Sunday Finds + 3 Thoughts From Last Week

Podcast episodes on Match Group + Altria Group This Week

Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week:

Interview: Altria Group and the US Tobacco Market (Ticker: MO) With Devin LaSarre

Investing Power Hour #53: Stripe Annual Letter; Deep Value in Colombia; Costco Comp Sales Report

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental research. With fundamental charting tools and data aggregation, Stratosphere saves us hours of time each month researching stocks.

Upgrade to one of Stratosphere’s paid plans and get 35+ years of historical financials, advanced KPI tables, and SEC filing aggregation.

Ditch the clunky and advertising-riddled websites like Yahoo Finance and upgrade your investing research using Stratosphere.io.

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

1. What’s the best way to screen for new stocks?

From time to time I come back to a basic stock screener for idea generation. Today, I was perusing Stratosphere’s new stock screener to come up with some new small and micro-cap companies to research (side note: I love how meticulous you can get when filtering sectors with their tools).

I think stock screeners are probably the best method today for finding undervalued companies no other investors are currently talking about. If you are reading something on Twitter, VIC, Seeking Alpha, or any other media publication, that means someone else has found the idea. The best risk/reward scenarios are found in companies very few people are interested in or know about, in my opinion.

It also helps when companies are illiquid enough so the vast majority of professionals don’t care because the stock won’t move the needle for them.

But a lot of people use stock screeners. You can’t just put in “P/E < 10” and “ROIC > 20%” and expect to find stocks ready to outperform. No, it is going to take a lot more effort than that.

That is why I like to filter out sectors I am not interested in (banks, healthcare, biotech, for example) and use a simple valuation screener like “P/S < 0.5” or something along those lines. There is bound to be a lot of garbage to sift through, and it is going to return a fairly sizable list of companies. But all I’m looking for is to find one diamond in this pile of garbage each year, which I actually don’t think is that difficult if you put enough time into the endeavor.

Happy hunting everyone!

2. Estimating profit potential for the Super Mario Movie

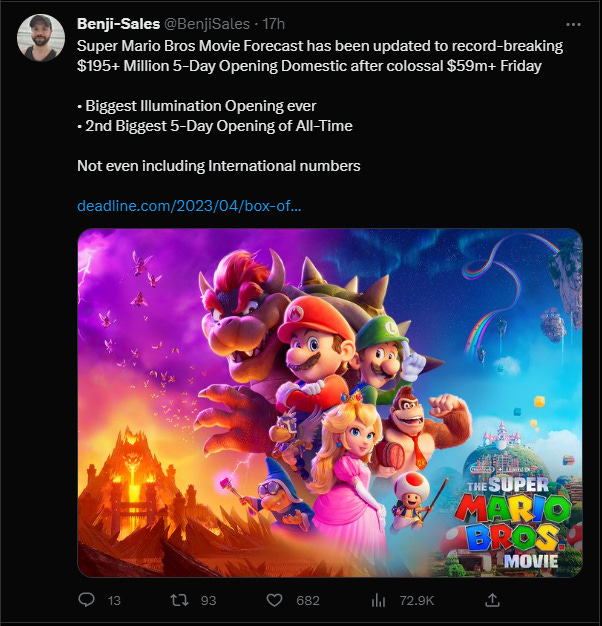

The Mario movie is premiering this weekend and seems to be crushing even the most bullish expectations:

(Screenshots are used here because of Twitter’s new rules against Substack links)

While this won’t be Avenger’s Endgame, it looks like a global box office run of $1.5 billion could be in the cards. Readers should note that the Japanese version (Nintendo’s home market) does not come out until the end of April.

But how much of this $1.5 billion will end up on Nintendo’s balance sheet? Let’s run some basic estimates.

The budget for the film is estimated to be over $100 million. Let’s say that total marketing spend around the globe will be $75 million (there are a ton of advertisements for this film).

So the total cost is $175 million, give or take. According to this Quora forum, it is extremely opaque and complicated to try and figure out how box office revenue is distributed for all stakeholders, but the general consensus is that big-budget films get a much higher proportion of the receipts than small indie films.

Let’s pick 60% for the Super Mario Movie. $1.5 billion multiplied by 60% is $900 million in net revenue flowing to the filmmakers. Subtract $175 million in costs and that is $725 million in earnings from the film.

It is being produced by Illumination and Nintendo, so let’s say they split the costs and earnings 50/50 (I’m sure Nintendo could have asked for a better split since it is their IP, but again this is just an estimate). Divide total earnings of $725 million by 2 and you get $362.5 million in earnings for Nintendo on a $1.5 billion global box office.

Nintendo earns around $4 billion - $6 billion a year in operating income. If Nintendo starts making one movie a year it could be somewhat incremental to the bottom line, but will not be a game changer for this business. And they probably will only release a film once every few years.

But in all honesty, they will make much more if they can convince the incremental buyer to purchase gaming hardware and an additional Mario game after watching this movie. The incremental margins on video game purchases (especially digital downloads) are off the charts strong.

3. 40-year mortgages?

Anything but lower housing prices, I guess:

This week the Federal Housing Administration gave the OK to 40-year mortgages. It's a move designed to try and make it easier for first-time home buyers.

The idea is to reduce monthly mortgage payments, which have been rising as mortgage rates go up.

This quote just ground my gears to no end as well:

“If it helps people relax, it is a good thing” - local heroin dealer.

The math on a 40-year mortgage is not pretty. Play with the numbers on the calculator yourself, but all else equal a 40-year mortgage on a $400k house with a 5% interest rate will have a monthly payment of $1,826 compared to $2,001 on an equivalent 30-year mortgage.

So buyers save $175 in monthly housing costs but get debt strapped to their balance sheet for an additional 10 years. Wow, incredible, count me in.

Here’s an idea: lower housing prices. It is the second thing (besides nuclear energy) that can work towards solving so many of the systemic issues in American society today without any huge technological breakthroughs.

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

Cross River Crack-Up - Dirt Bubble Media

While banks are generally expected to be conservative and risk-averse, the recent banking crisis has exposed some of the questionable practices in the industry. Banks like Signature and Silicon Valley took on the significant risks of holding large uninsured deposits that were likely to flee at the first sign of trouble. Both Silvergate and Signature chose to do business with problematic and potentially criminal customers, a decision that contributed to the failure of both institutions.

The conditions which create this rule are:

A ratio of 2 to 1 in market share between any two competitors seems to be the equilibrium point at which it is neither practical nor advantageous for either competitor to increase or decrease share. This is an empirical observation.

Any competitor with less than one quarter the share of the largest competitor cannot be an effective competitor. This too is empirical but is predictable from experience curve relationships.

Stanley Druckenmiller at the Lost Tree Club - Investment Talk

Stan Druckenmiller is one of the world’s greatest money managers, the former mentee to George Soros, and someone who has lived and traded through market cycles for more than 30 years. I believe that people enjoy hearing what he has to say because of his experience, but equally due to the manner in which he carries himself. His passion for the stock market and demystifying its complexities as though they were puzzles oozes from his persona. In 2015, he sat down with Ken Langone at the Lost Tree Club in what is now considered a timeless discussion about markets, processes, and monetary policy. Many of the things discussed in this interview hit especially hard today.

The transcripts for this discussion I could find online were of poor quality so I have taken the liberty of reproducing my own. Instead of interjecting with my own commentary, I wanted to present this conversation in its raw form; because it’s so great it needs no interruption.

1 Good Podcast

A Conversation With Shree Viswanathan - Best Anchor Stocks

Last week I had the opportunity to talk with Shree Viswanathan, founder and portfolio manager of SVN Capital. Shree was incredibly kind to give me 1h30m of his time to discuss several investment related topics. We also talked about two great companies in detail, Copart (CPRT) and HEICO (HEI), focusing on the main risks for each.