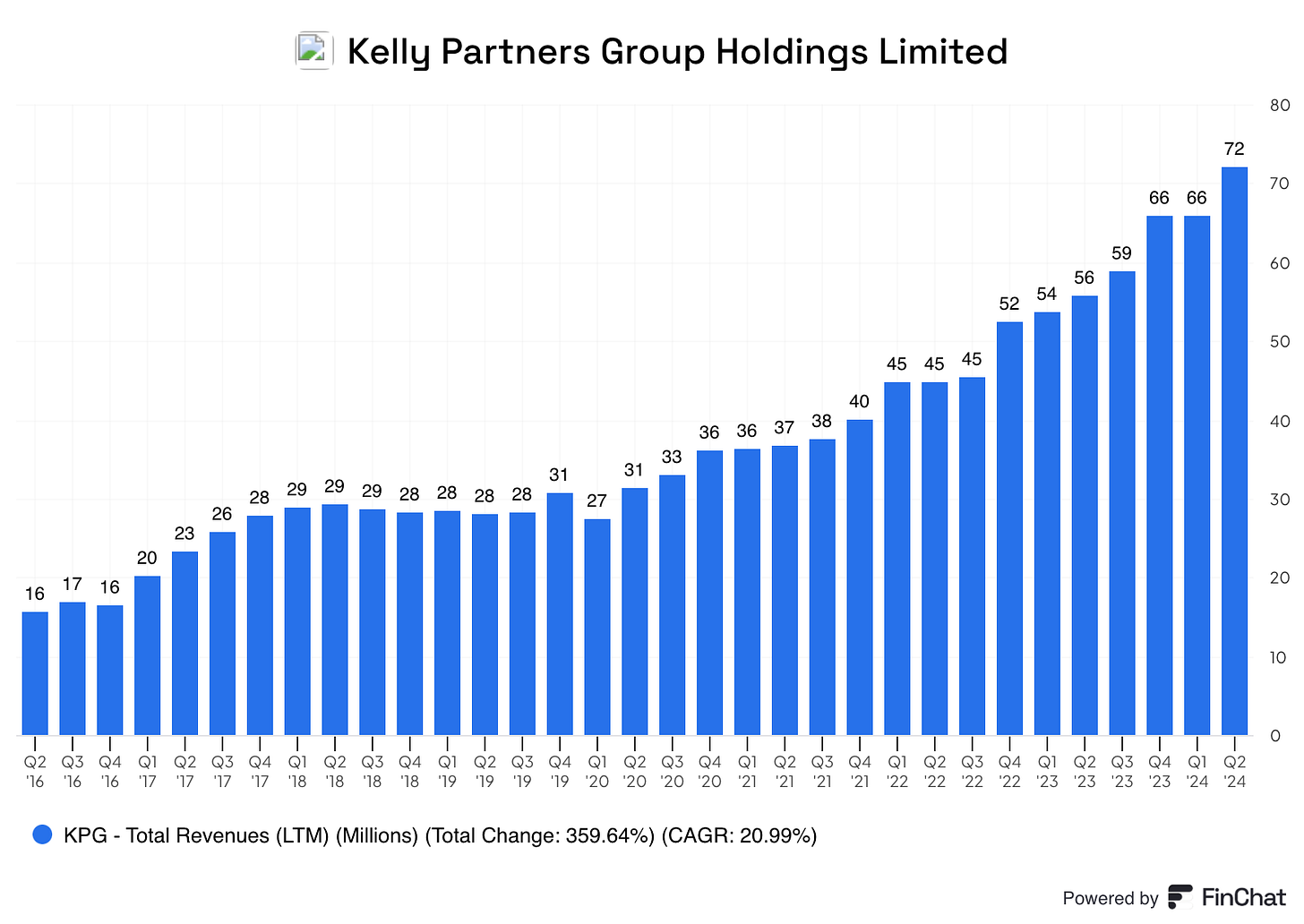

Kelly has grown pretty quickly since its IPO, with most of that coming from acquired revenue. Brett Kelly has said before that being a public company has helped establish credibility for would-be sellers. However, it’s not all acquired growth. From 2018 to 2024, Kelly’s operating businesses have averaged just under 5% organic revenue growth.

In terms of the aggregate profitability, if you look at GAAP earnings figures, it’s going to be a bit misleading. They report just $3.5 million in net income over the last 12 months on $108 million in revenue (that’s in AUS dollars, US would be $2.7M on $72M), but there’s an accounting treatment that doesn’t really make a whole lot of sense for them.

I’ll try to explain it the best I can. When Kelly acquires an operating business, that operating business has to estimate its asset value. You’ll get tangible items like computers, chairs, and whatever equipment they might have, but the biggest asset for an accounting firm is an intangible one, it’s their customer relationships. They have to state the value of those upon acquisition. However, the accounting treatment for those customer relationships is to amortize the value over 10 years. If you’ve got a customer that you’ve been working with for 5-10 years, they’re probably not going to leave, so it leads to this big amortization of intangibles that is just not based in reality and it gets inflated when there are periods of big acquisitions.

The metric I think is more valuable is Owner Earnings, which they break out:

“Owner earnings represent the cashflow available to the parent entity. Owner earnings is used to measure cashflow to the Group (after taxes and finance costs) after taking in to account: 1) additions or reductions in working capital investment (debtors, creditors and other accrual movements) and 2) deductions required for the maintenance capital expenditure of the business to maintain ongoing operations in the long term.”

For FY 2024, which is their most recent report, they earned $7.8 million in owner earnings in Australian dollars (~$5M USD). That would represent 11% net margins.

We also saw margins compress in 2023 due primarily to elevated investments into the central services team beyond what they pull in from the 9% revenue fee. When this happened Brett Kelly said, “I understand the compression in that margin in this period, but know that, that won't continue.” And he was right, margins have improved again.

International Expansion: Why do I think this is a big deal?

Over the last couple of years, KPG has acquired some businesses outside of Australia. The two other areas markets that KPG really cares about are the United Kingdom and the US. They’ve made it clear that these markets are going to be important for them moving forward.

So far the expansion has been more US heavy. They acquired a couple accounting firms in Los Angeles and just announced a greenfield business in Texas, which will become a Partnership Platform, where a Texas Management Team owns a minority of the Texas business.

The other thing I like about this is that it doesn’t take local tax expertise on KPG’s part. The accountants are the ones that need the expertise. It is however somewhat costly to get set up. I can’t remember where I heard this (I think it was an interview with the CEO) but basically there are some up-front costs for that first acquisition because you need the business licenses and maybe a local team to operate their, but the acquisitions after the fact are easier to make.

Why do I think it can resemble Constellation Software?

To be clear, it’s not Constellation. I know we’re going to get some passionate Constellation shareholders telling us the differences, but I think there are some similarities.

Thinking small is an advantage. Like CSU, their acquisition strategy is volume-based. They aren’t competing with the giant capital allocators, because these wouldn’t be needle-moving acquisitions for them.

Lots of Targets. Here’s a quote from Brett Kelly: “So there's 28,000 firms that we are contacting consistently across the U.S., the U.K. and Australia. There's 138 live leads. We are actively meeting with firms, we expect that we can very materially grow the group over a virtually unlimited runway unless governments decide that they are disinterested in taxing people in the future.”

Programmatic Approach to Acquisitions: KPG has gotten to the size where they have now set up a dedicated acquisition team. It’s no longer just Brett Kelly calling and shaking hands.

For those that don’t follow Constellation Software, they have a massive database of basically every vertical market software provider in North America, or at least a good chunk of them. And they frequently send emails to those founders just waiting for them to be ready to sell.

Little Capital Intensity. In both cases, CSU and KPG, the operating businesses themselves are not very capital intensive. They can grow with minimal CapEx. In KPG’s case though, I think there’s probably more inbound demand.

They actually model their approach to measuring ROIC based on Constellation Software. Kelly has a page on their investor presentation with a Mark Leonard quote that says “If you add Organic Net Revenue Growth to ROIC, you get what we believe is a proxy for the annual increase in Shareholders’ value. In a capital intensive business, you couldn’t just add Organic Net Revenue Growth to ROIC, because growing revenues would require incremental Invested Capital. In our businesses we can nearly always grow revenues organically without incremental capital.”

Discussion Q: What makes them different from Constellation?

What do I think of Brett Kelly?

Brett Kelly is quite a character. He’s a best-selling author and he makes a lot of public appearances. Quite the opposite of Mark Leonard actually. He does seem a little bit full of himself (he sends a package of his books to every company they acquire) but I think it’s more of just having a chip on his shoulder. If you listen to his interviews you’ll understand what I mean.

I do think he has a good grasp of what drives shareholder value. Having a background in investment banking and accounting probably helps.

Typically, when we analyze management, I go through the Proxy and take a deep look at the incentives, but you probably don’t have to here. Brett Kelly owns 48% of the shares outstanding and no new shares have been issued since the IPO. They have no executive options, just cash-based performance bonuses.

Valuation

Kelly has a $258 million market cap in USD. But as I mentioned earlier, they use debt to acquire companies so EV is probably the more important metric here. They have ~$26 million in net debt across the company in total, but 80% of that debt is in the operating businesses. So theoretically, if something were to go wrong the liability is limited to that one operating company.

Anyways, the EV comes out to basically $285.9 million USD. Over the last 12 months, the stock is up 102% and earnings have not doubled, so the stock has gotten more expensive. But to run the numbers quickly, I’m going to use a metric they use called Underlying NPATA (adds back acquisition related costs and other non-recurring items and deducts the non-recurring revenue like government grants and changes in fair value of contingent consideration). But I am fine with them adding back the amortization, and I’m fine with looking at the pre-acquisition profits, so I actually think it’s a fairly useful metric. For context, this number is lower than operating cash flow.

For 2024, KPG had $16.2M USD in Underlying NPATA. Using that figure, the stock trades at ~17X. Now I think those margins will expand a bit over time for the reasons I mentioned earlier (new acquisitions maturing), so let’s run some quick numbers.

But let’s run some quick math and see where we get.

15% annual revenue growth until 2030

Underlying NPATA margins at 30%.

15x multiple (a little bit of compression)

Steady share count

Debt to EBITDA metrics stay consistent

If that happens you’re looking at about $75M in underlying NPATA in 2030 and a market cap of just over $1.1 billion. Today it stands at ~$400M AUS, so nearly a triple over 6 years. That’d be great.

Am I buying? What Risks am I looking at?

Yes, I think so. I’m going to take a starter position.

I am a little wary of the valuation, but really what I’m waiting for is to see whether or not they can continue this blueprint for a while. Can they add 10-15 new operating businesses each year over the next few years?

If I see that kind of execution, then I’ll be excited. Because once they’ve really nailed that acquisition blueprint, I think that’s when you get to see the spectacular returns.

Discussion Q: What’s the reasonable runway for reinvestment? (dollars or years or both)

What I’m watching

If we don’t see the margin expansion, it’ll be concerning. Especially if the acquisition count isn’t growing. Then that means their “playbook/system” doesn’t create the operational benefits that they claim.

How much more beyond the 9% revenue fee do they invest into the business? If that number continues to grow, then I’d be a bit concerned.

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.

Great podcast and article. I'm seeing underlying NAPTA of $8 million Australian to the parent company, which will make this much more expensive than 17x... What am I missing??

Just saw your pod on Kelly Partners. It was great. 2 points I wanna check with u. I see Lawrence A. Cunningham as one of the major shareholders, do u see that too? Secondly the CEO has relocated to the U.S. just pointing that out.