Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

1. Electronic Arts preview

This month, our partners at Commonstock are doing an idea competition ($5,000 prize money!) with a 750-word count limit. Here is a snippet from my post on Electronic Arts (full post here):

EA has three competitive advantages. The first is intellectual property (IP) and licensing. Competitors are unable to copy EA’s games because of IP laws and the deals struck with sports leagues. Among the sports categories, these deals are so advantageous that EA has built virtual monopolies over the last 20 years.

EA’s live services games have network effects that promote winner-takes-most outcomes. The most important of these games are FIFA Soccer, Apex Legends, Madden NFL, and the Sims, all of which generate $1 billion+ in revenue each year. Any game that has a social and/or multiplayer aspect will improve the player experience with each incremental person that joins.

EA has economies of scale that allow it to invest more in game development than almost any other publisher. This includes its existing live services games and new games in development. While too long to list here, EA’s current games pipeline is as strong as ever.

An extended write-up will be written on our fund’s website. Access it here and sign-up for our mailing list at the bottom of the page.

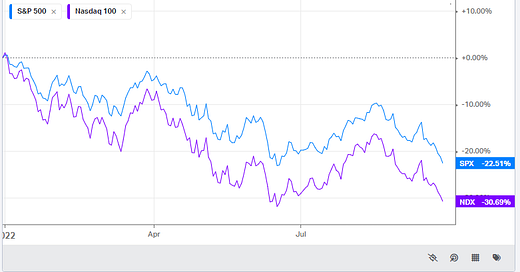

2. New lows soon? Don’t throw in the towel

According to my scientific research of just looking at the chart, the indices are essentially back to the June lows:

Could we be at peak pain? Who knows. But it has been a tough year for so many investors. And if you skew towards “growth” and/or unprofitable companies, the pain train has been going on for close to two years now when that bubble popped in February 2021.

The longer a bear market goes on, the more discouraged you get. It is hard to not doubt yourself. Is my strategy wrong? Was I wrong to buy [X stock]? Unless you have irrational confidence in yourself, it is normal to question things when prices are going down.

But the worst thing you can do right now is throw in the towel. There are some high-quality businesses trading at reasonable valuations. If you have the cash to spend, don’t be afraid to make some bets on companies you believe in. The stock might fall another 20% after you buy it, but you’ll likely thank yourself 10 - 20 years from now.

3. Another reason to love buybacks (and good management teams)

Speaking of declining share prices, this year has highlighted (at least for me) the power of share repurchases.

If a stock you own declines 50%, that is almost always not good. But if the company is going to consistently repurchase its own shares, the stock decline will improve your long-term returns, all else equal.

Spending $2 billion on buybacks is going to be better for shareholders if done at a $10 billion market cap instead of $20 billion. There’s nothing to debate there, that is just a fact.

Of course, you want to make sure the buybacks are done sustainably. This means you need to trust the management team. When you have these two criteria in mind when finding stocks to buy (consistent repurchaser and good management team) portfolio drawdowns are much easier to go through. Because you know it will be better for your returns over the long haul.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

Catch up on Our Shows From Last Week

Is Build-a-Bear Workshop Stuffed With Value? With Strat Becker (Ticker: BBW)

Investing Power Hour #25: BYND COO Gets Nosey, IAC SOTP, Is the Gig Economy Screwed?

Sunday Finds is brought to you by CCM+, our subscription podcast/research feed. For $5 a month, subscribers get:

A weekly Not So Deep Dive episode covering the basics of an individual stock.

A newsletter with research notes, charts, and valuation work for that week’s premium podcast episode.

Access to our historical research folder for all of our CCM+ episodes.

A monthly Arch Capital investment fund episode covering a stock we own in our limited partnership.

Sign-up directly through Spotify or Apple Podcasts. On other podcast players, you can build a private RSS feed through this link: https://anchor.fm/chitchatmoney/subscribe

3 Good Reads

Solar Is Happening. Nuclear is (mostly) Not - Noahpinion

Out there in the real world, however, businesses and countries around the globe are building solar power for all they’re worth. Nuclear, meanwhile, has stalled out. These developments are not due to governments putting their thumb on the scale for unaffordable unworkable renewables, as renewable opponents claim. Indeed, government regulation is the main remaining obstacle to the renewable energy transition, while new nuclear will need heavy financial assistance from government.

Rotoplas: A Mexican Industrial Giant in the Making - Ian’s Inside Corner

Rotoplas looks particularly compelling when you consider its downside. Prior to the pandemic, the company brought in around M$1.00-M$1.20 per year in earnings. This was before it had begun its drive to improve capital efficiency.

So, even if we write off any benefit from all of the company's self-improvement work, we ignore the rebounding Mexican housing market, and we discount any revenue growth since 2020, we're still looking at a business trading on around 25x pre-Covid earnings. You can assume zero improvement in the business whatsoever and the stock is not aggresively priced today.

FOMO - Young Money by Jack Raines

Passively investing in index funds is, for most people, the optimal way to allocate their portfolios. The S&P 500 averages ~9% returns per year, and $10,000 invested annually for 40 years would yield ~$3.7M if previous historic trends hold true. If you approach investing rationally, it should be a slow and steady long-term game that pays out over time.

This isn't some closely-held secret controlled by the gatekeepers of finance. There are a million blog posts, books, and articles that cover the benefits of long-term index investing. There are a million more blog posts, books, and articles that cover the perils of taking unnecessary risks with one's investments. And there are plenty of investing platforms that offer you these services for basically no cost.

1 Good Listen

Nuclear power is one of the safest, cleanest forms of energy -- yet to most people, it might not feel that way. Why is that? Isabelle Boemeke, the world's first nuclear energy influencer and creator of the social media persona Isodope, deftly debunks the major objections to nuclear power and explains her unconventional way of educating people about this clean energy source.

Smart and Funny Tweets: