Welcome to Chit Chat Money’s Sunday Finds + 3 Thoughts From Last Week. In this newsletter you will find three topics I thought about last week, links to shows we’ve recently released, and links to some interesting articles, podcasts, and tweets. Check out the archive here.

1. Will tech companies get religion on hiring/compensation?

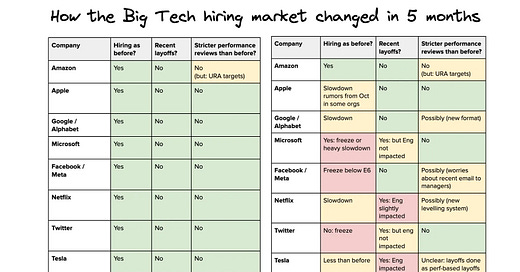

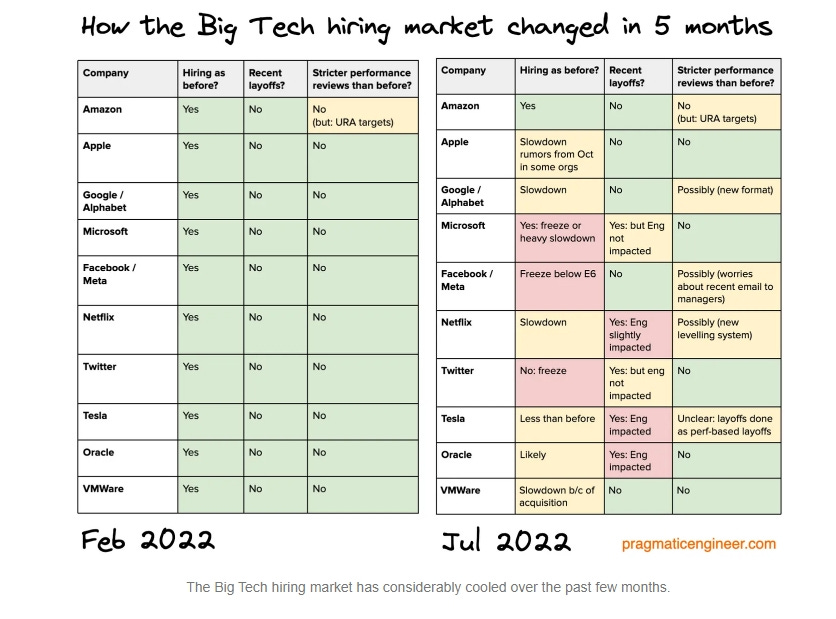

A big theme of 2022 has been layoffs and hiring slowdowns across the start-up, technology, and internet sectors. You can see this clearly in the below tables:

Now, I don’t know if these are exactly correct (some hiring decisions are not leaked to the public), but it is directionally right. From an investor’s perspective, I am trying to wrap my head around what it could mean for these businesses long-term.

On its face, these slowdowns and layoffs seem like bad news. You typically don’t fire people unless something has gone worse than you planned.

But what if a lot of these companies just hired too many people over the last five years? Just take a look at some of the employee counts given in annual reports and you will see what I mean. Maybe this “downturn” will allow them to trim unnecessary fat without looking like a-holes. Is this just wishful thinking? We’ll see what happens to profit margins over the next year or two.

If the venture capital market dries up, we should also see less competition salary-wise for top software/technology employees. A reduction in demand should mean a reduction in bargaining power for compensation (including stock options, perks, etc.). Obviously, we all want employees treated well, but if you don’t have to compete with X-software trying to poach your hardware engineers after raising a $200 million Series B, I think these older companies will sleep more soundly at night.

2. Is TV not long for this world?

Good tweet thread this week from Mostly Borrowed Ideas on the Tik-Tok threat across the entertainment landscape:

A lot of us are aware of the Instagram Reels vs. Tik-Tok battle, but the most interesting part of this thread is the idea of the real loser with the continued growth of these platforms: television.

In the western world, especially in the United States, TV has been a big part of people’s lives for decades. The estimates are that the average American watches hours of TV each day. That is a lot of time to fill and a lot of money to make off of subscriptions, cable bundles, and advertisements.

But with these internet-based platforms getting better and better at serving your individual tastes combined with a content supply that feels infinite, I would make a bet that hours spent watching scripted TV will be down significantly 10 or 15 years from now. And we can’t forget about the rise of video games, either. Why would I watch the new 1883 show on Paramount+ (which apparently is great) when I can have a more fun interactive experience playing Red Dead Redemption 2? I just have a hard time seeing how TV dramas win out over this stuff. And it will only get worse every year. TV has no meaningful technological advances left to make it a better entertainment experience, while video games and platforms like YouTube should only get better this decade.

(of course, sports have their own moat, given the cultural ties and intense fandom. So I don’t think that part of TV is going away anytime soon. A good movie may also be fine, too.)

Personally, I find myself watching less and less scripted TV. When I’m using my CTV, my most popular apps are YouTube (watching niche videos and podcasts) and Spotify (podcasts, background music player for work). I also enjoy shows on HBO occasionally, but I rarely watch anything else.

Now, everyone is different, so I’m not trying to say this will happen to everyone overnight. But the trend seems fairly plausible, and I personally get worried about the durability of any asset exposed to the TV space (linear, streaming, or both).

3. What is China’s economic endgame?

Look, I’ll be the first to tell you I am way out of my league trying to analyze anything about China. But I’m going to do it anyway.

This article caught my eye this week:

Confidence in the safety of Chinese banks has been badly shaken by the failure of several small banks in Henan Province in April this year. In terms of their assets of about 40 billion yuan ($6 billion) and the number of customers, roughly 400,000, the shuttered rural banks are minions in China's financial system.

The implosion of these poorly supervised and likely corruption-ridden financial institutions should not be surprising. But how local authorities handled the fallout is shocking even to the most jaded observers of China's political scene.

Instead of compensating the depositors, who are entitled to up to 500,000 yuan, according to government regulations, officials in Henan have done everything imaginable to silence them.

They initially restricted the movement of the depositors by turning the COVID test code on their smartphones red, which effectively made it impossible for them to take public transportation or even drive their own cars. A public outcry forced the Henan government to abandon this abusive tactic.

China’s economic growth has been fueled by debt. And from what I’ve read, a lot of this has been in the real estate industry. Many real estate developers (remember Evergrande?) are already defaulting on this debt.

From the outside, it looks like China is stuck between a rock and a hard place. They have all this debt that was supposed to keep GDP growing at outsized levels for many years. But with a zero-COVID policy still in place, economic growth has stalled out. And unless something changes with how we can treat the virus, I don’t know when they can fully reopen the country. Or at least, not anytime soon. So what are they going to do about these rising debts and bank failures? Someone has to lose here, and I’m willing to bet (because it is a socialist nation) that the system will generally favor putting the losses with stockholders, both foreign and domestic.

We’re also seeing signs of the downsides of a totalitarian regime. Given my lack of expertise in the region, these troubling indicators make me want to keep my investing exposure to China at an absolute minimum. Why risk it when there are clear signs the country is in trouble?

See you next week,

Brett

***Our fund, Arch Capital, may own securities discussed in this newsletter. Check our holdings page and read our full disclosure to learn more.***

***Want our free weekly wrap-up delivered to your inbox each week? Subscribe here***

Catch up on Our Shows From Last Week

3 Good Reads

The Risk of Deflation is Now Greater Than the Risk of Prolonged High Inflation - Pragmatic Capitalism

As we learned in 2008, housing IS the US economy. So when US housing slows it will drag down everything with it. While some are worried that inflation has to continue to surge because price:rent ratios are still wide I believe the risk of deflating home prices will pose a meaningful downside risk to inflation in the coming years. In fact, investors worried about the exact same thing in 2006/7 when the price:rent ratio was far smaller. This is part of why the Fed overreacted in 2005/6 and raised rates so much. But what they were really doing was crushing housing demand and creating dysfunction in the credit markets. That same risk is playing out today.

But you can’t compound money at 20% forever unless you have that hard-wired into your brain from the age of 10 or 11 or 12. I’m not sure if it ís nature or nurture, but by the time you’re a teenager, if you don’t already have it, you can’t get it. By the time your brain is developed, you either have the ability to run circles around other investors or you don’t. Going to Harvard won’t change that and reading every book ever written on investing won’t either. Neither will years of experience. All of these things are necessary if you want to become a great investor, but in and of themselves aren’t enough because all of them can be duplicated by competitors.

Sometimes It Pays to be Lucky - Young Money

A lot of credit is given to Jobs, Musk, and Bezos, and that credit is well-deserved. But all three of their companies were one roll of the dice away from failure. From companies to individuals, luck and skill both play roles in success and failure. The problem is that we cannot weigh the importance of either trait.

The unknown importance of luck is overlooked when we study and emulate winners. Case studies on Amazon focus on Bezos's bias towards experimenting with different ideas. The former CEO called Amazon "the best place in the world to fail," as he believed that failures like the Fire Phone were an inevitable ingredient when you are swinging for home runs like Amazon Web Services.

And Bezos is correct, but none of those home runs would have been possible without a timely capital raise in 2000.

1 Good Listen

Rolex: Timeless Excellence - Business Breakdowns

Today, we’re breaking down one of the strongest brands in the world - Rolex. Founded in the UK in 1905 under the name Wilsdorf & Davis, Rolex has become the leading name in luxury watches. But, while the company’s products are iconic, the business itself is highly secretive. Owned by a Foundation and run as a non-profit entity, little is known about Rolex.

Smart and Funny Tweets: