Should You Buy Mexican Stocks? (ALSEA, AGUA, and Airports)

Do not fear investing outside of the United States. Fear overpriced stocks

YouTube

Spotify

Apple Podcasts

This week, we released an episode with Ian Bezek from Ian’s Insider Corner, which you should of course subscribe to:

I like to think of Ian as our Latin American stock correspondent. He has a vast knowledge on the various countries and a good knack at finding dirt cheap stocks that are actually investable.

He believes Mexico is offering some major discounts for investors, especially vs. the U.S. stock market.

These were my bullet point show notes from the interview:

The Mexican Election and Expectations for the New Administration

Foreign Direct Investment and Nearshoring in Mexico

Investment Ideas: Airports and Grupo Rotoplas

Margin Expansion and Pricing Power of Mexican Companies

Capital Allocation and Dividend Policy of Mexican Companies

The Privatization of Airports in Mexico

A Fast-Food Franchise Operator in Mexico

Understanding the Changing Dynamics of the Mexican Market

Consumer-Related Companies as Investment Opportunities in Mexico

If any of these topics interest you, I hope you’ll give this podcast a listen. The country is not as dangerous (literally, and figuratively for investors) as you think.

Using our friends at Finchat.io, let’s look at two stocks Ian discussed: Alsea and Grupo Rotoplas.

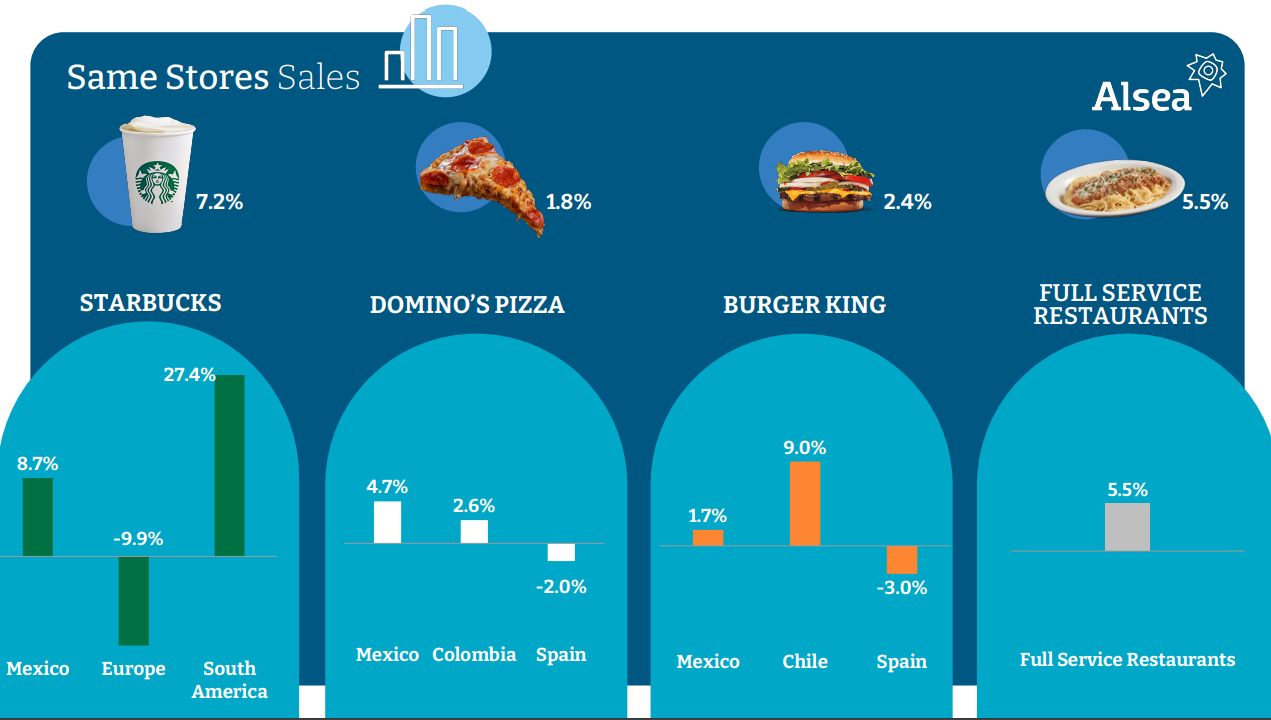

Alsea operates Domino’s, Starbucks, and Burger King franchises in Latin America and Europe. It is mainly focused on Mexico.

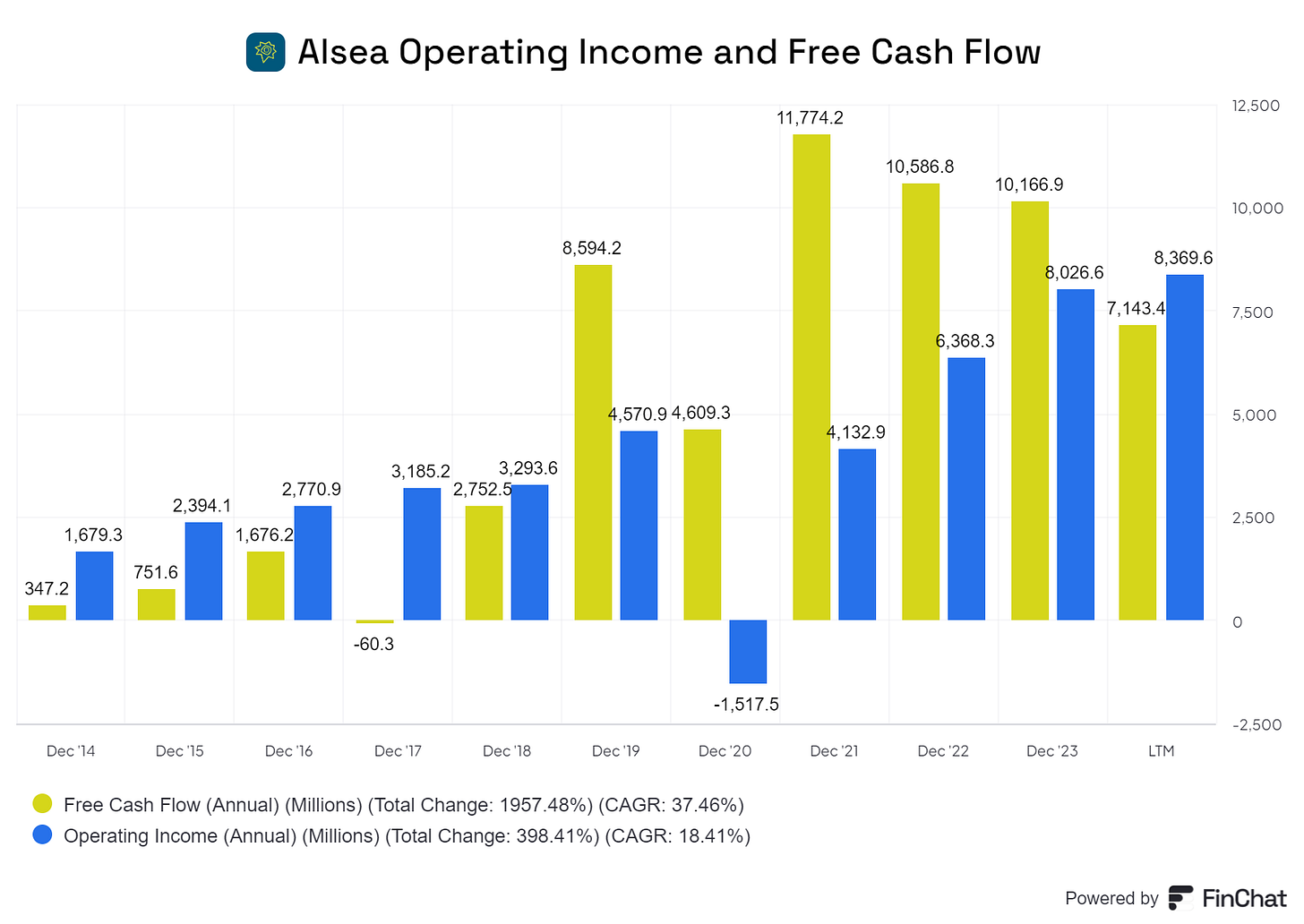

The company has generated healthy amounts of operating earnings and free cash flow since the pandemic downturn:

The current market cap is $45 billion in Mexican Pesos. That is around 5x its trailing operating earnings. Even with a good amount of debt on the balance sheet, this looks like a potential bargain.

Fast food penetration should only grow in Latin America as more and more citizens are able to afford regularly eating at restaurants.

The stock also pays a dividend yielding 2%.

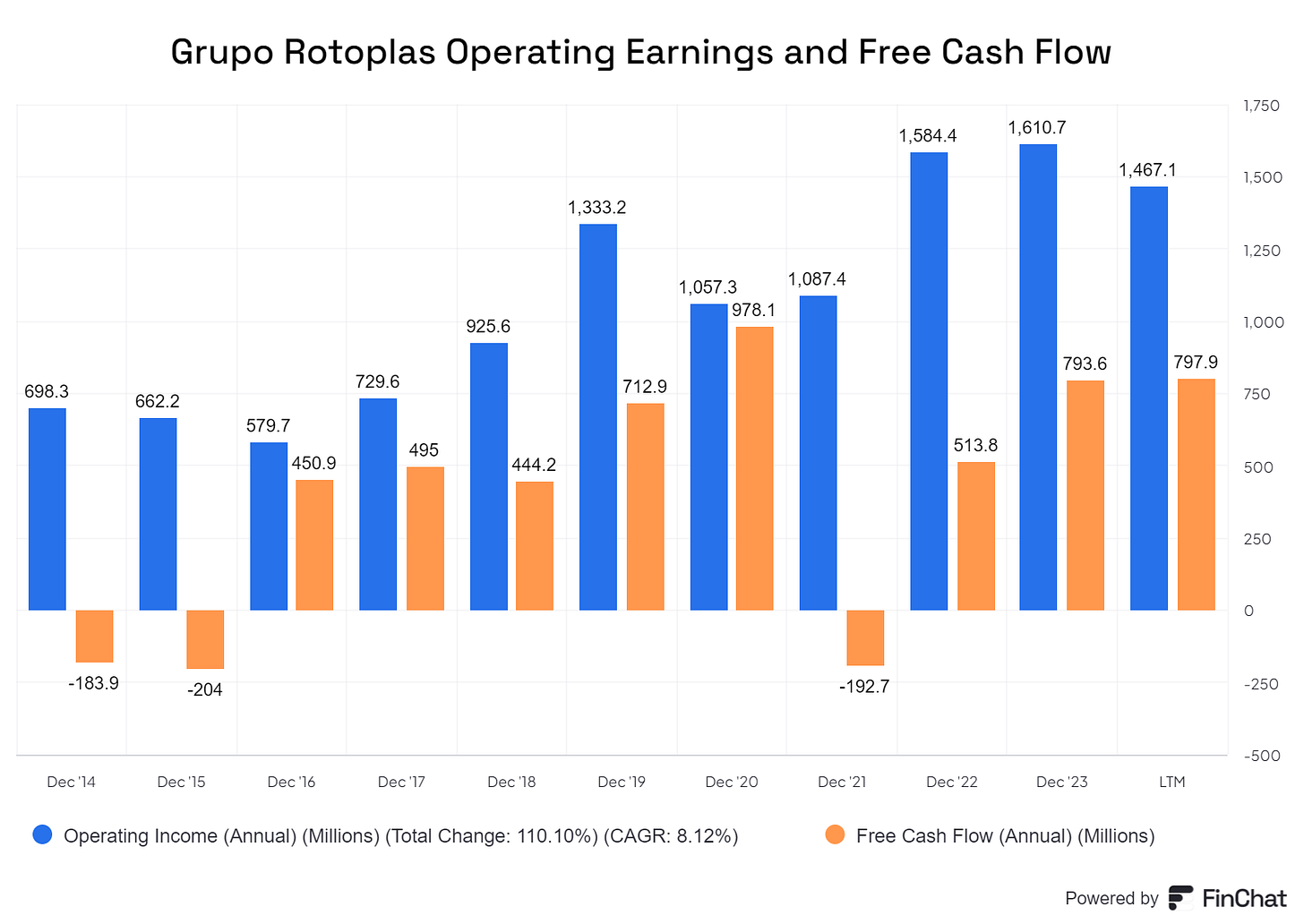

Grupo Rotoplas (ticker AGUA) does water storage and filtration in Mexico. A pretty important task given how water deprived and populated the country is. If the country is going to make the next step in wealth/income and greatly increase its manufacturing capacity, Grupo Rotoplas will play a part.

The company generates healthy amounts of operating earnings and free cash flow:

It has a market cap of $12 billion (Mexican pesos), meaning it trades at around 8x operating earnings according to Finchat.io.

Of course, a cheap trailing earnings is just one fact to consider before investing in a stock.But it does indicate a breadth of potentially cheap stocks in Mexico. Which is what we discuss with Ian this week. Better than a single-digit revenue grower at over 50x earnings in the United States.

Don’t be afraid to invest in Mexico. There could be a lot of returns to be had if this reshoring theme has any legs.

Have a great weekend everyone!

Brett

Chit Chat stocks is presented by:

Public.com just launched options trading, and they’re doing something no other brokerage has done before: sharing 50% of their options revenue directly with you.

That means instead of paying to place options trades, you get something back on every single trade.

-Earn $0.18 rebate per contract traded

-No commission fees

-No per-contract fees

Options are not suitable for all investors and carry significant risk. Option investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read and understand the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found at: www.theocc.com/company-information/documents-and-archives/options-disclosure-document

Supporting documentation for any claims will be furnished upon request.

If you are enrolled in our Options Order Flow Rebate Program, The exact rebate will depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. Order flow rebates are not available for non-options transactions. To learn more, see our Fee Schedule, Order Flow Rebate FAQ, and Order Flow Rebate Program Terms & Conditions.

Options can be risky and are not suitable for all investors. See the Characteristics and Risks of Standardized Options to learn more.

All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Open to the Public Investing, Inc., member FINRA & SIPC. See public.com/#disclosures-main for more information.

Alsea does look very attractively priced.