[PODCAST] Medpace Holdings: An Undiscovered High Quality Biotech Stock, With Luis Sanchez (Ticker: MEDP)

Longtime guest Luis Sanchez returns to the show to discuss a high quality business in biotech

YouTube

Spotify

Apple Podcasts

This week, Luis Sanchez from LVS Advisory returned to the Chit Chat Stocks Podcast to discuss Medpace Holdings. Here is a link to his write-up on the company.

I like what I see with this business. It has the industry qualities of a Peter Lynch growth stock, a market share gainer with a small current share in a fragmented industry that is growing its overall spend. Medpace Holdings should grow along with the contract research organization (CRO) market and take share from existing players.

But what is a CRO? These companies — of which Medpace is one — take on outsourced work to run clinical trials for pharmaceutical companies. Medpace is the only global player that is a “full service model,” meaning it does all of the clinical trial work. Smaller biotechs use the full service model, which is Medpace’s core customer.

Here is a chart from Luis’s write-up on Medpace. Read the full report for more details:

Market share gains and overall growth in industry spending have led Medpace to grow revenue at a 23.3% annual rate since 2015. This is even with the biotech industry in a massive spending slowdown coming out of the COVID-19 boom.

With still such a small market share, would it be surprising to see Medpace keep up this durable double-digit growth for the next decade? If biotech spending recovers, this feels likely.

The company is founder-led by August Troendle, who has run the business for 30 years. Luis compares him to IBKR’s Thomas Peterffy, an eccentric and hard-driving leader who strives for greatness (and was another well-timed pitch by Luis on the Chit Chat Stocks Podcast).

Troendle is an owner-operator and passes my “trusting management” test. Plus, he has implemented some well-timed buybacks when the stock is cheap.

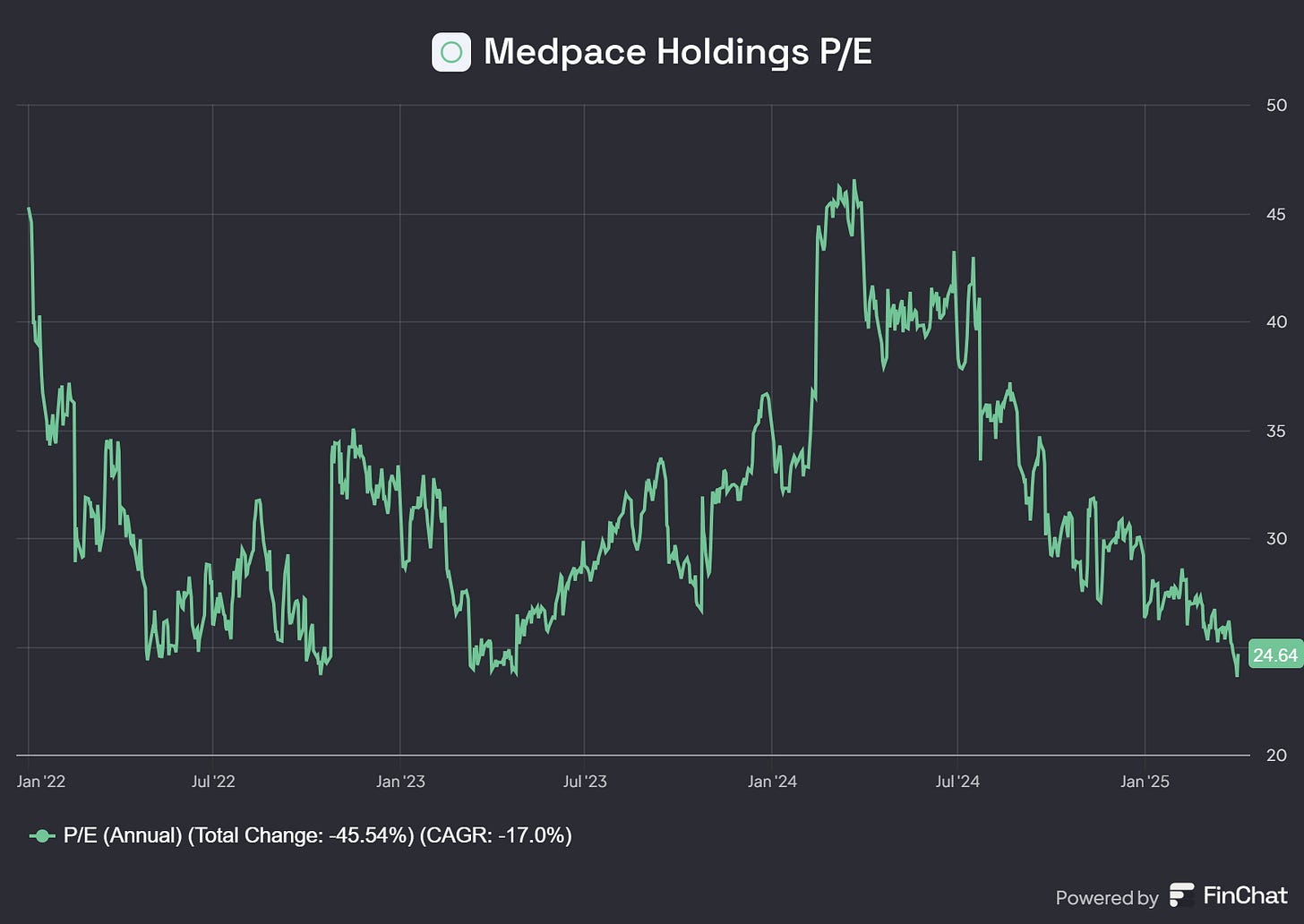

Which brings us to valuation. Medpace trades at a P/E of around 25:

If you are a believer in double-digit EPS growth for the next five years, the stock is cheap here.

Of course, don’t buy just because you listened to this interview or read this teaser. Do some more work on the competitive advantages, valuation, and biotech market. But I think you will like what you find.

This looks like a great business trading at a reasonable price run by a manager with high integrity…the exact type of stock I want to own.

I am glad Luis wanted to take the time to bring this stock to the audience’s attention. Because it looks like a promising long-term compounder.

-Brett