Why I Bought Interactive Brokers Stock (Ticker: IBKR)

A deep dive into this brokerage compounder

YouTube

Spotify

Apple Podcasts

Note: Interactive Brokers is a sponsor of the podcast, but is in no way sponsoring this pitch for the stock. I love its product, and feel grateful to get paid to tell you to join as well. My conviction for the stock is personal!

A long history of innovation in markets

Interactive Brokers (IBKR) and its founder Thomas Peterffy has been an evolving presence in financial markets since 1965 when he arrived as an immigrant from Hungary. A computer programmer, automation and cutting edge digitization have been a part of the culture at IBKR up until today. All executives at IBKR must have experience as a computer programmer.

At his home, Peterffy developed a program to calculate the fair value of options. In 1977 he purchased a seat on the American Stock Exchange and became a market maker in options.

He quickly professionalized the operation, founding T.P. & Co. and growing the team to four members in 1979. In 1982, they formalized Timber Hill, which initially started as an options market maker. In 1983, Timber Hill created the first handheld computers for trading.

By 1987, Timber Hill became fully automated and had its systems trading automatically with Nasdaq's systems, which you could say makes it the first humanless trader on Wall Street. Staying on the cutting edge of trade clearing and market making, Peterffy saw an opportunity to grow its presence in financial markets.

In 1993, Interactive Brokers (IBKR) was formed to make Timber Hill’s execution systems available to customers. With the trader workstation (TWS), IBKR was catering to more professional traders looking for a wide breadth of assets to trade.

In the 1990’s, Timber Hill started expanding globally, which gave IBKR a foot in the door to offer trading on all sorts of international markets for its clients.

We could keep going in more detail, outlining every new asset class, country, or currency able to be traded on IBKR, but there are two more things I believe investors today need to understand about IBKR’s journey.

First, it divested of Timber Hill in 2017. Why? Because it was losing to competitors such as Citadel, and wanted to focus on the crown jewel of the business in IBKR.

Second, IBKR launched IBKR Lite in 2019 to cater to individuals with commission-free trades and an easier-to-use customer interface. Evolving the business is a great indicator of a culture that can focus on the long-term.

Peterffy served as the CEO of IBKR until 2019, when he gave the job to Malin Galik. Galik began with the company as a software engineer in 1990. They love internal promotions and long executive tenures, which is a good thing for investors who plan to have a long tenure with the stock. You want this aligned.

What makes IBKR superior? And for who?

Since 2012, IBKR has grown its active accounts from 200,000 to 3.6 million, a 26% annual growth rate.

I can explain why investors switch to IBKR with my personal journey utilizing the platform. Historically, I was a Charles Schwab guy, simply because that is where I first opened a brokerage account in college. Friction is high with personal finance products.

However, as I expanded my investing horizons outside the United States, I found Charles Schwab lacking in capabilities. That is when I decided to make the switch to IBKR for all my investing needs.

IBKR offers the ability to invest in all meaningful stock markets, trade all meaningful currencies, and from virtually every country around the world. Its automated systems make this seamless and with very low fees for users.

Personally, I can fund my account with USD and buy any stock in the world with a minimal foreign exchange fee that IBKR performs automatically for me. Most FX conversions at competitors will have a total cost of 1% each way, making IBKR a significantly cheaper offering.

Apply this framework to other asset classes. IBKR has or aims to offer the widest breadth of products with the best blended price in the industry. It is able to do this because of its consistent investment in automation and global presence.

IBKR Lite is similar to Robinhood, a digital-first platform with free commissions that relies on payment for order flow. However, with the breadth of offerings available to investors compared to Robinhood, I believe IBKR will keep stealing share for investors looking for a truly better product.

IBKR Pro is for more professional investors and operates on a cheap commission model across asset classes. It attracts professional investors because of what we discussed before (wide breadth, cheap prices) but for other reasons as well. For example, there is IB SmartRouting that automatically searches for the best price across all exchanges and dark pools for clients. Margin loans are the cheapest in the industry due to, once again, its automated systems that will close out positions for clients.

Management says its north star is offering the widest selection of asset classes (even prediction markets!) at the cheapest price driven by automated digital systems. It wants to take whatever it builds in the United States and bring it globally to as many other countries as it can.

It is doing so with increasing efficiency. Accounts per employee have risen over the years, which shows the scalability of the automated brokerage platform and disciplined hiring practices.

Top tier management and culture

Peterffy has build a phenomenal culture at IBKR. They are product first, focused on the long-term, and believe in building a non-zero sum game with clients (as opposed to someone like Robinhood which I believe leeches off of clients).

They believe in hiring from within and want software engineers leading the company as opposed to a finance, marketing, or consultant person. In the proxy statement, they state that they have never hired a compensation consultant. Wonderful. The very fact they are able to retain employees for such long tenures tells me they treat them well.

Now is a good time to discuss the complicated ownership structure of IBKR. The market capitalization of the Class A common stock understates the actual market value of the business given that it is only a 25.8% “membership interest” in the operating subsidiary. The rest is controlled by Peterffy through his IBG Holdings LLC and the Class B common stock.

To get the true market value, take the market cap listed on places such as Finchat and divide it by 25.8%. That takes your market cap from $18.45 billion to $71.5 billion.

One concern would be Peterrfy’s age. He is 80 as of this writing, and could pass away at any time. As a shareholder that hopefully is holding this stock in perpetuity, I wonder what will happen with Peterffy’s controlling ownership in IBKR when he passes away. This is a looming risk: can they keep the culture intact without his influence?

Long runway left to grow

With only 3.6 million accounts, IBKR has a lot of room to keep stealing market share in the industry. We can show this by simply looking at its brokerage competitors.

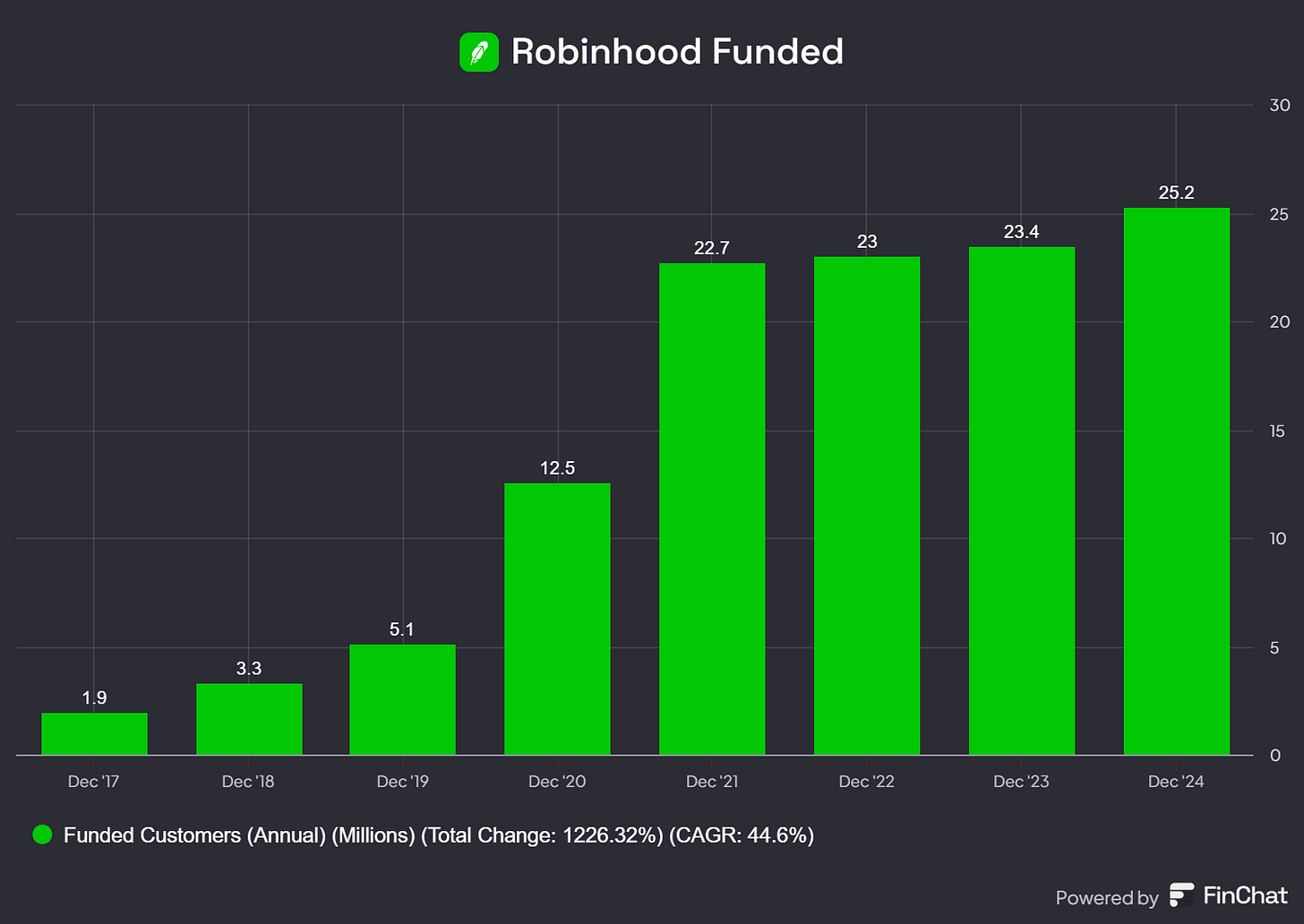

Robinhood has 25 million funded customers. Charles Schwab has 37 million active brokerage accounts.

I could go on with plenty of other examples. Do all of these accounts need IBKR’s superior product offering? No. But a good chunk will, and I think IBKR can keep stealing share year-after-year from this client base.

Focusing on just the United States is actually misleading on how large the IBKR opportunity is around the world. At a conference a few years ago, Peterffy stated that only 20.8% of accounts are in the United States, with international growing quicker (albeit with smaller account sizes on average).

“So as I said previously, new accounts are smaller and new accounts are younger and non-U.S. To underline the strength of this trend…U.S. accounts represent only 21% of our total accounts. As a matter of fact, it’s like 20.8%. So obviously, non-U.S. growing faster than U.S. customers.”

The reason IBKR is growing so quickly in other countries is the same reason I like IBKR, but reversed and supercharged. Investors around the world want access to invest in the largest equity market in the world, the United States. IBKR enables them to easily do so.

With this context, I think IBKR has room to grow its accounts for the next 10 - 20 years as long as it maintains a better product for these “advanced” traders that want to move beyond Robinhood.

It white labels its solution for some international financial institutions, which should further help it keep growing account balances outside of the United States.

As the number of clients grow, revenue should grow as well. The most important metric I will be using for IBKR is accounts growth. Through the market cycle, this will be the best indicator for IBKR’s future growth. If accounts grow, the rest of the business will follow suit.

Tracking a widening competitive advantage

I believe that IBKR has a competitive advantage over other brokers. I am not sure we can box them into one of the traditional moat categories, but it is there.

One is the culture of staying on the cutting edge technologically, along with the management culture of staying focused on the long-term. Few companies have a culture moat (Costco, Adyen). IBKR is one of them.

Legacy players with large footprints, employee bases, and antiquated technology face an innovator’s dilemma when competing with IBKR. They could scrap all their cash cows and try to catch up, but they will not choose to do this and likely couldn't if they tried.

Building global scale takes time. You need to work with local market regulators similar to other financial services. If Robinhood wants to replicate IBKR’s offering, it would take years (not to mention the payment for order flow it would have to give up). In that time, IBKR will be much farther ahead of where it is today.

As IBKR advances its technology, it moves further ahead of the Schwab’s of the world. As it adds more assets to invest in, it further expands ahead of the Robinhood’s of the world. I believe management understands this is what butters their bread.

I think IBKR can expand its moat over the next decade by doing what it has done over the last decade. And, it is something we can track fairly easily.

Valuing the stock

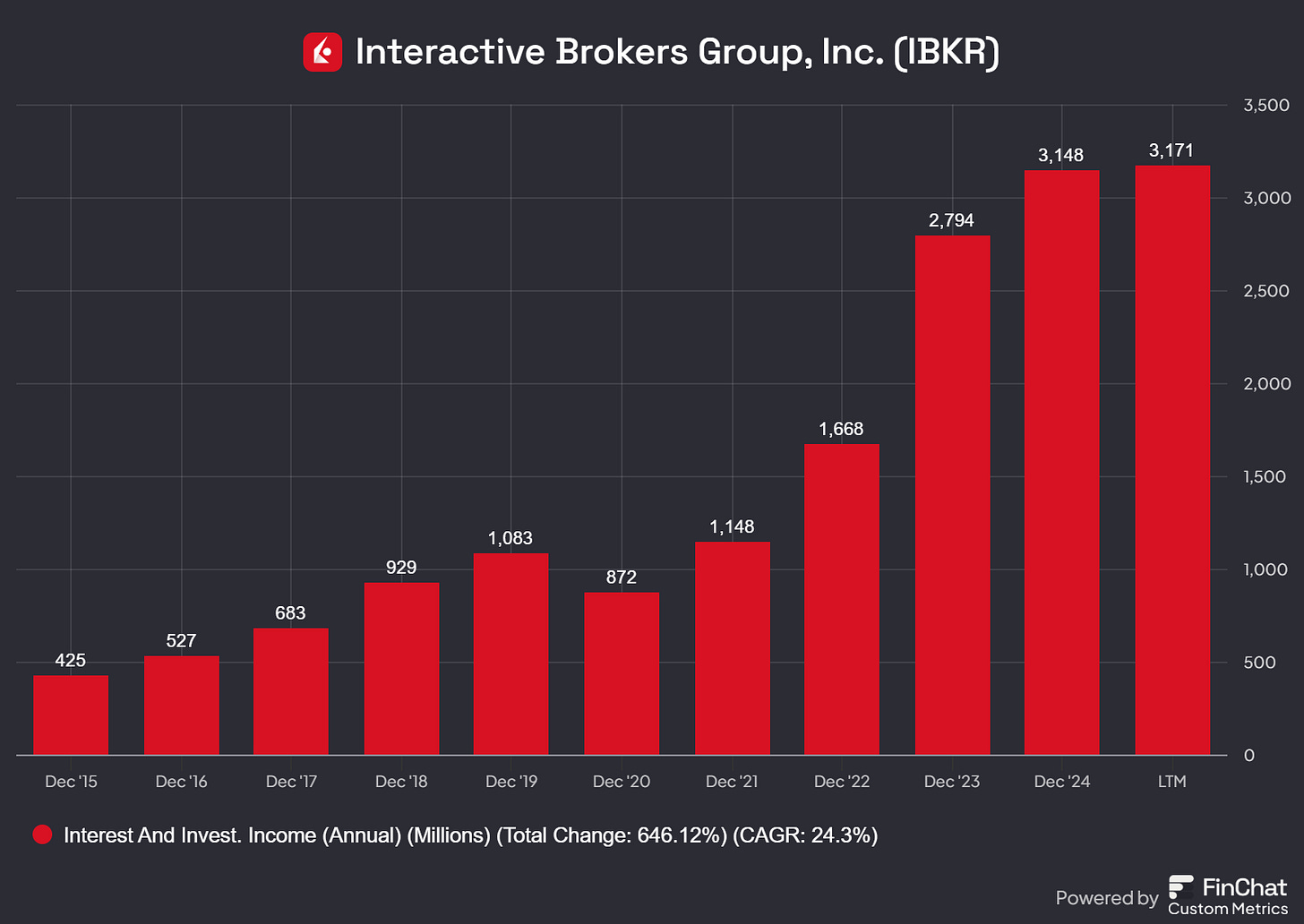

IBKR’s culture of spending discipline and automation is evident in its profit margins. Over the last twelve months, it had a pre-tax profit margin of 72%. This has grown from around 60% in 2019. I expect this figure to grow slightly over the next 10 years, but a lot of the earnings growth from margin expansion is likely done given we are already at 72 cents on every dollar of revenue. Higher than Visa! Good stuff.

Revenue has grown at a 16% annual rate since 2015. If accounts keep growing quickly, revenue will fall in line and keep growing at a double-digit rate. It isn’t complicated.

IBKR runs a conservative balance sheet and wants to have a large buffer of capital to make its large clients comfortable and maintain its superb product suite. CFO Paul Brody (joined the company in 1987, btw) on the last conference call:

“Yeah. It kind of remains in the six to seven billion range [Excess Capital], you know, of as this business grows, we earn more and we have more capital and more of it is devoted into the business to support things like customer trading and clearing fund deposits where we are, you know, self-clearing in most places and various buffers that have to be maintained both for regulatory purposes and for standard operating, you know, liquidity buffers. It does take a lot of capital, which is why we maintain it. And but, you know, we're profitable enough that determine we could raise a dividend and still grow that capital”

Translation: we run a conservative balance sheet but are so damn profitable that we can keep growing the dividend too. Not a bad place to be.

This conservative balance sheet and the culture around staying nimble has helped IBKR manage the interest rate hiking cycle better than peers. If you remember, Charles Schwab was close to crisis-mode (and maybe a bailout?) due to it holding long-dated bonds and mortgage securities at low interest rates in the hiking cycle of 2022.

IBKR never reached for yield and held a lot of short-term treasuries that it could recycle into higher rates. As that happened, net interest income exploded higher. It also enabled IBKR to offer better interest paid on idle cash deposited in accounts.

Over the last twelve months, operating income was $3.877 billion. If accounts grow at an average rate of 15% over the next 10 years, they will reach just under 15 million total accounts. If operating income growth tracks account growth, it will reach $15.6 billion in operating earnings in 10 years.

All of this feels reasonable. Growth will not be linear due to the pro-cyclicality with the stock market, but it is well within reach over a 10 year period.

Why I bought Interactive Brokers stock

I purchased shares of IBKR in my non-taxable Roth IRA at an average price of $154. This is a great management team and a competitively advantaged business. Check and check.

But is the stock cheap? Over the next few years, it may not appear cheap if the market crashes (I have no clue whether that will happen, and neither do you reading this). But over the long-term, if accounts keep growing, it is very cheap. $15.6 billion in operating income in 10 years is a sub 5x earnings multiple compared to the current market cap. IBKR deserves to trade at 20x - 25x earnings imo. Add in some dividend payments and we have a solid multibagger from today’s levels.

IBKR is currently ~5% of my invested assets. I am willing to greatly increase this figure if the stock collapses during a recession/market crash. Embrace the dip buying with this one.

I will sell if I see an erosion in the culture (qualitative) or stalled account growth over a multi-year period (quantitative).

-Brett

Futu is also pretty good. There are many advantages

.

I wonder how you will gauge the erosion in culture. Perhaps when they start hiring from the outside?