Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

1. Druckenmiller on analysis paralysis

One of my favorite investors Stan Druckenmiller spoke for around 20 minutes at a conference this week.

(link here, he speaks around two hours into the video)

First off, I find the guy hilarious. When asked about what the Fed will do, he said “I historically would not describe Jerome Powell as a profile in courage.” Maybe it was just the way he said it but it made me burst out laughing.

On a more serious note, Druck brought up an idea I hadn’t heard him talk about before (but it clearly fits his philosophy).

I am paraphrasing, but essentially he said with his investment team he’d rather jump into an idea too early and then pull out a month later than get “analysis paralysis” and miss a 50% rally because you are waiting to finish your work.

I think this makes a lot of sense and is a good risk/reward mindset (on average, of course. Maybe don’t do this in banking stocks currently). If you get in before you finish your work, there is a good chance you are right and you don’t miss any rally in the stock. And if you are wrong, there is probably just a small chance the stock underperforms the market over that month.

Conversely, if you wait a month because of “analysis paralysis” you could miss a lot of gains in a stock as it is likely other people are developing that idea at the same time. The downside of being wrong is nowhere near as high as the downside of missing out on the idea.

The question is, though: What about position sizing with this philosophy? That is something I am going to chew on for the rest of this year (and likely much longer). I don’t know what the answer is.

2. Housing update! (spoiler: affordability is only getting worse)

So yeah, my takes on a housing correction have been dead wrong so far:

The median home in the U.S. now calls for a $2,555 mortgage payment, which is up around $1,000 from 2020 and 2021. Those years weren’t troughs in the business cycle, either.

For a full year, that is $12,000 in extra mortgage payments. The median household income in the United States is around $70,000 a year.

What’s strange about this is that high-interest rates are causing shelter prices to go up, which is exacerbating inflation. More expensive mortgages should make the median rent in the U.S. go up, which will make inflation go higher. This causes the Federal Reserve to raise interest rates, which makes mortgages more expensive…

Cullen Roche describes it well in a tweet thread:

So how do we solve this doom loop? I have an idea, maybe (!) home prices have to go lower. That is the only way we can solve the affordability issue when it comes to shelter AND the current inflation crisis.

3. The weak “tough economic conditions” excuse

Almost every conference call this earnings season has called out the tough macroeconomic environment as an excuse for bad performance or to prove they have a “resilient” business (whatever that means).

Here’s a snippet from the Amazon call:

That said, the uncertain economic environment and ongoing inflationary pressures continue to be a factor, and we believe it's continuing to drive cautious spending across consumers. This means our customers are looking to stretch their budgets further and are focused on value.

The problem is, right now this looks like a made-up narrative based on the feelings of these executives and what is written/talked about in the news/online:

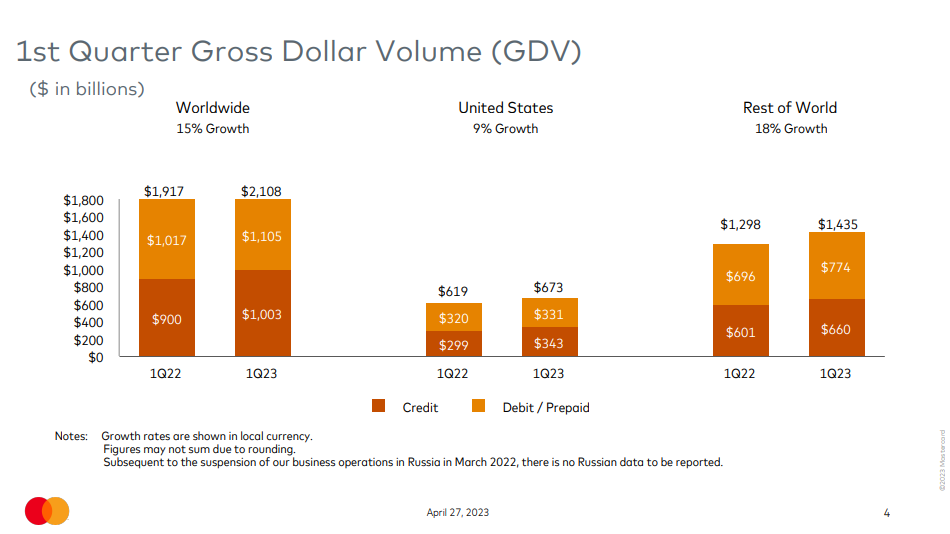

If you don’t want to zoom in on these slides, this shows the big three card networks (Visa, Mastercard, American Express) payment volumes this quarter.

Visa’s volume was up 10%.

Mastercard’s volume was up 15%.

American Express’s volume was up 16%.

Look, some people are clearly feeling the pinch of inflation right now. But as a whole, consumer spending is booming. Managers using “economic conditions” as an excuse in their Q1 results are not being honest with themselves. Stop blaming the economy when the consumer is in great shape.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

We are invested in a handful of banks, all recipients of low-cost permanent capital courtesy of the US Treasury’s Emergency Capital Investment Program. While the goal of this program was to encourage lending in economically disadvantaged areas, it also happened to make its recipients some of the nation’s best-capitalized banks in terms of total equity to assets. For that reason, there is no cause for concern regarding the safety of any of the banks that Alluvial Fund holds. The market seems to agree as the share prices of our four banks fell just 1% on average this quarter.

Here…comes…INDIA! - Noahpinion

Obviously, crossing this threshold doesn’t mean much in practical terms. Being a tiny bit bigger than China doesn’t really change anything, and India has just about as many people as it did a year ago. But the flurry of news stories accompanying the event is a wake-up call for the world: India has arrived on the world stage, in a big way.

All Hail King - Sleepwell Capital

Rolex. What springs to mind when you hear that word? Probably the image of a stainless-steel watch with a black dial and bezel. Maybe a yellow crown with a dark green background. Or perhaps a sense of quality of craftmanship, precision timekeeping, timeless excellence.

1 Good Podcast

There's been a lot of discussion about the possibility of "de-dollarization," or the idea that the world could move away from using the dollar as the de facto global reserve currency. Some of this desire makes sense. Not only has the Federal Reserve been hiking rates at the fastest pace in decades, which puts economic pressure on other countries through links to the dollar and US trade, but sanctions imposed on Russia have also made some nations more wary of relying on US financial assets and infrastructure. And in BRICS countries (Brazil, Russia, India, China and South Africa), there seems to be growing appetite to usurp the dollar’s hegemony. Of course, we've seen this kind of talk before, yet there has been little change to the dollar's special role. So is it different this time? On this episode, we speak with Paul McNamara, an investment director at GAM and a veteran of emerging markets, about what's driving this renewed clamor for de-dollarization.

Great thoughts on analysis paralysis. Finding the balance is key and I agree that over-analysis is often detrimental to portfolio returns. RE: position sizing, I prefer to layer in tranches with a couple of preferred buy points identified in advance...a back up the truck price and an alternative buypoint closer to moving averages or VWAPs. Take a starter position, continue analysis, buy more in tranches if analysis is still positive, take gains often in trims. Cheers!