Portfolio Rankings: What Stocks Are We Buying And Selling?

Our favorite portfolio optimization technique

YouTube

Spotify

Apple Podcasts

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

Show Notes

For this episode, I did a “force ranking” exercise of all the stocks I own + some of the top stocks on my watchlist.

I believe it is a great exercise to force out thoughts about stocks you own and ones you don’t. If there is a big discrepancy in the list (i.e. one I don’t own is ranked much higher than one I do) then maybe I should swap the positions.

Here is how the ranking works:

Ranking list 1 - 25

Only twelve stocks make the list, meaning some of the slots are empty (allowing better separation between two stocks side-by-side on the list)

And that’s it. I make the ranking off of my “gut” looking at the watchlist and how I feel about the stock at the time. After, I will go in and look at the numbers to make sure I am not misremembering the current financial/business situation. I want to match my feelings with the data.

At the moment, I struggle to find a bunch of stocks I like. Unfortunately, a lot of my watchlist stocks have soared around 50% in the last six months and I would not be comfortable buying them at these prices.

This is the complete opposite of what I felt in late 2022 and early 2023. I say this because I want to keep myself from “pressing” and trying to keep up with the market. If I don’t find any promising opportunities for a while, so be it. Maybe a bunch will materialize in 2025 and 2026. Either way, I have a few existing holdings I can add to.

Here is the list. Green highlights are stocks I currently own in my portfolio. The 25+ grouping are a few other stocks on my watchlist that didn’t make the top 12.

Here are some details on how I am thinking about these 12 stocks at the moment. This is as much a personal journal for me as a public record for listeners to read through on our Substack. On the podcast, we will be debating these rankings (Ryan has made a similar ranking for his portfolio).

I am including some charts and data for some stocks. Others may only get a brief summary.

Nelnet (Ranking #1)

At ~$106 a share, I think Nelnet is still a tremendous value. It makes up more than a third of my portfolio today. If I was starting a portfolio from scratch, it would be the first stock I buy.

Management keeps proving they can be trusted (even though they made some mistakes in 2023). I think they understand capital returns well. Shares outstanding have declined by 2.5% per year since 2014. Dividend per share has grown at 11% since 2014. I see no reason why both these rates can’t continue for the foreseeable future.

(Like these charts? Use our link and get 15% OFF a premium subscription for Finchat.io)

The education software/payments division is highly profitable and likely extremely cash-generating. Loan servicing is uncertain by cash generative. The existing loan book is cash-generative.

There are many places where they can pour capital (the bank, solar investments, etc.) and get strong ROIC or ROE. If they can’t, they are not afraid to stay patient and let cash pile up on the balance sheet, increase the dividend, or repurchase stock at lower prices.

At 1.1x P/B, I believe there is still plenty of room for Nelnet to run, and this is with a discounted book value (we discuss this in detail on our Nelnet-specific episodes).

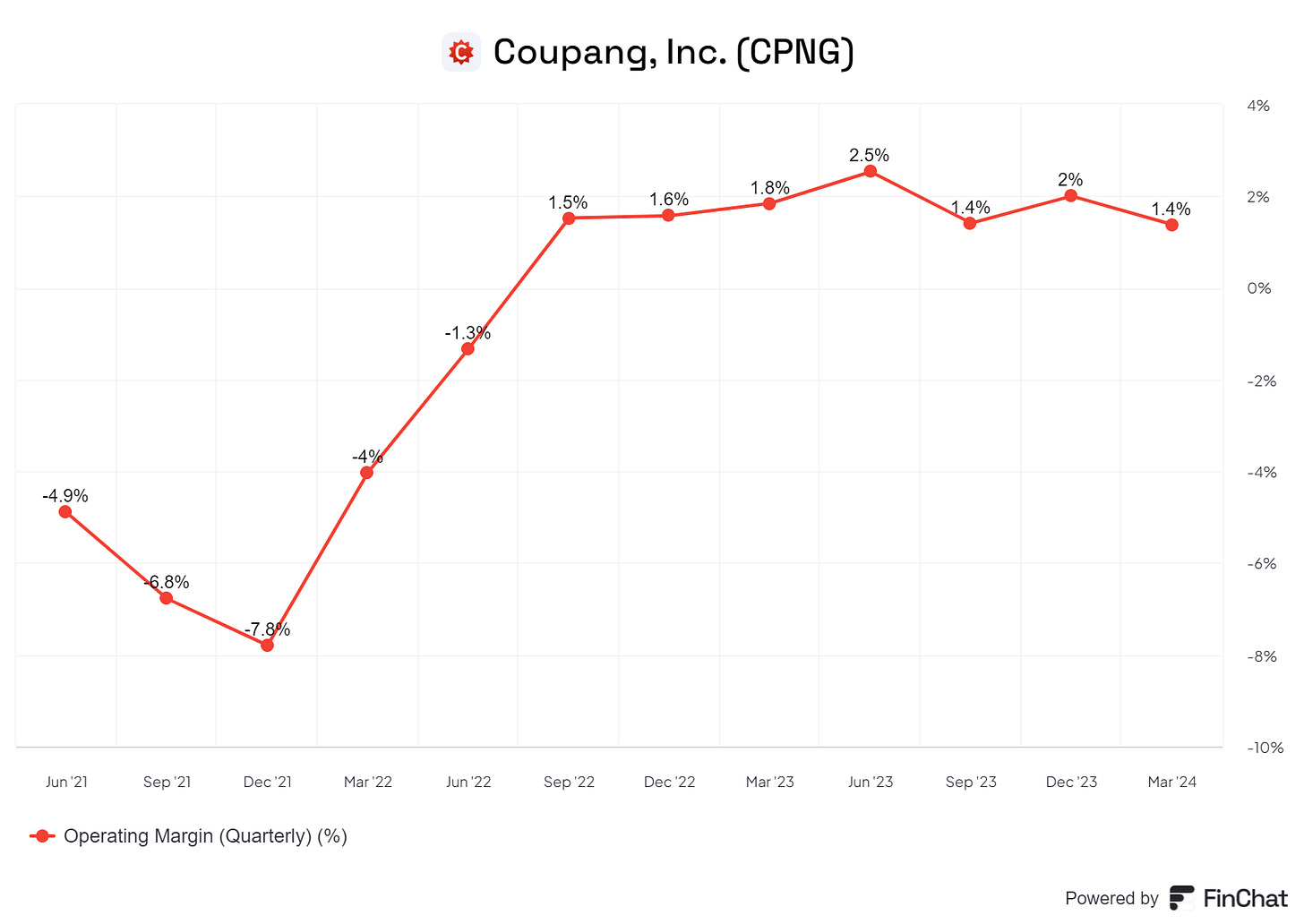

Coupang (Ranking #3)

Coupang is currently my second-largest position, so I am pleased that it ended up being third on my ranking. I still think it is cheap, competitively advantaged, and has a rock-solid management team. I will be adding to Coupang with new deposits unless one of these things materially changes.

Last quarter, Coupang outgrew the South Korean retail space with 23% revenue growth and even better gross profit growth. It is investing in its infrastructure/delivery moat and seems poised to fend off the Chinese entrants to the market. I am not concerned about these competitors today.

Management focuses on the right things and seems to understand capital allocation. Plans for investing in Taiwan are smart, and they got Farfetch assets for dirt cheap.

Operating margin has flipped to positive despite deep losses in Taiwan and Farfetch. They are self-funding with a huge war chest of cash. I think they can start to play offense in many ways and are replicating the Amazon subscription moat.

We have an episode that fully breaks down Coupang if anyone is interested:

GoGo (Ranking #5)

GoGo came as the third company on my list, but #5 in the ranking. It is a stock I already own and my most recent purchase.

At a tad above $10 a share, we are at a market cap of $1.3 billion and an EV of around $1.8 billion (not precise).

GoGo is an interesting “catalyst” investment that could turn into a durable compounder. Right now, they are upgrading their internet network for business jets to get faster 5G speeds and partnering with an LEO satellite to go global. However, neither is available to the public yet, and 5G has seen many delays.

These delays and the growth of Starlink are scaring people. But, due to its moat, switching costs, and distribution advantage, I think GoGo is in a comfortable position. Cash flow will be uncertain before these products launch, but the company generated $28 million in free cash flow last quarter and positive cash flow for the last 10 quarters.

If they get 5G and global internet launched, they believe free cash flow can inflect to $200 million a year. I think that makes the stock cheap, although there is execution risk.

They are now starting to repurchase shares. This is a solid indicator.

I would not make this a huge position, but I love the risk/reward with GoGo stock right now.

A prior episode on GoGo:

Portillo’s (Ranking #6) - don’t own

Portillo’s is the highest-ranking stock I don’t own. Given there are a few holdings below this ranking, we should discuss whether the stock matches up better with these existing positions and whether I should swap them out.

At $9.65 a share, I am seeing a fully diluted market cap of $700 million and an EV of $1.3 billion if we include the tax liability issue (explained in our breakdown stock episode).

If I am right about the unit economics and expansion plans, I think they can generate over $1.1 billion in restaurant profits AFTER accounting for new build costs, cumulatively, through 2030. This is an attractive place to be.

I think the stock is cheap because people are worried about comp sales slowing down, which I believe is a macroeconomic thing and not Portillo’s specific. I like the management team, their experience in restaurant brands, and their strategy to improve the new stores to increase volume and ROIC.

I don’t see why this isn’t a good risk/reward at these prices. It would not be a Nelnet or Coupang-like position given the debt/downside risk, but if I am right this is a 10-bagger over the next 10 years. Investors may be underrating the upside at the moment.

Full episode on Portillo’s:

Discussion question: comparing this to IAC and Match Group

Nintendo (Ranking #8) - don’t own

Nintendo is an easy one for my watchlist. You have a stock trading at a market cap of $60 billion - $70 billion (the crazy Yen movements can make it change rapidly in USD terms). The company has a rock-solid group of entertainment characters with durability.

As long as the Yen doesn’t go to zero, I think they can generate $5 - $6 billion in annual operating profits once this new console comes out. Management (finally) said it would be coming out in around a year. For a business with this much durability, I am comfortable having this in my portfolio.

Add in the movies/theme park upside, and there is a lot to like about Nintendo.

Here is the thing about Nintendo, though: you need to be patient. They make plans on a 10-year time horizon or longer. So should you, if you own the stock. Don’t get impatient with this one. If you are an impatient investor, this is probably not for you.

I think the stock outperforms over the next 5 and 10 years and can start returning tons of cash to shareholders given they have built their conservative balance sheet already (a goal they had over the last 10 or so years).

Phillip Morris International (Ranking #9)

Phillip Morris International is fairly easy to understand. They own legacy non-U.S. assets in tobacco/cigarettes. These are more durable (more Europeans are comfortable smoking) but come with more Fx risk than the U.S. market.

They are growing in new nicotine products. IQOS heat-not-burn has close to 30 million customers. I think this can keep growing and generate billions in annual profits.

Zyn nicotine pouches are growing like wildfire. I think this can eventually turn into a segment that generates billions in annual profits.

At a 5%+ dividend yield, PMI seems like a stock with low downside and a lot of upside if management is smart in returning capital to shareholders. While I worry about growth, this is something I would be comfortable owning. Management has shown it is the best in the industry with how dominant it now is in new-age nicotine.

Harbor Diversified (Ranking #10)

Harbor Diversified is a strange microcap I own. It owns a regional airliner called Air Wisconsin. I believe it trades at an EV of around zero, but we don’t have numbers past Q3 of 2023 due to the need to revise some accounting after a ruling in a United Airlines dispute. This will take them time given a smaller accounting department.

The airline is still running. I worry about some cash burn, but the pilot shortage is getting better and they have a new partner in American Airlines. Nothing has changed about this thesis. I think there is minimal downside but the chance this 3x - 5x’s if things work out well. I am okay staying patient here and adding more if I get more deposits to my account. Although I would not make this a giant position.

Airbnb (Ranking #12)

I don’t have much to say about Airbnb for this episode. I probably put my ranking a bit too high after giving this a second thought, but there is a lot to like about this business. Management is solid and it has a long reinvestment runway with great unit economics. But, I don’t like the price I would have to pay.

I am kicking myself for ignoring it at $90 a share 18 months ago.

IAC (Ranking #14)

This is one of the lower-ranking stocks I own. I could see myself selling this position if I decided other stocks should be ranked above.

On the one hand, IAC trades at an EV of just $1.27 billion after netting out the MGM stake, Angi stake, and its net cash position. In theory, this is a discount to its Turo stake, Vivian stake, and the wholly owned businesses like DotDash Meredith and Care.com.

I want to like this thesis. But I worry that the management team is not executing and has not for the last few years. The DDM acquisition was bad – no disputing that – and Care.com has stagnated. I don’t know why I am holding this except that it is a SOTP discount. But, management is not repurchasing stock to close this discount. Compare that to Nelnet.

I also worry about these new AI generators taking share from DDM, which are supposed to be authoritative sources on topics. This is uncertain and could really hurt the business.

I am losing trust in management. Do I think the stock is undervalued? Yes. But would I rather own a stock where I trust management and/or have a durable growth opportunity? Of course.

I am definitely not adding to my position right now.

Visa (Ranking #15)

Visa will sneak up my watchlist if the stock price continues to go nowhere. With tons of cash generation and what I would call a “permanent growth opportunity” and a wide moat, at the right price I would load up on Visa shares.

That is not at a P/E of 30. Perhaps at a P/E of 20. Maybe it never gets there, but I want to keep following the company in case it ever happens. I hope it can be a never-sell position if it gets cheap enough.

American Express (Ranking #16)

American Express is frustrating because I still like the business a lot but the stock went from undervalued to a premium valuation pretty quickly. It is up 40% in the last six months.

The enterprise is rock solid and I think the management team has a good head on its shoulders. They understand capital returns. It has a permanent growth opportunity.

At 15x P/E, I love AXP. But at a P/E of 20, it is staying put on my watchlist over many other things.

Match Group (Ranking #17)

The last one on my list is Match Group. This is another stock I own but is low on my list.

Match Group has failed to stabilize Tinder. When I made my thesis, the combination of steady growth at Tinder and explosive growth at Hinge was supposed to deliver 15% - 20% revenue growth for the next few years. Well, that has happened with Hinge but not Tinder.

Tinder MAUs are declining and management has not been able to fix the bleeding. I am uncertain about whether they can.

Also, is this misleading? https://x.com/CCM_Brett/status/1793759389637304557

On the other hand, management is buying back a ton of stock, revenue and cash flow on a consolidated basis is stable, and the stock is at an EV/FCF of 12.

I think MTCH is a decent risk/reward here. But, I can definitely see another stock having a better risk/reward given how I have lost trust in management.

Should I switch out this position for another stock?

We discuss some, but not all of these stocks on this week’s podcast. In the future, our ranking episodes will likely be for just one of us, giving the episode more breathing room to flesh out ideas. This one felt a bit rushed, but still a good concept we hope to do a couple of times a year.

Have a great week everyone!

Brett