Instacart: The Next Great Network Effect Business? (Ticker: CART)

An underrated marketplace hiding in plain sight

YouTube

Spotify

Apple Podcasts

This morning, we released another stock research podcast episode. Ryan’s turn this week.

The company? Instacart (Ticker: CART). The grocery delivery giant could be a sneaky cheap network effect business hiding in plain sight. Ryan explores the business and how he analyzed the stock.

Here are his edited show notes from the episode.

How has Instacart become the leader in 3rd party grocery delivery?

Instacart was in many ways your stereotypical Silicon Valley story. An Indian Canadian named Apoorva Mehta landed a job as an engineer at Amazon in Seattle after finishing school, and like many young developers, he had ambitions to build something of his own. This was around 2010, when more and more network businesses (Airbnb, Uber, Grubhub, etc.) were popping up and gaining traction.

Mehta had a similar idea which was inspired by his own terrible commute to get groceries during the Canadian winters. In 2010, Mehta quit his job at Amazon, moved down to San Francisco and pitched his idea at Y-Combinator. His application was accepted in 2012 and the idea that garnered traction was simple.

Here’s a quote from Mehta in the early days:

“Instacart is a product where you can order your groceries and get them delivered to your door within 1 hour. What’s interesting about this is how we actually make this happen. Instacart is an entirely software company. This means we don’t have any warehouses, no trucks, and we don’t hold any inventory. So when you order your groceries, we have one of the thousands of personal shoppers in our network pick up your groceries from stores such as Wholefoods, Costco, and Safeway, as well as many others, and have them brought to your door within 1 hour.”

I won’t spend too much time on the genesis of the idea as it’s not too important today, but I do want to focus on how they actually gained traction because I think that’s the hard part with early stage networks like this.

For this part, I’m going to refer to our friend Buyback Capital (follow his Substack!) as I like what he wrote about it:

“The first personal shoppers would text Mehta after their orders were completed. In fact, the personal shopper was an unusual hack - from the retailer’s perspective it was just another person walking into their physical location to buy groceries. Long time CART execs fondly refers to this as ninja shopping. From CART’s perspective, this was the beginning of aggregating the demand side of the equation without necessarily needing to consult the supply side.

The only hitch with side-lining the retailer (initially at least) was the lack of adequate SKU information to display to customers. This challenge was obviated by CART actually physically going into all relevant retail outlets and purchasing each individual product, photographing it, and uploading it to the app. This was the beginning of an unusual competitive advantage - they became the only centralised data depository of SKU information across retailers.”

That data advantage served them well in attracting new customers and they did what most emerging networks do, they started in San Francisco then gradually branched out.

Today, Instacart reaches about 98% of US households, they are home to an estimated 8 million customers (don’t give out that info), and they have 600,000 shoppers on their platform.

How do the mechanics of a transaction work?

This part has evolved over the years quite a bit. The core value prop hasn’t changed much but the way Instacart makes money has.

Let’s run through a typical transaction. You’re a mom, you’ve got some kids, you work a 9 to 5, and all in all, you’re pretty busy. You know you’re running low on groceries, but you don’t have time to go get stuff on your own so you take to Instacart.

Once you’re in the Instacart app, you pick the store you want to buy items from then you can basically browse that store digitally. You can browse by category or you can type in what you’re looking for and start to build your cart.

At each stage of the digital shopping experience, you will see discounts. So for example, I made an account, I said I wanted to shop at HEB (the closest big grocery store near me), I chose bakery as a category and I was presented with a number of baked goods items that were on sale. That is one of the ways Instacart generates ad revenue. It is essentially the modern day shopping coupons.

After I’ve filled my cart and checked out, a shopper can then accept the order (much like Uber) and start picking out the items at the store to bring them to my house. Now importantly, this is not an entirely hands-off experience, there’s a lot of messaging that goes on between the shopper and the customer in the shopping experience (substitutions, size of items, etc.).

Once the shopper has checked out, they deliver the items to your door and your bill is based on a number of factors. There’s a service fee that ranges depending on location and the number and types of items in your cart. There’s a delivery fee (unless you have the subscription). And there’s the option to tip.

Importantly, the tipping option incentivizes shoppers to do a good job on the orders.

I ran the girlfriend test and asked her about her experience using the app and I thought it provided some useful insights around the customer value proposition:

Ryan: “Why do use a grocery delivery service?”

Ryan’s GF: “Sometimes I’m just being lazy but typically it’s the time savings. If I have a bunch of stuff after work but I know I need the items, it’s more convenient. Also, sometimes I just don’t have the ability to go like if I’m on vacation or something.”

Ryan: “Have you ever used another grocery delivery service?”

Ryan’s GF: “No.”

Ryan: “Would you ever use Uber or Doordash for groceries? Why or why not?”

Ryan’s GF: “Probably not. I feel like the Instacart shoppers are typically like stay at home moms or that they are just more responsible and care more, whereas the uber drivers are probably trying to go as fast as they can.”

Ryan: “Do you tip?”

Ryan’s GF: “Yes. I’m more willing to tip because it’s just a small percentage of the order usually compared to like Uber or Doordash.”

What is the advertising offering?

Advertising wasn’t really a big part of Instacart’s business until 2021. It actually took them 8 years before they even started offering advertising and pretty quickly they realized that this is going to be their real monetization engine.

Instacart offers a variety of ad destinations for consumer packaged goods brands. In each destination, CPG brands pay to be put front and center in the user experience. Sometimes that’s while browsing, sometimes it’s while searching, and sometimes it’s even after the order (sponsored substitutions).

This is super valuable for CPG brands, and it seems to be resonating in a big way. Advertising & Other revenue has more than 10x’d since pre-COVID.

Does Instacart have a MOAT?

Let’s put some industry-wide numbers together to give a sense of where Instacart sits. First off, e-commerce broadly accounts for ~14% of total grocery spending in the US. I suspect that number will continue to grow over time, but I wouldn’t expect anywhere near the sort of penetration you see in traditional retail.

Of that grocery e-commerce space, Instacart accounts for 19% of the industry, making them the 3rd largest player behind Walmart (34%) and Amazon (24%). However, if you exclude those and you just focus on 3rd party delivery providers, Instacart has more than 70% market share. So in terms of grocery delivery, they are significantly larger than Uber and DoorDash today.

To answer this question, you have to look at their competitive standing in two ways:

1) Are they advantaged versus other 3rd party services? And,

2) Do they provide enough value to prevent grocers from trying to do this in-house?

Are they advantaged versus other 3rd party services?

I see the competition from Uber and Doordash brought up a lot from investors when talking about Instacart, and I think the concern here is way overblown. Skeptics say Doordash has more than 40 million users and Uber has more than 170 million users, so they have a size advantage, but I really don’t buy that.

Despite significant investments from both companies in the grocery space, they are having a hard time migrating customer habits over to big grocery orders. I think part of this is the shopper base Instacart has acquired. Frankly, anyone can deliver DoorDash orders, whereas Instacart requires a little more experience and know-how. You’re not just picking up a food order at a restaurant. These are typically $200+ orders with more than 100 items. There’s some personal discernment and judgment required on the part of the shopper, and customers know that.

Will grocers build this out in-house?

Some will. Walmart has obviously done a very good job in this regard. But I think for pretty much everyone else, it makes more sense to let the delivery providers come to you. Services like Instacart increase store traffic and sales volumes, and they actually provide a number of other services as well.

Instacart has inventory management tools, advertising products, and white-labeled e-commerce storefronts for grocers as well.

Not to mention. This is not most grocery stores’ core competency. I would be very surprised if a whole bunch of grocery stores started to squeeze out Instacart.

Long story short: I don’t think they have some impenetrable moat, but I do think they hold a stickier position in the eyes of almost all their stakeholders than many people realize.

Management & Capital Allocation

Apoorva Mehta led the company as CEO until just prior to its IPO. In July 2021, Fidji Simo took over as CEO and a year and a half later, they went public. More on her in a bit.

After stepping down as CEO, Mehta initially became Chairman but a year later he left the board completely and wanted to pursue other stuff. Not sure if there was a falling out here or not, but he still owns ~7% of the stock (single share class so no extra voting power) and he has been selling a lot lately. I don’t think he’s too important to the story here, but it’s worth knowing that if he continues to sell the only major holders left will be the VC funds that were there in the early days.

Anyway, onto the current CEO. Fidji Simo spent most of her corporate life at Facebook. She was there from 1k employees to 100k employees and was apparently pretty instrumental in the buildout of Facebook’s ads business. She’s had some good commentary on public calls, and she lays out the priorities of her ads business in one of them. Here were the 4 levers she says they are focused on:

“One is getting our current advertisers to spend more, and that comes from continuing to roll out innovations in terms of format.”

“The second lever is to get more emerging brands to advertise on Instacart.”

“The third lever is penetrating categories that have high investment rate even further. I'll give you a couple of examples, alcohol, personal care, pets tend to have a much higher investment rate than the rest of the selection.”

“And then a fourth but smaller lever is actually our investment in off-site through Carrot Ads, where we take our entire ads platform, and we make it available on our retailers owned and operated properties so that they can create a retail media business on their own.”

So far she has done well as a CEO and has done a great job building out their advertising business. As for her pay, she gets a $1M base salary and received a big signing package that now (after being amended) basically states if the stock price hits various price levels up to $86/share she can receive up to $63M in PSUs. I think the timeframe was supposed to be until 2025 on these and the stock got to $53 so she made a lot of money this year.

I was in the middle of trying to calculate how much she could make when I came across news that as of 10 days ago she is now the CEO of OpenAI Applications and is leaving Instacart.

As for capital allocation, over the last 2 years, they’ve spent $2.2B on buybacks. They’ve actually reduced the share count by 6% over that time. Their multiple has come up a bit over the last year or so, so I suspect it won’t be as effective now. However, they’ve shown that they can easily pull that lever when they want.

Where will Instacart be in 5 years?

Today, Instacart processes about $34 billion in transactions each year. On that, they typically earn about a 6.5%-7.5% take rate, so that comes out to ~$2.5B in transaction revenue. Then they earn an additional $1B in advertising revenue.

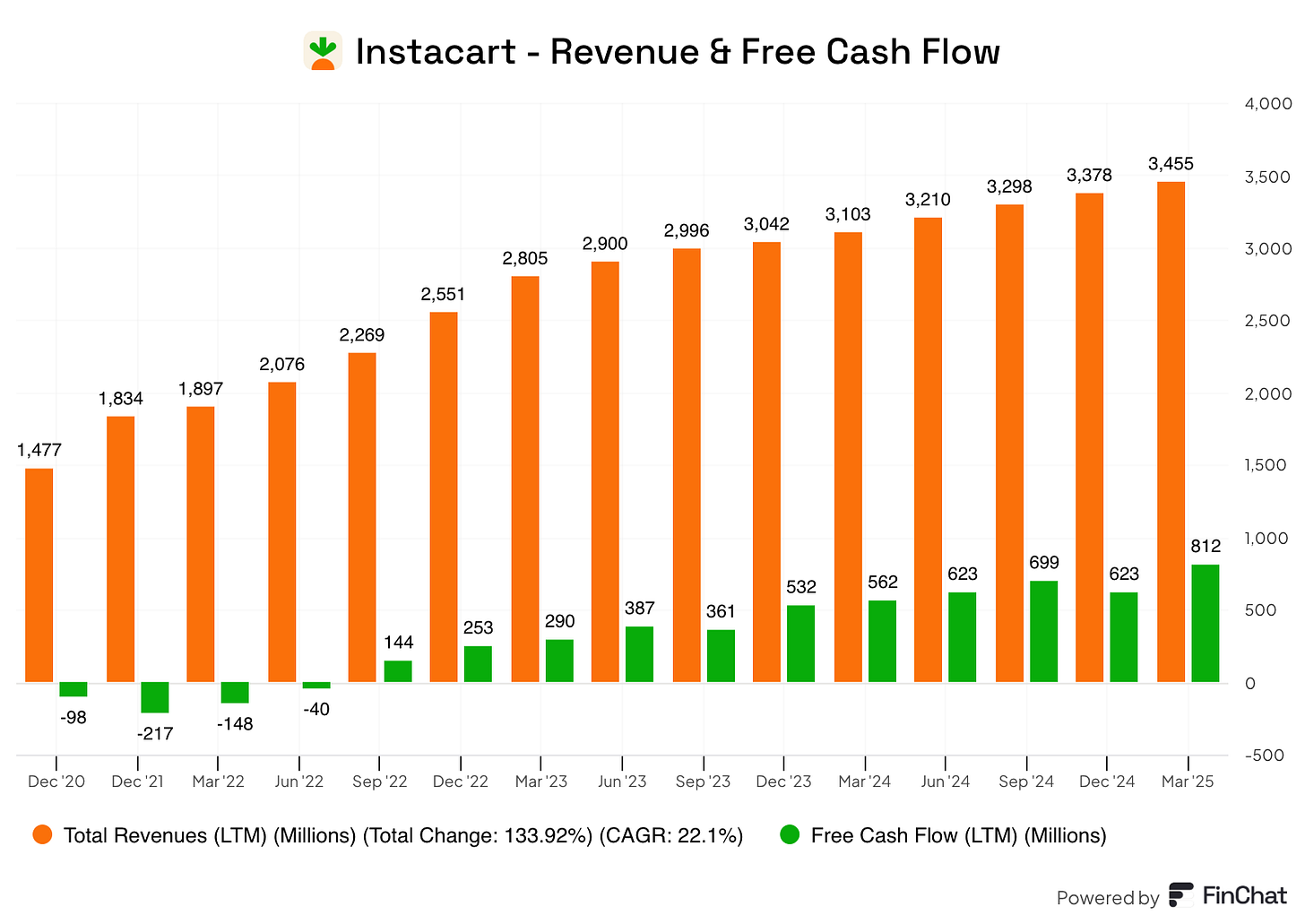

Altogether, they currently do about $3.5B in revenue. The bulk of shopper payments are tips, so for a marketplace like this Instacart actually has really high gross margins of 75%, and then the bulk of their expenses come in the operating expense lines. So they spend a lot on Sales & Marketing as well as general talent.

Ultimately, they generate 24% free cash flow margins, which has grown rapidly over the last few years but they pay about 10% of revenue out in SBC. So right now you are looking at about 14% FCF margins minus SBC.

As for projections, if we look at post-COVID (which I would have expected to be a slow period), Instacart has grown its gross transaction value at 10%+ per year. I personally don’t see why there would be a big slowdown for this. I’ve seen a lot of arguments that they’ll lose out to competition and it will impact this, but I simply disagree.

Additionally, I don’t expect the take-rate to change a whole lot, so I suspect revenue will grow in line (maybe faster if Advertising outpaces the rest of the business). And if you get this level of revenue growth, nothing is stopping margins from continuing to expand. So my projections for the next 5 years are as follows:

10% Revenue growth

20% FCF-SBC Margins (up from 14% today)

Share count doesn’t change. (Either they spend all their cash flow on buybacks or you get a higher multiple than I forecast and it works out anyways)

That would mean that in 2029, Instacart would be generating $1.1 billion in free cash flow minus stock-based compensation. At 20x, which is just under where they trade today, you’d get a market cap of ~$22B. Today they have a market cap of $12B. So just under a double over 5 years.

Am I buying?

I’m still undecided. I seem to believe in the staying power of this business much more than a lot of other investors, but I would have hoped to get a slightly better return under my current assumptions.

At under 20x EBIT, I’d start a position.

-Ryan