The Real Brokerage: The Fastest Growing Company We've EVER Covered on The Podcast (Ticker: REAX)

But am I buying the stock?

YouTube

Spotify

Apple Podcasts

I’m delighted to share our latest research report for Chit Chat Stocks. It is an underfollowed small-cap with no write-ups on Value Investors Club, YellowBrick Investing, or Substack. Music to my ears. Few investors even know this company exists.

That’s where the opportunities lie.

Revenue has gone up 100x in the last six years, and it is taking market share quickly in the large real estate brokerage sector while expanding into title insurance, mortgage loans, and financial services. Potential for more share gains reminds me of Remitly Global.

The company we are studying today is The Real Brokerage (Ticker: REAX). A cloud-based brokerage that is using smartphones, software, and the internet to disrupt the traditional agent-to-brokerage model.

With no physical offices, The Real Brokerage has lower overhead costs than traditional brokerages, enabling the company to offer much better commission splits with its real estate agent contractors and teams.

Acting as an operating system for agents in residential real estate transactions, the Real Brokerage is driving down costs and creating a non-zero-sum outcome for all players in the industry. It may even help lower those pesky commission rates you pay when buying and selling a home.

That is why agents are flocking to the platform and why revenue has gone from under $10 million to closing in on $1.5 billion in less than a decade.

Plus, the company is facing a macroeconomic headwind that may be about to reverse.

Below, you will find my show notes from the episode. Give the podcast a listen if you haven’t already!

-Brett

The traditional real estate commission model

The best way to begin our analysis of The Real Brokerage is to look at how the residential real estate industry operates.

Typically, a licensed real estate agent will join a branded brokerage such as Windermere, which is a large brand in the state where I reside. Agents make money by taking a commission on every real estate deal they close. Commissions are usually 6% of the final value of the transaction, split evenly between the buyer and seller agents.

For a home that sells for $1 million, $30,000 will go to the buyer’s agent and $30,000 will go to the seller’s agent (3% and 3%). However, agents have to share part of these commissions with Windermere, the brokerage they represent. Exact details of these commission splits are kept under wraps, but from what I read, the split typically starts at 50/50 and can work up to a better 80/20 split if the agent is successful.

This means agents are giving upwards of $15,000 of the $30,000 commission they get with a million-dollar home sale to the brokerage they work with.

Why do agents work with a brokerage brand such as Windermere and sacrifice so much profit?

Well, for one, they are required by law to use a broker. Two, a company such as Windermere will tout its brand status along with the mentorship from its community and other agents. The agents need Windermere because sellers only want a trusted brand, and Windermere needs its agents in order to close deals. A symbiotic relationship where both stakeholders succeed. Or, so the story goes.

As you may have guessed, today we are discussing the next chapter in this story.

Real estate internet portals, smartphones, and digitization have changed the homebuying process, leading to disruption and pricing pressure across the brokerage industry.

That disruption is now being led by The Real Brokerage. Its revenue was a measly $8.4 million in 2018. Over the last twelve months, it has grown to $1.4 billion, a 127% compound annual growth rate.

Here’s why it is the fastest-growing business in all of real estate.

How The Real Brokerage is disrupting the industry

The internet allowed Charles Schwab and Robinhood to drive down costs on stock trades. Online banks such as SoFi and Ally Financial have lower overhead costs without physical bank branches that enable them to offer higher interest rates to customers.

Real Brokerage is aiming to do the same for real estate agents.

The company is what’s known as a cloud brokerage. Instead of going into an office and working with a legacy player such as Windermere, agents who work with the Real Brokerage simply use its digital brokerage to manage their business and process transactions for clients.

There are a few reasons why an agent would want to switch to The Real Brokerage over a traditional office-based brokerage.

First, the software and ease-of-use. Real Brokerage gives you independence when operating as a real estate agent. You can build your own brand (and even private label Real Brokerage’s software) instead of getting overshadowed by the brokerage brand. Real will even send you your own physical advertising set for properties. The software is modern, can be operated from on-the-go all from a smartphone, and is getting better by the quarter as Real invests more in technology development.

A main point of differentiation is the commission split offered to agents who use the Real Brokerage. Instead of the 50/50 or 70/30 split, all agents START at an 85/15 split. From there, they can earn even more bonuses through customer referrals, where if you bring in a new agent, you get some of Real’s commission income. Once an agent hits $12,000 in commission income a year paid to Real, the agent earns 100% of the transaction value, excluding a transaction fee (I assume this is to keep transactions from going to negative gross margins).

Plus, agents are enticed with a stock purchase plan and stock awards to align both stakeholders. Shareholders, management, and the agents would all like Real Brokerage stock to go up. I believe this is a good thing.

What do agents potentially give up by switching to the Real Brokerage? In general, I believe they give up the community of the legacy brokerage, its relationship with clients, and the branding it provides. They are trusted entities, at least the well-run ones such as Windermere.

In the internet age, the upside of switching to Real greatly outweighs the downside. This is especially true for established real estate agents. From the real estate agent blogs/forums I read in research for this episode, Real Brokerage may not be useful for an agent that just received their license. But for an established agent, it can allow them to take home tens of thousands more in income annually with minimal downsides.

The numbers speak for themselves. The Real Brokerage has grown its revenue by 127% annually since 2018, going from $8.4 million in revenue to $1.4 billion over the LTM.

Gross profit has gone from zero to $128 million. Operating income remains slightly negative, but has moved in the right direction (more on that later).

Today, the stock has a market cap of $858 million.

Acquisitions and Ancillary Services

Real Brokerage sees the real estate industry as antiquated and broken. Instead of trying to fully disrupt the traditional model like Redfin or the iBuyers, such as Opendoor (RIP), Real Brokerage wants to use the internet and digital tools to make existing agents more productive, all with lower overhead costs on its end.

This combination will allow Real Brokerage to succeed if commission fees come down on real estate transactions. Traditional brokers will struggle in a lower fee environment because of overhead costs.

It has succeeded rapidly in the brokerage business. To further its ambitions, Real is now working to add ancillary services in categories that real estate agents operate in.

LemonBrew Lending

In late 2022, Real acquired LemonBrew Lending, a home loan platform. The acquisition allowed the company to enter the mortgage loan underwriting business, which has now been renamed One Real Mortgage. Now, instead of just operating as the software backbone for real estate agents, homebuyers can finance their home purchases with Real. The attach rate for One Real Mortgage for Real Brokerage agents is low today, but I expect this to grow over time.

This segment is small at just $4.4 million in revenue of the LTM, but it has 50% gross margins compared to 10% for the agent brokerage business. On $100 million in revenue, that could equal $50 million in gross profit.

Acquisition of Expetitle

Real performed the same strategy for the title insurance industry with the acquisition of Expetitle in 2022. This business has been renamed to One Real Title and offers title insurance and escrow services.

Again, this is vertically integrating what is needed across the homebuying process. Not a novel concept, I’m sure, but a smart one that can help bring in high-margin revenue for Real Brokerage. Title commissions come with 80% gross margins, even higher than mortgage commissions.

This segment generated $5 million in revenue over the LTM. Apparently, there have been complaints about the quality of service with One Real Title, which aligns with commentary on the Q1 call about a “strategic re-pivot” of the segment, which I translate to basically mean “we screwed up and are fixing the issues and customer complaints.”

The Real Wallet

The Real Wallet was launched in late 2024 and serves as a digital wallet for a real estate agent’s finances.

Real promises to get you your money faster, easily show commissions, payouts, and revenue share, and manage your finances all from a mobile application. It already has a debit card agents can use.

I would think of the Real Wallet as the PayPal, Wise account, or any other digital wallet, but tailored specifically for real estate agents who use the Real Brokerage. I am very optimistic about growth here. Real Wallet already has 3,200 agents in the United States using the product, compared to 27,000 total agents on Real Brokerage.

Eventually, the company wants to perform more financial services for agents, such as giving them lines of credit. If there is wide adoption of the Real Wallet, the Real Brokerage can widen its competitive advantage and start generating tons of interest income on the float held in accounts.

Leo AI

Leo AI is a support agent for all the agents working with the Real Brokerage. It is trained on your agent qualifications, history, and potentially even your voice to provide basic chats and even calls with buyers and sellers. It also helps generate content for social media.

The company may be hyping up these capabilities today in order to take advantage of the AI narrative – it even had prepared remarks from the CEO on the conference call read by Leo AI instead of him – but it can be highly valuable for agents to save them on busywork while they work with clients in the field.

There is a lot of busywork to deal with in residential real estate. The Real Brokerage aims to alleviate these pains.

Over the long term, Real management says it wants to have Leo AI be used by buyers and sellers in the homebuying process, which is a bit of a moonshot. It remains to be seen how much adoption the product has with agents, but it has a chance to widen Real’s competitive advantage and retain customers.

If The Real Brokerage executes in scaling all these ancillary services that circle around its brokerage business, it has a chance to be the true operating system for real estate agents. The moonshot is disrupting the client (i.e. homebuying process) through AI, but we do not have clarity on this strategy yet. Regardless, we do not need to see any penetration on the client side for the stock to work.

Confidence in continued growth (competition and market share)

The Real Brokerage may be on the cusp of a growth inflection in the real estate agent industry. Management estimates it has about a 2% market share, and that does not include Title, mortgage, and Real Wallet. Remitly comes to mind here when looking at the Real Brokerage. A lower-cost disruptor taking market share, but with plenty of room to keep stealing share from legacy players.

Real Brokerage has 27,000 agents using its services. There are an estimated 2 million real estate agents licensed in the United States, and even if only half are serious workers, that provides an immense opportunity for The Real Brokerage to take share.

Why can’t it get to 100,000 agents using its platform? I think that is highly doable. If 2% of the real estate agents find the brokerage worthwhile, why not 10%?

Real Brokerage generates approximately $4,700 in gross profit per agent signed to its brokerage. I believe this figure can grow to $10,000 over the long-term with the monetization opportunities at title, mortgage, and Real Wallet.

100,000 agents and $10,000 in annual gross profit per agent equate to $1 billion in annual gross profit compared to today. I am not concerned with Real’s ability to grow (shout out to the custom metric generator on Fiscal.ai).

Who are the competitors to Real Brokerage?

First, we have the legacy players. These are the easy targets where Real Brokerage can take market share. I expect cloud-based brokerages to keep taking share as a whole vs. these players.

Then, we have players like Compass. This is a digital-focused broker that got a ton of VC funding. Much more than the Real Brokerage. And yet, it only has 33,000 agents on its platform. Plus, it does not overlap much with The Real Brokerage, as I believe it serves a more luxury market.

Thoughts from agents in this Reddit thread: https://www.reddit.com/r/realtors/comments/1k6azac/compass_vs_realexp_is_the_higher_split_at_realexp/

A direct competitor would be eXp World Holdings, which is another cloud-based brokerage. It is older than the Real Brokerage and does $4.6 billion in annual revenue. However, Real Brokerage is catching up quickly.

Lastly, I should mention the state of the real estate industry. Transactions have fallen in the tank with high interest rates and high home prices. Supply is building up and frozen. Eventually, people will sell these homes (I do not know when). Real Brokerage is facing a macro headwind right now. Pre-pandemic, existing home sales were around 5.5 million a year. Today, there are 4 million (seasonally adjusted). That is a lot of real estate agent commissions that have disappeared. Perhaps they will return shortly.

Below is a screenshot from Trading Economics on seasonally adjusted existing home sales. Ugly.

Is this just a multi-level marketing scheme? + Management

I found that some real estate agents are concerned that The Real Brokerage is just a multi-level market scheme similar to Herbalife. It does have some pyramid-scheme characteristics to its marketing strategy of paying hefty referral fees for existing agents who recruit new agents to the Real Brokerage.

However, I do not believe this makes the Real Brokerage a scummy MLM. A scummy MLM simply focuses on recruiting as many customers to keep expanding the pyramid down and down. I believe the Real Brokerage is truly committed to building its products that agents use. It wants them to be a real estate agent first, not a recruiter of more agents to work below them and earn fees.

Was PayPal an MLM for paying referral fees if you convinced a customer to join? Is any financial services company an MLM for doing that? No. Neither is the Real Brokerage. The bulk of its $57 million in annual marketing expense – 50% of gross profit – may be spent on agent referrals and stock bonuses, but that does not make it a shady MLM.

Now, some real estate agents said they got “MLM vibes” from the eXp cloud brokerage because of the intense focus on recruiting new agents to join instead of doing your actual job as a real estate agent. Maybe this is why the company is losing market share to Real Brokerage.

This will allow us to talk about management. The Real Brokerage was founded by Tamir Poleg. He is CEO today and owns roughly 3.5% of the business according to Fiscal.ai. I like this shareholder alignment.

I have nothing much else to say about management except that Poleg feels rock solid. He gets what is needed to drive a competitive advantage and drive a marketing advantage to build scale and attract agents to the platform. It is going to take aggressive spending, but the unit economics are worth it.

He is a jockey I am willing to bet on. Importantly, I need to track his actions, decisions, and temperament to increase my conviction that he is a founder who deserves to “manage” my savings for me.

Modeling future earnings power and valuation

Before diving into my future earnings estimate for The Real Brokerage, we should remember two things:

The Real Brokerage is a low-margin business. Gross margin was 9% over the LTM.

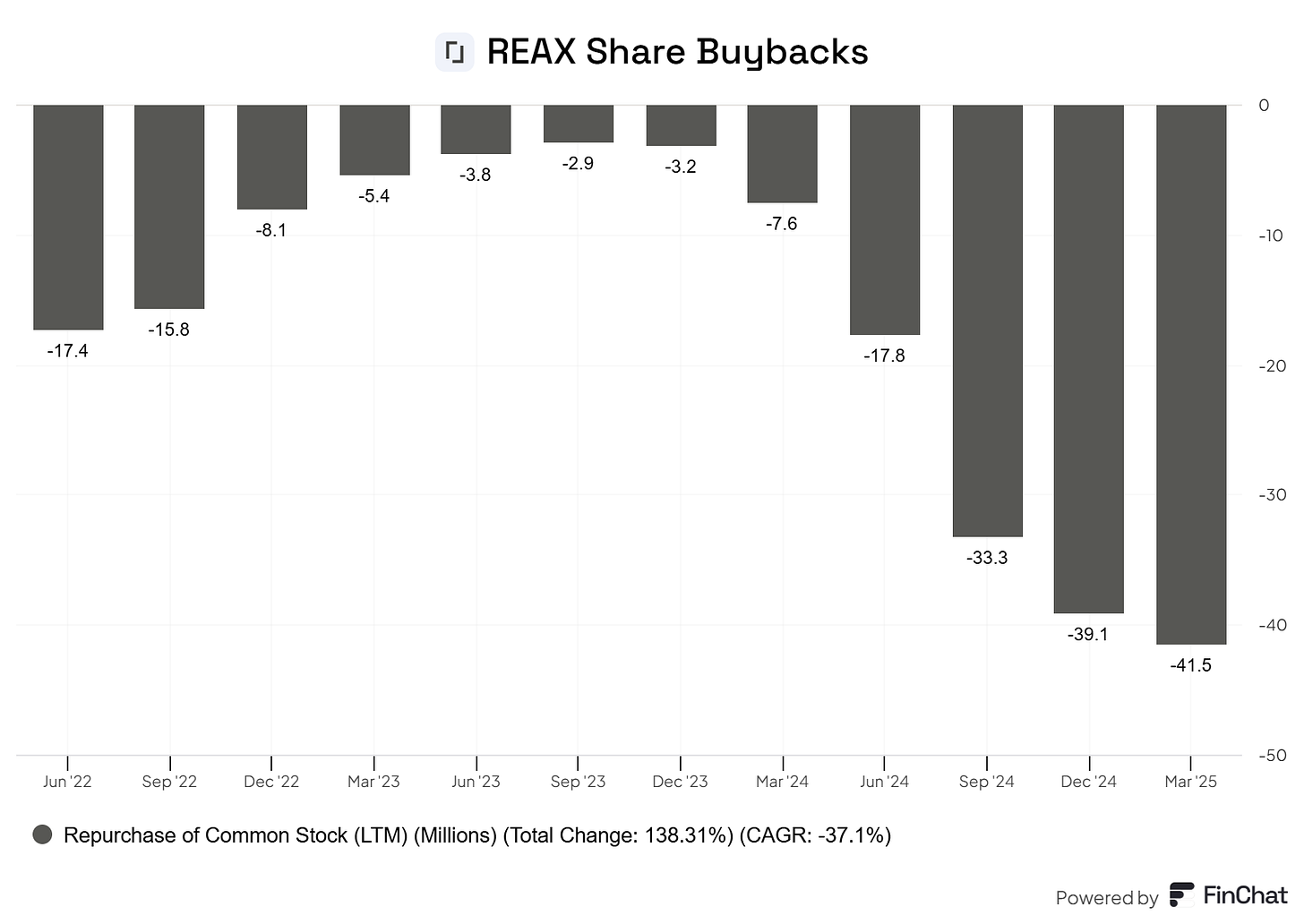

The company pays out a lot of stock-based compensation. It counteracts a lot of the SBC paid to agents and management with share repurchases. A short history says that the company is astute in timing these buybacks with lower stock prices.

Scaling up mortgage and title can edge gross margins higher.

We also need to consider the durable marketing costs that come with agent referrals and agent stock bonuses. This should have some operating leverage. Of course, there are always overhead costs and R&D.

I am not concerned about revenue growth. Revenue was up 76% year-over-year last quarter in a tough operating environment. Some may call this aggressive, but I think 50% annual revenue growth for the next five years is doable for The Real Brokerage. I am trying to be accurate, not stupidly conservative, and 50% growth seems ballpark reasonable to me when you have so much market share to take, headwinds that may turn into tailwinds, and the potential of title, mortgage, and the Real Wallet.

50% revenue growth for the next five years brings revenue to $10.7 billion.

The big question I struggle with is what operating margin the Real Brokerage will have in five years.

A 3% bottom-line margin is $321 million in earnings.

A 5% margin is $535 million in earnings.

A (unlikely) 7% margin is $749 million in earnings.

Assuming share count stays neutral because of buybacks, we have a market cap of $858 million in five years at today’s stock price of $4.16. That is 2.7x 2030 earnings, assuming a 3% operating margin. I don’t think I need to calculate how cheap the stock is if profit margins inflect to 5% in five years, you get the picture.

The stock looks cheap today. Dirt cheap. Assuming the company trades at 27x earnings in 2030 because of its fast growth rate, and that’s your ten bagger right there.

Of course, things may not go as planned. They probably will not follow this path. But I believe REAX stock trades at a margin of safety even though it is unprofitable today, given its potential for earnings growth over the next five years. If growth slows down dramatically, there will be some downside for the stock price, but it will not be catastrophic.

Am I buying The Real Brokerage?

I think I should buy REAX stock. The Real Brokerage has a chance to 10x and be a huge winner in the residential real estate space, and it is trading at a reasonable valuation with a founder at the helm.

To do so, I will need to trim an existing position. I own too many stocks for my liking at the moment. That will be the next decision I need to make.

Does the commission cap of $12k not reduce the growth potential here from more home sales? Assuming a 3% commission for the agent (buying or selling) and 15% sharing rate with Real thats total sales of $2.6m before capping out and not paying Real anymore. Do we know what proportion of agents are currently capped out?

"50% revenue growth for the next five years brings revenue to $10.7 billion"

How do you get that number? Shouldn't it be 2.6B ?

Starting $350M, 5 years, 50% CAGR.

You get (1+0.5)^5 * 350M = 2.6B