Sunday Finds + 3 Thoughts From Last Week

Podcast episodes on Amazon and Microcaps this past week

Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

Chit Chat Money Podcasts From Last Week:

Navigating Deep Value Microcaps and Altisource Management With Jeff Moore (Ticker: AAMC)

Investing Power Hour #42: NFLX Earnings Reaction, Cigarette Volume Trends, Stagnating Tik-Tok

Chit Chat Money is presented by:

Stratosphere.io, a powerful web-based research terminal for fundamental investors.

Stratosphere.io has made it easy for us to get the financial data we need with beautiful out-of-the-box graphs for researching stocks.

🎉Stratosphere.io just launched their brand new platform and you can give it a try completely for free.

It gives us the ability to:

Quickly navigate through a company’s financials on their beautiful interface

Go back up to 35 years on 40,000 stocks globally

Compare and contrast different businesses and their KPIs

Easily track insider transactions and news updates for any stock we follow

Get started researching for FREE on the Stratosphere.io platform today, or use code “CCM” for 15% off any paid plan.

1. The layoffs at big tech have arrived

The speculated mass firings at the big technology companies arrived this week. Well, at everyone except Apple. Here’s the list:

Microsoft at ~10k employees

Google/Alphabet at ~12k employees

Amazon at ~18k employees

Given the size of these companies, these are not gigantic layoffs but also not insignificant.

On the one hand, leaning up their operating expenses — which clearly got out of hand in 2021 — will be good for the businesses over the long run.

On the other hand, I do not believe this is a great omen for financial performance in 2023 and 2024.

Why? One, these executive teams understand the market’s profitability expectations. When things are going extremely well like in 2021, Alphabet can hire willy-nilly and still hit its earnings target. Laying off so many people means the companies are likely operating in a less ideal economic environment, as Alphabet CEO Sundar Pichai said in his letter to employees.

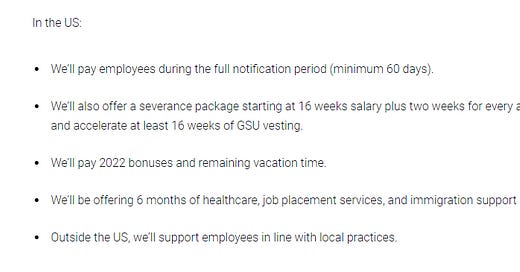

Second, these cost savings will not materialize for a few quarters due to the generous severance packages that technology companies offer.

Here is what Alphabet is offering, for example:

Frankly, this sounds kind of nice. You get paid for multiple months for free and can put Google on your resume. In all seriousness, it is good for society that companies treat employees well, but through the mindset of a shareholder, these cuts won’t show up on the income statement for at least a few quarters.

2. December 2022 Video Game Spending in the United States

This week, the NPD Group released its December update for the video game market. As someone who follows the industry closely, it is always fascinating to see how the trends are playing out each month.

Here are a few takeaways for investors.

First, the industry is back to consistent growth, with spending in the last months of the year above 2021 levels:

This is also with supply shortages hurting Playstation unit sales, the most important metric for driving industry growth in 2023 and 2024. If people don’t have consoles they can’t play new games, so they won’t buy them. Plain and simple.

Second, game sales have become fairly predictable. Call of Duty led the way as it does almost every year with its commercial blockbuster Modern Warfare II. Then, the rest of the chart is dominated by sports titles that have consistent sales each year and Nintendo evergreen titles. If a new Pokemon game is released like this year, it will be near the top as well (remember when looking at Nintendo sales they do not give out digital data, which is half of its unit sales). Yes, there will be a few new entrants each year like Elden Ring, but the charts have gotten very monotonous in recent years. This is great if you care about buying stocks with durable, predictable earnings streams in my opinion.

Third, people still want to buy Nintendo Switches. The console was the highest seller in unit sales even though it is much older than the PS5 or new Xbox generations. Apparently, the company is even looking to grow its inventory for the upcoming Zelda launch.

All and all, the video game market looks to be in great shape. If console shortages finally go away in 2023 and the new Grand Theft Auto is launched, industry spending should be up significantly from 2022.

3. They are who we thought they were

Apologies to the crypto lovers who follow our show, but you may have been the supply for Peter Thiel as he offloaded his crypto bags last year. From Fortune:

One month before billionaire venture capitalist Peter Thiel raved about the advantages of Bitcoin during a speech at a Miami conference, his VC firm Founders Fund had already offloaded an eight-year bet on cryptocurrencies.

If you don’t remember this conference, it is when Thiel made a maniacal pitch to buy Bitcoin, saying it would rise by 100x and that it was the end of the fiat regime.

At that exact time, he was offloading $1.8 billion in crypto investments.

For those crypto skeptics out there, I think this video sums up our feelings once again:

In other news, I just found out that Sam Bankman-Fried invested $1.1 billion using FTX’s money into a Bitcoin mining company in Kazakhstan that started using so much energy it caused riots to flare up in the nation. Of course, that company just filed for bankruptcy.

(details of the story can be found on the Journal podcast)

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our FREE weekly wrap-up delivered to your inbox each week? Subscribe here***

3 Good Reads

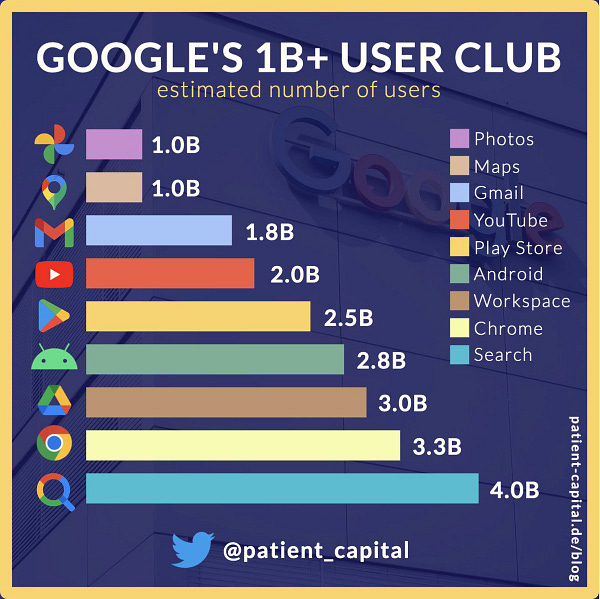

Uncommon Facts about Alphabet’s Common Stock - Patient Capital

Several of Alphabet's most successful apps come from acquisitions. To date, >250 acquisitions have been carried out for a total consideration of $30 bn (most recently, cybersecurity firm Mandiant for $5.4 bn). Android was acquired in 2005 for a financially insignificant amount of $50m, but it's one of the smartest M&A deals of all time. In conjunction with Chrome, Android enables direct influence on important access points to the Internet and cements Search's market position on mobile.

Demis Hassabis stands halfway up a spiral staircase, surveying the cathedral he built. Behind him, light glints off the rungs of a golden helix rising up through the staircase’s airy well. The DNA sculpture, spanning three floors, is the centerpiece of DeepMind’s recently opened London headquarters. It’s an artistic representation of the code embedded in the nucleus of nearly every cell in the human body. “Although we work on making machines smart, we wanted to keep humanity at the center of what we’re doing here,” Hassabis, DeepMind’s CEO and co-founder, tells TIME. This building, he says, is a “cathedral to knowledge.” Each meeting room is named after a famous scientist or philosopher; we meet in the one dedicated to James Clerk Maxwell, the man who first theorized electromagnetic radiation. “I’ve always thought of DeepMind as an ode to intelligence,” Hassabis says.

FOMO: The Worst Financial Trait - Morgan Housel

Most ambitious people’s intuition is to ask, “How can I get smarter? More informed? Find new skills?”

In many fields those are the right questions. Money is a rare exception where asking questions like, “How can I be less dumb, less greedy, less impatient?” can be more effective.

And there’s one trait whose removal from your personality can do more to improve your financial situation than anything else: The fear of missing out.

1 Good Podcast

Car-magaddon??? - Wealthion Podcast

Car prices went bananas after COVID hit -- propelled by inventory shortages from disrupted supply chains & the unprecedented stimulus sent to businesses & households.

Now here in 2022, the boom may be ending. Used car prices which nearly doubled post-COVID, have fallen for much of this year -- though still remain much higher than their pre-pandemic lows.

Smart and Funny Tweets: