Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

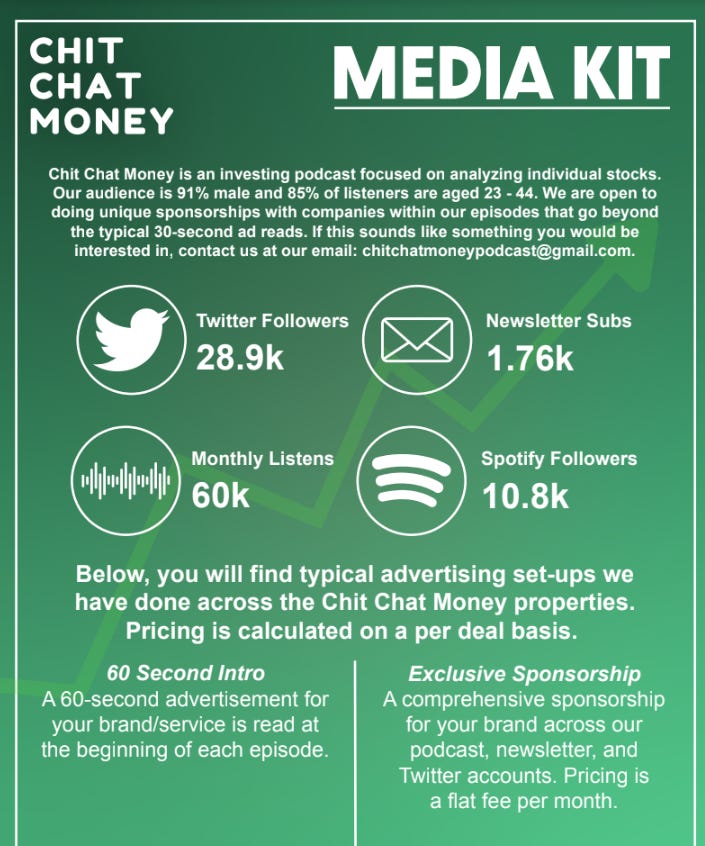

Chit Chat Money is presented by:

Potentially you! Reach out to our email chitchatmoneypodcast@gmail.com if you are interested in sponsoring the newsletter, podcast, or both.

1. Treasuries vs. the S&P 500

Today, the S&P 500 is at a P/E of 25:

This equates to an earnings yield of ~4% (earnings divided by price).

Short-term treasuries are all yielding over 5%:

I don’t understand why someone would deploy new capital into an S&P 500 index fund right now when treasuries are yielding these levels.

Are you really confident that earnings will grow that quickly? Or that the market multiple will stay elevated?

Making that bet over a short-term (you are not even taking duration risk!) risk-free yield of 5% seems quite absurd.

Stealing from the mouths of great investors: During bull markets, everyone’s time horizon expands to infinity; during bear markets, it shrinks to the extreme near term.

You can feel the time horizons slowly expanding out to infinity. Whether right or wrong, I’m trying to resist this urge and be much more conservative with my investments at the moment.

2. Cava IPO and looking back at early 2021

More than any quantitative measure, this is the biggest indicator I’ve seen that the bull market “vibes” are back:

Shares of Mediterranean restaurant chain Cava soared as much as 117% in its market debut Thursday.

The company’s stock closed at $43.78 per share, up from its opening trade of $42 per share. Its closing price gives it a market value of $4.88 billion and makes it the top-performing IPO this year for companies valued above $500 million.

Cava Group priced its IPO at $22 per share on Wednesday, above the expected range of $19 to $20. The company sold 14.4 million shares, raising nearly $318 million and initially valuing the restaurant chain at roughly $2.45 billion.

This could unlock the IPO market, which has been frozen shut for the last 18 months. It is probably a bad thing for active investing portfolios (investing in IPOs almost always never works) but it will make things much more entertaining. I love debating new IPOs that come public.

I’ve seen some takes that we are back at 2021 bubble levels with crazy optimistic sentiment from everyone. Maybe with mega-cap tech stocks, we are. But across the whole market, I don’t think it is nearly as crazy as 2021:

There were almost two SPACs going public each day in 2021! That’s insane.

Are we getting a bit frothy again? Sure. But this is nowhere near the mania of 2021 (yet).

3. Microsoft really wants me to use its Edge browser

The pop-ups for Microsoft Windows users have gotten much more annoying lately (and are not working).

For example, this app “randomly” loads for me every day now:

I think it is likely that Microsoft executives have set goals for market share gains on its browser/Bing search engine, and passed these goals down to their VPs, who are now getting increasingly desperate in trying to hit these goals.

Honestly, I have no idea what Microsoft could do to get me to switch from Chrome. Everything works so seamlessly on Google Workspace (Drive, Gmail, etc). Maybe if they literally just gave me $100? I don’t know, I think it would have to be higher than that, even though I am still a fairly broke younger person. I think if they offered $250 I’d probably switch.

Damn, Alphabet’s moat. Just an incredible feat of competitive advantages laid on top of competitive advantages.

It looks like the excitement around ChatGPT is starting to wear off too:

Call me crazy, but these new AI products may have gotten a bit overhyped…

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

Time to Stop Believing Deficit Bullshit - The Big Picture

What do you do if you have a philosophy that over the course of half a century, is continually proven wrong?

I do not mean a little bit off, or theoretically askew, but verifiably, factually, quantifiably wrong? Do you admit the error and change course? Or do you double down and keep repeating the same nonsense, hoping that maybe in another half-century you might be proven right?

Even God Would Get Fired as an Active Investor - Alpha Architect

What the chart highlights is that even God would get fired multiple times over. The relative performance of God’s hedge fund is often abysmal and he’d surely make the cover of Barron’s or the WSJ on multiple occasions throughout his career. The passive index would eat his lunch on multiple occasions — often getting beaten by 50 percentage points — or more — on multiple occasions!

A Batesian Mimicry Explanation of Business Cycles - Falkenblog

Once the number of mimics is sufficiently high, their valueless enterprises become too conspicuous and they no longer pass off as legitimate investments. Failures caused by insufficient cash create a tipping point, notifying investors that some of their material assumptions were vastly incorrect. Areas that for decades were very productive, are found to contain exceptional levels of fraud, or operate with no conceivable expectation of a profit. Everyone outside the industry with excessive mimics marvels at how such people—investors, entrepreneurs, and their middlemen--could be so short-sighted, but the key is that the mimics and duped investors chose those business models that seemed most solid based on objective, identifiable characteristics that were, historically, correlated with success. An econometric analysis would have found these ventures a good bet, which is why investors did not thoroughly vet their business models. For example, banks stocks through 2007 were one of the best performing industries since industry data has been available in the US, and performed well in the 2001 recession. Another notable example: when I was head of economic risk capital allocations for KeyCorp in the 1990s, residential mortgages had the lowest risk allocation because of their historical minuscule loss rates; speaking with an economic risk capital allocator recently, they currently have the highest.

1 Good Podcast

Smart, Insightful, and Funny Tweets:

(link)

(link)

(link)

(link)

(link)

(link)