Should Robinhood Be Allowed to Sell OpenAI Tokens?

I have severely underestimated the savviness of Vlad Tenev and Robinhood

YouTube

Spotify

Apple Podcasts

We can simplify how Robinhood makes money in three ways:

Attract more deposits

Grow spending (i.e. Robinhood Gold Card)

Increase trading activity

Its core business is the trading of assets. The more assets it has on the platform, the better its value proposition is for customers, which will attract more brokerage customers and increase trading volumes.

This is why — even though deep down it kills me — I understand why Robinhood embraced cryptocurrency trading. It isn’t CEO Vlad Tenev’s job to decide what investors should be allowed to buy; that is the job of the regulator. If something is legal to trade, Robinhood has a fiduciary obligation to make it available on the Robinhood brokerage.

Which leads us to this week’s announcement around tokenized trading:

“Robinhood Markets earlier this week said it would offer European users the option to trade “stock tokens,” and that it would give away $5 worth of “tokenized” stock in two major private companies, OpenAI and SpaceX, to eligible investors”

How does this work? Here is how I understand it:

Customers in Europe can buy the OpenAI token

This gives customers a piece of a special purpose vehicle (SPV) that buys a stake in OpenAI

As the value of OpenAI rises or falls, the customer’s token rises and falls, essentially tracking the returns you would get by owning shares of OpenAI

OpenAI is not happy about this:

OpenAI is unhappy because it did not sanction these tokenized investments.

I’m not sure that matters. This is no different than democratizing how a venture capital fund works, but likely with a better fee structure.

An investor in a VC fund sends money to the VC, which pools capital (similar to the SPV) and buys stakes in companies. Eventually, the investors get returns that track the value of these investments. The liquidity event is even the same: when OpenAI eventually goes public.

I have zero issue with this, as long as it is legal (it is not currently in the United States).

Joseph Carlson had a good tweet on the matter:

I think Joseph nailed it.

Here’s a thought for OpenAI: if you are so unhappy about Robinhood selling tokens that track your stock value, just go public.

Go public! It solves all these issues. You are apparently valued at $300 billion, which would make you around the 30th most valuable company in the world. You cannot argue that fees around audits and SEC filings will be too costly, which is a case that can be made for microcaps stocks.

I may have underestimated how savvy Vlad Tenev is. The actual goal of this project may not be to build a huge tokenized trading business, but to nudge these large private companies to IPO.

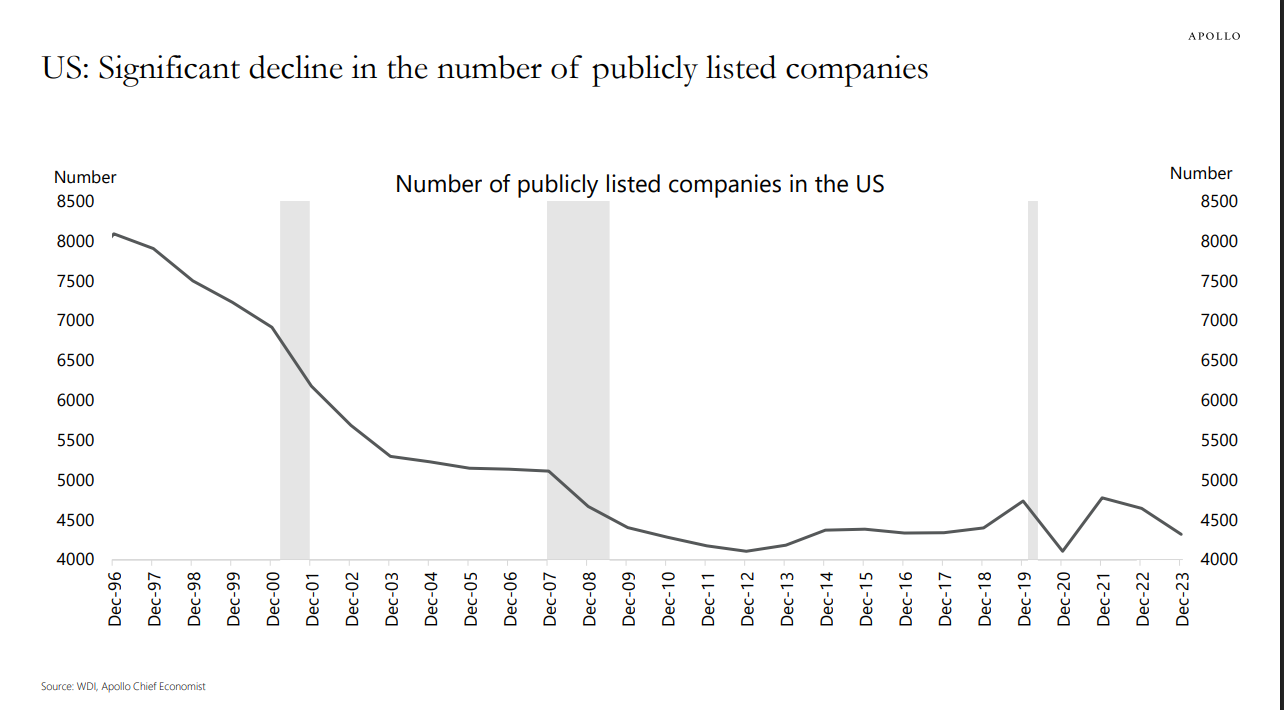

Companies staying private for longer is a headwind to Robinhood, a multi-decade trend:

Reversing this decline would mean more stocks available to purchase on Robinhood, increasing the value proposition for users, leading to more trading and more revenue.

I expect more pushing of the envelope from Robinhood in regards to tokenization and new ways to invest. Will I utilize them? Probably not. But it will be fascinated to watch if you care about financial markets.

Happy 4th!

-Brett

I'm not sure I understand how these tokens work. The VC fund works because the private company sells the VC fund shares. Robinhood (or the SPV, more accurately) would have to have a willing seller of both OpenAI and SpaceX. Is that the case?

Going public very frequently ruins a company's culture by forcing them to focus on short-term results. For a company like OpenAI, I think it would be disastrous.

Additionally, the whole argument about it improving wealth inequality if they go public relies on the stock being undervalued at IPO, and given the current hype around AI, I think that seems unlikely. Who would really benefit? The investment bankers, who collect a very healthy fee on the IPO, and the insiders, who sell to retail investors at an eye-watering valuation. Oh, and Robinhood.