YouTube

Spotify

Apple Podcasts

Our Power Hour this week was recorded pre-Deepseek news. We discussed Project Stargate, some recent earnings from IBKR and Netflix, as well as a pitch on Bumble. Here are the timestamps for the episode:

(03:30) Anecdotal Insights from Texas

(06:39) Netflix Earnings and Subscriber Growth

(12:26) Exploring Netflix's Future Strategies

(18:25) IBKR Earnings and Market Dynamics

(24:32) Bubble Watch: Signs of Market Sentiment

(30:17) Cultural Reflections on Investing

(34:05) Introduction to Sponsors and Community Engagement

(35:39) Small Cap of the Week: Rev Group Analysis

(41:59) Project Stargate: AI Infrastructure Investment

(50:28) Nintendo Switch 2: Anticipated Release and Market Impact

(54:54) Dating Apps: Bumble and Grindr Investment Insights

Let’s talk about R1 and Deepseek. Or, what I know I don’t know about the future of artificial intelligence.

Deepseek came out with a workable LLM that is much less costly than ChatGPT, Gemini, and all the AI start-ups. It is also Chinese. Shares of Nvidia are down 17% today because people are worried the future of AI models will be less cost-intensive from a semiconductor perspective.

In the last year, Nvidia has looked invincible. The financial results have been fantastic. Perhaps they will continue to be fantastic. I don’t know.

That is the key: I don’t know. You don’t know. Not even Sam Altman knows what the future of AI will look like. If you are investing in AI stocks, you are buying into a sector that is rapidly changing, making future earnings unpredictable.

I want to invest in sectors where I am confident things won’t change. That doesn’t mean the companies are guaranteed to have durable earnings, but it is one less variable to worry about. I want to be certain that end-market demand will be present in the future.

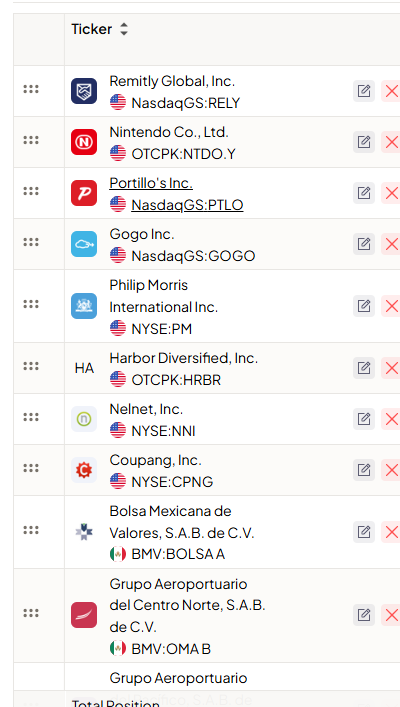

Let’s look at my current portfolio to see if this stacks up:

(ignoring Harbor Diversified, which is an illiquid market cap that is untradeable right now. Long story for another day. Also ignoring Nelnet which is a conglomerate bet on management.)

Will people need to send money across borders in the future? Yes.

Will families be looking for kid-friendly home entertainment options? Yes.

Will people want to eat greasy food at a reasonable price? Yes. (maybe Ozempic kills this. Maybe.)

Will business jets want access to high-speed internet? Yes.

Will people use nicotine? Yes.

Will South Korean people want a wide selection of e-commerce products that can be delivered in a few hours? Yes.

Will there be publicly traded Mexican stocks? Yes.

Will people want to fly in and to Mexico? Yes.

A business with more predictable end-market demand is one that is of higher quality than one with unpredictable end-market demand because you can be confident in earnings durability.

AI is the complete opposite. None of us know what the sector will look like in a few years, just like none of us knew what the internet would look like in 2010 back in 1995.

Why pay up for this uncertainty?

If it walks like a bubble and quacks like a bubble, perhaps it is a bubble. We will see.

-Brett

Chit Chat stocks is presented by:

Public.com has just launched its BOND ACCOUNT. Lock-in interest rates of 6% or higher (as of 9/30/24) by signing up today!

With as little as $1,000, the bond account allows you to buy a diversified portfolio of bonds and lock in your yield even if the Federal Reserve cuts rates.

It only takes a couple of minutes, get started today at Public.com/chitchatstocks and open up a bond fund today!

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. As of 9/26/24, the average, annualized yield to worst (YTW) across the Bond Account is greater than 6%. A bond’s yield is a function of its market price, which can fluctuate; therefore, a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule. Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. See https://public.com/disclosures/bond-account to learn more.