YouTube

Spotify

Apple Podcasts

Today, we released a podcast covering Nu Holdings (Ticker: NU), parent company of Nu Bank. The episode goes into detail on the company’s sprawling operations in Latin America and why it has been so successful in acquiring customers.

Here are the show notes from the episode.

-Brett

A one foot hurdle in improvement

The founder and current CEO of Nu Holdings is David Velez. He was born in Colombia but moved to Costa Rica to escape cartel violence, went to Stanford University, and then obtained a job as an analyst/portfolio manager at a venture capital firm focused on Latin America.

His biography is important for two reasons. First, he can have a deeper understanding of how the Latin American economic engine works, being from the region. Second, right before the founding of Nu Holdings, he got boots-on-the-ground experience on how bad personal finance and consumer banking are in Brazil.

And boy, does it sound like a poor user experience. Sky high interest rates. Penalizing fees. Gatekeeping the system only for those with reasonably high incomes. All controlled by just a few banks who offered the same (excuse my language) shitty services.

That is, until Velez and the founding team saw an opportunity for disruption. Yes, you guessed it, with the smartphone. Like many of the disruptive stories of the past 20 years, Nu Bank was able to wiggle its way into the Brazilian financial sector by building a personal finance platform tailored to the smartphone.

It is of course much more complicated than this. And we will get into Nu Bank’s business model in following sections. But the gist of the story is that Velez saw a poorly run industry (Brazilian consumer banking) and an opportunity to disrupt it with the smartphone while still remaining profitable. This is why Nu Bank is now serving the majority of adults in Brazil.

I can provide a personal example with these antiquated systems. As someone who travelled around Colombia, Bancolombia branches and ATMs were ever present. Fortunately, I am someone who has the privilege of using international digital payment systems (thank you Wise and American Express), making my life easier.

However, when in a country such as Colombia you want some cash for emergencies or when faced with a vendor that only accepts paper currency. So, I needed to access a Bancolombia ATM a few times.

Not only did these ATMs charge an 8% (!) fee on withdrawals, it literally didn’t give me money one time. Yes, the ATM told me “collect your cash” while I got no cash out of the ATM and my bank account was credited with a withdrawal. This led me to a huge time waste dealing with customer service at my actual bank to recoup what Bancolombia stole.

It looked even worse for local customers. There was a line at the branch where you had to queue for 30 minutes to an hour, wasting millions of hours for Bancolombia customers every year. They deal with the sky high fees all the time. A miserable experience.

No wonder Nu Bank has rapidly gotten to 2.5 million active customers in Colombia and 94.9 million total monthly active customers including Brazil and Mexico.

Founder led and incentives

Long-time listeners will know that one of my three pillars to an investment thesis is (repeat after me) asking whether I trust management.

Velez founded Nu Holdings and still runs the business to this day. In his 40’s, he is in the sweet spot of founder-led managerial age. He is actually already one of the wealthiest people in the world with a net worth of over $10 billion, almost entirely tied to Nu Bank.

Sure, he has skin in the game. But I don’t think Velez cares about bringing his net worth to $20 billion. The game for him isn’t purely monetary anymore. What could he do with $20 billion that he can’t do with $10 billion? That figure doesn’t (or shouldn’t) matter to him.

He seems to be dedicated to building and growing Nu Holdings. From my feeling reading and listening to him, he is dead set on crushing these stodgy financial institutions that are leeching off of consumers. Yes, he will do so profitably, but in a way that actually has a good customer experience.

I believe he cares about outside shareholders as well. The team cares about return-on-equity (ROE) above all else, which is good for a bank. Quarterly net income has now been positive since the start of 2023. We don’t see bragging about adjusted EBITDA like at SoFi (sorry SoFi shareholders, it’s true).

And, Velez decided to get rid of an extra stock-based compensation pay package for himself back in 2022. He could have easily taken this and diluted existing shareholders, but he didn’t. I think that is a good sign.

Velez reminds me of Airbnb’s founder Brian Chesky or Coupang founder Bom Suk Kim. If it was just about the money, they would have retired and gone off into the sunset long ago. I believe they care about making an impact with these companies beyond just getting more wealthy. They want to win the game.

Velez, I would put in the same boat.

How I see Nu Bank’s business model

Nu Bank has a sprawling and complicated business model. I may miss something, don’t get mad if I do. This presentation will also focus more on the customer value proposition of Nu Bank and less on the credit underwriting. This is an area I can understand better and hopefully provide some insights on.

If you want to read more details on the credit business at Nu Bank, check-out this piece from Red Beryl:

Nu Bank’s goal is to provide a much better personal finance experience than traditional banks. This was not hard in Brazil, as I discussed above.

Let’s go through how a potential customer – or even who has seen an advertisement to “consider Nu!” and is thinking of switching banks – would compare personal finance applications in Brazil.

At your existing bank you have ridiculous fees, ultra-high rates on credit cards and personal loans, and stodgy systems that are frustrating to deal with. You hate them.

At Nu Bank you get a debit/credit card with no fees, attractive interest rates on your savings account, and products that are easy to understand. Oh, and you can seamlessly manage everything from your smartphone to save time. No wonder Nu’s NPS scores are wildly better than any legacy bank in Latin America.

58% of the adult population in Brazil uses Nu Bank in some form. This is astounding, but given the context around how poorly the existing banks treated customers, it becomes much less surprising.

From customer acquisition, Nu Bank implements a “land and expand” model. With more data accumulated for the customer, Nu Bank can decide whether it wants to offer more products to them. This could include higher credit limits on credit cards, personal loans, and more.

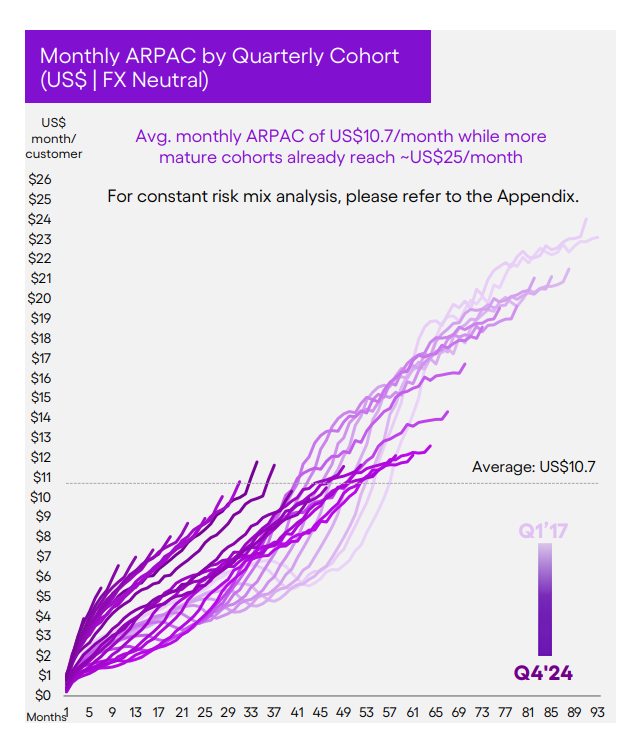

You can see this customer expansion in the chart below. When a customer joins Nu Bank, it will generate around $1 - $3 in average revenue per month – ARPAC is the acronym. However, if we look at the company’s customers from 2017, they now generate close to $25 in ARPAC per month. Newer customer cohorts are on an even more aggressive trajectory. Inflation will help this over the long term.

At first, a customer may just want to sign up for the high-yield savings feature and get the free credit card. Over time, these customers may expand to more lending products, make Nu Bank their primary banking institution, or even sign up for its investment or insurance products.

We can also see this in Nu Bank’s product history. It began with an easy-to-use credit card with no fees. Then, it expanded with a consumer bank account to attract deposits with high interest rates (similar to a SoFi or Ally). With deposits rolling in, Nu Bank began expanding its credit card lending. Now, it is rapidly expanding its personal lending business, which is a huge sector in Brazil.

Using a chart from our friends at Finchat.io (use our link and get 15% off!), we can see this land and expand model has worked wonderfully for Nu Bank. Fees (mostly credit card interchange fees) were the majority of revenue in 2018. Then, interest income on credit cards began to take over the business. Then, in 2021 the personal lending segment began growing at an insane rate and should surpass credit card lending sometime soon.

At the end of the day, Nu Bank is a well run digital personal finance platform that customers love. Since they love it, they want to use it more over time. Simple.

The Brazilian opportunity

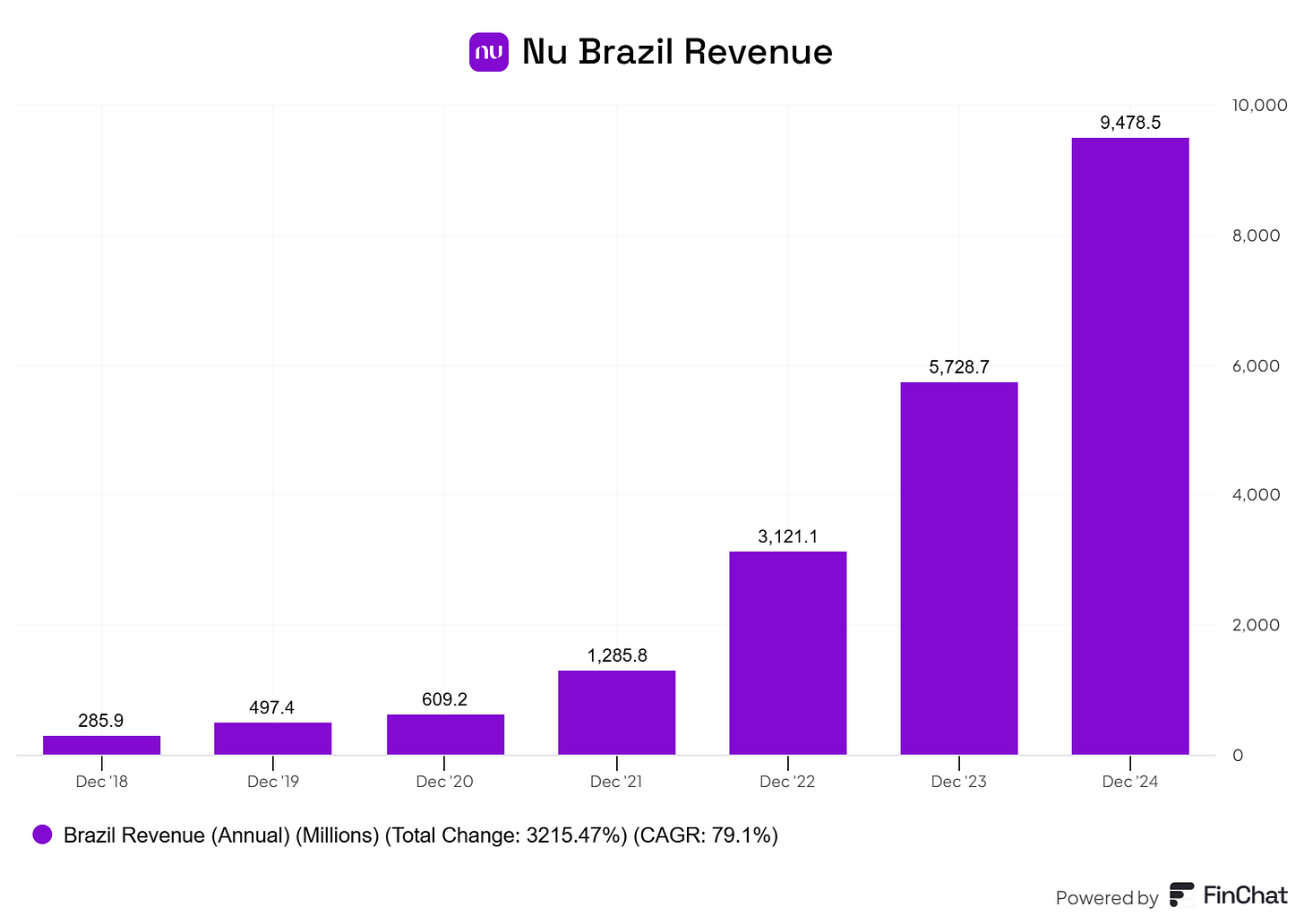

Today, the majority of Nu Bank’s revenue comes from Brazil. This market generated around $9.5 billion in revenue in 2024 and is closing in on 100 million active customers.

Discussed above, over the long-term Brazil’s monthly ARPAC should reach $30. Let’s bank on $25 to be conservative. Using round numbers, let’s say that active customers in Brazil eventually reach 100 million.

A $25 monthly ARPAC and 100 million active customers is a $30 billion revenue opportunity in Brazil, or over 3x its current levels. We will cover profitability in the final section by combining it with Mexico.

We can also use this section to talk about the UltraVioleta Card. This is a new initiative that is trying to copy the American Express model a bit. UltraVioleta users get a metal card and perks focused on travel. It caters to wealthier customers in Brazil.

Perks include an exclusive lounge at the Sao Paulo airport, travel protections, instant cash back on purchases, and even international internet using a free e-SIM card. This sounds like a no brainer for the wealthier customer in Brazil.

Here are some stats on UltraVioleta:

688k customers growing 132% YoY

84 NPS

Already 10% of the Brazilian credit card portfolio

This sounds like a fantastic upsell to wealthier customers and can keep ARPAC marching higher. One high-spending UltraVioleta cardmember might be worth 10 of the poorer Cuenta Account members.

The Mexican opportunity

Nu Holdings does operate in Colombia, but I am excluding them from this analysis. Sorry Colombians, the economy is just not big enough to matter compared to Mexico.

Mexico is a sizable opportunity and damn near as big from a GDP perspective as Brazil. The population is a good chunk smaller than Brazil (130 million total in Mexico), but there is still an opportunity to get to tens of millions of customers in Mexico using Nu Bank.

In just a few years, it has already surpassed 10 million customers. Revenue is growing like gangbusters:

Why has Nu Holdings done so well in Mexico?

Similar macro backdrop as Brazil. Legacy Mexican banks don’t treat consumers well. Many people operated solely with cash before smartphones. Interest rates on savings accounts were poor. This opened up a huge hole that digital banks could disrupt.

Nu Holdings knows what works. After learning for years in Brazil about what customers want and how to acquire new customers through trial and error, Nu Holdings is a well-oiled machine. They are using a sky-high interest rate on deposits to attract customers in Mexico, which is why the market is growing even faster than in Brazil at the same point after launch. It already has the products ready, they just need to get regulatory approval and tailor them to Mexico.

Deposits in Mexico grew 438% year-over-year (not a typo) to $4.5 billion in 2024. That is incredible growth and indicates that Nu Holdings is at the beginning of its S-curve in growth in Mexico. In Mexico and Colombia, the company is getting highly aggressive with interest rates paid to customers, and it is working. They still remain profitable on a consolidated basis.

With slightly higher GDP per capita and a much more attractive economic backdrop than Brazil (tariff uncertainty not withstanding), Nu Bank Mexico should have better monthly ARPAC than Brazil over the long-term.

Assuming a $30 monthly ARPAC and 40 million active customers, that is a $14.4 billion revenue opportunity in Nu Mexico, or over 10x today.

In just these two markets, there is a ton of potential for top-line growth over the next five years.

And, there’s barely any scaled competition to slow them down.

Where to next? And an enviable competitive position

We can use country GDP size as a rough gauge for how attractive a market could be for Nu Holdings to enter. Banking regulations are local and require a lot of boots on the ground in the country, so only larger economies make sense to expand into for Nu Bank.

From the list below, it only makes sense to expand into Argentina, Peru, and Chile. I hope and expect the company to do this over the next 10 years. It would be disappointing if they felt the need to expand rapidly in smaller countries or outside of Latin America.

Even if we combined #3 - #6 on the list below, those economies are still much smaller than each of Brazil’s or Mexico’s. The countries are simply not that big. Perhaps they can be a $10 billion revenue opportunity over the long haul, but it will not be meaningful anytime soon and pales in comparison to Brazil and Mexico.

Let’s talk briefly about competition. Operating in many countries in a large market, Nu Holdings has a ton of competitors. There are legacy institutions, direct digital bank competition, and MercadoLibre’s fintech subsidiary called MercadoPago.

I am generally not concerned about any of them getting in the way of Nu Holdings reaching a combined revenue of $45 billion in Mexico/Brazil. The legacy institutions are in a classic innovator’s dilemma situation, and it would take a miracle for them to recover. It would shock me if they stopped ceding share to Nu Holdings.

There are some well-run digital bank competitors such as Inter. It has 36 million customers, generated close to $1 billion Brazilian Reals in net income last year, and is growing quickly. However, we can’t expect personal finance to be a winner-takes-all situation. There will be other players in the industry, Nu Holdings will do fine either way.

(side note: Inter trades at a P/E of 14.5 and has grown its net interest income at a 37% annual rate since 2015. Maybe that is a better opportunity than Nu?)

That leaves us with MercadoPago. The fintech subsidiary of MercadoLibre is quite large and works seamlessly with its e-commerce marketplace. However, I think Nu Bank is a bigger threat to MercadoPago than the other way around.

MercadoPago was invented to make it easier for customers to shop on MercadoLibre. It is also focused more on helping businesses process payments. Yes, it does offer financing and some banking solutions, but it is not the #1 priority of the business like at Nu Bank. It is available in more countries, but in the countries that matter (Brazil and Mexico) Nu Bank can offer a better personal finance product.

Let’s think about it from a customer decision standpoint. You have used MercadoPago in the past to send money, spend on MercadoLibre, and even paid using it at a local shop and acquired a personal loan.

However, with the arrival of Nu Bank, you now use this service as your primary bank. MercadoPago cannot offer the same set of products or interest rates because it does not have full banking licenses. You use Nu Bank more and it can offer you a full suite of products, so why wouldn’t you use it instead of MercadoPago?

We can see this playing out with Nu Bank set to surpass MercadoPago in Mexico within a few years in # of users.

Using an American analogy, Venmo had and still has many more active users than SoFi or Ally. However, I would be more optimistic on the earnings growth of SoFi or Ally over the long-term because they can offer a better fully-fledged banking solution compared to Venmo. I believe Nu Bank should steal some share from MercadoPago in Brazil but especially Mexico.

One large risk (or opportunity?)

As a bank, there is an obvious risk we can talk about briefly: the credit cycle. If users in Brazil and Mexico start struggling financially and can’t pay their loans, Nu Bank’s earnings will go down.

It uses sub-90 and +90 delinquency rates to track the health of its credit portfolio. So far, it has been a great underwriter of credit. But who knows what could happen over a multi-year period that could make these metrics much worse.

As someone who is focused on buying and holding for the long-term, this does not concern me. Brazil has been struggling as an economy for the last 10 years with stagnant GDP growth. Nu Bank has done fine in this environment. My expectation would actually be for the economy to bounce back somewhat over the next decade, it would be hard for things to go worse over a long time period.

Second, Nu Bank has a conservative balance sheet with plenty of capital to get through a downturn. It is growing deposits quickly, has lower overhead costs than traditional banks, and diversified revenue streams.

In fact, I think a downturn would be good for Nu Holdings and would allow it to take more share. This is the type of stock you want to buy during a recession when the numbers look ugly but you have a longer time horizon than Mr. Market.

The one large risk I have when it comes to creating shareholder value comes back to management and culture. Seeing the below graphic, Nu Holdings has an ambition to be large and diversify beyond financial services.

Red flag. Red flag. Red flag.

Yes, Nu Holdings has executed brilliantly with product development. Yes, some companies succeed (Amazon) in expanding outside of their core competency.

Most destroy shareholder value. I would be concerned if Nu Holdings expanded into new geographies outside of Latin America, started making large acquisitions, or endeavored on entirely new business models.

You have such a long runway to grow with what you have right now. Keep it that way.

Estimating future financials

I am going to estimate the financials quite simply. Through our modeling above, it looks like there is the potential for $45 billion in revenue just in Brazil and Mexico. Add in some other countries and we can easily get to $50 billion.

But what net income margin will they earn on this revenue?

In 2024, Nu Holdings had a cost of revenue of 54%. This includes interest, transactional, and credit loss allowances. They have not achieved much scale in this part of the business, so let’s estimate that it only falls to 50% when we get closer to maturity.

There has been much more leverage on customer support, marketing, and general overhead costs. These made up 21% of revenue in 2024 compared to 57% in 2020.

At scale, let’s assume this falls to 15% of revenue.

15% + 50% is a total cost of revenue of 65%, or a 35% margin. Add in some taxes and – roughly – we can get to a 25% net income margin without too much more operating leverage. Tax rates are obviously subject to change in these various jurisdictions.

A 25% net income margin on $50 billion in revenue is $12.5 billion in annual net income. Today, Nu Holdings has a market cap of $56 billion.

Why don’t I own this stock?

-Brett

Nu bank is partnering with Wise to do international transactions, international debt card etc. So may be wise is a better bet with similar valuations and much lower credit risk?