Podcast: Why Has E.L.F. Beauty Soared 600% In Two Years? (Ticker: ELF)

A report on one of the fastest growing consumer brands worldwide

Reminder: these are show notes that should be read in conjunction with the podcast. Do not expect these notes to be a polished research report. Enjoy the episode and listen wherever you get your podcasts!

YouTube

Spotify

Apple Podcasts

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

By sharing 50% of their options revenue, Public has created a more transparent options trading experience. You’ll know exactly how much they make from each trade because they literally give you half of it.

Activate options trading at Public.com/chitchatstocks by March 31 to lock in your lifetime rebate.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

For each options transaction, Public Investing shares 50% of their order flow revenue as a rebate to help reduce your trading costs. This rebate will be displayed as a negative number in the “Additional Fees” column of your Trade Confirmation Statement and will be immediately reflected in the total dollars paid or received for the transaction. Order flow rebates are only issued for options trades and not for transactions involving other assets, including equities. For more information, refer to the Fee Schedule.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

Show Notes

Sep. 22, 2016, from the WSJ

“The stock, which trades under the symbol “ELF,” closed at $26.50 in New York, valuing the company at $1.18 billion. The shares opened at $24 and rose as high as $27.40 intraday”

“E.l.f. products are sold online and in roughly 19,000 retail stores in the U.S., according to the company. It counts Target Corp. as its oldest national retail customer but also has agreements with Wal-Mart Stores Inc., Gap Inc.’s Old Navy chain and CVS Health Corp. The company also had nine of its own retail stores in the New York metro area, as of August, and plans to open more stores nationally in high-traffic locations”

“For the six months ended June 30, e.l.f. reported a profit of $1.1 million, compared with $2.7 million a year earlier. Revenue rose 29% to $96.8 million.

E.l.f. said it aims to expand its brand into skincare and other products, and that it recently introduced a skin-care line priced at $4 to $12 per product”

Today, we are studying the company from the above 2016 article: ELF Beauty. Standing for “Eyes, Lips, Face” the company was one of the hottest IPOs of 2016 at a time when the market was finally coming out of its GFC slumber.

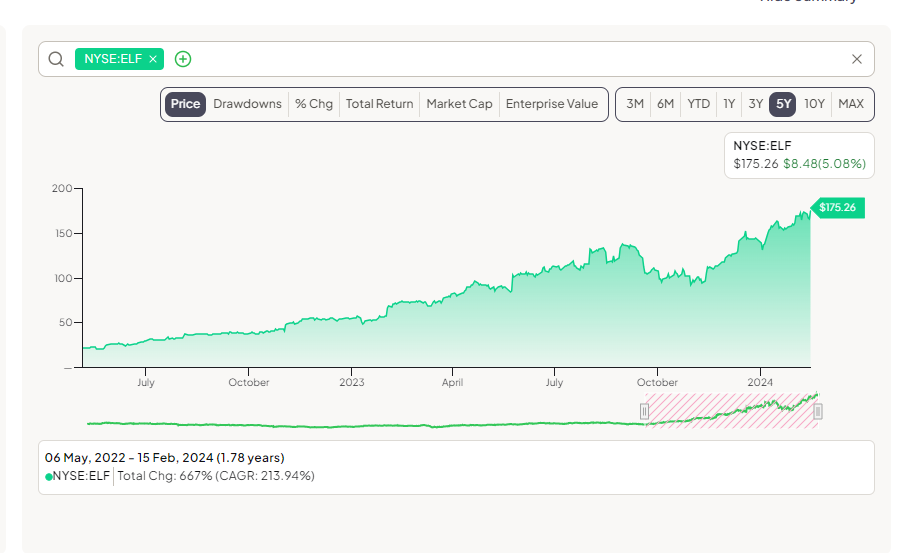

But if we fast forward over five years, in May of 2022 shares of ELF Beauty were BELOW its IPO price, producing terrible total returns for investors while the broad market soared.

During this time, ELF Beauty:

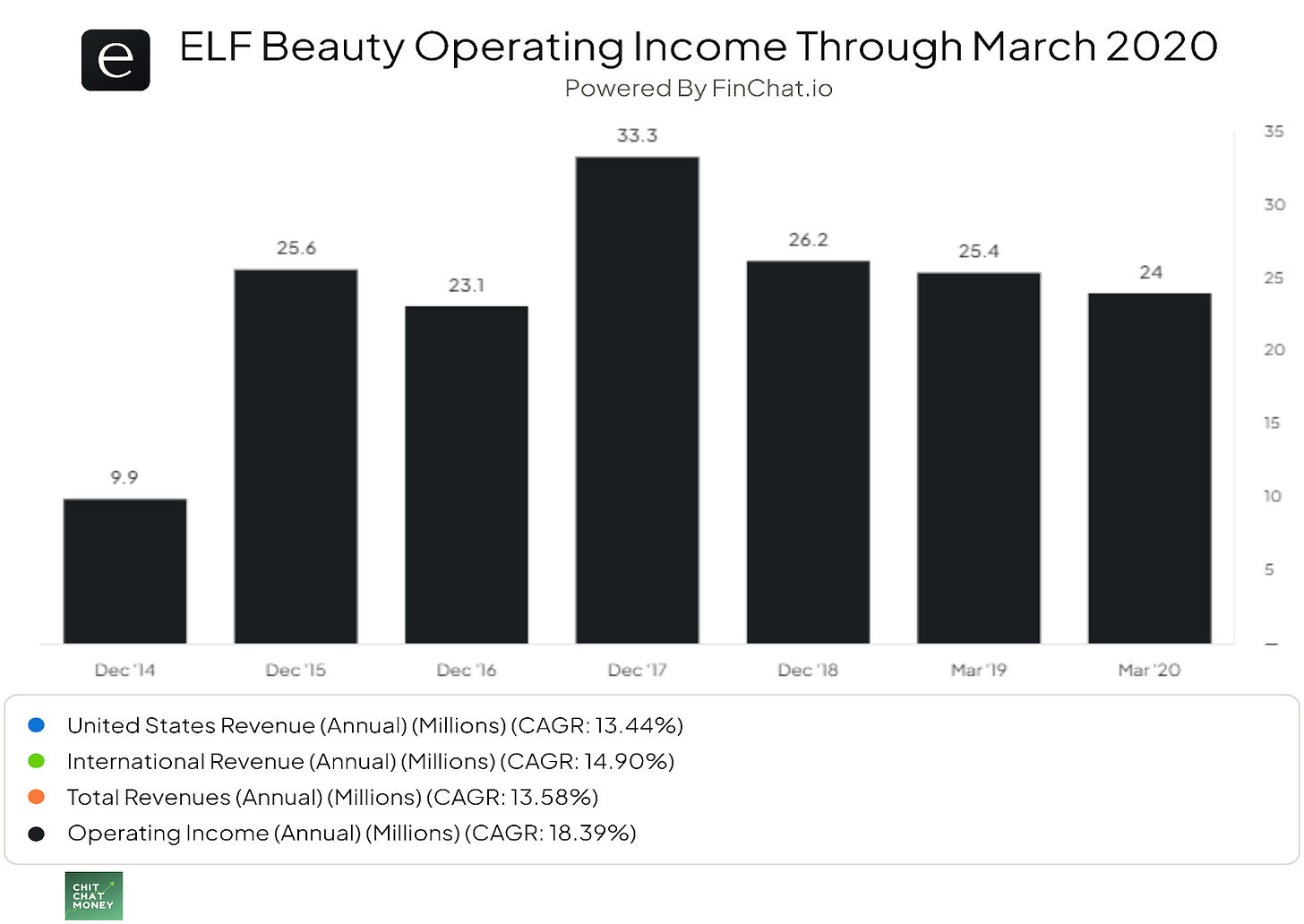

Saw stagnating revenue for multiple years (along with operating earnings)

Closures of 22 stores

The same CEO, and minimal strategy changes

And yet, starting in the summer of 2022, ELF Beauty’s revenue growth started to take off, as well as its stock price. As of this writing, shares have enjoyed a 29% CAGR since the IPO, despite spending most of this time going nowhere.

Since May 2022, shares of ELF Beauty are up 667% with a 214% CAGR, making it one of the best-performing stocks of the past few years.

But why?

In this podcast episode, I am going to try and answer a few questions:

What is ELF Beauty?

Why did the story rapidly change a little under two years ago?

Is it a buy today?

What can we learn from the ELF Beauty stock story?

Come learn along with us.

What is ELF Beauty? (and some history)

ELF Beauty began in 2004 with a classic 21st Century brand story. It was started by 23-year-old Joseph Shamah (NYU student), a beauty entrepreneur named Scott Borba, and Joey’s father. Interestingly, it was three males who would start the business that now has a cult following among females.

The brand positioned itself as “quality cosmetics at a cheap price” originally selling products for just $1. And, like a lot of disrupters, it made its name online instead of in-store:

“In a unique move, e.l.f. was born and only sold online, making it one of—if not the first—digitally native beauty brands. The positioning came out of necessity when Glamour magazine wanted to feature one of the brand’s items in its pages, but couldn’t unless it was nationally available for readers to buy”

After gaining notoriety, ELF Beauty won a deal with Target, which has remained its largest distributor ever since. Over the years, it has worked to gain distribution in places such as Ulta Beauty and Wal-Mart, while also growing its online presence.

So what does ELF Beauty sell? It targets younger female customers with cheap products that get the job done but are still “good” quality. If we look at some of the current best sellers on its website, we have a “Glow Reviver Lip Oil” for $8, a “Cream Glide Lip Liner” for $2, and a “Halo Glow Liquid Filter” for $14.

It’s not much more complicated than that. It focuses on its own DTC website and Amazon Store (digital sales were 24% of net sales in the 2023 holiday quarter) as well as Target, Ulta Beauty, Wal-Mart, and other physical retailers (the rest of sales).

In 2016, the company went public…and revenue stagnated. For the fiscal year ending in December 2017, revenue was $270 million. For the fiscal year ending March 2020 (they changed fiscal years) it was $283 million. Operating income looked even worse, with operating income at $25.6 million in December 2015 compared to $24 million in March 2020.

Investors were fed up with ELF Beauty at this point. In February 2020, there was an interesting short report written on ELF Beauty on Value Investors Club ($17 a share). It outlined reasons why ELF Beauty would continue to struggle, including:

Little success in e-commerce keeps them beholden to Target and ULTA (only 13% of sales at the time)

Closing of DTC retail stores

CEO a “strong seller” of ELF stock

Needing to raise prices to combat China tariffs from 2019 (affected the entire sector), which caused unit volumes to decline

The short likely worked due to the March 2020 stock market crash, as well as the headwind to the cosmetics sector as people spent less time in person in 2020 and 2021 (meaning less need to wear makeup).

However, as we know today, ELF Beauty at this point was actually poised to reinvigorate its business. So what happened?

What changed in 2022? What were investors missing? Why was there such a monstrous opportunity?

If we index revenue to start in March 2020, ELF Beauty’s revenue finally started to grow::

But remember, it was facing three major headwinds in March 2020:

Cosmetics industry tariffs

COVID-19 induced contraction for the industry

Reliance on physical retail vs. e-commerce

This made growth fairly meager through March 2022 during the heavy part of the pandemic lockdowns. Importantly, I think this made investors underrate ELF Beauty even though (and this is key) it had started to gain a lot of market share in the United States.

Take a look at the chart below.

After absorbing the U.S. reopening boom/bust (first quarter of FY 22, which was April, May, June of 2022), ELF Beauty started posting phenomenal revenue growth. This also started showing up in earnings, with TTM operating earnings now at $144 million. Add in EV/GP going to 16 and boom, there is a stock up over 600% in less than two years.

Okay, so why? And was this forecastable if you followed ELF stock? I think multiple factors were coming together in early 2022:

The cosmetics industry as a whole went from a big headwind to a tailwind as core younger customers wanted to go out again

Pent-up savings from all consumers during the pandemic (stimulus checks, no travel, huge bank balances. We’ve all seen the charts before)

Inflationary costs allowed ELF Beauty to increase prices while retaining the gap between the legacy, higher-priced products while ALSO forcing people to trade down and try ELF Beauty for the first time

Management put on a masterclass in marketing

The first three on this list were somewhat important, but are more out of management’s control. I want to focus on ELF Beauty’s marketing spend, as it will be the key to consistent growth over the long term. Marketing will always be a part of the equation for a cosmetics brand, and it has shown prowess compared to the legacy brands that seem to do the same stuff every year.

Essentially, ELF Beauty was able to put its marketing dollars where the puck was going, and then turn up the volume of this marketing spend to drive profitable growth. For example, it:

Has the top branded experience on Roblox (4 million plays)

Released a true crime parody documentary (2 million YT views)

Tik-Tok focused brand collaborations that get billions of impressions

Smart Super Bowl commercials that “explain” why you should use ELF Beauty (ex > Judge Judy telling the court it should be a crime to overspend on makeup when ELF exists)

Marketing spending went from 7% of revenue to 22% of revenue and is expected to go even higher in FY 2024 (12 months ending in March). This is actually a good thing as the company is getting a fantastic ROI on this spending with revenue growth accelerating to 85% last quarter.

Even better, it looks like they can invest a ton of incremental dollars into marketing and get great returns. Unaided awareness is only at 26%, and there is a ton of opportunity in international expansion (only 15% of sales but growing quickly).

Over the next 5 - 10 years, I would expect marketing as a % of revenue to start flatlining and then declining. It now has 4.5 million “beauty squad” members (loyalty program) which drives recurring spending on its mobile application and DTC website. I think this is a great asset and shows the strong relationship they have with the core under-30 customers of ELF Beauty.

The problem is, I’m not sure I could have predicted this in early 2022. Sure, in hindsight it all makes sense, but it would have been very difficult to see marketing spending start climbing as a % of revenue and have confidence to bet on this same management team that had gotten this stock nowhere in 5 years.

Discussion question: What was predictable here? Was ELF Beauty a smart bet two years ago? Or did investors just get lucky?

Thoughts on the management team and how important they are to the thesis

ELF Beauty is run by Tarang Amin. He joined the company 10 years ago before the IPO, and seems to have run the same strategy for years, betting on the future of social media advertising, younger female cosmetic shoppers, the DTC website, etc. From reading his transcripts, they seem to have a strategy of:

Producing quality, innovative beauty products

Price them well below the competition, which has legacy cost structures and very high margins due to decades of pricing power

Use unique (they call it innovative) marketing

Repeatedly tell customers they don’t need to spend a fortune on beauty products

Build a loyalty program

If you looked at this stock in 2021, you might think it was time to get rid of Amin or call for an activist investor. But Amin and the team stayed the course with their strategy, and it finally worked. Did they get lucky? Maybe a little. But I like that they had conviction in their strategy and didn’t sway from it even through some tough periods.

They also seem to be building a robust employee culture that cares about everyone in the organization:

“Importantly, all 300 of our employees are shareholders in ELF Beauty, with a total employee ownership at nearly 15% of shares outstanding”

One thing I am concerned about is dilutive acquisitions. Previously, ELF Beauty acquired Keys Soulcare (Alicia Keys-backed start-up) and Well People. Both seem to have done poorly compared to the core ELF brand.

Now, they have acquired a company called Naturium for $355 million (a combination of cash and stock). Naturium seems like it is doing well as a skincare start-up. Time will tell if this acquisition will work, but we are already seeing it growing slower while ELF continues to accelerate:

(Q3 2024 CC) “We previously talked about Naturium contributing about $48 million for the year, and we expect that to be consistent. So our raised guidance really is reflective of the momentum that we continue to see behind the ELF Beauty overall”

I like this management team. They have executed well. They can get revenue to efficiently grow. But I have a lingering question:

Do they understand capital allocation and creating per-share value?

I think they will answer that question for shareholders over the next 5 - 10 years. The proxy is not great, with targets based on adjusted EBITDA and heavy RSU payments to the executive team.

Are there any competitive advantages here? Can the company expand its competitive advantage over the next five years?

I would remind listeners/readers we have three criteria before investing in a stock:

Do we trust management?

Is the business predictable/durable? (i.e. competitive advantage analysis)

Is the stock cheap?

After looking at Amin’s track record and philosophy, I think I trust them. Now, let’s try to figure out whether ELF Beauty has any competitive advantages that can lead to business predictability.

I think ELF Beauty has fantastic counter positioning vs. the legacy brands. It definitely doesn’t have switching costs or a network effect, but I do believe it has a good brand competitive position as well as developing economies of scale vs. any other newcomers.

Brand position:

ELF Beauty has a nice position in the market. The older prestige players are facing a bit of an innovator’s dilemma. ELF has come in and taken market share by offering quality products at a cheap price, but these competitors haven’t reacted much at all.

Will this dynamic change? I wouldn’t bet on it.

For example, they dominate with Gen Z:

“Our strength is the #1 brand amongst Gen-Z with almost a 29-share of them as well as growing other audiences”

Economies of scale:

Economies of scale that come with doing $1 billion in revenue. I believe will allow them to underprice (or equally price) any of these start-up brands without risking profit deterioration. It has shown it can still price products low and make a profit, and can continually reinvest hundreds of millions into marketing campaigns every year. Can any other start-up in this space do a Super Bowl commercial? No. And the legacy brands seem to be asleep at the wheel.

I also think ELF Beauty has pricing power. Yes, it has to be a bit reactive to Maybelline or L’oreal as they want to keep the gap in price but look at the screenshots of the website above. Shoppers can get a product like the lip oil you will use many times for just $8. Will demand fall off if they raise prices to $10? $12? I don’t think so, and the gap will still be there.

What makes them so successful is the fact the legacy brands seem to be addicted to pricing power, which further allows someone like ELF to win customers again and again.

Lastly, I would note that beauty products are a bit different from a brand perspective. Unlike a fashion brand, you are not really showing off the brand in public (the products stay in the bathroom cabinet). There are no addictive qualities to the specific taste or chemical (such as a food/drink product). I think this creates an opening for a brand like ELF Beauty to win, but conversely also makes the entire sector much more competitive. Less people are embarrassed

Can ELF Beauty widen its moat over the next five years? Yes, I believe it can. All it has to do is keep up what it has been doing for the last five years and it will gain more power over the cosmetics industry (which will theoretically lead to more profit potential). However, I would be hesitant to say that ELF Beauty has a wide moat today. The brand is solid, and people get locked in psychologically to their consumer products, but there is nothing about this business that screams to me “wide moat” like a luxury brand, high switching cost software, and economies of scale retailers (Costco, Amazon).

That doesn’t mean this is a bad business, but it will inform my opinion on what earnings multiple I believe the stock deserves to trade at.

Valuation work: What could ELF Beauty earn 3 - 5 years from now?

You guys know we keep it complicated with management/competitive advantages, but simple on valuation.

With ELF, I think there are two key factors:

Operating margin

Revenue growth

Revenue growth is probably the most important. I ran a few projections with varying revenue growth and margin assumptions going out to fiscal year 2026. So just two years of projections.

Today, ELF Beauty is growing revenue 85% year-over-year with just above 15% operating margins.

I think continued growth and margin expansion is reasonable, especially with the international push:

“We’re super excited about what we’re going to be able to do in Italy and the response of the brand there. You will hear about additional countries in the coming quarters. I don’t think you’ll ever hear us talk about going into 30 countries all at once”

If we assume 40% revenue growth and an operating margin of 25%, P/OI looks like:

41 this FY

29 in FY 2025

21 in FY 2026

So, if we assume major operating leverage and strong revenue growth, ELF Beauty will be trading at a market multiple in two years. This assumes the market capitalization is unchanged.

If we assume revenue growth slows to 20% and operating margin stays at 15% (not a crazy scenario!), P/OI looks like:

68 this FY

56.6 in FY 2025

47.2 in FY 2026

Would ELF really be trading at 47.2 in FY 2026? Any investor needs to be asking this.

As a disclaimer, yes we are forgetting any capital returns from free cash flow coming into the business in FY 2025 and 2026. However, given where the stock trades today, any capital returns will not drastically affect the total return equation.

Am I buying shares today? When would I buy shares?

No. I believe there is minimal upside for shareholders over the next few years and a lot of potential downside. Go through the varying scenarios and model out what investors are expecting at this price. Two more years of 50% growth? Maybe even 60%? With margin expansion. That is a tall ask, and you might underperform the market if that happens. The downside is quite low if the multiple contracts.

I would buy shares if I was confident in durable growth and the P/OI got down to 10 - 15. So, very far from here. This is an incredibly risky stock at these prices. I’m not saying it is guaranteed to do poorly, but it feels like a terrible risk/reward right now.

I don’t think this means long-term shareholders should sell. You have done well and there’s no reason to take the tax hit. But is it wise for someone to buy shares trading at this nosebleed multiple after such miraculous revenue growth? I’m not sure that is a good bet.

Sources and Further Reading

WSJ article: https://www.wsj.com/articles/discount-cosmetics-firm-e-l-f-soars-in-stock-market-debut-1474560269

Historical timeline: https://cew.org/beauty_news/timeline-how-e-l-f-cosmetics-grew-into-a-giant/

VIC short report: https://www.valueinvestorsclub.com/idea/e.l.f._Beauty_Inc./5316795490#description

Q3 FY 24 Investor presentation: https://investor.elfbeauty.com/~/media/Files/E/ELF-IR/documents/event-and-presentation/elf-beauty-fq3-fy24-earnings-presentation.pdf